Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 21, 2024

By Dan Lowrey

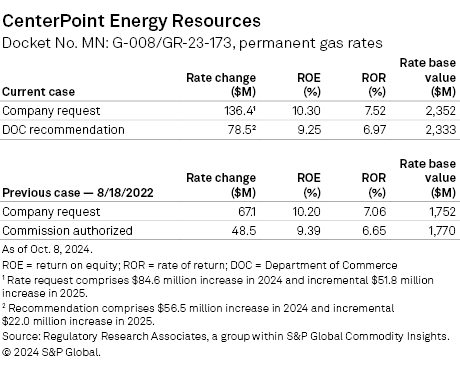

The Minnesota Department of Commerce recommends that the Minnesota Public Utilities Commission authorize CenterPoint Energy Resources Corp. a gas base rate increase of $78.5 million over two years, which is a little more than half the $136.4 million increase that the utility requested. The department's recommendation is based upon a return on equity that trails national averages tracked by Regulatory Research Associates.

Public hearings in the proceeding are scheduled for Oct. 18 and Oct. 21–22. A commission decision could come by the end of October.

➤ The Minnesota Department of Commerce (DOC), representing the public interest in utility rate proceedings, supports a two-year increase in gas base rates for CenterPoint Energy Resources (CER), about 58% of what CER requests. The DOC's adjustments to CER's projected net operating income over 2024 and 2025 account for the majority of the difference in revenue requirement.

➤ The rate increase recommendation by DOC is premised upon a 9.25% return on equity (ROE), which is significantly below national averages tracked by Regulatory Research Associates and is also below the 9.39% ROE authorized for CER in its last rate case, which concluded in 2022. The Minnesota Public Utilities Commission (PUC) may ultimately authorize CER a higher ROE than that recommended by DOC if the company's last rate case offers any evidence.

➤ RRA considers Minnesota regulation, overall, to be balanced and stable from an investor view. The state has not restructured its electric or gas industries, and utilities are regulated under a traditional framework. Recently authorized equity returns typically have approximated industry averages but, in some cases, have been significantly below industry averages when established.

In Docket G-008/GR-23-173, the DOC supports a $56.5 million increase in the test year ending Dec. 31, 2024, and an incremental $22.0 million increase in 2025. The increase is premised upon a 9.25% return on equity (52.50% of capital in the test year and 52.49% of capital in 2025), a 7.00% overall return on a $2.16 billion rate base for 2024 and a 6.97% overall return on $2.33 billion rate base for 2025.

The 9.25% ROE supported by the DOC is well below national averages tracked by RRA. The average ROE authorized for gas utilities was 9.83% for cases decided in the first half of 2024, above the 9.64% average observed in full year 2023. For the 12 months ended June 30, 2024, the authorized gas ROEs averaged 9.68%.

The recommended ROE is also 14 basis below CER's currently authorized ROE of 9.39%, which was authorized in 2022. The DOC also recommended a 9.25% ROE in that proceeding.

The DOC supported CER's proposal to increase the monthly basic charge for several customer classes but keep the residential basic monthly charge at $9.50. CER proposed raising the commercial and industrial Rate A charge to $20 from $15, the commercial and industrial Rate B charge to $28 from $26, the large firm sales charge to $1,550 from $1,250 and the large firm transport charge to $1,650 from $1,350.

Rate of return

RRA calculates that differences in the rates of return put forth by the company and the DOC account for about $18 million of the $57.9 million revenue requirement difference between the company's supported $136.4 million increase and the department's proposed $78.5 million increase.

DOC estimated CER's cost of equity using the discounted cash flow (DCF) model applied to a group of proxy companies with risk similar to the company. A constant growth and two-stage growth DCF analysis was conducted. DOC used a second financial model, the capital asset pricing model (CAPM), and compared those results to its DCF results. DOC also compared the results with independent estimates of the cost of equity from sources such as academics, actuaries, institutional investors, investment banks and other financial institutions. The results were further adjusted to account for flotation costs.

However, the DOC recommended that CER's authorized ROE not equal its DCF or CAPM estimates. "While there are strong theoretical reasons to set the allowed ROE equal to the cost of equity, empirical evidence suggest[s] that allowed ROEs typically exceed the cost of equity. While the exact reasons why this may be the case are unclear, there may be some risk departing substantially from allowed ROEs in other jurisdictions," the DOC testified. "The company's cost of equity is a reasonable starting point in determining a fair allowed ROE, but it does not necessarily follow that the allowed ROE should be set equal to estimates of the cost of equity," the intervenor said.

The DOC reduced its calculated ROE to account for the fact that the company's proposed capital structure includes more equity than the capital structures of the companies in the proxy group.

The DOC recommended a 9.25% ROE, which was the same equity return it recommended in CER's last rate case. "While interest rates have increased since then, awarded ROEs have not followed suit, and CenterPoint's higher equity ratio offsets any associated increase in its cost of equity. An allowed ROE of 9.25 percent reasonably balances these competing factors, and is significantly above the company's cost of equity, providing insurance against estimation error," the DOC said.

Rate base

RRA calculates that the department's adjustments to rate base account for about $2 million of the $57.9 million revenue requirement difference in the case.

The DOC recommended a $2.33 billion rate base for the final year of the rate plan (ending Dec. 31, 2025), compared to CER's request of $2.35 billion. The DOC's adjustments included a reduction of $16.2 million to net plant in service in the 2024 test year and a reduction of $15.2 million to net plant in service in the 2025 plan year.

Net operating income

The DOC's proposed net operating income adjustments account for the remaining $37.9 million of the revenue requirement difference over the two years.

