Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 Jan, 2024

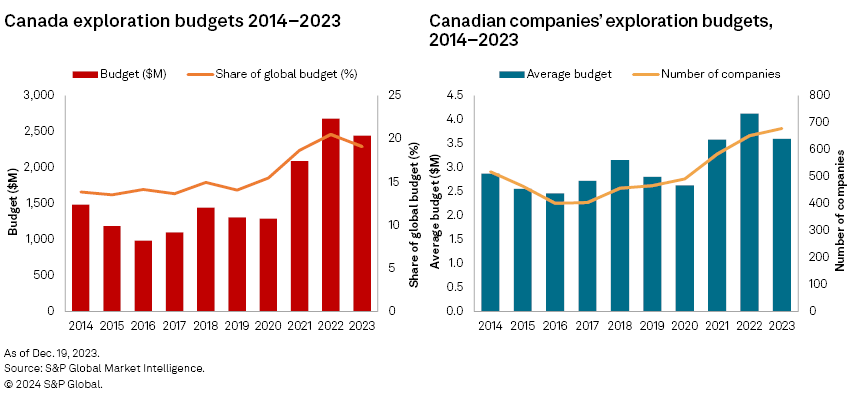

For the third consecutive year, Canada remained the top exploration nation worldwide. Canada's nonferrous exploration budgets dropped 9% to $2.44 billion in 2023. The substantial increases in 2021 and 2022 quickly lost momentum the following calendar year, as junior companies slowed their exploration activities and financings declined due to macroeconomic headwinds and geopolitical uncertainties. Nevertheless, Canada remains a global mining hub, with a sizable number of junior exploration companies accounting for 26% of the global budgets of all juniors and 58% of Canada's total exploration budgets in 2023. Gold continues to encompass the largest target share of national exploration, at 56%, despite its 23% budget decline.

Canadian exploration budgets have decreased 9% year over year in 2023, dropping to $2.44 billion. From a global perspective, a less substantial 2.5% loss year over year dropped the global total to $12.764 billion. The contraction from the previous year's lofty highs was to be partially expected during 2023. High inflation levels persisted in Canada, and further federal interest rate hikes during the year tempered the exploratory ambitions of Canadian junior companies, already operating on such fine margins. This negative market sentiment, coupled with geopolitical tensions, could cause aftershocks on the mineral exploration scene in 2024.

Using data compiled as part of the 2023 Corporate Exploration Strategies series, S&P Global Market Intelligence has identified 678 companies exploring for nonferrous metals in Canada — the most in 11 years — up from 651 in 2022. The average budget per Canadian company decreased 12% year over year to $3.6 million.

Canada's decrease in exploration budget was a 9% loss year over year, compared with the global exploration budget decrease of 2.5%. For comparison, budgets for the second and third largest exploration destination countries by size, Australia and the US, were down 5.4% and up 1.4%, respectively.

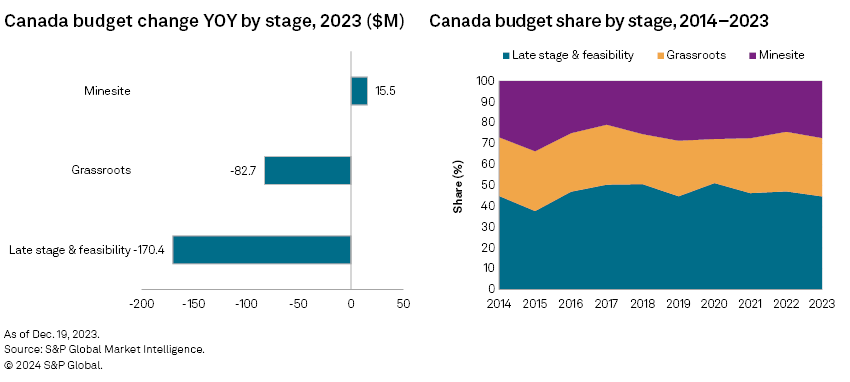

With metals prices displaying high levels of volatility during 2023, Canadian companies began shifting exploratory focus to established mine site exploration, which displayed a marginal 2% growth, reaching the highest amount in dollar terms in our record.

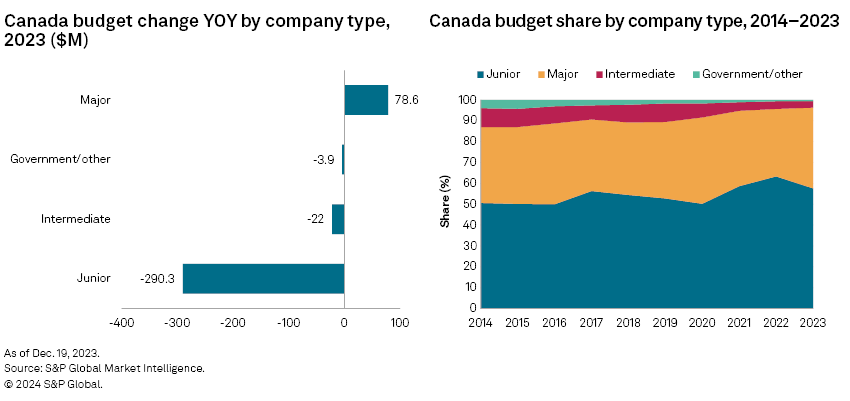

Juniors' share of Canadian exploration drops

Budgets for Canadian junior companies continue to account for a majority of the region's budget but dropped 17% year over year, a sign of overall market volatility and coinciding with the substantial drop in grassroots exploration, the category of focus for junior miners. Juniors accounted for 58% of Canada's total exploration budget during the year, down from 63% in 2022.

