Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 22, 2023

By Ken Wattret

The global economic expansion is looking more fragile, the US excluded.

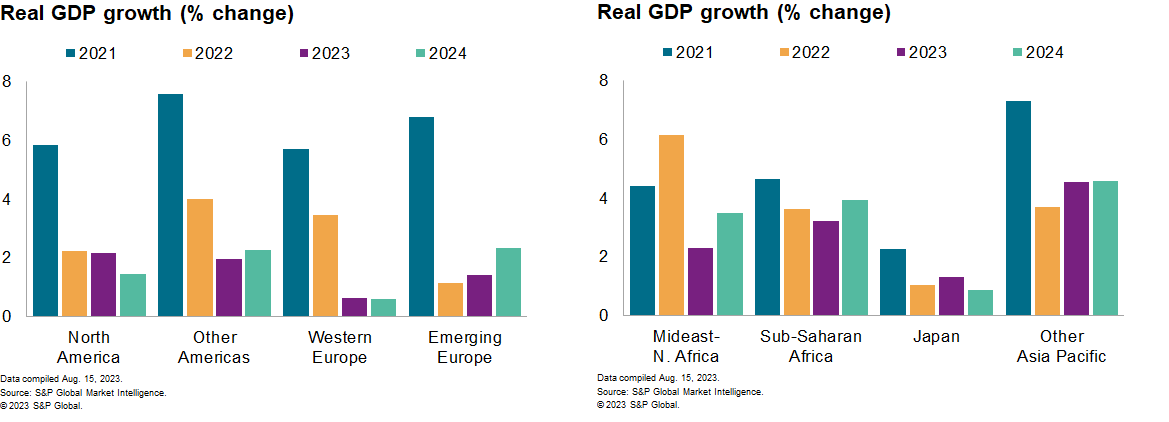

S&P Global Market Intelligence's global real GDP growth forecast for 2023 has again edged higher — from 2.4% to 2.5% in August — primarily owing to upward revisions to the US forecast. The 2024 global growth forecast is unchanged at 2.4%, also supported by an upward revision to the US forecast. Elsewhere, the effects of tighter financial conditions are becoming increasingly apparent, with leading indicators generally showing an alarming loss of momentum. The JPMorgan Global Composite Purchasing Managers' Index™ (PMI™) compiled by S&P Global fell markedly again in July, to just 51.7, the weakest level since January.

Monetary policy prospects are becoming more divergent.

The US Federal Reserve is forecast to deliver at least one additional 25 basis point policy rate increase before the end of the year, in November. Given the backdrop of unexpectedly robust activity data and still tight labor market conditions, September's meeting is also in play. The deteriorating growth outlook for the eurozone, in contrast, suggests that the European Central Bank has probably already delivered its final hike. Its focus is shifting toward balance sheet shrinkage. Policy rate cuts in advanced economies are not forecast until mid-2024. In some emerging economies, interest rate cuts are already underway, in line with our expectations.

Inflation will continue to decline, although sticky core rates remain a concern.

Having fallen by close to four percentage points in less than a year, we forecast the gradient of the decline in global consumer price inflation to become much less steep from the second half of 2023 as downward pressure from energy-related base effects fades. While the general direction of travel for global inflation will remain downward, the 2024 forecast has been revised slightly upward. This reflects a combination of near-term gains in crude oil prices and stubbornly high services inflation rates. Global monetary conditions may need to remain tighter for longer, intensifying growth headwinds.

US real GDP growth forecasts have been revised up again.

The August forecast shows notably stronger real GDP growth in 2023. The upward revision, from 1.8% to 2.2%, is again due mainly to newly reported strength in mid-year. GDP grew by 2.4% annualized in the second quarter, while high frequency data show a strong "carry over" from the second to the third quarter. Our growth forecast is above consensus for this year and next, and the consensus will likely follow our upward trend given recent data. A period of below-trend GDP growth, and a consequent rise in unemployment, remain prerequisites for a return to 2% inflation. We anticipate the Fed raising its policy rate once more in 2023, in November, to a peak range of 5.50-5.75%. However, its communications suggest the September meeting is also "live," so we cannot rule out a peak of 5.75-6.00% by year-end.

The eurozone is heading for a double dip.

Annual real GDP growth estimates for 2023 and 2024 stand at just 0.7%, with the latter lowered again in the August forecast round. The pickup in quarter-over-quarter real GDP growth in the second quarter, to 0.3%, merely matched our forecast (and was boosted by a surge in Ireland). Survey data continues to deteriorate. The HCOB Eurozone composite PMI™ output index fell to 48.6 in July, the lowest since November 2022. The ECB raised its policy rates by a further 25 basis points in July, lifting the deposit facility rate to 3.75%, matching its record high. Its communications left options open for upcoming policy meetings. Given the deteriorating economic outlook and improvements in some of the alternative inflation metrics that we track (including a sharp drop in the trimmed mean rate), we continue to forecast that the July hike will prove to be the last of the cycle.

Mainland China's faltering recovery is set to prompt additional stimulus.

We lowered our real GDP growth forecasts in the July forecast round in response to signs of softening domestic and external demand. The recent run of data has reinforced those signals, with broad-based weakness increasingly apparent. Further deterioration is likely in the absence of effective policy action. The central bank unexpectedly cut the medium-term facility rate by 15 basis points in mid-August, the largest reduction since 2020. S&P Global Market Intelligence expects additional near-term expansion of stimulus, including support for the property sector and further loosening of monetary conditions.

Learn more about our economic forecasts and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.