Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Dec, 2023

By Brian Bacon

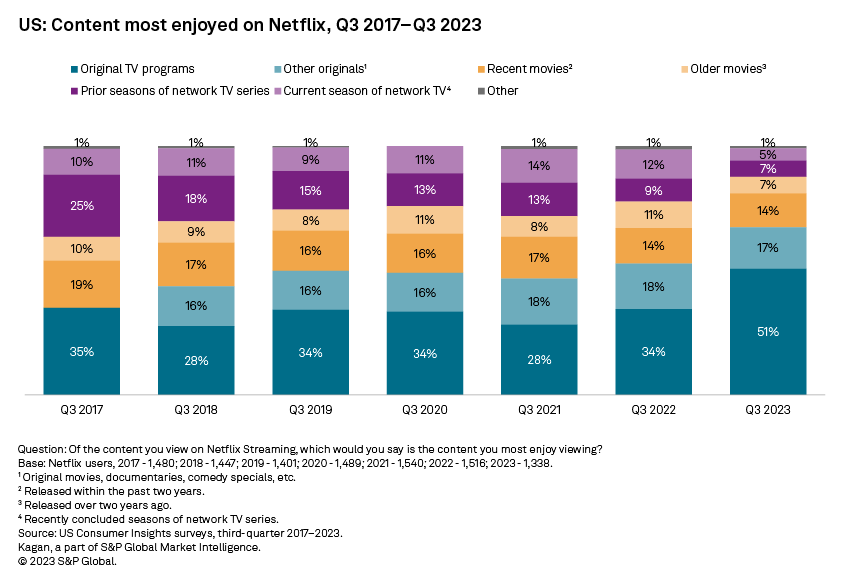

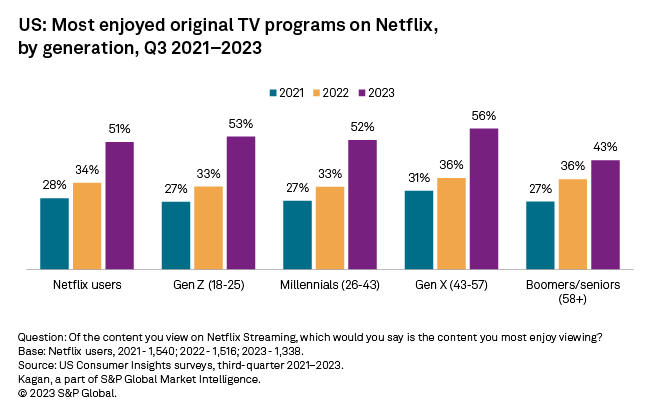

The content that Netflix Inc. users reported most enjoying on the service has changed dramatically over the past year, as the share of subscribers selecting original TV programs increased to 51% from 34%. All the other content types declined in share compared to the previous year, and current season network TV and older movies declined the most.

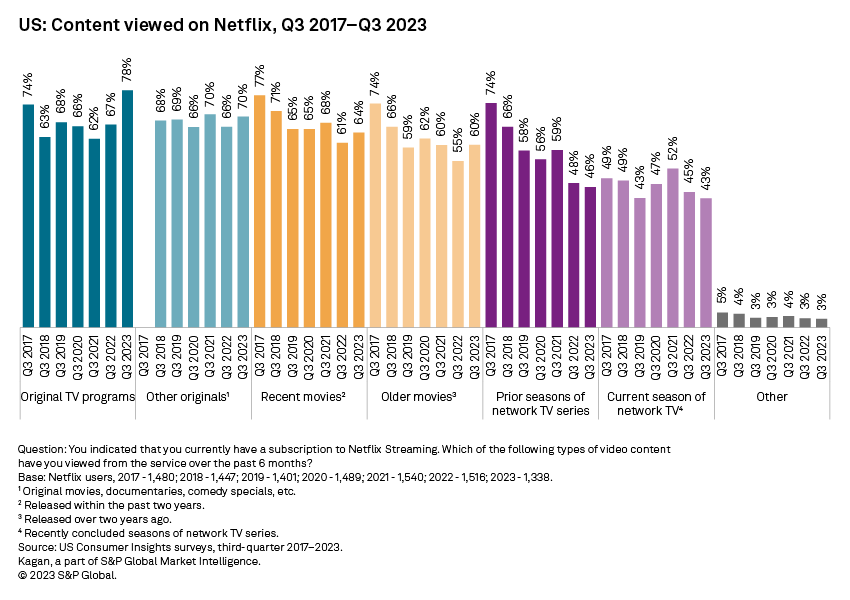

➤ Over three-quarters (78%) of Netflix users responding to Kagan's third-quarter US Consumer Insights survey in 2023 viewed original TV programs, up from about two-thirds (67%) surveyed in 2022.

