Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Jan, 2023

Strong year-over-year premium growth at The Progressive Corp. has put the Ohio-based insurer on track to be the second-largest U.S. private auto underwriter as of the end of 2022.

Progressive's growth in direct premiums written through the first nine months of 2022 allowed it to surpass GEICO Corp. as the No. 2 writer of private auto insurance in the U.S. GEICO had held that position for nearly a decade after it surpassed The Allstate Corp. during 2013.

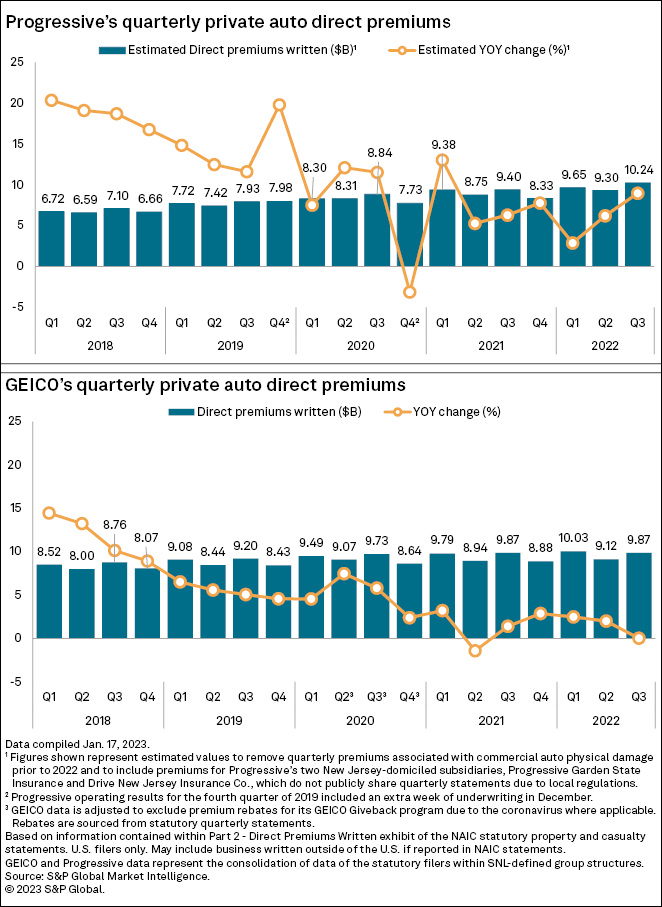

Adjusting Progressive's reported statutory premiums to include its two New Jersey filers, S&P Global Market Intelligence estimates that its year-over-year direct premium growth through the nine-month period ended on Sept. 30, 2022, is 6.0%, compared to GEICO'S as-reported growth of 1.5% during the same period. This change moves Progressive's estimated year-to-date direct premiums written to $29.19 billion versus GEICO's $29.03 billion.

If Progressive's growth advantage continued through the fourth quarter, the insurer would be on track to record more premiums than GEICO for all of 2022.

The NJ situation

S&P Global Market Intelligence calculates Progressive's reported statutory premiums as the sum of all of its reporting subsidiaries. However, the National Association of Insurance Commissioners no longer releases quarterly statements for New Jersey-domiciled subsidiaries. It has been more than a decade since the NAIC reported details from Progressive's two New Jersey subsidiaries, Progressive Garden State Insurance Co. and Drive New Jersey Insurance Co. GEICO does not have a subsidiary domiciled in The Garden State.

But even without accounting for the premiums at those subsidiaries, Progressive's third-quarter 2022 private auto direct premiums written were $9.93 billion, compared to $9.87 billion for GEICO. That was the first time in more than 14 years that Progressive reported higher quarterly direct premiums written within its statutory statements than GEICO, excluding a couple of quarters in 2020 that were due to accounting differences over COVID-19 rebates.

Since 2010, the two Progressive New Jersey units have constituted between 3.0% and 4.1% of the group's annual reported private auto direct premiums written. In 2021, the New Jersey-based subsidiaries reported an aggregate of $1.10 billion in direct premiums written, or 3.1% of Progressive's total private auto premiums for the year.

If the two New Jersey subsidiaries account for the same percentage of Progressive's total premiums for 2022, the group's direct premiums written would have been approximately $10.24 billion in the third quarter of 2022 and $9.30 billion a quarter earlier. Using the estimated figures, Progressive's adjusted second-quarter 2022 direct premiums written would have also been greater than GEICO's.

Directionally, these calculations match the trend reported within the insurers' GAAP statements. Progressive recorded net premiums written of $10.33 billion and $9.47 billion in its personal lines segment during the third and second quarters of 2022, respectively. GEICO's total net premiums were $10.14 billion and $9.42 billion in those periods. The figures reported within GEICO's GAAP statements include a small amount of premium dollars that would not be classified as private auto insurance, such as homeowners, renters, boat and commercial fleet insurance.

