Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2023

By Keith Nissen

Results from a recent Kagan US Consumer Insights survey show that the use of digital entertainment among younger Americans (Gen Z adults and millennials) and older Americans (baby boomers and seniors) is profoundly different. Gen Xers tend to bridge the gap, which makes them part of everyone's target market.

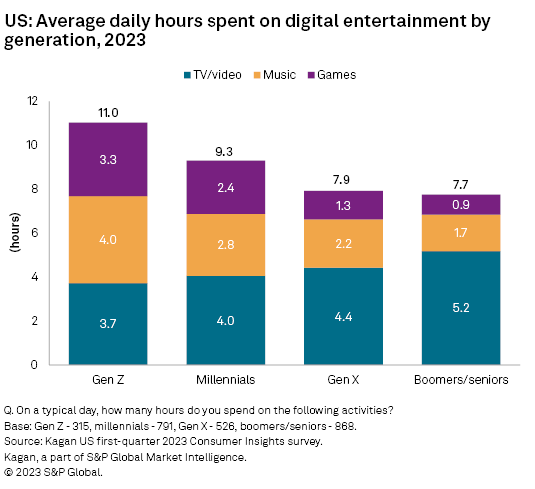

➤ Baby boomers/seniors (ages 58+) spend approximately eight hours per day on digital entertainment, mostly watching TV/video content. Online-centric Gen Z adults (ages 18-25) and millennials (ages 26-42) spend nine to 11 hours per day on digital entertainment, viewing less TV/video with more time dedicated to music and games. Gen Xers (ages 43-57) bridge the entertainment divide between older and younger generations.

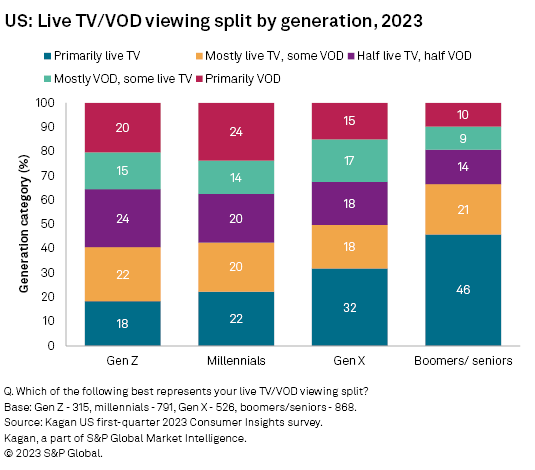

➤ Gen Xers tend to watch more live TV than millennials and more video on demand than baby boomers/seniors.

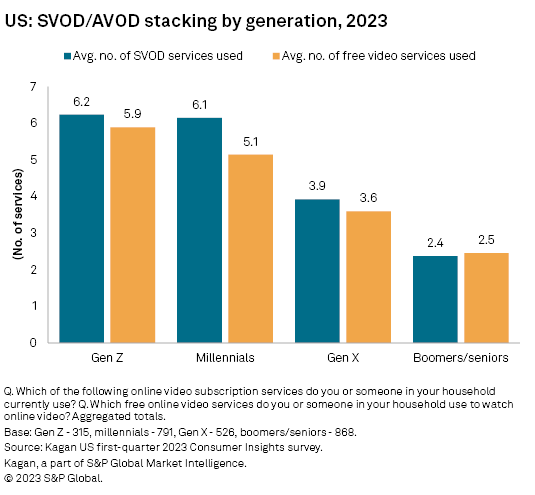

➤ Gen Xers tend to use more subscription VOD and free online video services than baby boomers/seniors, suggesting their content preferences are more aligned with younger Americans.

➤ Gen Xers also tend to use a more diverse set of online music services than baby boomers/seniors and are much more likely to play mobile games than older Americans.

Results from the Kagan US first-quarter 2023 Consumer Insights survey documents a generational entertainment divide, which this report outlines. Baby boomers and seniors represent 35% of US internet adults, while millennials and Gen Z adults represent 32% and 13%, respectively. Approximately 20% of internet adults are Gen Xers.