In 2022, 74 juniors had Canadian budget allocations greater than $5 million; in 2023, that number dropped to 63. The volatile macroeconomic environment and decreased funding for juniors listed on the Toronto Stock Exchange have caused further constraints for these upstart companies to continue their expenditures.

Among the juniors, Osisko Mining Inc. yet again leads the way with a gold budget of $74.5 million despite a $85.3 million drop compared to 2022. Coming off Windfall Lake's positive 2022 feasibility study, Osisko continues to primarily explore this flagship late-stage project, which, as of May 2023, has become a 50/50 joint venture with South African major Gold Fields Ltd. While the budget is down in 2023, drilling remained active during the year as programs continued towards completion.

New Found Gold Corp. ranked second among the juniors with a budget of $59.6 million, compared with $37.2 million in 2022. The 60% growth in exploration expenditure is entirely attributed to the increase of exploratory drill programs exclusively in Newfoundland. New Found Gold is conducting a 500,000-meter drill program at the Queensway early-stage project, which is still in the exploratory phase, but positive results are consistently being recorded.

Growing explorers continue to add sizable budgets

Canada Nickel Co. Inc. registered its first significant exploration budget in 2022 and budgeted an additional $37.2 million in 2023 as the demand for battery metals increases, especially for nickel. The Toronto-based company continued with its late-stage Crawford project in Ontario. The company released updated reserves and resources for Crawford in 2022, and a bankable feasibility study in 2023 increased the total reserves of nickel by 74%, making the project the world's second-largest nickel reserve. The company's nickel exploration budget is the second-largest among all company types in Canada.

Vancouver-based Foran Mining Corp. also added $37.2 million of exploration to Canada's total in 2023. Its exploration is confined entirely in the Saskatchewan province; the company has focused its expenditures on the McIlvenna Bay late-stage copper-gold-silver-zinc project and has received positive results during the year.

Majors continue focusing on gold and nickel

Contrary to the other mining company sectors, the major companies posted a 9% budget increase year over year in Canada, outpacing the majors' global increase of only 1%. Nickel was the primary driver of this increase, with majors devoting an additional $62.7 million to the metal over the previous year ($186.5 million total). This growth, however, was not enough to take gold's position as the top target of choice for majors in Canada, with allocations dropping only 2% to $575.1 million.

B2Gold Corp. enters the Canadian exploration sector as it recently acquired assets in the Back River gold district, spending $21 million on the year, its first venture in the country. Agnico Eagle Mines Ltd. continued to have one of the largest increases year over year, increasing by $18.6 million. While their global budget declined 8%, the company's Canada budget increased 9% over the 2022 total.

Nickel climbed as the second most explored target, replacing copper among the majors exploring in Canada. Vale SA, the Brazilian iron ore and base metals giant, has registered a Canadian budget of $161.4 million, up from $95.6 million in 2022. The company has been the largest base metals explorer in Canada since 2017, focusing primarily on nickel.

Grassroots and late-stage on the decline, minesite flat

Grassroots budgets for Canada decreased $82.7 million, or 11%, year over year, to $682.5 million. Grassroots' share of Canada's overall exploration budget further shrank to 27.9% of the 2023 total. This decrease puts into perspective the heightened hesitancy for grassroots exploration in a volatile market. In 2001, 56.5% of the total budget was devoted to grassroots endeavors. Most of this current decrease can be attributed to the drop in the majors' grassroots exploration.

Late-stage exploration accounted for nearly half of the total Canadian budget in 2023; however, late-stage exploration budgets also decreased year over year, similarly to the overall budget. Late-stage and feasibility exploration budgets total $1.09 billion — $170.4 million, or 13%, less than in 2022.

The budget for minesite exploration stayed relatively flat in 2023, increasing only $15.5 million, or 2%, year over year to $667.7 million. This stability in minesite exploration exhibits that despite an overall decrease in national totals, there seems to be a gradual transition towards exploring established properties instead of a more greenfield approach.