Based on regulatory statements, private auto premiums accounted for 98.1% of GEICO's total direct premiums written in 2021.

Progressive's early-mover advantage

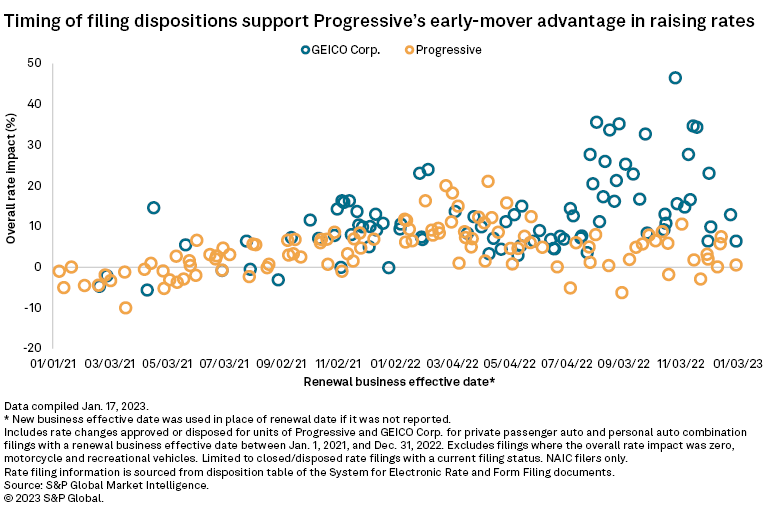

Higher losses within the private auto lines have pushed many insurers to seek rate increases. Progressive started hiking rates earlier than GEICO, and those increases have generally been smaller, according to a review of rate filings submitted to state regulators.

"We believe we took rate earlier than the industry, which initially negatively impacted volume, but more recently has created opportunities for growth," Progressive CEO Tricia Griffith said during a third-quarter 2022 earnings call. Consumers were shopping around for coverage significantly more in that period, as Griffith noted that Progressive logged "the best July, August and September" in company history for quote volume.

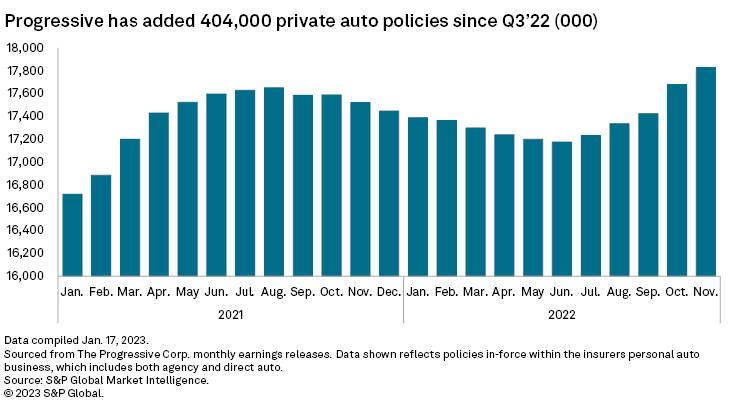

Progressive initially saw a decrease in its in-force policy counts when it raised rates in 2021, losing 204,000 policies from its August high to the end of that year. The trend continued during the first half of 2022 when the insurer ended June with 17.18 million private auto policies in force, down 1.6% from year-end 2021.

But in-force policy counts began to increase month over month starting in July 2022. The insurer ended the third quarter of 2022 with 17.42 million policies in-force, down just 0.1% from the end of the prior year. Through the first two months of the fourth quarter of 2022, Progressive added an additional 404,000 policies, pushing the number of in-force private auto policies to 17.83 million at the end of November 2022.

While the number of in-force policies for GEICO at the same time is unknown, it reported that its voluntary in-force auto policies decreased by 4.6% during the first nine months of 2022.

Methodology

Due to reporting limitations within quarterly financial statements filed with the National Association of Insurance Commissioners, some figures cited within the article are estimates based on an analysis of the insurers' annual regulatory statements.

In addition to the premium adjustments for New Jersey-domiciled entities, historical quarterly statements prior to 2022 combined commercial auto physical damage and private auto physical damage as a single reported line of business. The NAIC implemented line of business reporting changes at the start of 2022, which separated private and commercial auto physical damage. This analysis attempts to exclude the premiums associated with commercial auto physical damage for Progressive in interim periods prior to 2022, as the insurer writes a sizable amount of commercial auto business. GEICO's direct premiums written are not adjusted as its commercial auto physical damage business is negligible.