Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 May, 2018

Capital Markets

Highlights

The Clariant/Huntsman merger also ranked amongst the highest as likely to be cancelled, according to recent analysis conducted by S&P Global Market Intelligence’s Quantamental Research team.

On May 22, 2017, Huntsman Corporation announced a “merger of equals”1 with Clariant, meant to create a global company valued at about $20 billion. Just five months later in October, the two chemical companies mutually agreed to halt the merger, citing shareholder and activist investor concerns on the side of the “buying” company, Clariant. If the investors, M&A advisors, or chief officers had the gift of hindsight, they may have foreseen certain telltale signs that this deal was likely prone to cancellation. In fact, the Clariant/Huntsman merger also ranked amongst the highest as likely to be cancelled, according to recent analysis conducted by S&P Global Market Intelligence’s Quantamental Research team.

According to the group’s report, The Art of the (no) Deal: Identifying the Drivers of Canceled M&A Deals, proposed deals with large proportionality ratios (“mergers of equals”), can be difficult to manage. Key factors, such as who will lead the combined entity to board membership constitution, may lead to a higher cancelation risk for these types of transactions. The Clariant/Huntsman cancellation not only embodied a large proportionality ratio, but also fit the profile of other cancelled deal drivers including “large target based on revenue” and “cross boarder deal.”

Clariant/Huntsman was one of 16 deals announced and canceled in 2017 for companies observed in the Russell 3000 Index. Terminated deals impact capital market participants in various ways. Predicting deals that are likely to be canceled is of interest to chief officers, M&A advisers, and investors alike because of the potential opportunity of cost benefit savings. Findings from the report show that certain key drivers influence whether deals are likely to be canceled, which include the following:

In addition, the research documented several other characteristics that increase the cancelation risk of M&A deals such as material changes in the company or industry fundamentals (e.g. 2008 financial crisis) and anti-trust and national security concerns, which was evident in the case of Clariant/Huntsman.

FINDINGS

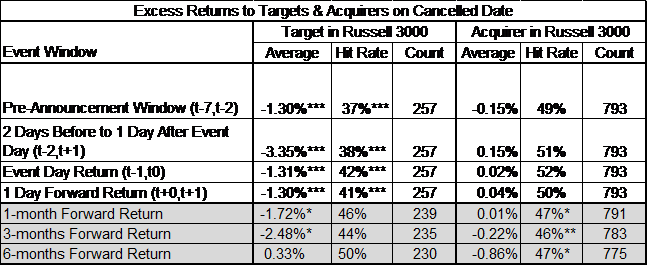

The analysis also points to excess returns to both targets and acquirers on deal announcement and canceled dates, where targets earn an average excess return of 7.79% (or -3.35% during a cancellation) in the three day window surrounding deal announcement (or cancelation).

Canceled Deals: Excess Returns to Targets & Acquirers on Canceled Dates (January 2001 – March 2017)

*** statistically significant at 1% level; ** statistically significant at 5% level; * statistically significant at 10% level.

Source: S&P Global Market Intelligence Quantamental Research. For all exhibits, all returns and indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Data as at 09/30/2017.

The short-term impact to targets following deal cancelation is negative (-3.35%), although the long-term impact is muted. Equity investors should consider this price impact and the probability of the deal going through, if they currently hold, or plan on adding a stock that has been targeted for acquisition to their portfolio.