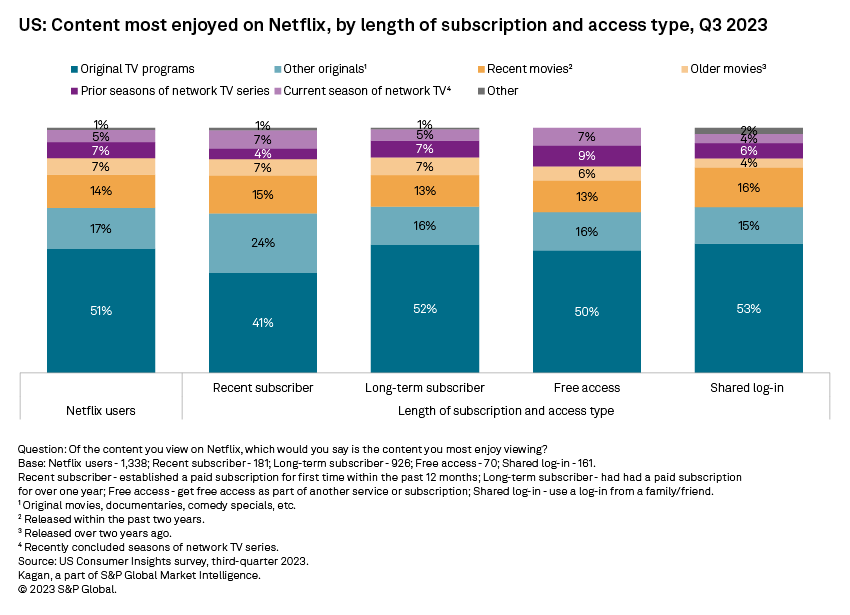

➤ Recent Netflix subscribers who signed up within the last year were less likely to most enjoy original TV content (41%) than long-term subscribers (52%).

