Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 May, 2022

NiSource Inc. executives promised "definitive announcements" about the company's future when they update stockholders this fall on an ongoing strategic review.

The review comes as the company embarks on a transition to cleaner energy resources. NiSource plans to invest up to $10.6 billion from 2021 to 2024 in electric and gas operations, with $2 billion earmarked for renewable energy investments as it shuts down its coal fleet.

Like its peers, NiSource is looking for ways to fund its transition.

The management team and board of directors will take a "hard look" at the company's portfolio, President and CEO Lloyd Yates said Feb. 23 on a fourth-quarter 2021 earnings call. "Should we keep all of the [local distribution companies (LDC)] or all the businesses we have? Should we buy some? Should we sell other businesses?"

In January, NiSource announced that Yates, who retired from Duke Energy Corp. in 2019 as executive vice president of customer and delivery operations, would take the helm as president and CEO of the multistate investor-owned utility upon the Feb. 14 retirement of Joseph Hamrock, and that Yates would conduct a strategic review of the business.

Yates said May 4 that management has yet to determine whether it will announce a LDC sale in the fall. A review of NiSource's assets, its M&A history and its regulatory and policy landscape suggests that the company has no shortage of strategic options.

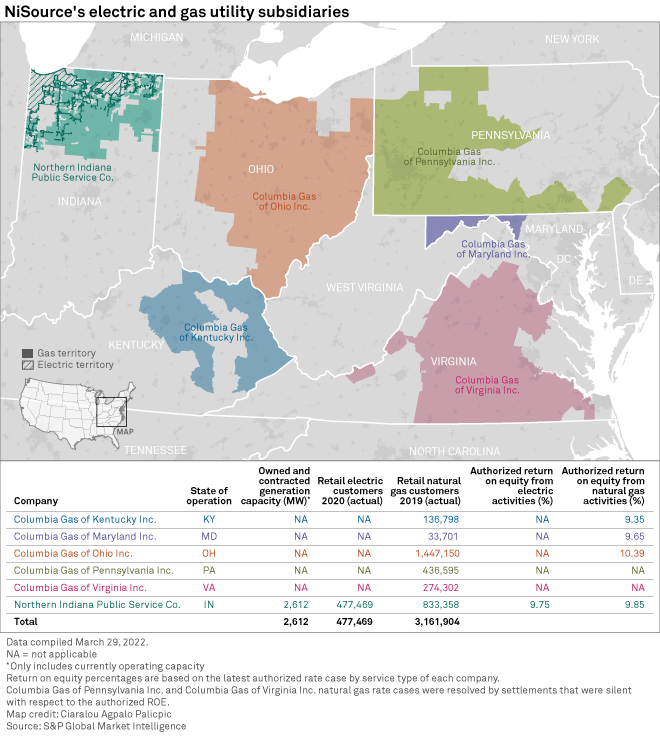

NiSource's portfolio includes local natural gas distribution companies in six states serving more than 3 million customers, a northern Indiana electric utility serving about 477,500 retail electric customers and a mix of more than 2,600 MW of owned and contracted generation capacity.

The Merrillville, Ind.-headquartered multi-utility traces its history back to 1847 with the founding of Springfield Gas Light Co. in Massachusetts, according to its website.

NiSource utility subsidiary Northern Indiana Public Service Co. was founded in 1912 and is Indiana's largest natural gas distribution company and second-largest electric distribution utility.

NiSource grew to one of the largest regional US gas distributors through two acquisitions: Bay State Gas Co. in Massachusetts in 1999 and Columbia Energy Group in 2000.

In 2015, the company spun off its Columbia Pipeline Group Inc. midstream business.

NiSource sold the Massachusetts gas utility to Eversource Energy in late February 2020 in a $1.1 billion deal after agreeing to exit the state as part of a settlement over a series of deadly natural gas explosions and fires in the Merrimack Valley.

NiSource now operates through subsidiaries Columbia Gas of Kentucky Inc., Columbia Gas of Maryland Inc., Columbia Gas of Ohio Inc., Columbia Gas of Pennsylvania Inc., Columbia Gas of Virginia Inc. and Northern Indiana Public Service Co.

Funding the transition

Wall Street has a keen sense of what the company hopes to accomplish in its review.

"There's no question that [the new CEO is] taking a bottom-up approach at the company," Guggenheim Securities LLC analyst Shahriar Pourreza said in an April 19 interview. "I think what his sense is, is that maybe we don't necessarily need to be in so many states."

Pourreza noted that in a recent meeting, the NiSource management team highlighted no "restrictive" states.

"None of their states are below-average regulatory constructs, so they are not trying to solve for an issue," Pourreza said.

Yates, however, does think it makes sense to look at some of the gas LDCs as a potential funding source for planned and potential renewables investments, according to Pourreza.

NiSource is focused on cutting carbon emissions by 90% from 2005 levels by 2030, at which time the company will no longer own or operate coal-fired generation. Coal makes up about 45% of the electric utility's owned and contracted generation portfolio.

