Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Feb, 2024

US real estate investment trusts are largely well-positioned and should only be minimally impacted by the first phase of New York City's Local Law 97, which was passed in 2019 and sets a limit on greenhouse gas emissions for buildings above 25,000 square feet starting this year.

Improvements may be required to keep properties in good standing, however, in the coming years when the greenhouse gas emission limits shrink.

New York City is one of a handful of cities to pass laws in recent years setting greenhouse gas emission standards for buildings, with Boston and St. Louis in particular enacting similar legislation to that of New York City, setting emission limits by building type that will shrink over time.

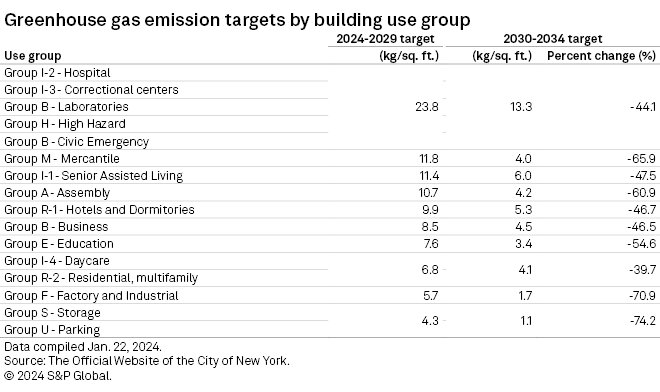

➤ Greenhouse gas emission limits for buildings in New York City will begin fairly lenient, but will become much more stringent starting in 2030 and will continue to shrink in the following years.

➤ S&P Global Market Intelligence identified 289 REIT-owned properties subject to New York City's Local Law 97, however, most REITs are already ahead of the curve with regard to sustainability practices, and should be only minimally impacted by the greenhouse gas emission limits starting this year. That being said, as limits shrink starting in 2030 and beyond, improvements may be required to keep properties in good standing.

➤ The majority of REIT-owned multifamily properties in New York City contain some rent-stabilized units, which instead of being subject to a greenhouse gas emission limit, will instead be required to implement property improvements from a prescriptive list. The list includes things such as insulating heating and hot water pipes, installing heating system sensors and boiler controls and upgrading lighting.

Greenhouse gas emission limit to start this year

New York City's Local Law 97 is set to come into effect this year, which sets a limit on greenhouse gas emissions for all buildings in the city larger than 25,000 square feet. While greenhouse gas limits will start fairly lenient this year, the threshold will become much more stringent beginning in 2030. The greenhouse gas limit will further shrink in the following years, with the ultimate goal to reduce the city's carbon emissions from buildings 80% by 2050.

The legislation pushes building owners in the city to allocate funding toward building improvements to reduce greenhouse gas emissions or the landlord could be subject to hefty fines.

The limit for each building will be based on its use group, with buildings such as hospitals and correctional centers, which need to be operated 24/7, among those with a larger greenhouse gas limit, while storage facilities and parking garages are among those with the smallest limits.

Should any building surpass its greenhouse gas limit for the year, it will be subject to a fine of up to $268 per metric ton of exceeded carbon emissions.

Most REITs are ahead of the curve in regards to sustainability practices

REIT executives have had their eye on this legislation since its passage in 2019.

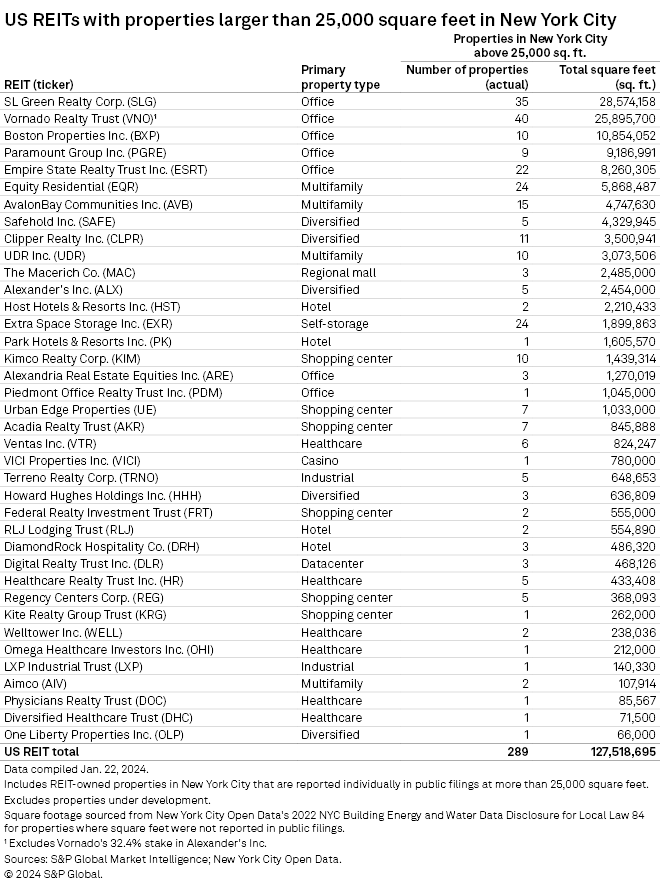

S&P Global Market Intelligence identified 289 properties across 38 publicly traded real estate investment trusts that own properties in the city above the 25,000 square-foot cutoff. In aggregate, the properties totaled more than 127.5 million square feet.

SL Green Realty Corp. owns 35 properties in the city above 25,000 square feet, totaling nearly 28.6 million square feet in aggregate.

Landlords in the city that own older buildings and have not been investing in sustainable practices could be impacted the hardest and incur onetime costs to renovate their buildings, SL Green CEO Marc Holliday said on the REIT's first-quarter 2019 earnings call. The benefit, however, is the landlord's operating costs will be lowered in the long-term.

