Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 6 Sep, 2022

Introduction

Green loans. or GLs, and sustainability-linked loans (SLLs) are two financing instruments made available by banks to datacenter operators for projects that aim to improve the environmental performance of their facilities. Green loans are very similar to conventional loans, with the difference that borrowers must comply with the guidelines established in the Green Loan Principles developed by the International Capital Market Association. Sustainability-linked loans represent a more complex financing scheme that adjusts the interest rate on the environmental performance of the borrower based on the individuation of key performance indicators, or KPIs, and the achievement of preestablished performance targets for each KPI. In 2020, Aligned Data Centers was the first operator to employ such a loan structure. In August 2021, a syndicate of banks led by Banco Bilbao Vizcaya Argentaria SA converted a loan granted to Nabiax into a sustainability-linked loan. Similarly, in September 2021, AirTrunk obtained the conversion of a preexisting loan into a sustainability-linked loan with the guidance of Crédit Agricole SA.

The Bank for International Settlements estimates that bank loans represent the main financing source in most G20 economies. Indeed, bank loans are often the only financing source for small and medium-sized enterprises, which represent part of the backbone of many advanced and emerging market economies. Therefore, we think green and sustainability-linked loans may outpace green bonds as financing options available to datacenter operators to facilitate the industry's green transition while reducing their facilities' operating costs.

Context

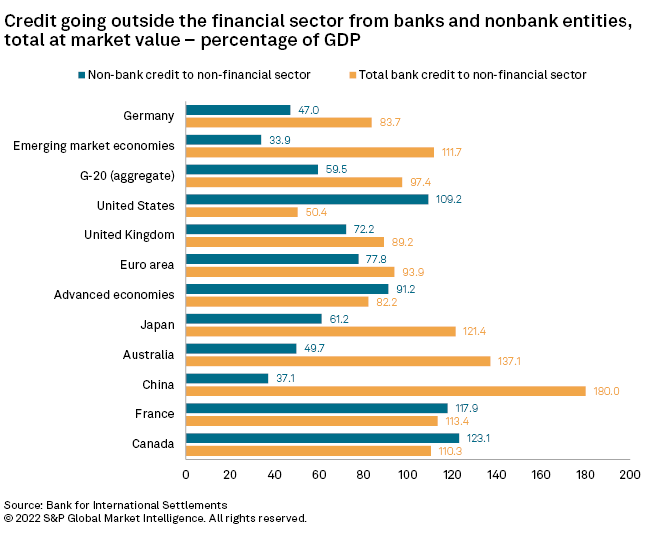

Bank loans still represent the primary source of corporate debt financing in many advanced and emerging market economies. The Bank for International Settlements estimates that in the third quarter of 2021, the volume of bank loans outside the financial sector amounted to 112% and 82% of the gross domestic product of emerging markets and advanced economies of the G20, respectively. However, the figure varies greatly across countries within the G20. We can observe market-based financial systems, as in the case of the U.S., where bank loans account for less than one-third of the total credit going outside the financial sector, and bank-based financial systems, as in the case of China, where the bank loan equals 180% of the GDP (almost the totality of the domestic credit going outside the financial sector). Japan can also be considered a bank-based financial system because total bank credit going outside the financial sector is more than double nonbank credit. Significant variability is also observable in the eurozone, where we can find bank-based financial systems, as in the case of Germany, and hybrid systems, as in the case of France. Nevertheless, except for the U.S., bank credit accounts for (at least) nearly half of the total domestic credit in all countries.

In the context of the predominance of bank credit in the financial systems of the world's largest economies, GLs and SLLs are financial instruments particularly suitable for companies that cannot raise funds through the issuance of corporate green bonds due to various reasons concerning corporate dimensions, business practices or the level of financial development of the country within which they operate. Smaller operators, in particular, may be precluded from issuing green bonds in the capital market due to a lack of reputation, high costs of certification fees and the relatively smaller size of their companies.

GLs have the same structure and conditions as conventional loans, with the difference that they are granted explicitly by banks to finance corporate green projects and are certified by international consortiums and trade associations in the banking industry.

SLLs are structured so that the rates paid by borrowers vary according to the achievement of contractually established sustainability performance measured using key performance indicators. In other words, borrowers benefit from lower interest rates by hitting preestablished benchmarks for environmentally sustainable practices. Therefore, SLLs incentivize borrowers to improve their environmental, social and governance performance in exchange for relief on interest payments.