The US generational entertainment divide is vividly apparent in the type and quantity of digital entertainment consumed each day. The survey data shows that baby boomers and seniors spend an average of 7.7 hours per day consuming digital entertainment, the vast majority (5.2 hours) spent watching TV/video. In contrast, millennials spend over nine hours per day on digital entertainment, with less time spent watching TV/video content (4.0 hours per day) and substantially more time listening to music (2.8 hours) and playing video games (2.4 hours) than older Americans.

The survey also found that Gen Z adults spend the most time on digital entertainment (11 hours per day), with substantially more time dedicated to music and gaming than even millennials. However, their use of digital entertainment may likely curtail with age. For TV/video operators, targeting Gen Xers makes sense in that they spend substantially more time watching video than Gen Z adults and millennials. Online music and gaming vendors may also look positively on Gen Xers due to their higher consumption compared to baby boomers and seniors.

Not only do Gen Z and millennials spend less time on average watching TV/video content than older Americans, but they also spend substantially less time watching live TV. Kagan defines live TV as either traditional linear TV from a broadcast/cable network or livestreamed video content. VOD represents any TV or video content (derived from VCR recorded, pay TV or online services) that is initiated by the viewer.

The survey data reveals that nearly half (46%) of baby boomers/seniors watch primarily live TV, compared to only 22% of millennials and 18% of Gen Z adults. At the other end of the spectrum, one-quarter (24%) of millennials report watching primarily VOD content compared to 10% of baby boomers and seniors. While one-third (32%) of Gen Xers still watch primarily live TV, another 32% report watching mostly or primarily VOD content.

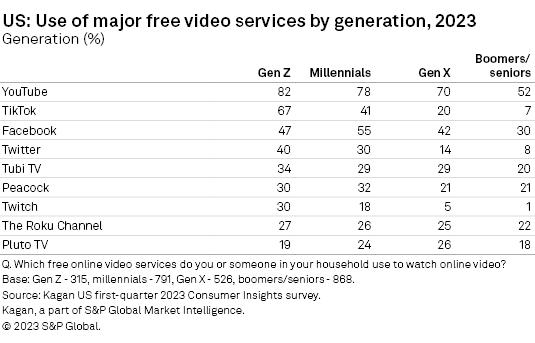

Overall, eight out of 10 US internet households report using either subscription-based or free advertising-based video services. Yet, the number of online video services being used varies greatly by generation. The survey found that Gen Z and millennials use an average of six SVOD services, nearly three times as many as baby boomers and seniors (2.4 services). Similarly, the average number of free online video services used by Gen Z and millennials (5 services) is double that of baby boomers and seniors (2.5 services). Once again, the higher use of online video services among Gen Xers, compared to baby boomers/seniors translates into more SVOD and free online video services being used.

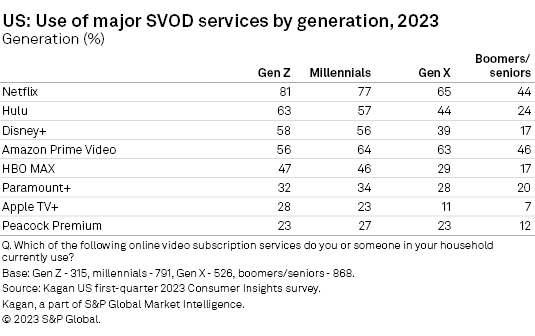

Drilling down into the use of specific SVOD services shows that baby boomers and seniors are most likely to use only Netflix and Amazon Prime Video. In addition to these services Gen Z and millennials are likely to use Hulu, Disney+ and HBO MAX as well. A significant portion of Gen Xers already uses many of the same SVOD services as Gen Z adults and millennials, which suggests the Gen X SVOD content preferences may be more in line with younger adults than with baby boomers and seniors.

When it comes to free online video, YouTube and Facebook are the preferred choices across age generations. The survey data highlights that online services offering free TV content, such as the Roku channel, Peacock, Pluto TV and Tubi TV have modest appeal across the age generations, as well. The main differentiation between the age categories is that Gen Z adults and millennials are much more likely to watch free videos on TikTok, Twitter and Twitch than older Americans. While Gen Xers do not use TikTok, Twitter and Twitch to any great extent, their use of the free online TV content services closely matches and sometimes exceeds that of younger Americans.

