Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Jun, 2022

In today's complex and rapidly changing environment, companies face the same challenge: growing their business while reducing spending. In this blog, we will review five ways commercial banks are approaching these cost savings for the municipal segment.

Looking for new customers is the starting point of growing your business; however, ensuring that the credit quality is aligned with your expectations and that the associated risks are aligned to loan pricing is vital. The first step to growing your loan/investment portfolio and identifying new creditworthy customers/investments is facilitating the due diligence process. We suggest:

It’s unsurprising that gathering data for any credit risk assessment is time-consuming and challenging. To get economic data you can go to many governmental sources to find income, unemployment, and population data. When it comes to financial data, regardless of where you get the financial report, you must collect the main financial data points from different statements and just one year of data might not be enough to see trends over time.

Sound familiar?

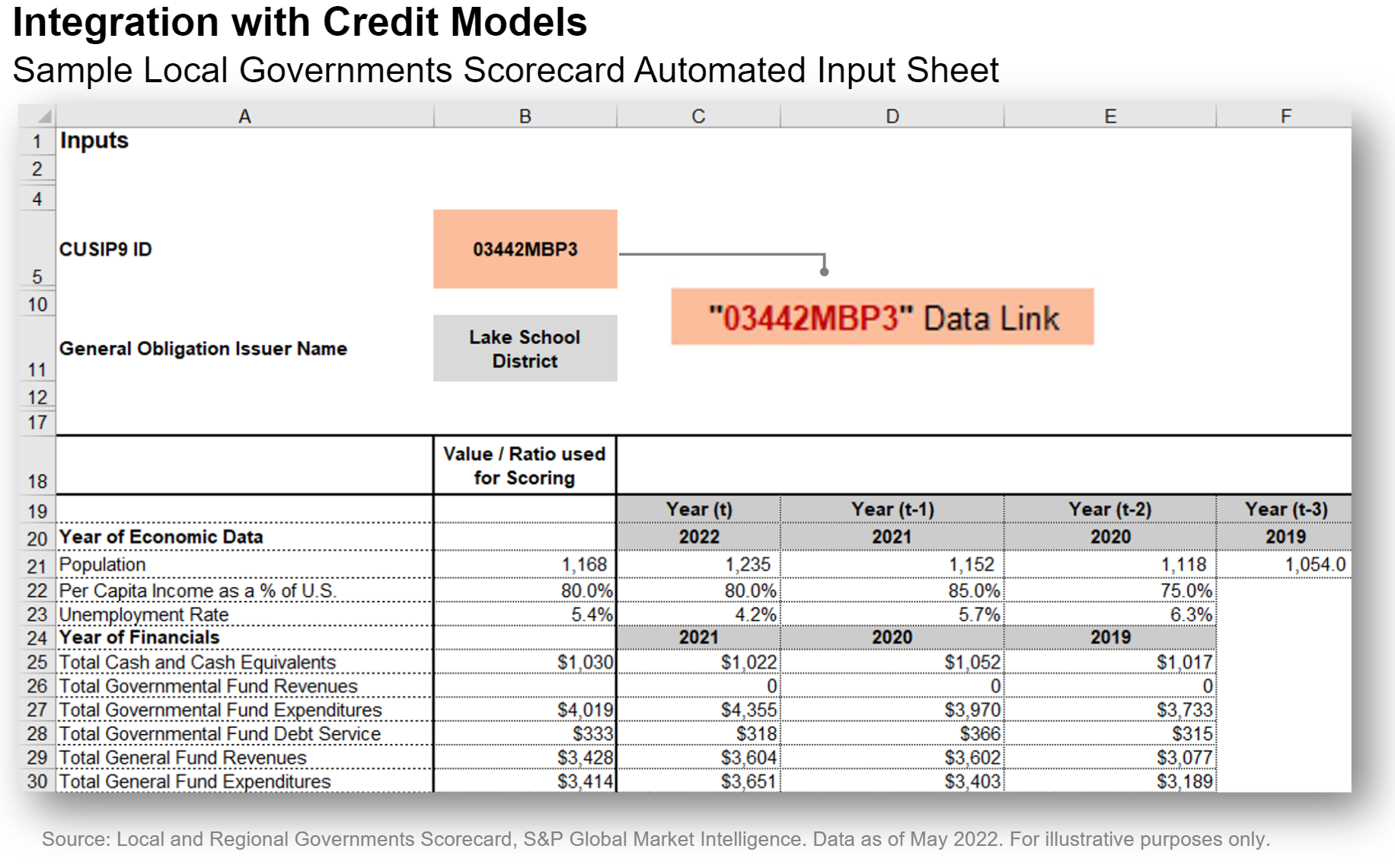

Today, with Artificial Intelligence, extraction models, and a spreading system it is possible to automate the extraction of financial and economic data. At S&P Global Market Intelligence, we've worked with our data scientists to build an extraction code that automates the data collection of financial and economic data points. We go through various data extraction processes each month and we add all the new information to our database to ensure our clients have the most up-to-date data. With this, analysts can spend their time on what they do best, analyzing the data, doing prospective scenario analysis, and focusing on what matters most.

