Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 May, 2022

By Alice Yu

Highlights

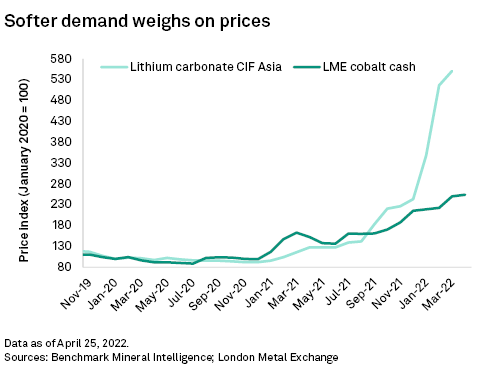

The monthly increase in the lithium carbonate CIF Asia price slowed to 6.7% month over month in March, compared with 48.3% in February.

We now expect a lithium market surplus of 6,426 tonnes of LCE in 2022, instead of the 4,296-tonne deficit in our previous report.

The monthly increase in the lithium carbonate CIF Asia price slowed to 6.7% month over month in March, compared with 48.3% in February. The London Metal Exchange's cobalt cash price edged 0.1% lower month-to-April 22.

* Passenger plug-in electric vehicle, or PEV, sales for the remainder of the year face strong headwinds from production-side losses due to the latest wave of COVID-19 lockdowns in China, the ongoing computer chip shortage and repercussions on the automotive supply chain from the Russia-Ukraine conflict.

* We have therefore downgraded our 2022 passenger PEV sales estimate by 149,166 units globally, including 92,674 units in China.

* Chinese lithium demand has also been weakened by consumption pullbacks across end-use segments due to high prices and the production losses, while supply is relatively strong.

* We now expect a lithium market surplus of 6,426 tonnes of LCE in 2022, instead of the 4,296-tonne deficit in our previous report.

* Despite weaker cobalt demand, the cobalt price correction has been muted due to further challenges from Africa's export logistics. Severe flooding disrupted operations at Durban port for 36 hours before partially resuming April 13.

* We have increased our cobalt price forecast by $0.22/lb to $32.09/lb in 2022 on the dominant impact of persistent challenges at Durban port and its auxiliary infrastructure.

Learn how S&P Capital IQ Pro platform can help you stay ahead of global mining activities and metals markets analysis and forecasts. Request a demo >

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Webinar Replay

Blog

Products & Offerings