Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 29 Jun, 2022

By Brian Bacon

Introduction

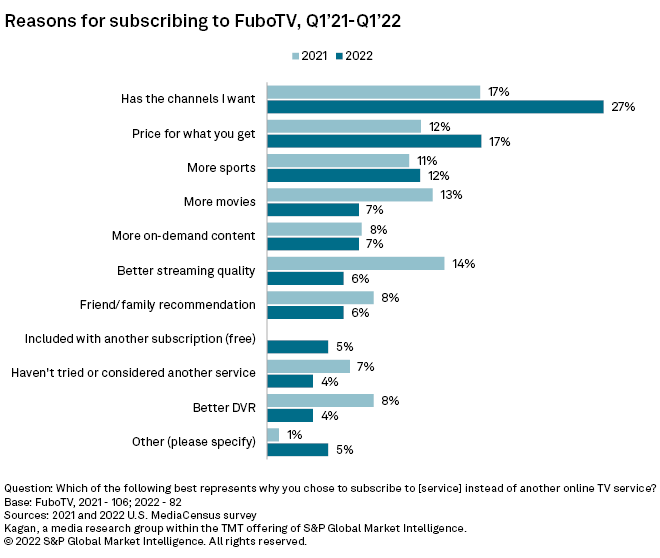

Channel lineup was the most selected reason for subscribing to fuboTV Inc.'s virtual multichannel service over other virtual services at 27% of U.S. subscribers surveyed, a significant increase from 17% in 2021. According to data from Kagan's U.S. MediaCensus online consumer surveys, conducted in February 2021 and February 2022, fuboTV subscribers were also more likely in 2022 to indicate they subscribed to the service because of "price for what you get" at 17% compared with 12% in 2021. Subscribers were less likely to indicate they subscribe to the service because it has more movies or better streaming quality compared with 2021. "Better streaming quality" took a hit in our 2022 survey, with only 6% of subscribers choosing this as a reason for subscribing compared with 14% in 2021.

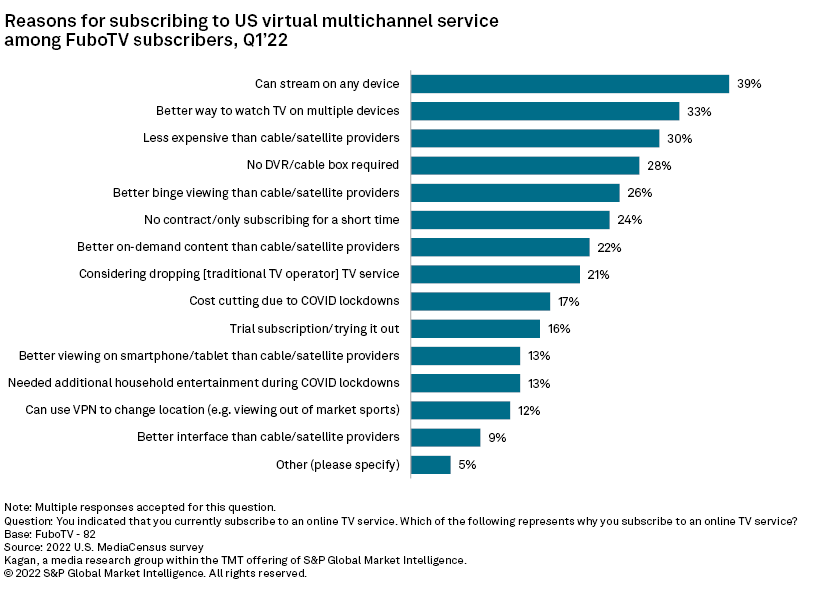

* In Kagan's 2022 U.S. MediaCensus survey, fuboTV subscribers chose "can stream on any device" and "better way to watch TV on multiple devices" as the top reasons for subscribing to a virtual multichannel service.

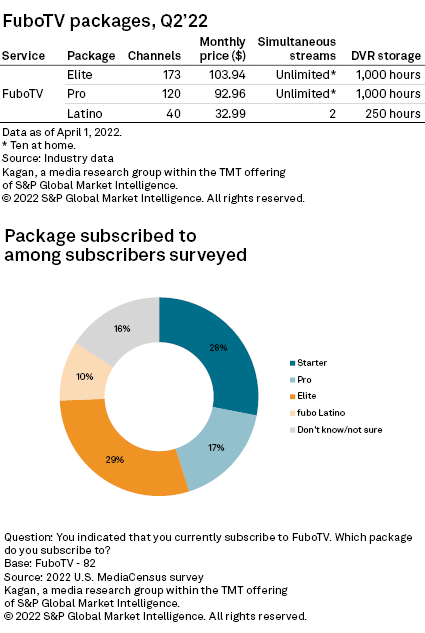

* 29% of fuboTV subscribers indicated they subscribe to the Elite package.

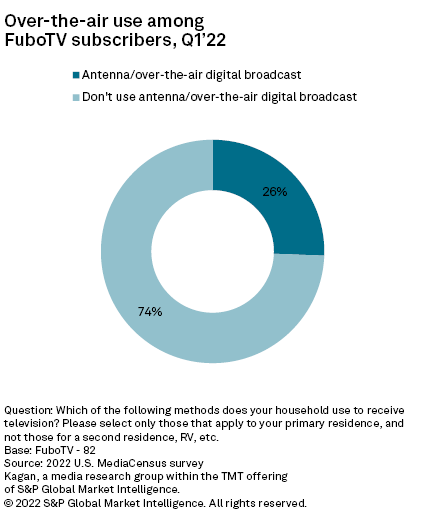

* 26% of fuboTV subscribers use an antenna to receive over-the-air broadcasts.