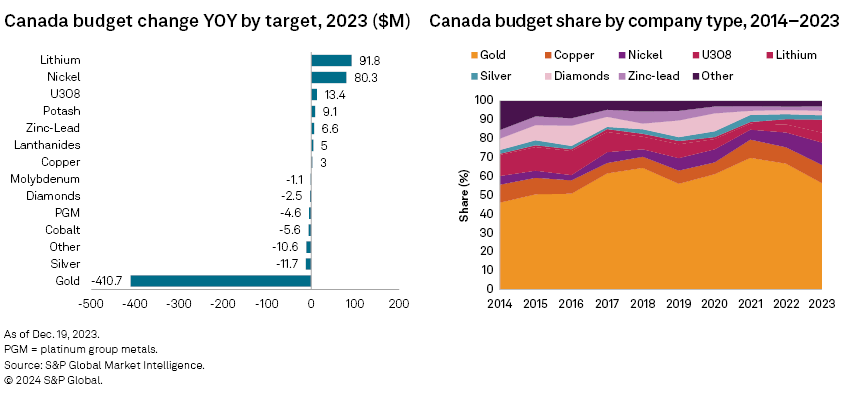

Primary Canadian targets

Similarly to the majors within Canada, gold remains the exploration target of choice by a substantial amount, accounting for 56.4% of Canada's entire budget in 2023. Gold allocations total $1.38 billion in 2023, down $410.7 million, or 23%, over 2022. This alone accounts for 92% of the year-over-year decrease in Canada's total exploration budget.

Nickel overtook copper during the year to become the second most-explored target for 2023. Budgets total $289.1 million — $80.3 million, or 38.5%, higher than in 2022, with the Vale nickel budget being 55.2% of the expenditures.

With budgets totaling $235.9 million in 2023, copper dropped to the third most explored target in Canada. Year over year, the budget is very similar to the 2022 total of $232.9 million, with several companies exploring the commodity nationally.

Lithium increases continue

Lithium budgets for Canada have increased for the third consecutive year, gaining 120% to $168.3 million — the largest percentage gain of all metals covered in the CES. This massive gain has moved lithium's rank from the fifth to the fourth most explored target in Canada. Our data shows 110 companies with active Canadian lithium exploration programs in 2023 compared with only 40 in 2022. This near threefold increase is buoyed by the significant number of juniors exploring the commodity during the year. Patriot Battery Metals Inc. had the largest lithium budget increase year over year and the largest amount spent on lithium exploration.

Silver notably declines

Silver budgets for Canada have notably declined, similar to the gold trend for the year; silver budgets dropped 16.8% year over year in 2023. The drop was also felt within the total number of companies exploring for the precious metal in Canada, with 77 companies in 2023 compared to 96 in 2022.

Big 3 mining provinces all experience losses

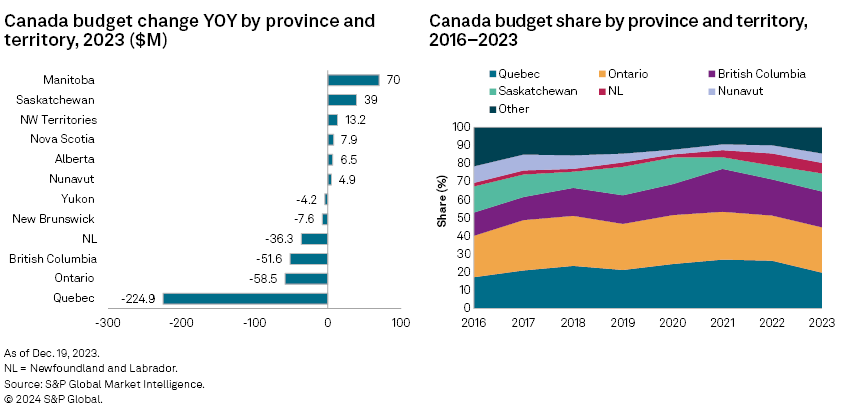

Exploration expenditures decreased year over year for each of the three major mining provinces of Ontario, Quebec and British Columbia, falling 8.7%, 31.7% and 9.6%, respectively. The decreases dropped these provinces' combined share of the national total to 65%, a 6% drop from the previous year.

Breaking down the three major provinces' totals, with a budget of $611.9 million in 2023, Ontario overtook Quebec as the number one exploration destination within the nation. Ontario's significant $58.5 million decrease was not enough to keep it out of the top spot on the year. Quebec dropped back to second on the year as its budget decreased $224.9 million to $484.9 million. This substantial drop in Quebec can largely be attributed to the decreased expenditure from junior gold miners within the province. British Columbia barely missed the second spot in 2023, trailing Quebec by $1.7 million, with its annual total of $483.2 million.

Contrary to the major mining regions, the prairie provinces of Manitoba and Saskatchewan had significant increases of $70 million and $39 million, respectively. Uranium exploration continues to dominate the region's exploration budget, and the nuclear energy source will likely remain important for the foreseeable future. A recent global spike in battery minerals demand and the steady increase of uranium prices have further driven the multiyear growth trends in the region.

Further budget declines expected in 2024

As raising funds became more difficult, junior explorers were heavily affected from an operational perspective, accounting for a large portion of all the decreases in exploration expenditures within Canada in 2023. Globally, we forecast budgets to slightly decrease or remain constant; however, should the macro environment and financing conditions persist, we believe a modest year-over-year decline of less than 5% is the most likely scenario. As for Canada, the large proportion of junior miners may signal the potential for a greater decline in expenditure for the upcoming year. However, financings have recovered slightly in the late quarters of 2023, when many 2024 budgets are finalized, which could limit any reductions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.