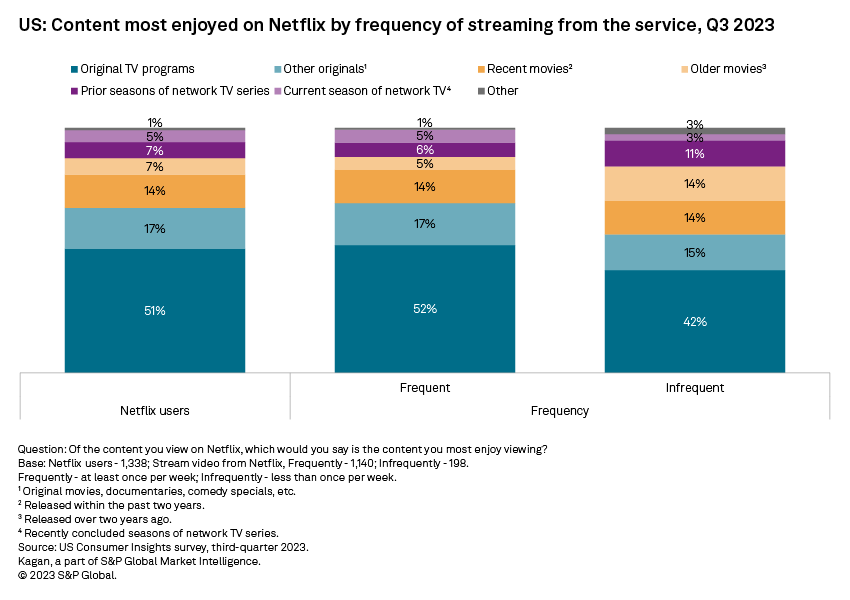

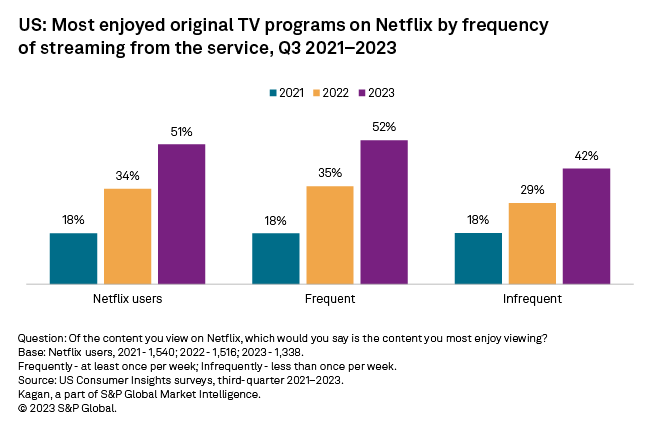

➤ Frequent Netflix streamers, defined as those who streamed Netflix at least once per week, were more likely to most enjoy original TV content (52%) compared to infrequent streamers (42%).

Following the fielding of our third-quarter 2022 survey, Netflix altered its service plans by debuting an ad-supported tier in November 2022 and cracking down on password sharing. We believe that these changes impacted the respondents who indicated they used Netflix and influenced responses to the content they most enjoy on the service.

Netflix executives in the company's third-quarter 2023 earnings report pointed to original titles such as "One Piece" and licensed content such as "Suits" as driving viewership, contributing to customer retention and acquisition. In Kagan's 2023 survey, 51% of Netflix users indicated that original TV series was the type of video content that they most enjoyed on the service. Interestingly, despite the success of "Suits," users surveyed in 2023 were slightly less likely to select prior seasons of network TV series as the content they most enjoy, at 7%, down from 9% in 2022.

Turning to viewing trends, Netflix users were also more likely to indicate they watched original TV programs in 2023 (78% of users), compared to 2022 (67%). The share of Netflix users viewing movies, both recent and older titles, was also larger in 2023 compared to 2022 results. Network TV viewing was down year over year, with 46% viewing prior TV seasons and 43% viewing current seasons on the platform.

Recent subscribers, or those who signed up within the past year, were less likely to indicate that they most enjoyed original TV programs (41%) compared to long-term subscribers (52%) and free access users.

Among the two types of free access users, half (50%) of those who receive Netflix as part of another subscription reported that they most enjoyed original TV programs, slightly less than the share of free access users who shared a log-in (53%).

Notably, recent subscribers were more likely than all other types of users to say they most enjoyed "other originals" at 24% versus 17% of Netflix users overall.

A majority of frequent streamers, defined as those who streamed Netflix at least once per week, said they most enjoyed original TV programs (52%) compared to less than half of infrequent users (42%), defined as those who streamed less than once per week. Frequent streamers were also a little more likely to most enjoy other originals, at 17%, compared to infrequent streamers at 15%.

Infrequent users were more likely to indicate they most enjoy older movies (14%) and prior seasons of network TV series (11%) versus frequent streamers (5% and 6%, respectively).

As recently as 2021, there was no difference in the percentage of frequent and infrequent streamers selecting original TV programs as the content they most enjoyed, at 18%. Although the share of streamers selecting original TV programs as the content they most enjoy has increased in both groups in the past couple years, it has grown more sharply for frequent Netflix streamers than infrequent streamers.