Once the data is extracted and collected, you also need to make sure that the data flows into your internal credit and surveillance systems. For this, you need:

Monitoring credit quality is a time-consuming task and per the Dodd-Frank Act[1], you are required to do your own assessments to have your own opinion about your rated and unrated municipal exposures. Even if they are all investment grade, you may want to know if credit quality is deteriorating as soon as possible as it may lead to a pricing and credit risk.

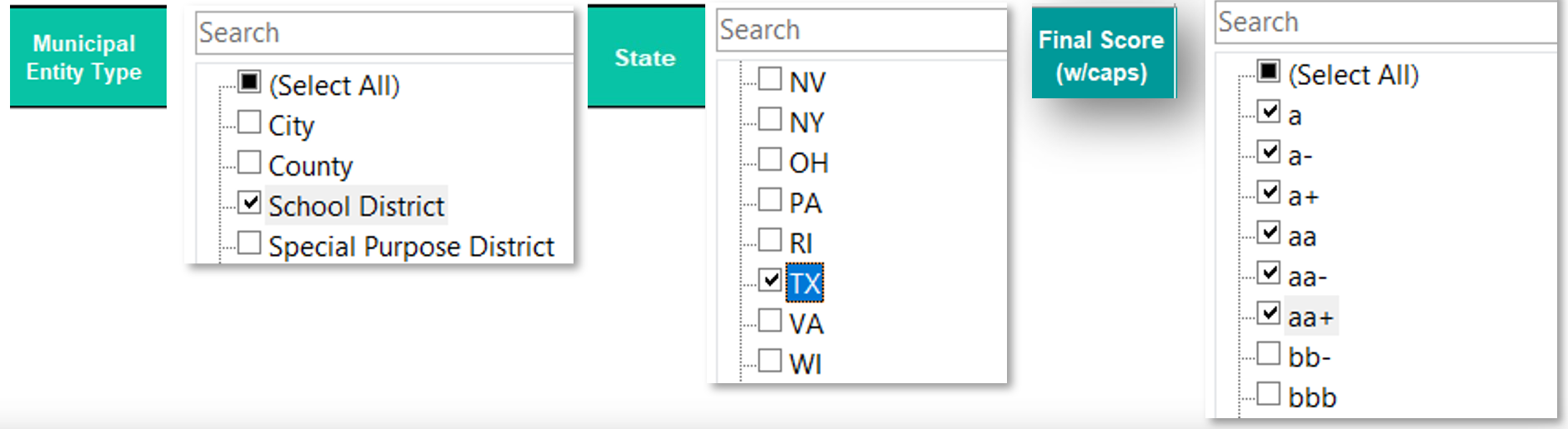

To address this promptly, having quick access to the latest financial and economic data to generate point-in-time credit scores is crucial. At S&P Global Market Intelligence, we have developed a Portfolio Tool for municipals. Through this process, you can score your municipal portfolio in minutes by simply inputting a CUSIP or S&P Capital IQ Identifier, and you can generate risk scores for local governments, water & sewer, and healthcare entities.

When your bank is doing municipal lending, supplying financing for bonds, notes, or any other needs, you want to make sure you're pricing it correctly. If you use a credit-scoring system and risk-based loan pricing model, you need to do an in-depth analysis of the credit risk associated with the municipal entity. You want to ensure that the loan pricing aligns to the credit risks of the municipal entity.

For this purpose, S&P Global Market Intelligence has developed the Public Finance Automated Scoring Tool or PFAST. This credit scoring solution provides a granular, transparent, and consistent framework for the measurement and assessment of municipal credit risk.

We provide an effective approach to navigating today's climate for low default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated. We leverage the analytical process of S&P Global Ratings Public Finance ratings criteria to determine an overall Public Finance risk score, which is mapped to historical default and recovery data dating back to 1986.

Using a solution like PFAST, banks that use risk-based pricing can offer competitive prices on the best loans across all borrower groups and reject or price at a premium those loans that represent the highest risks.