Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Technology, Media & Telecom — 30 Mar, 2018 — Technology, Media & Telecom

Technology, Media & Telecom

By Jeff Heynen

The following post comes from Kagan, a research group within S&P Global Market Intelligence. To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

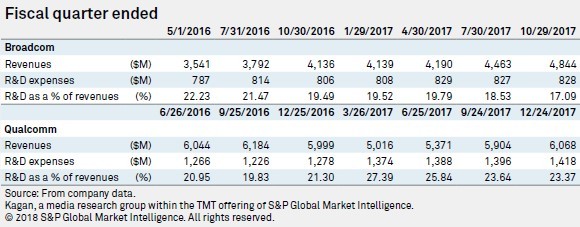

President Donald Trump's blocking of Broadcom Ltd.'s proposed $140 billion takeover of QUALCOMM Inc. and Broadcom's subsequent withdrawal of its offer has less to do with security concerns than fears that massive investments by the Chinese government in improving domestic chipset production will put Qualcomm at a competitive disadvantage in the long term. Like the recently proposed tariffs on steel and aluminum, putting a halt to the acquisition is more about protecting Qualcomm's advantage in intellectual property and patent licensing. The primary concern is that Broadcom's focus on closely managing research and development investments and growing profitability will hurt Qualcomm's chances of competing long-term with Chinese semiconductor companies receiving government support to expand their intellectual property portfolios.

Broadcom's CEO, Hock Tan, is well-known and well-regarded as a leader who focuses on improving operational efficiency and overall profit by diligently managing R&D expenses while growing the pipeline of customers for its existing products. In the wireless, Ethernet, cable and optical market segments, Broadcom has locked up the top customers for its components, squeezed competitors out of those segments, and then steadily increased the average selling prices for these components by effectively becoming the only game in town.

The net result for Broadcom has been dominance in its primary market segments. But for the industry as a whole, one can argue that the net result has been a slower pace of innovation and a forced reliance on the company's products because of their ubiquity in so many networking platforms, from routers and smartphones to cable modems and Ethernet switches.

One can also argue that with the industry's shift toward virtualization and commercial, off-the-shelf hardware is a response to this vendor lock-in, as network operators no longer want to rely on vendors whose proprietary hardware platforms are reliant on Broadcom's, and other chipset manufacturers', conservative product roadmaps.

Qualcomm presents a unique opportunity for Broadcom — and other semiconductor companies, for that matter — because it consists of a lucrative patent licensing business in addition to a successful, though potentially slowing chip business. There is tremendous value in both sides of the business, though the patent licensing side is the more intriguing, particularly with the upcoming transition to 5G.

5G represents a huge technology shift that will impact the entire networking supply chain. 5G doesn't just define a new mobile standard. It defines a new ecosystem encompassing a wide range of spectrum bands, from low- to mid- to high-spectrum, as well as applications and use cases, such as those associated with the massive internet of things, mobile broadband, and fixed wireless environments. To deploy 5G successfully, network operators are going to invest hundreds of billions of dollars in components such as new base stations, IoT sensors, smartphones and core infrastructure, all of which will require the purchase of semiconductor patent licenses, in addition to chips and baseband units.

Qualcomm continues to dominate the patent licensing for 4G LTE network equipment and handsets, and will certainly be one of the leaders for 5G licenses. Back in November, Qualcomm disclosed that it could charge 5G smartphone manufacturers up to $16.25 in royalties for every phone they sell. This fee is significantly higher than the $5 per-phone royalty Ericsson has said it will charge. Qualcomm has by far the largest intellectual property portfolio and can use that as leverage against both the handset and radio access network equipment manufacturers, who must also pay royalties to Qualcomm for its intellectual property around how smartphones connect to the network. Qualcomm's intellectual property dominance has resulted in a $1 billion lawsuit by Apple Inc., which has argued that the company's royalty charges are onerous.

For Broadcom, the Qualcomm patent license portfolio represents a high-margin, segment-leading business that shows no signs of slowing ahead of the pending upgrade to 5G. But Broadcom's penchant for lower R&D spending puts that market leadership business in jeopardy in the long term, which is the primary reason for the Trump administration's decision.

The Chinese government laid out lofty goals for decreasing its reliance on foreign-made chipsets and intellectual property back in 2015 through its "Made in China 2025" proposal. The proposal aims to increase the domestic content of core materials to 70% by 2025, up from 50% for most high-tech equipment today.

The government is also putting $20 billion toward the China Integrated Circuit Industry Investment Fund, which has invested $400 million in Hua Hong Semiconductor, a chip foundry and manufacturing company, and $185 million in CECPort, an online portal for the domestic sale of chips and components from all over the world. One of the indirect results of the increased levels of investment, focus on moving toward the development of intellectual property, and moving away from labor-intensive manufacturing is that, according to Google, in its rationale for opening an artificial intelligence center in China, "Chinese authors contributed 43% of all content in the top 100 AI journals in 2015."

Huawei's HiSilicon semiconductor division has been focused for years on developing chips for the parent company's networking platforms, smartphones, and tablets. The focus for HiSilicon has been on increasing the product development cycle so that Huawei could reduce its reliance on Broadcom and Qualcomm. The company's Kirin series of systems-on-a-chip, or SoCs, relies on a custom implementation of code-division multiple access technology, allowing it to be included in phones used in the LTE networks of Verizon Communications Inc. and Sprint Corp., while also avoiding the heavy royalty fees associated with licensing Qualcomm's technology. Though the company has not yet announced a 5G SoC, there is likely one on the way.

The competitive threat, not the security threat, is what ultimately forced the Trump administration to step in. But the odds of a merger were long to begin with, as Qualcomm had no desire to become part of the Broadcom umbrella. Also, a merger would have created significant antitrust concerns for regulators around the world. It is likely the deal would have been postponed by global regulatory review.

Perhaps the more favored outcome, beyond Qualcomm remaining an independent entity, would be for another American company to make an offer. Intel appears to be the most realistic candidate, as the company has a strong track record of investing in R&D and has made inroads with smartphone manufacturers, including Apple, at the expense of Qualcomm. But again, such a transaction would undergo tremendous global scrutiny by regulators, who fear that further consolidation in the chip market will hamper overall technology growth and innovation.

Technology is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.