Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 12 Apr, 2021

Efficient ways to perform text analysis of S&P Global Ratings’ credit ratings research* using machine-readable technology

This is the third and final blog in the series. Click to read the first or second blog.

In our first two blogs, we explored the ability to spot trends in credit ratings research compared to earnings transcripts, and three ways to uncover additional insights from credit ratings research. In this blog, we look at how to use textual data analysis of these reports to uncover regional differences in key themes that may lead to potential credit ratings changes.

Differentiating the Key Areas of Credit Risk Across Geographies

Text analysis of credit ratings research can be used to detect early-warning signals of potential changes to credit ratings. The reports can also be analyzed to uncover differences in key themes driving potential credit ratings changes across geographies.

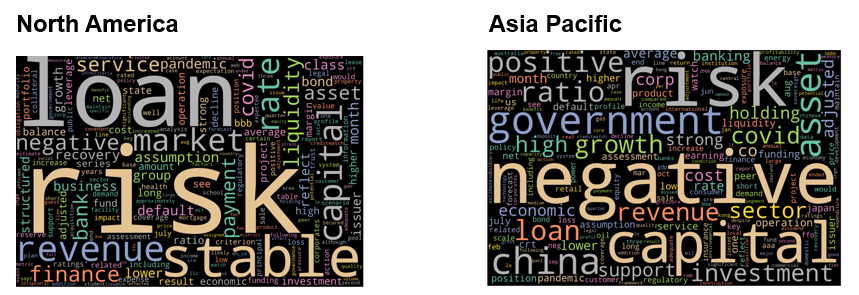

Word clouds are graphical representations that give greater prominence to words that appear more frequently in a source text. The larger the word in the visual, the more the word was used in the document(s). In Figure 1 below, we analyzed all the S&P Global Ratings research reports published during the three months leading up to November 2020. We then created word clouds of keywords mentioned for North American entities and for Asia Pacific entities. In this simple analysis, we looked at all sections of the reports, including those describing financial risk and business risk, which could explain some of the keywords from financial statements.

Figure 1: Sample of geographic differences in key themes contained in credit ratings research

Source: RatingsXpress: Research, S&P Global Market Intelligence, as of November 2020. For illustrative purposes only.

It is interesting to note that there are a few common themes across geographies:

In North America, the keywords highlight an emphasis on financial risk:

In Asia, however, the keywords are more closely related to business risk (e.g., macro, top-line growth, and China):

When we drill down into the business risk components of Asia Pacific-based corporates, we find that there is a negative skew in the Corporate Industry and Country Risk Assessments (CICRAs), indicating that there could be systemic vulnerability of a good number of Asia Pacific corporates to a macroeconomic or industry downturn and/or political (country) risk in some developing markets.

On the other hand, the financial risk profiles (i.e., financial leverage and the ability for companies’ cash flows to service these debt obligations on a forward-looking basis) appear to be the Achilles heel for North American corporates.

Chart 1: Distribution of CICRA scores of Asian corporates

Source: RatingsXpress®: Scores & Factors, S&P Global Market Intelligence. As of November 2020. For illustrative purposes only.

Chart 2: Financial risk scores for North America

Source: RatingsXpress: Scores & Factors, S&P Global Market Intelligence. As of November 2020. For illustrative purposes only.

From this analysis, we find that it is possible to research the key credit risk drivers of chief concern using text analysis and differentiate these by region and/or industry. Based on the above and prior analysis, we suggest some areas where text analysis can be used to extract more information and trends from S&P Global Ratings research in a systematic and scalable way:

Text analysis is taking credit risk assessments to a new level by letting machines parse over a large number of articles. With RatingsXpress: Research, users can develop text analysis algorithms to filter relevant research, identify unique signals, monitor country and industry credit risk trends, and gain deeper insights from research reports in an automated fashion.

Click here to request more information about how to gain useful insights from text analysis of credit ratings research.

*Credit ratings are prepared by S&P Global Ratings.

Theme

Products & Offerings

Segment