Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jun, 2023

By Brian Bacon

While a majority of US consumers surveyed in the first quarter of 2023 were indifferent towards the NFL Sunday Ticket coming to Alphabet Inc. 's YouTube, Kagan's MediaCensus data pointed to pockets of interest, particularly among those who previously subscribed to the Sunday Ticket programming on DIRECTV.

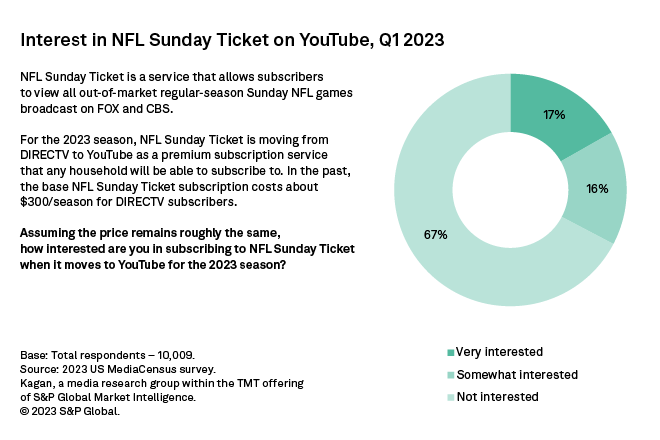

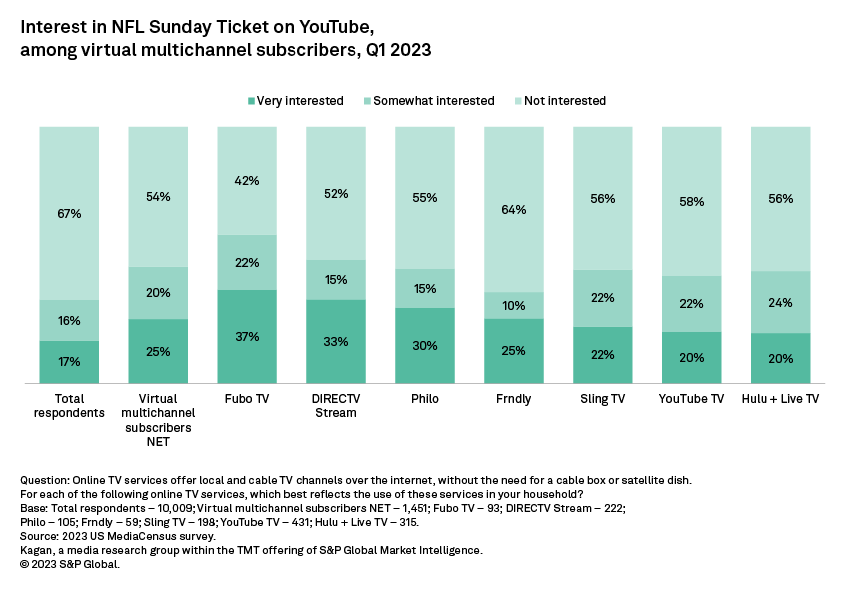

Of the total respondents to Kagan's recent US MediaCensus online consumer survey, only 17% indicated they were very interested in the NFL Sunday Ticket on YouTube. Another 16% of respondents indicated that they were somewhat interested, but most respondents (67%) were not.

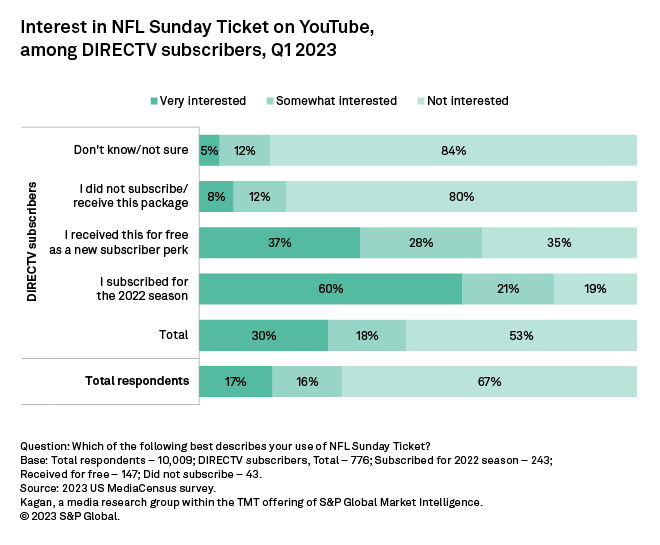

➤ Unsurprisingly, past subscribers to the NFL Sunday Ticket on DIRECTV were about twice as likely as total respondents to be very interested in Sunday Ticket on YouTube at 30%.

