Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Jun, 2022

By Celeste Goh

Introduction

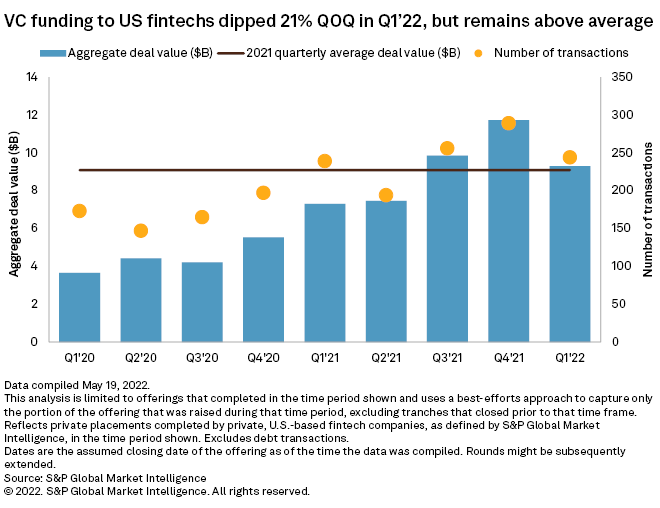

Against a rising rate environment and plummeting stock market, venture dollars to U.S. financial technology companies held up surprisingly well in the first quarter of 2022 with $9.30 billion raised over 244 deals. While the figures reflect a quarter-over-quarter decline of 21% and 16% in transaction value and volume, respectively, it is worth noting that 2021 was an exceptionally strong funding year for financial technology companies, and fourth-quarter fundraising levels have generally been higher than other quarters in the past two years.

In 2021, average quarterly funding levels for U.S. fintechs amounted to $9.09 billion across 245 deals. This means that the latest quarter's funding value was slightly above last year's level, while deal activity remained at average levels.

News of layoffs at several mature fintechs reflects a sobering concern that growth prospects of the industry are no longer as robust as before. As a result, privately held fintechs may find it more challenging to raise venture funding even as there remains an abundance of dry powder in the market. As investors grow wary of steep valuations, fintechs seeking to raise funds in the near term may have to contend with discounted valuations.

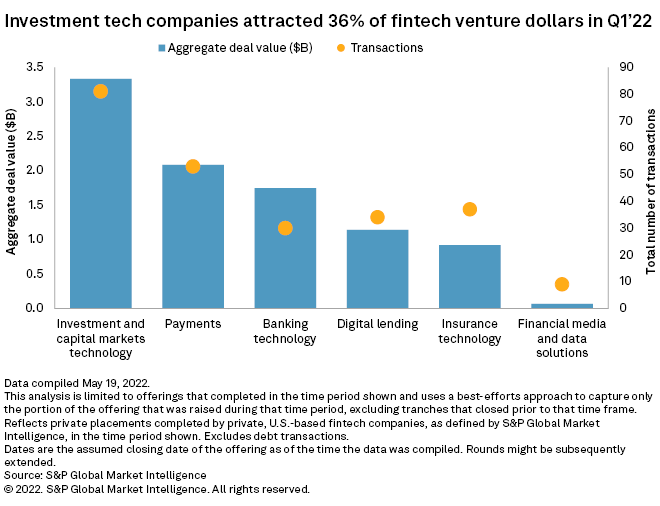

The investment and capital markets technology segment continued to take the lead in venture capital raises and activity in the March quarter. The $3.33 billion capital flow to the space represents about 36% of total funding received by U.S. fintechs while the 81 rounds closed accounted for 33% of total deal volume.