RESEARCH OVERVIEW

Predicting Deal Cancelation Risk

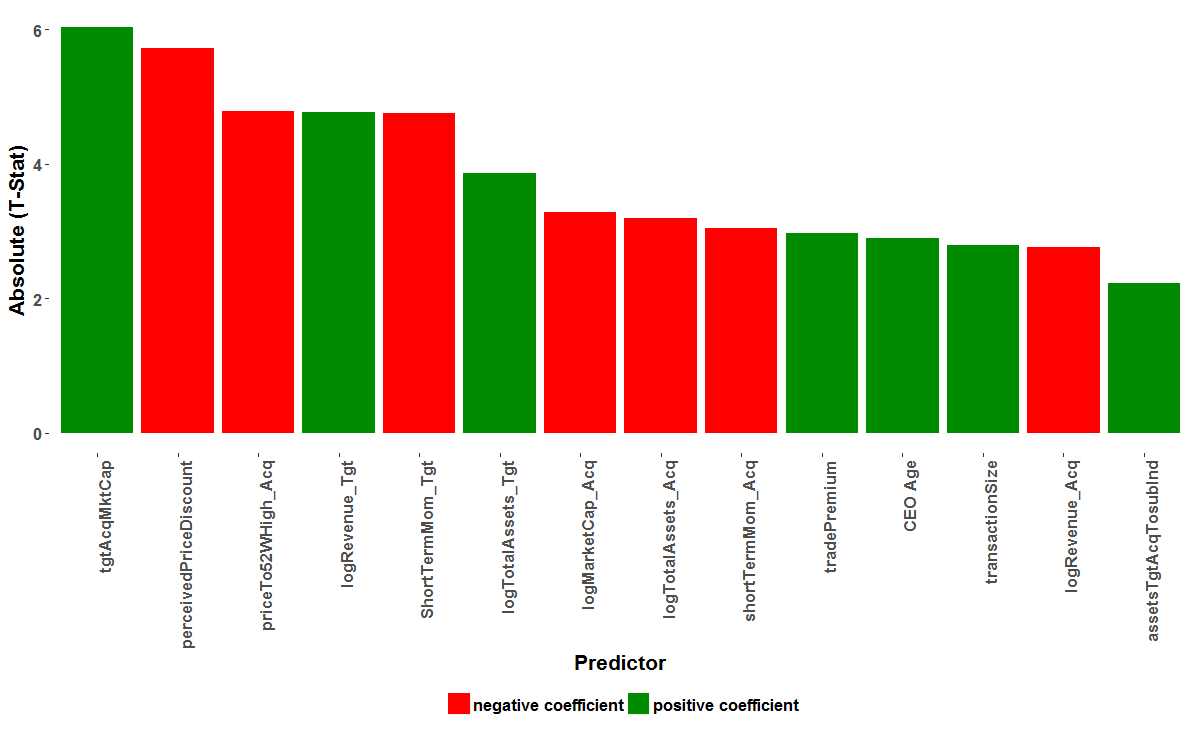

We estimated the probability of a deal being terminated using logistic regression. Our universe consists of 2,300 observations, of which 361 were canceled and the remaining were closed deals. We randomly selected two-thirds of our sample as the in-sample period and the remaining one-third as out-of-sample. Selected predictors with significant t-stats are shown in Figure 1 (See Appendix A in full paper for list of factors tested). Analyses in the following sections were conducted with data as at March 2017.

Figure 1: Predictors with Significant T-Stats: Target in Russell 3000

(January 2001 – March 2017)

Source: S&P Global Market Intelligence Quantamental Research. Data as at 09/30/2017.

Suffix “tgt” and “acq” indicate target or acquirer characteristics respectively. Green (red) bars indicate that the predictor has a positive (negative) relationship with deal cancelation risk. For example, deals with high “tgtAcqMktCap” values (ratio of the target’s market capitalization to that of the acquirer) have a higher probability of being terminated than deals with low tgtAcqMktCap values – a positive relationship

Large acquirers are in a better position to close deals due to stronger balance sheets and easier access to financing than smaller companies. However, the size of the target relative to the size of the acquirer is also an important metric, as very large acquisitions are difficult to consummate.

Deals with targets trading well below 52-week highs are at risk of not closing (perceivedPriceDiscount). Shareholders “anchoring” the value of their stock to the high over the past year may believe their stock is being acquired too cheaply and not support the deal.

Regulatory risk is another important consideration. The larger our metric of regulatory risk (assetsTgtAcqToSubInd), the higher the cancelation risk, as deals that would result in significant industry consolidation are likely to face antitrust scrutiny.

We also found the age of the acquirer’s CEO to be an important characteristic, as young male CEOs may be more combative and less willing to concede in negotiations, compared to older CEOs2 .

We tested several fundamental metrics including earnings yield, book leverage and return on assets as possible drivers of canceled deals, but our results were inconclusive.

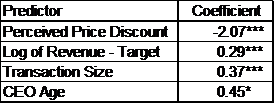

Although our data sample is small, three of the four predictors included in the model have coefficients that are significant at the 1% level3 .

Predictor Coefficients (in-sample): Target in Russell 3000

(January 2001-March 2017)

*** statistically significant at 1% level; ** statistically significant at 5% level; * statistically significant at 10% level.

Source: S&P Global Market Intelligence Quantamental Research. Data as at 09/30/2017.

Access the complete research and additional analysis here.

1 “Huntsman and Clariant to Combine in Merger of Equal.” PR Newswire. May 22, 2018.

2 CEO Age is a binary indicator set to 1 for male CEOs (50 years or less).

3 Three-fifths of the data was for in-sample and two-fifths for out-sample. This approach yields 826 and 552 observation for the in-sample and out-of-sample respectively.