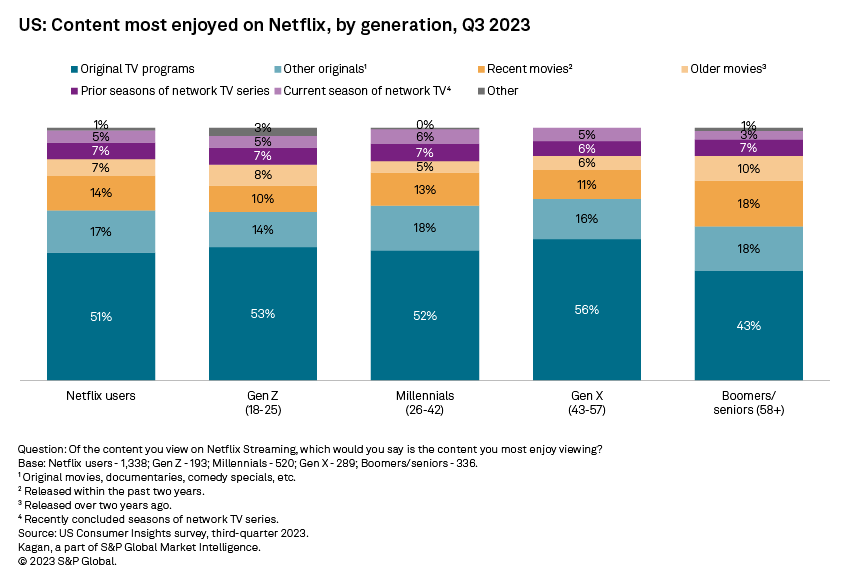

Regardless of age, original TV programs had the largest share of users indicating they most enjoyed this type of video content on the service; however, originals were not as dominate among boomers/seniors. Less than half of boomers/seniors said they most enjoyed original TV, at 43%, versus 52% to 56% for all younger generations. Boomers/seniors also were more likely to select movies as their most enjoyed content — both recent titles (18%) and older films (10%) — than the younger users surveyed.

Examining the jump in enjoyment of original TV programs over the past few years shows that boomers/seniors used to be much closer to younger users in their preferences. Gen X and younger users exhibited much larger increases in those reporting enjoyment of original TV programs from 2022 to 2023 than boomers/seniors.

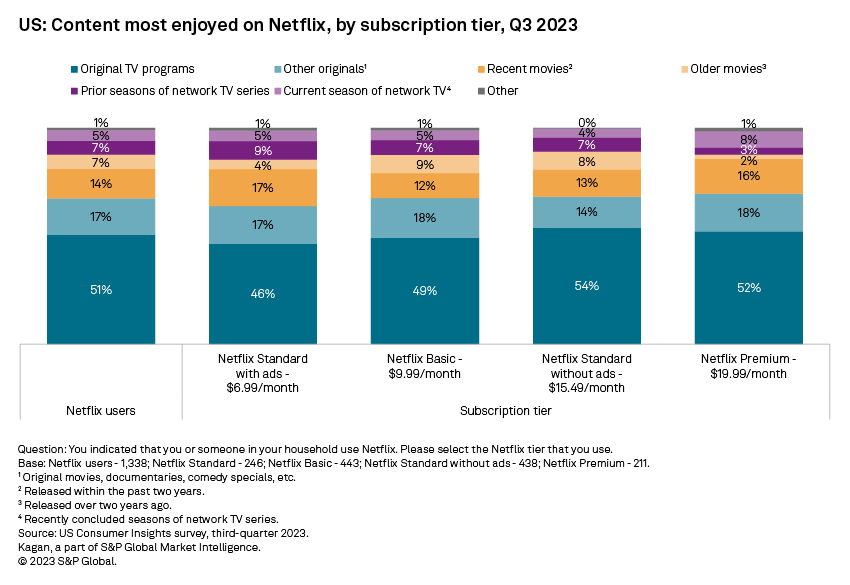

Subscribers to more expensive Netflix plans also were more likely to most enjoy original TV programs, at 54% for subscribers to the ad-free Standard and 52% for Premium subscribers. Less than half of subscribers to Netflix's Basic and Standard with ads plans said they most enjoyed original TV, at 49% and 46%, respectively.

The picture was more mixed for movies, with 17% of Netflix Standard with ads and 16% of Premium subscribers reporting they most enjoyed recent films, while Basic and ad-free Standard subscribers were more likely to most enjoy older movies at 9% and 8%, respectively.

Data presented in this article is from Kagan's US Consumer Insights surveys conducted in September 2017–2023. The online survey included 2,526 (2017), 2,536 (2018), 2,531 (2019), 2,502 (2020), 2,529 (2021), 2,528 (2022) and 2,500 (2023) US internet adults matched by age and gender to the US Census. The survey results have a margin of error of +/-1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Gen Z adults are individuals aged 18-25. Millennials are ages 26-42; Gen Xers are 43-57 years old; and baby boomers/seniors are 58 and older.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

For more information about the terms of access to the raw data underlying this survey, please contact support.mi@spglobal.com.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.