Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Sep, 2021

COVID-19’s effect on industries has varied dramatically and will continue to be felt for years to come in terms of the outlook for growth, financial policies and credit metrics. This is especially the case as shifting patterns of work and leisure continue to accelerate. This blog looks at S&P Global Ratings’ perspectives of the credit and ratings trends for the corporate sector, and then focuses specifically on telecom and cable and technology.

Credit and Ratings Trends for Corporates

According to S&P Global Ratings many positive developments have been seen of late with the rollout of vaccines, growth in GDP, proposed infrastructure spending and more. Despite this, however, the beginning of 2021 still showed high levels of “CCC” credits, although substantially lower than the COVID high.

As of June 2021, secondary market spreads remained tight despite inflation concerns,1 and combined speculative grade issuance set a record high at $648 billion U.S. when compared to the same month every year since 2018.2

Positive ratings actions have been outpacing negative ones for U.S. non-financials since February 2020, with even more significant improvements showing in 2021.3 Some sectors that were highly impacted by the pandemic are improving, and global rating actions (both positive and negative) have been largely concentrated in the speculative grade. The energy and capital goods sectors had the largest number of issuers with ratings actions between February 3, 2020 and July 2, 2021. The outlook bias remained negative across sectors in May, but less so than in May 2020.4

S&P Global Ratings expects the North American telecommunications and technology sectors (hardware and semiconductors) to see credit metrics recover to 2019 levels by the first half of 2021. Other sectors more heavily hit by the pandemic − including commercial aerospace, airlines, and cruise lines ‒ are not likely to see these recovery rates until 2023 or beyond.4

The “new normal” could mean structurally lower credit ratings for many sectors, a persistently higher level of defaults (although below past peaks) and the need to constantly monitor potential bubbles in certain asset classes due to low rates and hyper-liquidity.

Credit Outlook for U.S. Telecom and Cable

Rating downgrades outpaced upgrades by more than two to one for U.S. telecom and cable providers in 2020. However, most of the negative actions were at the very low end of the ratings scale where leverage was already elevated. High profile issues that filed for Chapter 11 bankruptcy included Intelsat Corp., a satellite service provider, and Frontier Communications, a telecommunications company. So far in 2021, rating trends have been more balanced, with 85% being “B” or higher.5

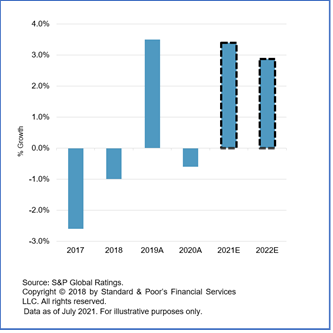

The telecom industry proved to be fairly recession resistant during the pandemic. As shown in Chart 1, wireless service revenue growth is estimated to be 3%-4% in 2021, although there is margin compression as the carriers look to differentiate their 5G capabilities with aggressive promotions.

Chart 1: U.S. Wireless Service Revenue Growth

On the other hand, wireline providers are losing their share of the broadband market to cable, which is contributing to revenue declines. Telecom companies are also aggressively building out fiber to the home (FTTH) to better compete with cable. Overall, weaker credit metrics are expected for 2021, with limited improvement in leverage over the next few years.

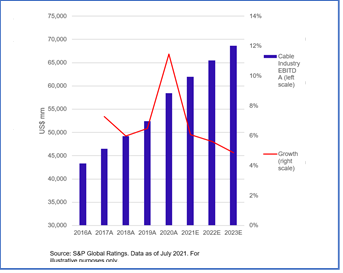

U.S. cable providers benefited from the pandemic, which accelerated inevitable secular trends towards high-speed data and away from linear TV services. As shown in Chart 2, growth spiked by approximately 11% in 2020 and is estimated to be at 6% for 2021.

Chart 2: U.S. Cable Industry EBITDA Growth

There is a favorable view of the cable industry given its dominant market share for data connections and mix shift away from less profitable video services. Most risks for cable are manageable. Overall, some improvement in credit measures is expected based on solid earnings growth and free cash flow (FCF) generation. That said, M&A and shareholder returns could constrain leverage improvement over the next couple of years

Credit Outlook for U.S. Technology

S&P Global Ratings estimates that global GDP will increase by 5.9% this year, while global IT spending will increase by 9.4%. Semiconductors show the highest estimated revenue growth at 16% for the year, followed by software at 12%. On the shipment front, PCs show the highest estimated growth at 15%.5

Looking forward, the top five themes for the Technology industry are as follows:

A positive rating action bias began in July 2020. As of June 2021, just 5% of issuers had a negative rating outlook versus 21% in May 2020, with tech issuance on the upside as of July 12, 2021.5

Click here for more on the S&P Global Ratings midyear outlook for Telecom & Cable and Technology.

Sources

Download The Full Report

Products & Offerings

Segment