Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 24 Jan, 2022

By Neil Barbour

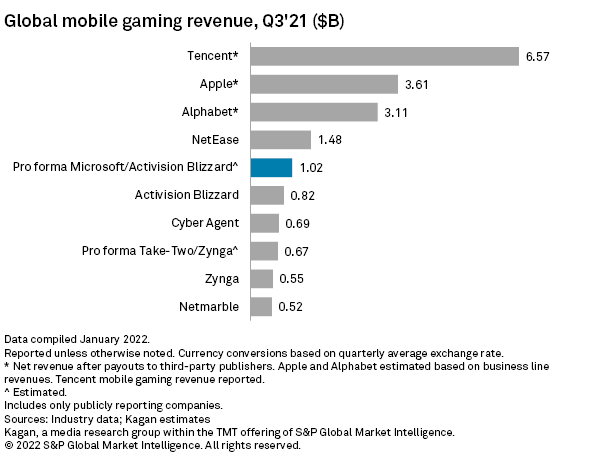

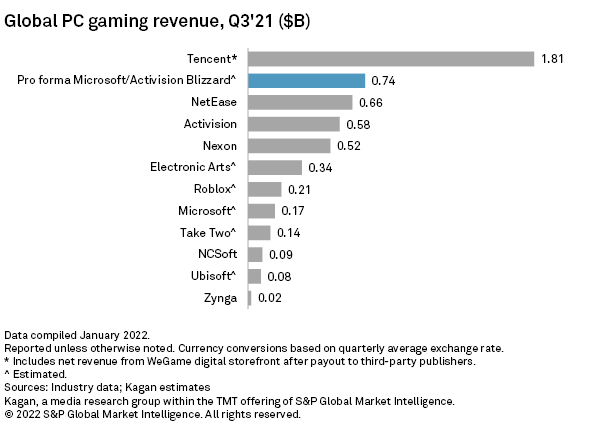

Microsoft Corp.'s proposed acquisition of Activision Blizzard Inc. would make it a top 5 mobile gaming company and the second-largest publisher on PC, according to pro forma revenue estimates compared to Kagan's quarterly gaming revenue tracker.

Combined, Microsoft and Activision would have made an estimated $1.02 billion in mobile gaming revenue in the third quarter of 2021, enough to firmly outpace CyberAgent Inc. but shy of NetEase Inc.'s $1.48 billion. The acquisition gives Microsoft control of Candy Crush and Call of Duty Mobile.

In the PC space, the combined company would have achieved an estimated $744.2 million in third-quarter revenue, enough to overtake NetEase but still well behind Tencent Holdings Ltd.'s $1.8 billion. Microsoft would pick up Activision's World of Warcraft.

Activision's PC and mobile divisions reported a combined $4.61 billion revenue in 2020, and we estimate they made $5.60 billion in 2021. Activision reports year-end earnings on Feb. 3.

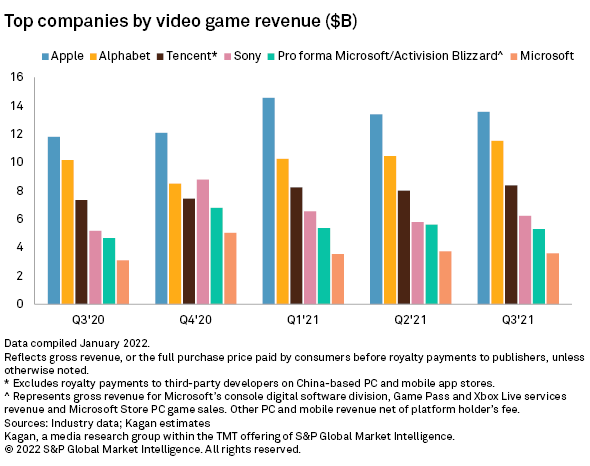

In the console space, Microsoft would not make up much ground on Sony at the outset of the deal close. Microsoft would not see a boost in Activision revenue flowing through Xbox because the console vendors recognize digital gaming revenue on a gross basis, before royalty payouts to publishers. Microsoft would get an additional $1 billion to $2 billion in annual Activision revenue from PlayStation royalty payments.

Microsoft records Activision's royalties in its cost of goods sold. So, it's likely that Microsoft's margin would improve after deal close, but Microsoft would then bear development and marketing costs for Activision's games, which would at least partially offset the decrease in cost of goods sold.

The additional $5.5 billion to $7.6 billion annual revenue may not seem like much in comparison to the $68.70 billion deal price, but the company has a longer-term goal in mind with the content it could add to its Game Pass subscription service.

Microsoft is looking disrupt Sony Group Corp. in the console space and giving consumers access to all or most of Microsoft, Electronic Arts Inc. and Activision games for $10 a month would give the company a distinct edge.

Game Pass also provides access to some of its library through cloud gaming via mobile, PC or Xbox. Microsoft has said it wants to push its Game Pass cloud service to smart TVs, expanding its addressable universe. In that sense, the Activision acquisition is a play for cloud gaming dominance over the long term.

We estimate that third-quarter results would have shown Microsoft remaining the fifth-largest gaming company across console, mobile and PC in terms of gross video game revenue (before royalty payments to publishers) with the acquisition of Activision, but it would have been far more competitive with Sony.

In the press release, Microsoft said it would become the third-largest gaming company by revenue, but that estimate either includes only net gaming revenue for Alphabet Inc. and Apple Inc. or excludes the mobile platform holders outright. In a call to discuss the transaction, Microsoft CEO Satya Nadella said the company faces strong competition from game distributors, likely a nod to Alphabet and Apple.

Note that we are using Tencent's reported net revenue in the chart above. Tencent owns app stores in China, but its distribution business is much smaller than the other companies in our analysis.

Technology is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.