"But for buildings like ours that I think are already at the leading edge," Holliday continued, "there'll be some additional compliance, but we would have done it anyway because that's the path we're on."

Vornado Realty Trust follows in total square feet, owning 40 properties in New York City above 25,000 square feet, aggregating to just under 25.9 million square feet. According to a statement by CEO Steven Roth on the REIT's first-quarter 2019 earnings call, Vornado's long-held strategy of continuously improving its buildings to reduce its carbon footprint has put the REIT "well ahead of the curve" with regard to sustainability practices, and Roth believes the emission cap in 2024 will have a minimal impact on the REIT's portfolio.

Majority of REIT-owned multifamily properties may not be subject to greenhouse gas emission limit

Greenhouse gas emissions from buildings make up roughly 71% of the city's total emissions, with residential buildings making up the largest percentage of any building type, according to data from the New York City Mayor's Office of Long-Term Planning and Sustainability.

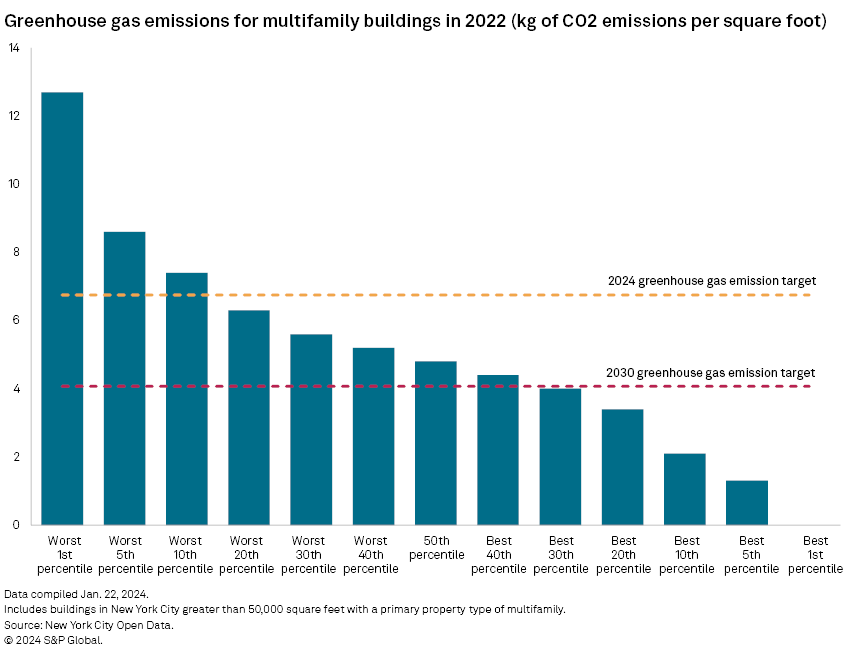

The majority of multifamily buildings are already within carbon emission goals set for 2024, with only the most-carbon-producing properties being impacted by the first round of targets. All property owners, however, will need to begin formulating a plan of action, as the emission cap will shrink nearly 40% in 2030 and affect a much broader range of properties.

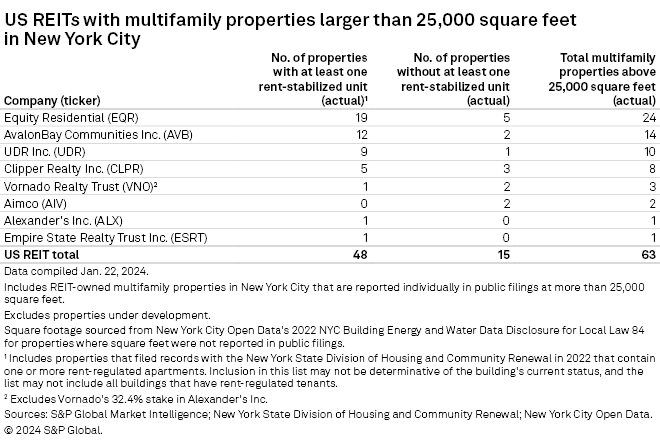

REITs own 63 multifamily properties in New York City above 25,000 square feet.

However, not all residential properties in the city will need to adhere to the greenhouse gas emission limits set forth. There was an alternate compliance path was set forth for rent-regulated multifamily buildings to help combat the disjunction between the city's need to reduce greenhouse gas emissions as well as provide affordable housing. Multifamily buildings with at least one rent-stabilized unit will instead be required to implement a prescriptive list of upgrades, which include measures such as insulating heating and hot water pipes, installing heating system sensors and boiler controls and upgrading lighting.

Of the 63 multifamily properties in the analysis, 48 were found in the New York State Division of Housing and Community Renewal's list of buildings that contain rent-stabilized units.

While Equity Residential owns the most multifamily properties in New York City above the 25,000 square foot cutoff of any publicly traded REIT, 19 of the REIT's 24 properties contain rent-stabilized units. When asked about the topic on the REIT's first-quarter earnings call in 2019, its COO Michael Manelis mentioned that due to Equity Residential already having a focus on energy consumption and efficiency, it was not as concerned about the 2024 requirement.

However, with the emission cap shrinking by roughly 40% starting in 2030, Manelis said that is going to take some work to achieve, but the REIT is up for the challenge.

AvalonBay Communities Inc. is next in total multifamily properties, however nearly all its buildings in the city include rent-stabilized units, with the only exception being the Avalon Riverview and Avalon Riverview North in Long Island City. On the REIT's first-quarter earnings call in 2019, COO Sean Breslin commented that the Riverview buildings utilize a cogeneration system that produces both heat and power from the same source to help reduce waste, and he is "pretty comfortable" the property will clear emission targets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.