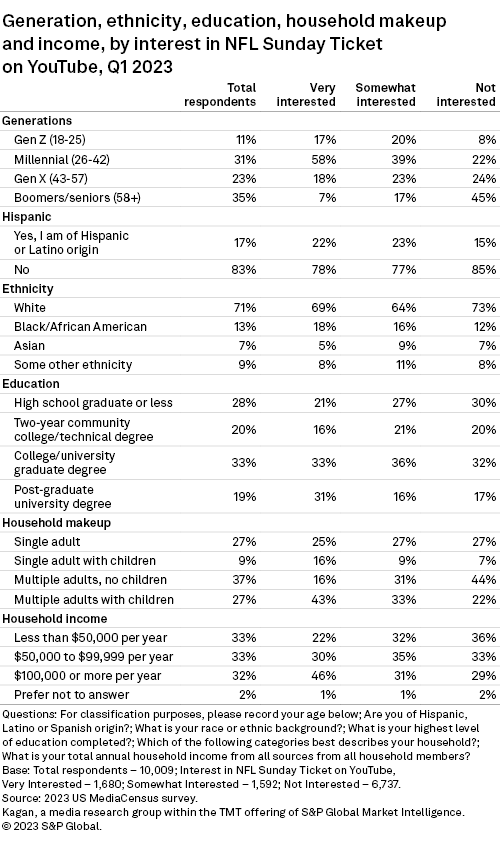

➤ Over half (58%) of those who were very interested in the NFL Sunday Ticket on YouTube were millennials. Very interested respondents were also more likely to live in households earning $100,000 or more per year at 46%, compared to 32% among total respondents.

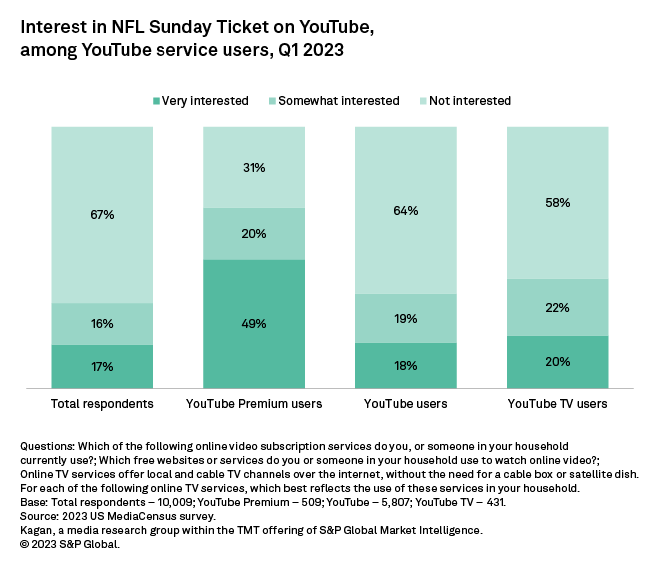

➤ Current YouTube TV subscribers were much less likely to be very interested in the NFL Sunday Ticket on YouTube (20%) than subscribers to other virtual multichannel services like fuboTV and DIRECTV Stream.

Respondents were first presented with a brief rundown of the NFL Sunday Ticket offering as it existed on AT&T Inc. 's DIRECTV, including a general price of $300 per season, before being asked how interested they were in subscribing to the service assuming the price would remain the same. Pricing was announced in April at $449 for the 2023 season, or $349 for YouTube TV subscribers. Now that the pricing has been announced, interest in the service will likely be different from when the survey was fielded in January and February.

As the Sunday Ticket offering moves from DIRECTV to YouTube, it is important to see how much interest there is among DIRECTV subscribers, especially those who previously received the Sunday Ticket. DIRECTV subscribers in general (30%) were about twice as likely as total survey respondents (17%) to indicate that they were very interested in the Sunday Ticket on YouTube, and those who subscribed for the 2022 season were by far the most likely to be very interested, at 60%. Those who had received the Sunday Ticket for free as a new subscriber perk were more likely than total DIRECTV subscribers in general to indicate they were very interested, at 37%. In stark contrast were the DIRECTV subscribers who did not receive the Sunday Ticket previously, only 8% of which indicated they were very interested in Sunday Ticket on YouTube.

