Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Apr, 2025

By Iuri Struta

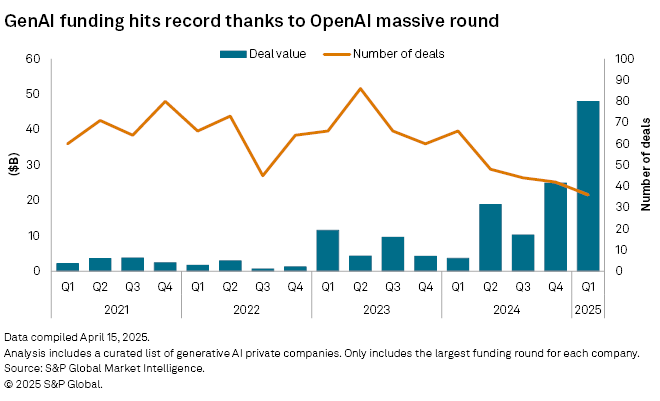

Funding for generative AI startups reached a quarterly record at the start of 2025, largely thanks to the blockbuster funding round for OpenAI LLC.

In the first three months of the year, there were 36 funding rounds among GenAI companies with a total deal value of almost $48 billion, according to an analysis by S&P Global Market Intelligence. The quarter was marked by OpenAI's record funding round of $40 billion at a $300 billion post-money valuation, which closed March 31 and was led by SoftBank Group Corp. OpenAI is frequently touted as the company that started the GenAI hype with the launch of highly popular ChatGPT in late 2022.

The record amount at the start of 2025 directly followed the previous record set in the last three months of 2024, when GenAI companies raised $24.80 billion. All told, more money was raised in the last two quarters than in the 12 previous quarters combined.

Sky's the limit

OpenAI's capital raise from the first quarter is significant on multiple fronts. First, it propels OpenAI into a select group of companies that own both their infrastructure, AI foundation models and applications. Others in this group include Alphabet Inc., Meta Platforms Inc., Microsoft Corp., Amazon.com Inc. and Elon Musk's X.AI Corp.

Second, the funding is a sign that OpenAI is setting its own course and further detaching itself from key partner Microsoft, as well as foundation model competitors such as Anthropic PBC. OpenAI, which said it has half a billion people using its flagship consumer product ChatGPT every week, will use the funding to scale its compute infrastructure.

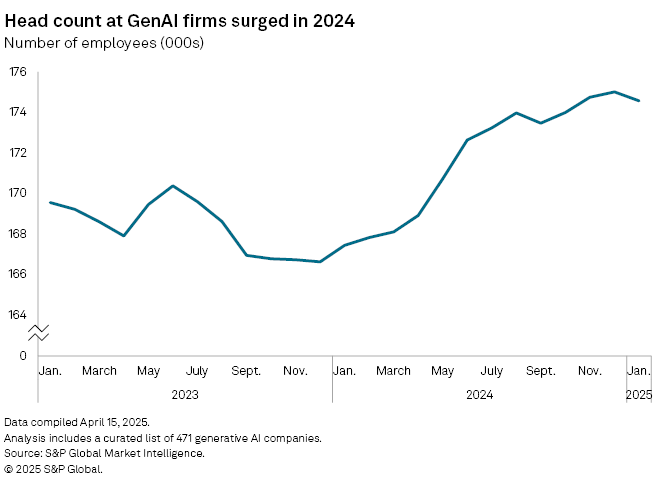

The growth in GenAI extends beyond the biggest players to include a wide swathe of startups, many of which have been hiring at a frenetic pace. Head count growth for GenAI startups started to increase at the start of 2024 and accelerated sharply in mid-2024, according to Market Intelligence data.

Adoption of GenAI technologies by organizations is already much wider than regular AI technologies such as pattern recognition and rules-based AI. According to a survey by S&P Global Market Intelligence 451 Research, 27% of organizations already fully integrated GenAI, versus 20% for other AI technologies. 451 Research analysts said, however, that the rapid uptake has led to higher rates of failure for GenAI projects.

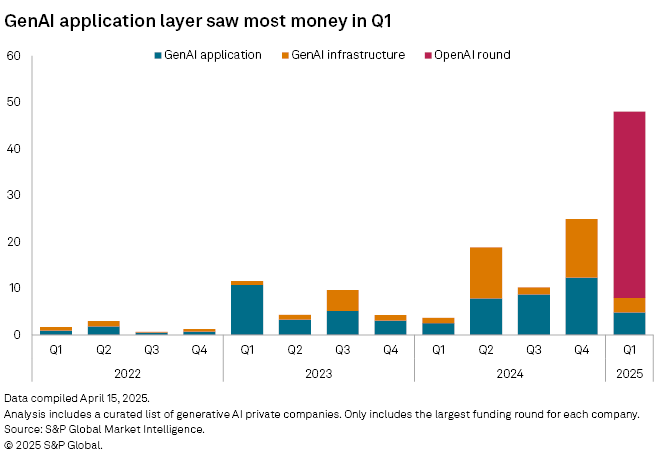

Infrastructure vs. application

Excluding the OpenAI funding round, about half of all funding went to the infrastructure layer, which includes semiconductor manufacturers, graphics processing unit cloud providers and software tool developers for GenAI applications. AI cloud providers such as Together Computer Inc. and Lambda Inc. raised $305 million and $480 million, respectively. Cloud infrastructure providers specialized for AI workloads emerged in recent years as a category. Semiconductor player Groq Inc., which focuses on inference chips, raised $1.5 billion.

In the application layer, encompassing foundation model creators and vertical applications, notable funding rounds included the $179.9 million raise of AI video communications platform Synthesia Ltd. and the $100 million raise of Instabase Inc. Instabase provides a platform to automate business processes.

Agentic AI

The Synthesia round is symbolic of a broader move among GenAI technologies vendors toward agentic AI, a form of AI that can execute specific tasks. This represents a step forward from robotic process automation pioneered by companies such as UiPath Inc. and Blue Prism Ltd.

Synthesia, which recently announced it had hit $100 million in annual recurring revenue, plans to launch an agentic AI tool in the first half.

According to a 451 Research survey, 98% of organizations are interested in using AI agents. "The real near-term isn't necessarily going to be fully autonomous agents," 451 Research analyst Sheryl Kingstone said on a recent webinar. "A lot of these [agents] today are more like co-pilots."

A lot of companies are focused on creating agentic AIs within specific verticals. Customer service, a human-intensive area that has been undergoing automation, and sales and marketing are areas where companies see the most promise for agentic AI.

ServiceNow Inc., for instance, announced in March that it is acquiring Moveworks Inc. for $2.85 billion, subject to customary purchase price adjustments, payable in a combination of cash and stock. Expected to close in the second half, the acquisition will combine ServiceNow's AI and automation capabilities with Moveworks' front-end AI assistant and enterprise search technology to accelerate AI adoption and innovation among workforces.