Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2017 | 11:00

By Jeff Heynen

The following post comes from Kagan, a research group within S&P Global Market Intelligence. To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

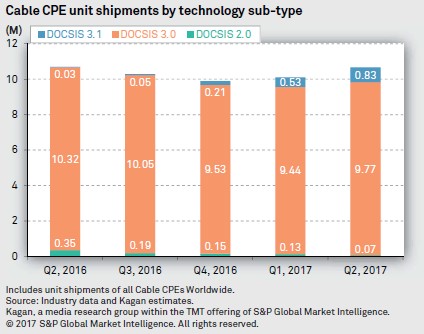

In the pursuit of enabling gigabit broadband services across their networks, cable operators globally are accelerating their deployments of DOCSIS 3.1 modems and gateways. Shipments of DOCSIS 3.1 modems and gateways through the first half of 2017 have reached nearly 1.4 million units, according to reported and estimated shipments by Kagan, a media research group within S&P Global Market Intelligence

Though those shipment numbers pale in comparison to current shipment levels of DOCSIS 3.0 devices, the trend over the last two quarters shows a rapidly increasing volume of DOCSIS 3.1 unit shipments, principally to cable operators in North America.

Cable operators, including Comcast Corp., can't get their hands on DOCSIS 3.1 fast enough, as customer premises equipment, or CPE, system vendors, such as ARRIS International plc, Technicolor, NetGear Inc., Hitron Technologies Inc., and Ubee Interactive seek to meet operator demand for these devices. With the first wave of DOCSIS 3.1 devices having been certified only in 2016, followed by successive certification waves in early 2017, a more rapid increase in volume is gated only by the lack of more widespread availability of these units.

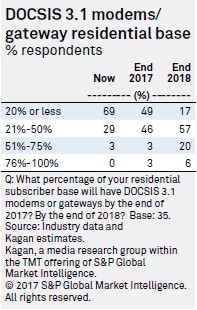

Our May 2017 forecast for DOCSIS 3.1 unit shipments set an aggressive expectation of 7.4 million units shipping in 2017, growing to 34 million units in 2022. Unit shipments in 2017 are likely to be closer to 5 million, though we do expect the later years in the forecast to match our current forecasts. By 2022, DOCSIS 3.1 units are forecast to represent 82.1% of the total market. Comcast, Liberty Global plc, Altice NV, and Australia's NBN Co Limited are expected to provide the early installation of end-to-end DOCSIS 3.1 technologies. These operators will drive heavy volumes of new DOCSIS 3.1 units and will quickly push per-unit pricing down to levels nearly comparable with DOCSIS 3.0 units. According to a survey of 35 cable operators from around the world published earlier this year, 69% of respondents said that 20% or less of their broadband subscriber base had a DOCSIS 3.1 modem or gateway today. By the end of 2018, 57% of respondents expect that 21% to 50% of their residential subscriber base will be DOCSIS 3.1-ready, while an additional 20% said that 51% to 75% of their subscriber base would have DOCSIS 3.1 CPE in their homes. Only 6% said that between 76% and 100% of their subscriber base would have DOCSIS 3.1 CPE at the end of 2018, which shows the challenges of deploying this technology on a widespread and rapid basis.

Still, we expect that operators will have a major incentive to move forward with DOCSIS 3.1 units, which have been priced around 25% to 30% higher than comparable DOCSIS 3.0 units so far this year. As shipment volumes increase throughout 2018, price points for DOCSIS 3.1 units will drop to being only 15% to 20% higher than comparable DOCSIS 3.0 units.