Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Feb, 2025

By John Wu and Cheska Lozano

Hong Kong's exchange operator expects initial public offerings to gather steam in 2025 on the back of policy tailwinds and renewed investor interest in equities.

A total of 71 new listings raised a combined HK$87.8 billion in the year ended Dec. 31, 2024, Hong Kong Exchanges and Clearing Ltd. (HKEX) said Feb. 27 in its earnings statement for the October-to-December quarter. In 2023, the exchange hosted 73 new listings with an aggregate HK$46.3 billion raised.

The "ongoing geopolitical and macroeconomic developments will likely continue impacting global markets. However, there are also encouraging signs of economic revitalization," HKEX CEO Bonnie Chan said. Policy stimulation in mainland China and interest rate cuts in other major markets are expected to provide a "renewed vibrancy to Hong Kong's fundraising and secondary markets," Chan added.

Healthy pipeline

The IPO pipeline remained healthy with 84 active applications as of the end of 2024, the HKEX statement said.

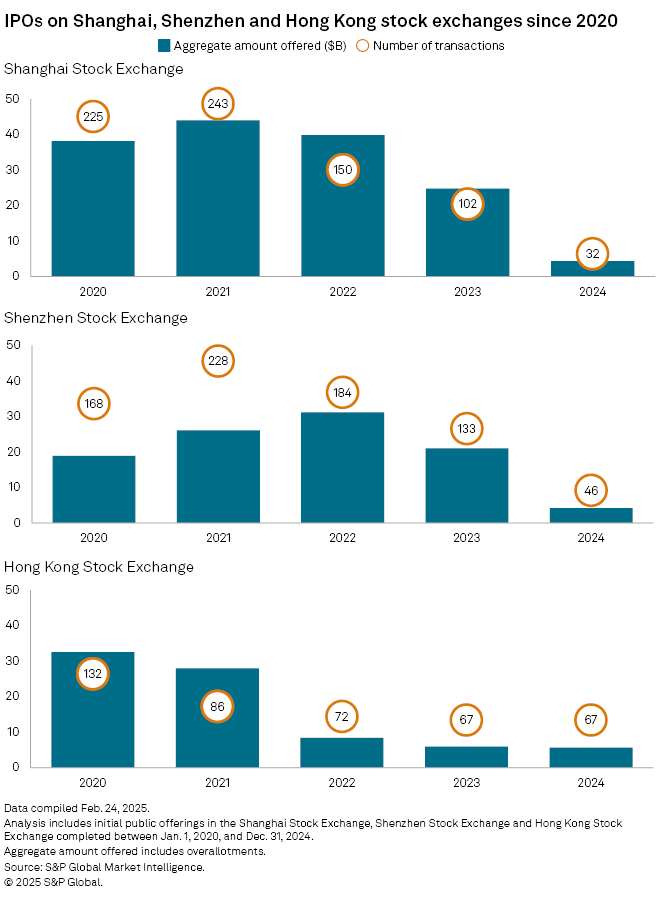

Hong Kong's exchange has benefited as IPO activities in Shanghai and Shenzhen, two of the world's largest listing venues by volume, have declined. This decline follows the China Securities Regulatory Commission's increased scrutiny of IPO applications since March 2024, aimed at enhancing the quality of new listings. The number of IPOs on the Shanghai and Shenzhen bourses fell to 78 in 2024 from 235 in 2023, while the aggregate fund raised plummeted 81.4% to US$8.50 billion, according to S&P Global Market Intelligence data, which only included companies that raised money from public equity markets for the first time.

Hong Kong shares have gained in recent weeks, raising the incentives for listing candidates to launch IPOs. The benchmark Hang Seng Index is up nearly 21% so far this year, touching a three-year high of 23,788 on Feb. 26.

January jump

Companies raised HK$5.7 billion via IPOs in January, a year-over-year increase of 159%, according to HKEX's monthly review.

On Feb. 11, Fujian-headquartered Contemporary Amperex Technology Co. Ltd., the world's largest battery maker already listed in Shenzhen, filed an application with HKEX for a share sale. The offering could raise at least US$5 billion, according to media reports.

Hong Kong is also benefiting as mainland Chinese authorities encourage companies to list there, aiming to strengthen the presence of leading homegrown firms.

"Mainland-based Chinese multinationals, even though there is no shortage of liquidity, would welcome an overseas listing as an international platform to showcase their operations and upgrade their company status," Xu Jia, deputy head of investment banking department at China International Capital Corp., told Market Intelligence in a Feb. 26 email. "A listing in Hong Kong is preferred as it's closer to home."

Uptrend

The upward trend in the Hong Kong IPO market is expected to continue in 2025, with about 70 to 80 companies anticipated to list, raising approximately HK$130 billion to HK$160 billion, according to a PwC report dated Jan. 2.

"This year, the market focus will be on industries such as AI, IT and telecoms, electric energy, and retail, consumer goods, and services," PwC said in the report.

HKEX earned HK$3.78 billion in net profit in the fourth quarter of 2024, surging 45.6% from a year ago. This was driven by the 31.4% year-over-year jump in revenue to HK$6.38 billion, according to the results release. The results were largely in line with the analyst estimates compiled by Market Intelligence, which indicated a net income of HK$3.79 billion for the quarter.

The volume of average daily trading, HKEX's main income source, of equity products in the fourth quarter was HK$171.5 billion, a year-over-year increase of 113%, according to HKEX's release.

As of Feb. 26, US$1 was equivalent to 7.77 Hong Kong dollars.