Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2023

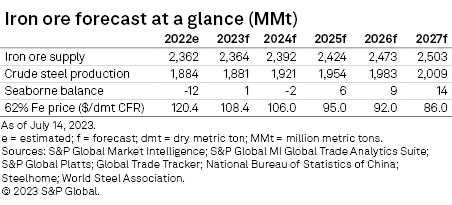

In the monthly Iron Ore Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the iron ore market within the broader macroeconomic environment and provides supply, demand and price forecasts for a rolling five-year period.

➤ The S&P Global Platts IODEX 62% Fe iron ore price rallied to $115.85 per dry metric ton July 18 as Chinese steelmakers took advantage of favorable import margins to buy from the seaborne market rather than procure from portside inventories.

➤ After a steady and robust first half, China's steel output has slowed into July on government-imposed production curbs to lower air pollution; steel production will likely be further restricted to relieve excess stocks in the face of sluggish demand, especially from the property sector.

➤ Seaborne trade has been buoyant with year-over-year increases in exports from Australia, Brazil and India, while imports into China were also healthy over the first six months, prompting an upgrade to our forecast for China's full-year imports to 1,120 million metric tons.

➤ Looking to the second half, we expect steel production to be cut back in China and remain curtailed in Europe with the prospect of more interest rate hikes to tame inflation in the latter economy weighing on iron ore demand and trade.

➤ With fundamentals expected to loosen, we have maintained our forecasts for iron ore prices to fall to $102 per dry metric ton (dmt) in the September quarter and $95/dmt in the December quarter.

Analyst comment

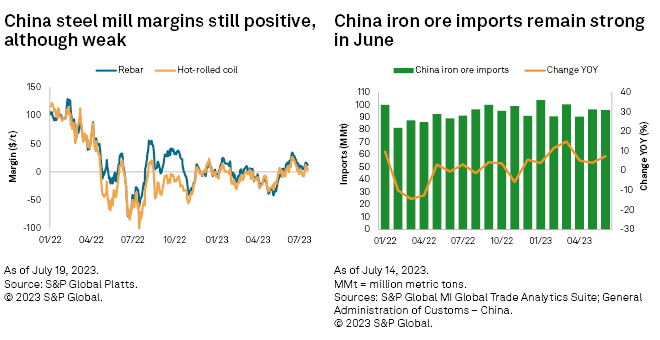

The S&P Global Platts IODEX 62% Fe iron ore benchmark retreated to $105.40/dmt July 10 amid a lull in demand and lingering doubts around the effectiveness of China's stimulus to boost its faltering economy. Prices recovered to $115.85/dmt July 18 as restocking steel mills in China favored procuring directly from the seaborne market, rather than from portside inventories, due to more attractive import margins. Nevertheless, we expect the underlying weakness in the domestic steel market, hampered by China's property sector malaise, to lower iron ore prices in the second half.

Although there are mixed signals for iron ore demand, China's stuttering economy has yet to derail ferrous markets. China imported 95.5 MMt of iron ore in June, with 576.6 MMt arriving in the first six months — marking a 40.7 MMt year-over-year rise. This was underpinned by robust steel production, up at 91.1 MMt in June from 90.1 MMt in May, feeding a 1.3% year-over-year rise to 538.3 MMt in China's first-half output. Chinese steel supply reportedly slowed in the early weeks of July, helped by cuts in Tangshan City — a key steelmaking hub — where the local government has requested as much as a 50% reduction in sinter output to lower air pollution during the summer.