When asked the broader reason for subscribing to any virtual multichannel service, the most-selected response among fuboTV subscribers was "can stream on any device" at 39%. A similar selection was "better way to watch TV on multiple devices," for simultaneous viewing, at 33%. Although fuboTV has a higher price point than other virtual services, 30% indicated they subscribe to the service because it is less expensive than cable/satellite providers.

Originally launched as a sports-centric virtual multichannel service, fuboTV's channel lineup has evolved to be a broad offering, with 120 channels in the base Pro package. FuboTV also offers a smaller package of Spanish language networks dubbed the Latino package, which offers fewer simultaneous streams and less DVR storage space than its other packages. Among subscribers surveyed, only 10% indicated they subscribe to the Latino plan. FuboTV no longer offers its Starter package to new subscribers; however, when the survey was in the field, 28% of subscribers surveyed indicated this was the package they received. Those formerly subscribing to the Starter package were migrated to the Pro package in May.

A quarter of fuboTV subscribers (26%) indicated they used an antenna to receive local broadcast networks, despite local networks being included. FuboTV subscribers were just as likely to use an antenna as DISH Network Corp.'s Sling TV subscribers (27%), but they made up a much larger share than subscribers to other services, like Walt Disney Co.'s Hulu + Live TV at 13% and Alphabet Inc.'s YouTube TV at 12%.

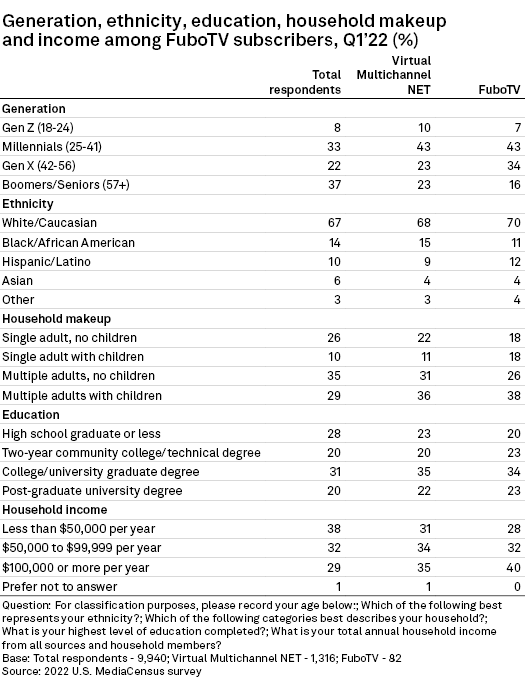

Gen X represented a larger share of fuboTV subscribers at 34%, compared with all virtual multichannel subscribers surveyed at 23%, and they represented 22% of total respondents. FuboTV subscribers also represented a larger share of households with children, both those with single adults (18% versus 11%) and multiple adults (38% versus 36%), when compared with all virtual multichannel subscribers surveyed. FuboTV subscribers were also more likely to be in households earning $100,000 or more per year, at 40%, compared with total respondents at 29% and all virtual multichannel subscribers surveyed at 35%.

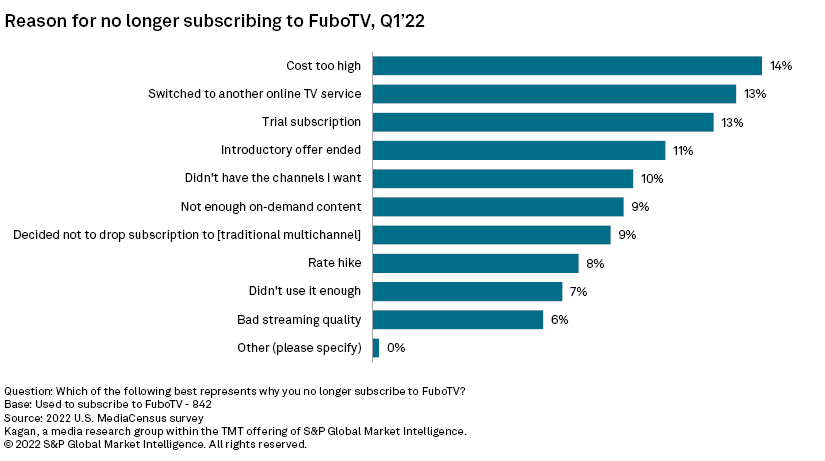

The most-cited reason for dropping among former fuboTV subscribers surveyed was "cost too high" at 14%, which might make sense given fuboTV's cost is over $90 per month (excluding the Latino package). However, this is a much lower share compared with former subscribers to other services, especially DIRECTV Stream at 31%. Slightly smaller shares of former subscribers indicated they switched to another service, at 13%, or only signed up as a trial subscription, also at 13%.

Data presented in this article is from the general population sample of the MediaCensus survey conducted in February 2021 and February 2022. The sample included 9,985 (2021) and 9,940 (2022) U.S. internet adults matched by age and gender to the U.S. Census. The survey results have a margin of error of +/-0.98 percentage points at the 95% confidence level. Generational segments are as follows: Gen Z: 18-24; millennials: 25-41; Gen X: 42-56; boomers/seniors: 57+. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.