Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 23, 2022

By Ken Wattret and Yacine Rouimi

Market consensus expectations for real GDP growth rates in the EU and eurozone through 2023 look increasingly unrealistic.

Household real incomes are taking a hammering, while supply chain disruptions are impeding the industrial sector. The broadening of the EU's sanctions against Russia is aggravating concerns related to energy supply and prices.

Persistently high and broad-based inflation is also forcing central banks, including the European Central Bank (ECB), to step up their policy tightening.

An intensification of energy and monetary policy-related headwinds would materially raise the likelihood of recession in Europe.

GDP growth likely to slow in 2023

We continue to forecast significantly weaker outcomes as the factors supporting Europe's growth in the short term - such as pent-up demand for tourism and recreation - are buffeted by inflation, energy-related risks and policy pressures.

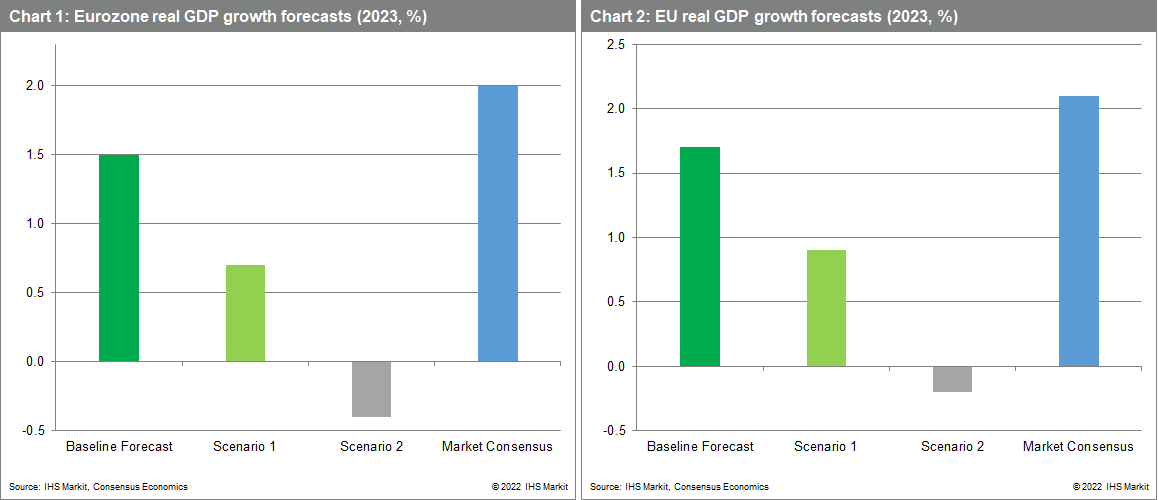

Following our mid-June updates, our baseline forecasts for annual EU real GDP growth in 2022 and 2023 now stand at 2.6% and 1.7%, respectively - below the market consensus expectation of 2.7% in 2022 and 2.1% in 2023, according to June's Consensus Economics.

For the eurozone, our updated real GDP forecasts of 2.5% and 1.5% for 2022 and 2023 also remain below the market consensus expectations of 2.8% and 2.0%, respectively.

The risks to growth in 2023 look increasingly skewed towards even weaker outcomes than in our baseline forecast, in part because the effects of higher energy prices related to the EU's ban on imports of Russian oil are yet to be fully factored in.

Using our Global Link Model (GLM), we have run two alternative simulations, which highlight the significant risk of recession in Europe.

They both incorporate sharply higher energy prices from the second half of this year, though with variations in both their persistence and the monetary policy response.

Risk of a hard landing

The first scenario underscores the material risk of a hard landing - a significant economic slowdown after a period of rapid growth. The key economic implications include:

Risk of a recession

In the second scenario, which assumes more aggressive monetary policy tightening, the EU and eurozone fall into recession during the first half of 2023.

The key economic implications in this scenario include:

Trigger points

A recession is avoided in the first scenario in part because the tightening of financial conditions is less acute.

The second scenario incorporates more severe financial stress and commodity prices fall back earlier owing to weaker demand, averting an even deeper contraction in output.

In both scenarios, the 'catch-up' of services sector activity back towards the pre-pandemic levels provides a cushion against the adverse shocks. The pick-up in demand from China contributing to the surge in energy prices also provides some support to European growth via stronger exports.

The risk of recessionary conditions in Europe is, of course, not confined to energy and monetary policy-related shocks. Adverse shocks through other transmission channels could also see real GDP contract, including via trade and confidence effects.

We already forecast a recession in the United Kingdom, the eurozone's second-largest export market, with the likelihood of a hard landing in the United States, its largest export market, also rising markedly given the policy shift from the Fed and its various implications (although this is not in the baseline).

It's likely just a matter of time before the marked deterioration in consumer confidence evident across Europe since Russia's invasion of Ukraine is accompanied by similarly sharp declines in other key sectors. A declining trend is already becoming apparent in many sentiment surveys (consumer-driven services excepted). A more pronounced deterioration, particularly in the most interest-rate sensitive sectors such as construction, has become much more likely given the increasingly challenging outlook on various fronts.

Posted 23 June 2022 by Ken Wattret, Vice-President, Global Economics, S&P Global Market Intelligence and

Yacine Rouimi, Senior Economist, IHS Markit

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.