The DOC reduced CER's proposed property tax expense by $8.5 million for the 2024 test year, arguing that "it seems unlikely that the property tax expense would jump by nearly $11.8 million in one year without significant property improvements that would contribute to an increase in property value." The DOC also argued that CER's 2025 property tax expense was overstated and adjusted it downward by $8.2 million.

The DOC disagreed with CER's proposal to increase the cap on short-term incentive compensation for exempt non-bargaining employees to 25% from 15%. "Keeping the 15% cap in place will still allow for recovery of significant incentive awards to these and other employees without asking ratepayers to pay for even more employee awards," DOC testified. This adjustment reduced short-term incentive plan expenses by a combined amount of slightly over $400,000 in the 2024 test year and 2025 plan year.

The DOC also made an adjustment to limit the Minnesota jurisdictional pay for CenterPoint's top ten paid executives who are eligible for recovery from ratepayers to approximately $150,000 in 2024, inclusive of salary and short-term incentive pay. This adjustment resulted in a reduction to compensation expense of approximately $500,000 for the 2024 test year and 2025 plan year on a Minnesota jurisdictional basis.

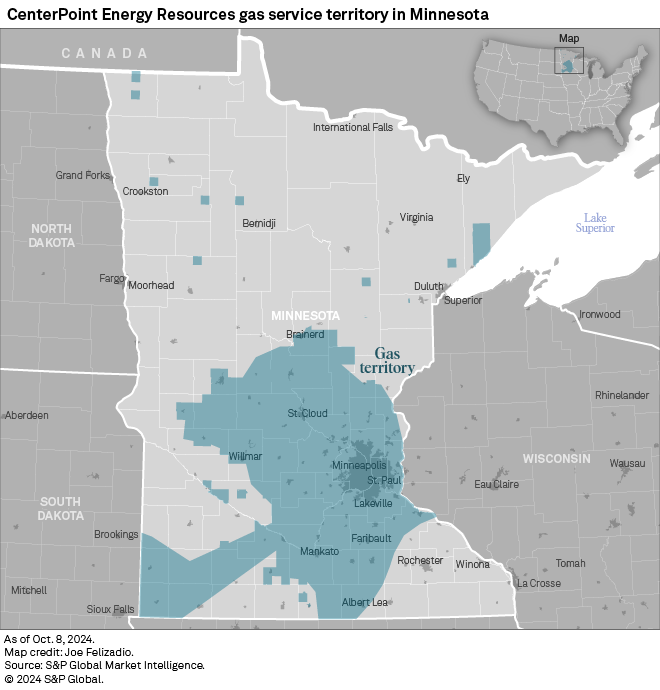

CER is a subsidiary of CenterPoint Energy Inc.

Rate case background

CER filed an application to increase base rates by $84.6 million (6.5%) in 2024 and an incremental $51.8 million (3.7%) in 2025. The utility is proposing to keep rates unchanged in 2026.

The $84.6 million increase in rates for 2024 is premised upon a 10.30% return on equity (52.50% of capital) and a 7.55% overall return on an average rate base valued at $2.18 billion for the test year ending Dec. 31, 2024. The $51.8 million rate increase for 2025 is premised upon a 10.30% return on equity (52.49% of capital) and a 7.52% overall return on a rate base valued at $2.35 billion for the plan year ending Dec. 31, 2025.

Safety-related pipeline investments are the biggest drivers of the rate request. CER continues to improve the safety and reliability of its system through its integrity management programs, which are consistent with federal and state requirements. Through those programs, CER has replaced all known legacy cast iron on the system as well as most of the bare steel and most of the Beltline transmission system, which is the company's higher-pressure pipeline system in and around the Minneapolis metro area.

The utility notes that it continues to invest in technologies to improve the safety and reliability of its system while reducing methane emissions, including new leak detection survey technology. It is also deploying new gas meters made by Itron called the Intelis meter. This new meter technology monitors gas flow and can automatically shut off the gas supply if it detects certain anomalies, such as leaks or open valves.

CER also highlighted the company's progress in meeting the state's carbon reduction goal in filing its first natural gas innovation plan, outlining more than two dozen proposals to decarbonize its distribution system with clean energy resources and strategies. The June 28 filing encompassed 18 pilot projects and seven research and development programs, which CER would operate during a five-year cycle.

On Dec. 14, 2023, the PUC granted CER's request for an interim rate increase of $68.7 million for 2024. On Sept. 30, the company requested an incremental interim rate increase of $33.2 million for 2025, but the commission has yet to grant that request.

Minn. regulatory environment

RRA continues to accord Minnesota regulation an Average/2 ranking, indicating it remains balanced from an investor perspective.

Under legislation enacted in 2015, a public utility may propose, and the commission may approve (in full or as modified) or reject a multiyear rate plan, establishing the rates the utility may charge for each year of a specified period of years, which cannot exceed three years, to be covered by the plan.

As permitted by statute, significant interim rate increases are usually requested and authorized, and as a result, rate case test years are effectively fully forecast. In addition, adjustment clauses or riders permit the timely recovery of electric fuel, gas commodity, transmission, certain environmental and reliability projects, and certain gas infrastructure costs. Utilities are permitted to file rate requests that annually adjust rates for up to three years, and the PUC may authorize two-step interim increases.

In the gas utility industry, large-use customers have been permitted to purchase gas from competitive suppliers for several years, but there is no movement to extend choice to small-volume customers. Legislation has established aggressive renewable portfolio standards and greenhouse gas reduction requirements, but the related recovery of compliance costs does not appear to be in question. Also, the PUC has adopted revenue-decoupling mechanisms for several of the state's utilities, and the commission's merger review standard is not particularly restrictive. For more information, refer to the commission profile.

For additional detail concerning RRA's energy rankings, refer to the latest RRA "Quarterly State Regulatory Evaluations" report.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Theme

Location