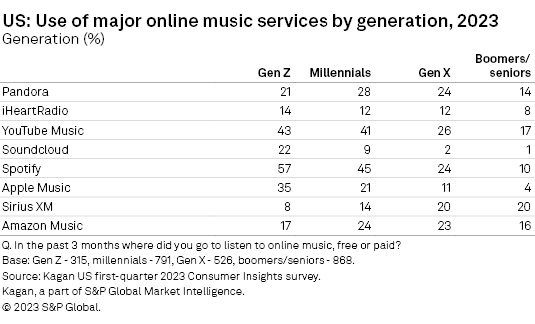

Listening to online music has become very popular with 80% of US internet adults reporting they use a free or paid online music service. The survey data indicates that over nine out of 10 Gen Z adults and millennials (94%) use online music services, compared to 80% of Gen Xers and 62% of baby boomers/seniors. On average, Gen Z adults and millennials use two online music services, Gen Xers use 1.5 services and baby boomers/seniors use only one online music service.

Survey results show that Spotify and YouTube Music, followed by Apple Music, are the most popular online music services among Gen Z adults and millennials. Baby boomers and seniors do not appear to have strong preferences. Gen Xers tend to emulate millennials in their use of Pandora and Amazon Music, while matching baby boomers/seniors in their use of Sirius XM.

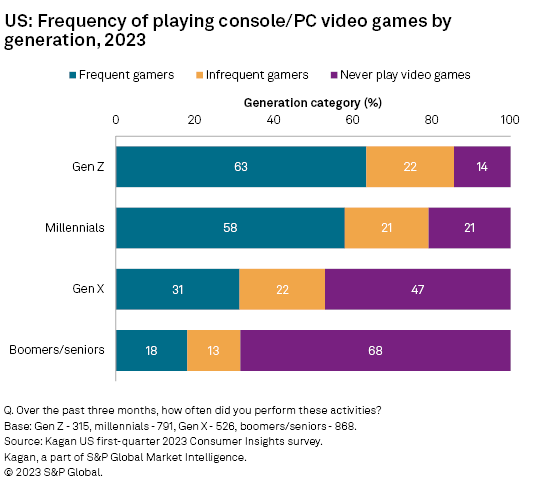

Approximately six out of 10 (58%) US internet adults report playing PC or console video games. The survey data shows that 85% of Gen Z adults and 79% of millennials play PC/console games, with the majority of both groups playing games at least once a week (a.k.a. frequent gamers). The majority (54%) of Gen Xers also play PC/console games, one-third (31%) being frequent gamers. Only 18% of baby boomers and seniors play PC/console games at least once a week.

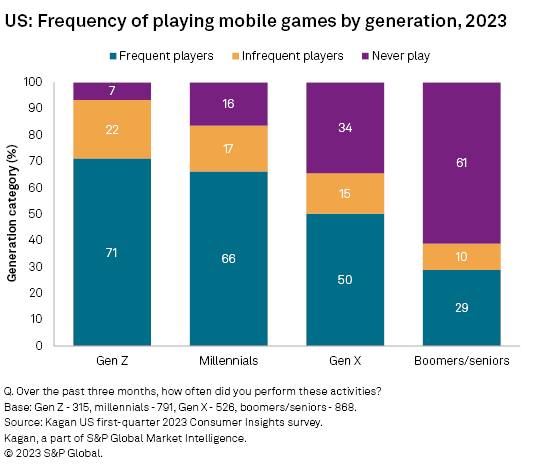

The survey data also highlights that two-thirds (65%) of US internet adults play mobile games. As with PC/console games, mobile gaming is skewed toward Gen Z adults and millennials. Nearly three-quarters (71%) of Gen Z adults and two-thirds of millennials indicated that they play mobile games at least once a week. In contrast, nearly two-thirds (61%) of baby boomers and seniors do not play mobile games at all. For the gaming industry, Gen Xers represent a growth opportunity, especially for mobile games.

Data presented in this article was collected from the Kagan US first-quarter 2023 Consumer Insights survey conducted during March 2023. The US Consumer Insights surveys consisted of approximately 2,500 internet adults per wave, with a margin of error of +/- 1.9 ppts at the 95% confidence level. Percentages are rounded to the nearest whole number.

To submit direct feedback/suggestions on the questions presented here, please use the “feedback” button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

For more information about the terms of access to the raw data underlying this survey, please contact support.mi@spglobal.com.

Consumer Insights is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.