NiSource is expected to follow a path similar to CenterPoint Energy Inc., which struck a deal in April 2021 to sell its Arkansas and Oklahoma gas utilities for 2.5x their combined 2020 rate base. CenterPoint also has electric utility operations in Indiana.

"It's going to be more strategic shrinking versus growing," Pourreza said. "But it is very debatable at what extent they go because they do have very small gas LDCs and they've got large ones. We happen to think they'll work smaller and build up, and that is because if they sell something too large, it is dilutive to earnings."

Morningstar analyst Travis Miller believes that everything is on the table. Selling a larger LDC would simply provide more capital to reinvest in electric and gas operations, Miller said. NiSource will likely monitor interest in each of the LDCs and consider which gas utilities would fetch the best value, Miller said.

In Miller's view, a private equity buyer is the most likely acquirer. Private equity funds have access to a locked-in funding base, which makes it much easier to pay higher valuations for long-lived infrastructure assets, Miller said. Infrastructure investment funds have been behind three recent LDC transactions valued at twice the target's annual rate base or more.

At those valuations, another publicly traded gas utility operator would struggle to make the deal additive to earnings, Miller said. "The numbers just don't work for any of the publicly traded utilities to buy a smaller gas utility at the prices we've seen from recent private market transactions."

Regulatory profile

The six jurisdictions in which the NiSource subsidiaries operate present varying levels of regulatory risk, according to Regulatory Research Associates, a group within S&P Global Commodity Insights. RRA views the regulatory climates in Indiana, Pennsylvania and Virginia to be more constructive than average for investors to varying degrees.

By contrast, Maryland and Ohio are viewed as less constructive for investors, while Kentucky is viewed as relatively balanced for investors and ratepayers.

RRA recently lowered its ranking of Kentucky regulation to account for the Kentucky Public Service Commission's emerging pattern of modifying rate case settlements, including one filed in a rate case for Columbia Gas of Kentucky that concluded in December 2021. Recent turnover at the Kentucky PSC is creating additional uncertainty, as Chairman Kent Chandler is the commission's sole member.

While still considered more constructive than average, the environment in Virginia has constricted somewhat in recent years and is not considered to be as constructive as it once was, with recent controversy concerning environmental policy creating additional uncertainty.

By contrast, RRA raised the ranking of Maryland regulation in 2021 for the third time in recent years, moving Maryland to the lower end of the Average category from the lowest ranking, Below Average/3. These changes recognized, among other things, the Maryland Public Service Commission's adoption of a multiyear rate case framework to reduce regulatory lag.

In RRA's view, the tenor of regulation in Indiana and Ohio has been relatively consistent over the last several years.

NiSource's operations are subject to a traditional cost-of-service construct in all six jurisdictions, with little in the way of alternative ratemaking frameworks in place. However, mechanisms in each jurisdiction allow for expedited recognition of infrastructure investment outside of a base rate case, and the gas operating companies have aggressive infrastructure replacement programs in place.

The returns on equity established in the operating subsidiaries' most recent rate cases have been at or somewhat above prevailing industry averages when established and compare favorably to current industry averages. The average ROE approved for vertically integrated electric utilities nationwide in cases decided during the 12 months ended March 31, 2022, was 9.52%, according to data gathered by RRA. For gas local distribution companies, the average ROE approved during the 12 months ended March 31, 2022, was 9.50%.

In Indiana, the only state in which NiSource has electric operations, retail competition for electric generation service has not been implemented, and Northern Indiana Public Service Co. is a vertically integrated utility. The company is permitted to adjust rates every three months to reflect projected changes in fuel and purchased power costs through its fuel adjustment clause, subject to an earnings test.

Policy environment

Indiana is among the few states that do not have a mandatory renewable portfolio standard in place; the state's voluntary standard calls for clean energy resources to comprise 10% of electricity produced by a participating supplier in the state by 2025.

A new Maryland law, meanwhile, requires the state to slash greenhouse gas emissions 60% by 2031 from 2006 levels and hit an economywide net-zero target in 2045.

The law also established a policy of advancing building electrification and directed Maryland state officials to develop an all-electric building code for lawmakers' consideration. Indiana, Kentucky and Ohio have passed laws that prohibit local governments from restricting gas use in new buildings. Similar legislation failed in the Virginia Senate earlier in 2022 but remains under negotiation in Pennsylvania.

Maryland and Virginia also participate in the Regional Greenhouse Gas Initiative, although there is an ongoing initiative to exit it by Virginia Gov. Glenn Youngkin.

The lack of agreement between the legislatures and governors in Virginia and Pennsylvania has added uncertainty for utilities operating in these otherwise constructive jurisdictions. RRA has listed them among the states to watch.

For a more comprehensive discussion of each state's regulatory policies, refer to RRA's Commission Profile for each state.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.