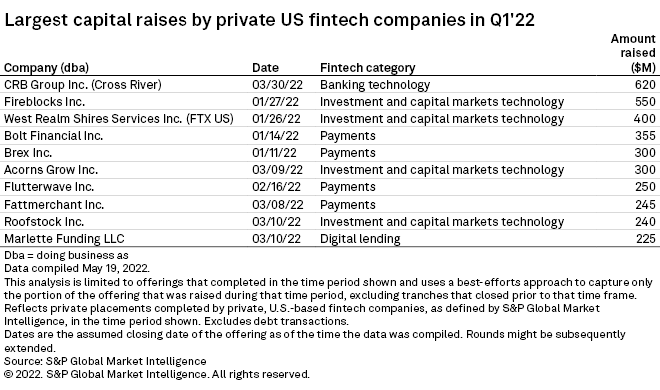

Four of the top 10 fintechs by amount raised are investment and capital markets technology companies. Of those, the two largest came from Fireblocks Inc. and West Realm Shires Services Inc., or FTX US, reflecting the popularity of digital assets.

Fireblocks is a digital asset infrastructure provider offering a suite of solutions that enable financial institutions to securely transfer, issue and store digital assets. The growing institutional adoption of digital assets has benefited Fireblocks, whose customer base expanded from 150 to over 800 clients last year. Aside from venture capitalists, the firm had also drawn in strategic investors like The Bank of New York Mellon Corp., which had just launched a digital asset unit last year and is leveraging Fireblocks' technology to offer cryptocurrency custody services. With the newly raised $550 million during its series E round, Fireblocks intends to expand its presence in Southeast Asia, Eastern Europe and Africa.

FTX US is a regulated cryptocurrency exchange in the U.S. that also offers a nonfungible token marketplace. In January, the firm closed a $400 million series A round with plans to launch new business lines. Earlier this month, FTX US announced an unconventional move to expand into equity trading, bucking the trend of traditional stock brokerages moving into cryptocurrencies.

Though funding for privately held investment tech companies remained strong in the first quarter, investors' sentiments on the sector could turn bearish in subsequent periods as declining cryptocurrency and stock prices dampen trading activity. The trend is already playing out in the public market with share prices of popular trading apps Robinhood Markets Inc. and Coinbase Global Inc. down by 50% and 76% this year, as of May 24. Both companies had reported earning slowdowns on the back of softer trading volumes. In the first quarter, Robinhood's total revenue fell 18% sequentially while its number of monthly active users declined 8%. Similarly, Coinbase's revenue fell 53% on a sequential basis while cryptocurrency trading volume declined 44%. The cryptocurrency exchange also guided for a weaker second quarter with expectations for lower transaction volumes and monthly trading users.

The recent implosion of the TerraUSD stablecoin, or UST, has shaken investors' confidence in the cryptocurrency market, which could spell further trouble for companies operating in the digital asset space. The algorithmic stablecoin was designed to track the value of the U.S. dollar but had lost its dollar peg, sparking a massive sell-off in the already-declining cryptocurrency market.

Looking ahead

Globally, there remains plenty of dry powder in the system but venture capitalists are ostensibly more selective than before amid the declining stock market and rising interest rates. Stripe Inc.-backed Fast AF Inc., a one-click payment checkout operator, was forced to shut its doors after running out of funds. The firm had last raised $102 million in January 2021, but its high cash burn model failed to convince investors to replenish its coffers. A string of layoffs at several mature fintechs, including Robinhood, On Deck Capital Inc. and Better Mortgage Corp., or Better.com, further warns of a broader concern that new capital injection may be harder to come by, compelling firms to trim operating costs to extend their cash runway.

For firms planning to raise fresh money, down rounds might be a new reality as investors steer clear of high valuations. According to an article in The Wall Street Journal in May, SoftBank Group Corp.-backed Klarna Bank AB (publ) reportedly was aiming to raise up to $1 billion at a post-money valuation in the low $30 billion range, about one-third below its last known valuation of $45.6 billion. The Swedish buy-now-pay-later provider had earlier sought a valuation of above $50 billion but faced pushbacks from investors.

With a persistent market rout, we expect a tepid fundraising environment ahead for U.S. fintechs. Companies are also likely to put on hold listing plans, a move that appears to be viewed favorably by existing investors who continue to show support for their portfolio companies. After terminating their blank-check deals, Acorns Grow Inc. went on to raise $400 million from returning investors while Kin Insurance Inc. received $82 million from a mix of returning and new investors in March.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.