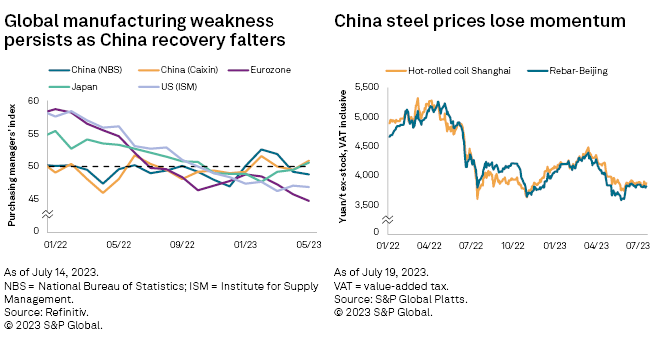

The iron ore market continues to weigh concerns that deeper curbs to steel production will be needed in China in the coming months to relieve excess stocks in the face of sluggish demand. Standing at 15.9 MMt, finished steel inventories in China rose 7.7% between June 30 and July 10, according to China Iron and Steel Association data. On a positive note, there has been a moderate improvement in China's steel mill profit margins, helped by firming domestic steel prices; this comes after hot-rolled coil margins had briefly turned negative in early July, hampered by weakness in the manufacturing sector. A weak domestic market, however, helped to drive up China's steel exports 31.3% year over year in January–June to 43.6 MMt but triggered a 35.2% slump in steel imports.

There was also a robust first-half performance for seaborne iron ore supply with Brazilian shipments rising 15.4 MMt year over year on the back of buoyant demand from China, Southeast Asia and the Middle East. Underpinning this was a 6.0% year-over-year increase in Vale SA's first-half production, driven by record output at the Northern System's S11D mine in the June quarter. Australia's exports increased 10.0 MMt year over year in January–May to 360.6 MMt, led by increased shipments to China, Southeast Asia and South Korea. Rio Tinto Ltd. posted a 6.8% year-over-year rise in first-half output from its Pilbara operation in Western Australia, helped by a ramp-up in supply from its Gudai-Darri mine. India's exports surged 56.7% (7.0 MMt) year over year in January–May — led by a doubling in shipments to China — triggered by a reduction in India's export duty on low-grade iron ore in November 2022. In response, we have upgraded our full-year forecast for India's exports to 40.0 MMt. Meanwhile, war-ravaged Ukraine's first-half exports dropped to 8.3 MMt, with most of this delivered to European steelmakers. Conversely, a slump in shipments to Europe prompted a downgrade to our forecast of Russia's iron ore exports to reach just 12.0 MMt in 2023, with most heading to China.

Outlook

The release of weak data on China's economy had tempered sentiment as of mid-July. China posted weaker-than-expected second-quarter GDP growth at 6.3% with the youth jobless rate rising to 21.3%. Pertinent to weak domestic steel demand were signs of China's property sector deteriorating, with accelerated slowdowns for new floor space under construction and real estate investment in June, which fell 25.5% and 7.9% year over year, respectively. Despite the government's efforts to stimulate home sales over recent months, prices have been falling as buyers remain on the sidelines. While we anticipate a broader recovery in China's property sector to take several years, other sectors of the economy show signs of improvement. Amid mixed trends in manufacturing, including deflationary pressures, growth in industrial output accelerated to 4.4% in June, beating expectations, as did fixed asset investment, which came in at 3.8%, albeit down from 4.0% in May.

The more bullish investors in the iron ore market are pinning hopes on expectations for further stimulus measures in China, although we expect such moves to have only a limited impact on prices. With domestic steel production continuing to run ahead of demand, we expect melt rates to be scaled back in the second half as Chinese mills seek to better align supply with demand. Furthermore, governmental concerns around pollution will likely result in further curbs to steel output soon. Because of the expected steel restraints, we anticipate a slowdown in China's iron ore imports in the second half. A strong first six months, however, has prompted an upgrade to our forecast for China's full-year imports to 1,120 MMt.

With ex-China steel production expected to remain on a tight leash in the second half amid the prospect of more interest rate hikes to tame inflation in Europe — a key iron ore importer — the iron ore demand outlook is unlikely to support prices. Furthermore, we expect a stronger flow of seaborne iron ore shipments over the second half, notably from Brazil and Australia, as weather-related disruptions typically impact early year supply. With fundamentals expected to loosen, we have maintained our forecasts for iron ore prices to fall to $102/dmt in the September quarter and $95/dmt in the December quarter.

Platts IODEX 62% Fe is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.