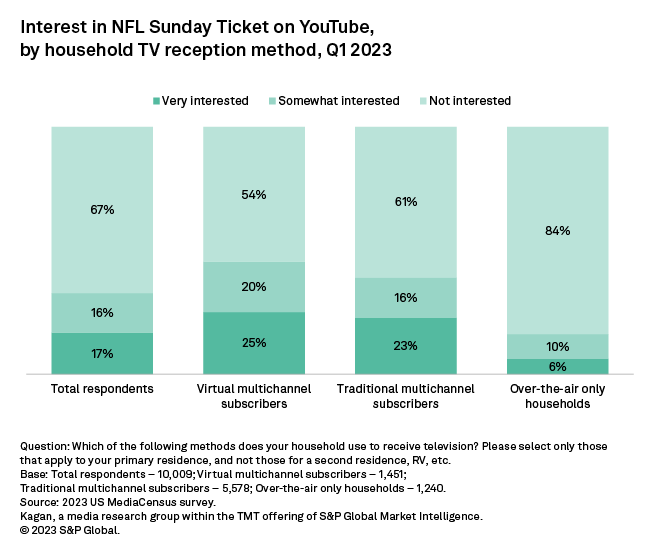

When segmenting by household TV reception type, the survey found that a quarter of virtual multichannel subscribers (25%) indicated they were very interested in the NFL Sunday Ticket on YouTube, a slightly larger share than among traditional multichannel subscribers at 23%. Among households who used over-the-air signals to receive TV and did not use traditional or virtual multichannel services, only 6% indicated they were very interested in the NFL Sunday Ticket on YouTube.

By YouTube service use, nearly half of YouTube Premium users (49%) indicated they were very interested in the NFL Sunday Ticket on YouTube, which was a much larger share than among total YouTube users at 18% and YouTube TV subscribers surveyed at 20%.

YouTube TV subscribers were much less likely to be very interested in NFL Sunday Ticket on YouTube (20%) than subscribers to other virtual multichannel services like fuboTV Inc. and DIRECTV Stream at 37% and 33%, respectively. YouTube TV subscribers had the second largest share indicating they were not interested in the NFL Sunday Ticket on YouTube at 58%, a little lower than among Frndly TV Inc. subscribers at 64%.

FuboTV and DIRECTV Stream subscribers might just be more into sports and thus more interested in the NFL Sunday Ticket on YouTube, given those services carry the most sports networks, especially regional sports networks, among virtual multichannel services. With similar price points across these services and no contracts to tie subscribers down, the NFL Sunday Ticket could be a big draw to bring some subscribers over to YouTube TV.

Millennials represented over half of respondents who were very interested in the Sunday Ticket on YouTube, at 58%. About half of those who were not interested were boomers/seniors at 45%. Respondents of Hispanic or Latino origin represented 22% of those who were very interested and 23% of those who were somewhat interested, compared to 17% of total respondents. Nearly a third (31%) of those who were very interested have a postgraduate degree, a much larger share than those who were somewhat or not interested at 16% and 17%, respectively.

Those who were very interested were more likely to live in households with children. Just over a quarter of survey respondents (27%) lived in households with multiple adults and children, yet that share rose to 43% among those who were very interested in the Sunday Ticket. Meanwhile, single adults living with children accounted for 9% of total respondents, but these households represented 16% of those very interested in the Sunday Ticket.

Very interested respondents were also more likely to live in households earning $100,000 or more per year, at 46%. Households at this income level accounted for 32% of total respondents and 29% of those that were not interested in the Sunday Ticket.

Data presented in this article is from the general population sample of the MediaCensus survey conducted in first quarter 2023. This sample included 10,009 US internet adults matched by age and gender to the US Census. The survey results have a margin of error of +/-0.98 percentage points at the 95% confidence level. Generational segments are as follows: Gen Z, 18-25; millennials, 26-42; Gen X, 43-57; boomers/seniors, 58+. Survey data should only be used to identify general market characteristics and directional trends.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.