Green and sustainability-linked loan principles

The taxonomy of these two bank lending instruments has been published in the Green Loan Principles, or GLP, and Sustainability-Linked Loan Principles, or SLLP, as established by the financial service trade groups Asia-Pacific Loan Market Association, the Loan Market Association, and Loan Syndications and Trading Association under the coordination of the International Capital Market Association, or ICMA.

As in the case of the Green Bond Principles, both taxonomies have been developed to facilitate environmentally sustainable economic activity and to support the transition toward a low-carbon economy by providing voluntary guidelines to lenders and borrowers.

The taxonomy of GLs is exactly equal to the one developed by the ICMA in the Green Bond Principles. Green loans are any loan instrument granted by bank institutions to finance or refinance green projects, including revolving credit facilities. To be considered "green," a loan agreement must include four components:

* Use of proceeds.

* Process of project evaluation and selection.

* Management of proceeds.

* Reporting.

SLLs are any loan instrument and contingent facilities granted by banks to incentivize the borrower to achieve preestablished sustainability performance. Therefore, the taxonomy of the SLLs is slightly different from that of the GLP.

An SLL must have five core components:

* Selection of key performance indicators.

* Calibration of sustainability performance targets, or SPTs, per KPI.

* Loan characteristics.

* Reporting.

* Verification.

The relevance of KPIs and SPTs in establishing the legitimacy of a sustainability-linked loan market is emphasized in the guidelines included in the Principles. KPIs should be relevant and material to the borrower's entire business, measurable or quantifiable on a consistent methodological basis, and benchmarkable against an external reference or definitions to help assess the SPT's level of ambition.

Potential benefits of GLs and SLLs for datacenter operators

We have identified four main benefits of GLs for datacenter operators:

* Improvement of the sustainability management of the facilities: The GLPs stress the importance of the "process for project evaluation and selection" and the "reporting" components to ensure that the green loan granted by the bank will produce positive environmental spillovers. In the case of the datacenter industry, operators may devote the proceeds of green loans to energy-efficiency projects, thus improving the sustainability of their facilities while reducing operational costs linked to electricity consumption.

* Acquisition of public acceptance by demonstrating a commitment to promote sustainable facilities: Entering a green loan scheme may signal a commitment to sustainability for potential investors and clients pursuing sustainability goals in their science-based targets or trade association agreements.

* Reinforcement of the funding base by building relationships with new bank institutions committed to sustainability: Datacenters operate in a capital-intensive industry where capital deployments have a payback period of approximately three to six years. Therefore, datacenter operators must build long-term relationships with bank institutions willing to provide patient capital for sustainability-related projects.

* Possibility to raise funds on relatively favorable terms due to reduction of transition risk: Datacenter operators publicly committed to sustainability goals are much less exposed to the risk arising from the transition of a low-carbon economy that includes changes in regulations, the introduction of a carbon tax and fees, changes in clients' preferences, etc. Consequently, they may access finance on more favorable terms than operators perceived as "unsustainable."

SLLs share the same benefits as the GLs, with the additional benefit of providing cheaper financing. By featuring a sustainability-linked pricing mechanism that adjusts the interest rate based on a datacenter facility's environmental performance, an SLL incentivizes a borrower to reduce the carbon footprint and improve the energy efficiency of its facility to lower borrowing costs.

Overall, the development of a larger GL and SLL market would benefit the whole datacenter industry because it would also allow small operators that cannot issue green bonds to access green financing schemes to improve their sustainability performance and reputation.

Aligned-ING, Nabiax and AirTrunk-Crédit Agricole sustainability-linked loans

In September 2020, ING Groep NV delivered the first-ever sustainability-linked loans in the datacenter industry by granting Aligned a lending facility with a pricing grid linked to pre-specified environmental performance targets. The loan package worth $1 billion was structured in a $750 million term loan and a $250 million revolving credit facility, with interest payments pegged to contractually agreed-upon KPIs and sustainability performance targets. In particular, the interest rate margins were linked to specific environmental KPIs, including sourcing 100% of the annual electricity consumption from renewable energy sources with net-zero emissions by 2024. After successfully hitting all the sustainability targets in July 2021, Aligned secured an additional sustainability-linked loan of $250 million.

In August 2021, Spanish datacenter operator Nabiax also negotiated the upsizing of its existing €285 million syndicated loan underwritten in 2019 to €320 million and its conversion into a sustainability-linked loan reaching maturity in 2026.

Similarly, in September 2021, Australian datacenter operator AirTrunk converted its A$2.1 billion loan facility into a sustainability-linked loan with the advisory of Crédit Agricole. The interest rates were linked to specific ESG KPIs related to diversity and inclusion, carbon neutrality, and energy efficiency through power usage effectiveness targets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.