Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Jun, 2022

By Piotr Gaber

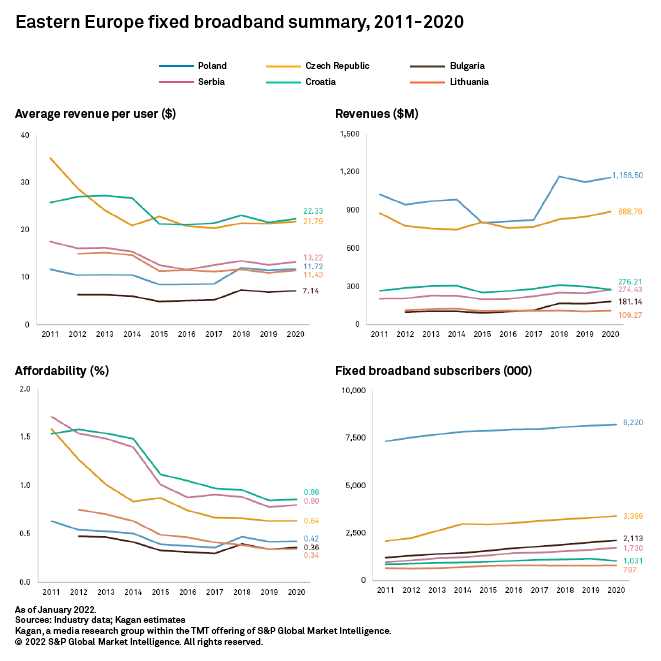

Fixed broadband revenues in most of the six central and Eastern European markets in our analysis — Poland, Czech Republic, Bulgaria, Serbia, Croatia and Lithuania — are rising in local currency terms, still driven by subscriber growth, whereas average revenues per user remained stable across the board.

In this group of markets, Poland, which has the largest subscriber base, was producing the highest revenues as of end-2020. The affordability metric was highest for Croatia, which means its fixed broadband services were the least affordable among the surveyed markets, while the most affordable services were available in Bulgaria and Lithuania, which had the lowest ARPU.

Poland's fixed broadband market is in a phase of slow growth, caused by the rise of mobile broadband as a real alternative to wired networks. The growth of the Czech broadband market seems limited as penetration passed 77% in 2021. Bulgaria has the most affordable fixed broadband among this group of markets. Fixed broadband revenues in Serbia have nearly doubled since 2011, mostly driven by the number of subscribers increasing from 1 million to 1.7 million in that period. In Croatia, a near-duopoly situation has led to a lack of competition. Fixed broadband in Lithuania still has room to grow as household penetration reached just 60% in 2021.

Already a client? Read the full report here.