Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Sep, 2016 | 15:30

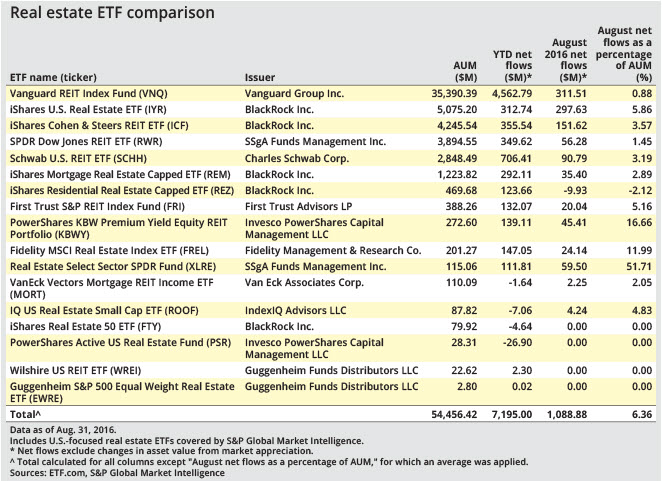

Demand for U.S. real estate securities remained strong in August ahead of the pending elevation of the industry into a new S&P 500 sector, with investors putting $1.09 billion into real estate exchange-traded funds in August after $1.00 billion in July. The popularity of real estate ETFs in August came as other interest rate-sensitive sectors, like telecom services and utilities, saw outflows of $312.5 and $539.2 million, respectively.

Passively managed U.S. real estate ETFs had $54.46 billion in assets at the end of August, down slightly from the $54.71 billion at the end of July thanks to softness in REIT stocks.

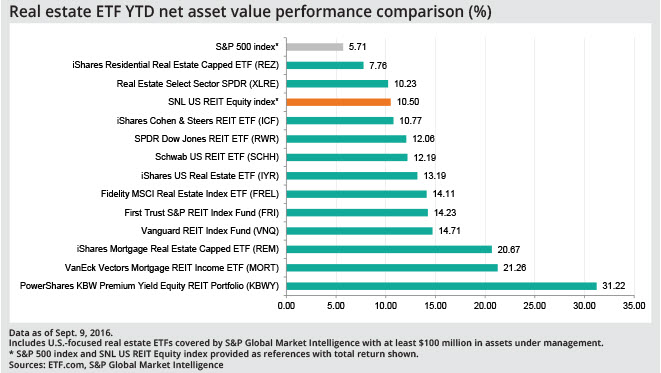

Vanguard REIT Index Fund (VNQ) remained the largest of these ETFs, at $35.39 billion, aided by $311.5 million of August inflows. Relative to the S&P 500 index and the SNL U.S. REIT Equity index, which saw total returns of 5.71% and 10.50%, respectively, VNQ's 14.7% year-to-date net asset value gain through Sept. 9 was much stronger.

Meanwhile, BlackRock's largest REIT product, iShares US Real Estate ETF (IYR) pulled in $297.6 million in August. Despite the popularity of these two products, there are differences in their holdings. VNQ focuses on companies that own traditional real estate, such as self-storage-focused Public Storage and healthcare-focused Welltower Inc., while IYR also holds specialty communications-focused REITs, such as American Tower Corp. and Crown Castle International Corp. among its largest positions.

Real Estate Select Sector SPDR (XLRE) gathered $59.5 million of new money in August, bringing its assets under management to $115.1 million at the end of the month. On Sept. 22, SSgA Funds Management Inc. plans to pay Financial Select Sector SPDR (XLF) shareholders an approximately $3 billion special dividend in the form of XLRE shares. Since Sept. 1, SSgA has injected roughly $3 billion of new money into XLRE.

The strongest performer of the REIT-focused ETFs has been Invesco's PowerShares KBW Premium Yield Equity REIT Portfolio (KBWY). KBWY's NAV climbed 31.22% year-to-date through Sept. 9, as high-dividend-yielding holdings such as Independence Realty Trust Inc., Senior Housing Properties Trust and Washington Prime Group Inc. climbed in value. KBWY gathered $45.4 million of new money in August.

Though demand for REIT ETFs has been broadly based, iShares Residential Real Estate Capped ETF (REZ) had $9.9 million of net outflows last month, bringing its total assets under management to $469.7 million. The ETF, which has been the weakest performer among those funds with more than $100 million in assets under management, counts Camden Property Trust, Essex Property Trust Inc. and Public Storage among its top 10 holdings.