Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2021

By Susan Dlin

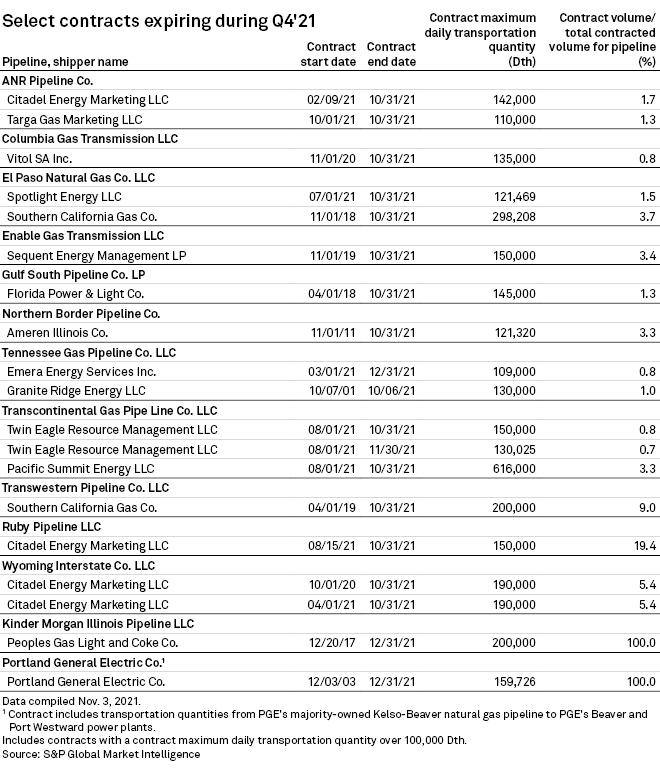

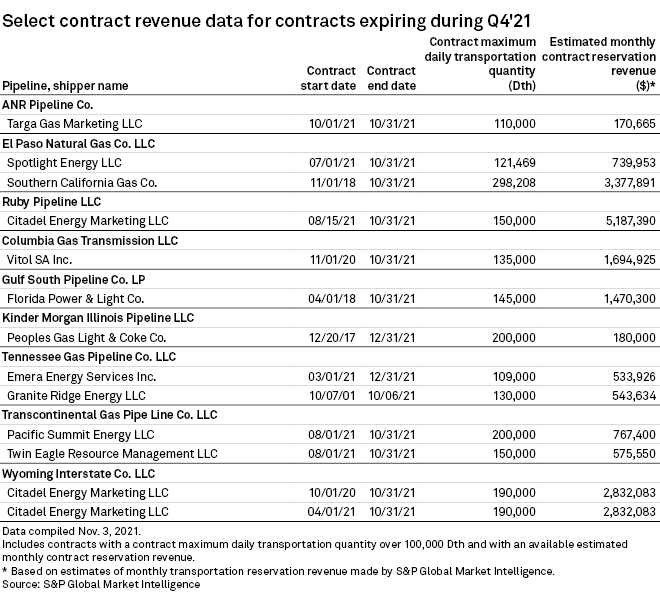

Major U.S. natural gas pipelines have more than $20 million in monthly revenues at stake with 3.4 million Dth/d of firm gas transportation contracts slated to expire during the fourth quarter, according to an analysis of S&P Global Market Intelligence data.

Kinder Morgan Inc.'s Wyoming Interstate Co. LLC recorded the biggest financial hit after it had two contracts totaling approximately $5.7 million in estimated monthly revenues end on Oct. 31, but these agreements only made up 10.8% of the capacity of the company's 850-mile pipeline that spans from western Wyoming to northeast Colorado.

Another Kinder Morgan unit, El Paso Natural Gas Co. LLC, which has a pipeline system that covers 10,140 miles, saw 5.2% of its contracted capacity roll off after two contracts worth $4.1 million in combined monthly revenues ended Oct. 31.

Ruby Pipeline LLC, the operator of a 680-mile pipeline system running from Wyoming to Oregon, lost 19.4% of its contracted capacity when an agreement worth about $5.2 million in monthly revenues expired at the end of October. In early November, Ruby Pipeline was again downgraded by S&P Global Ratings to CC from CCC, with a negative outlook, due to the company's potential for default on $475 million of 8% unsecured notes due April 2022. The rating agency did not expect indirect owners Kinder Morgan and Pembina Pipeline Corp. to provide financial support to Ruby Pipeline.

Pembina Pipeline did not immediately respond to requests for comment on Ruby Pipeline's expired contract. In a Nov. 4 earnings release, Pembina said the yearly drop in the third-quarter adjusted EBITDA of its pipelines division was mainly impacted by a lower contribution from Ruby Pipeline.

TC Energy Corp.'s Columbia Gas Transmission LLC and Loews Corp.'s Gulf South Pipeline Co. LP saw contracts worth roughly $1.7 million and $1.5 million in monthly revenues, respectively, roll off on Oct. 31. A TC Energy spokesperson declined to comment on whether the expired contract for Columbia Gas had been re-contracted. Loews did not respond to requests for comment by the time of publication.

In terms of capacity risk, the pipeline systems of both Kinder Morgan Illinois Pipeline LLC and Portland General Electric Co. could lose 100% of their contracted capacities at the end of December. Portland General Electric did not comment about whether the expiring capacity on its pipeline has been re-contracted. Kinder Morgan declined to comment on the contracts that are set to end in the fourth quarter.

Transwestern Pipeline Co. LLC, which saw 9.0% of its contracted capacity expire Oct. 31, has signed a new agreement with Southern California Gas Co. for 201,340 Dth/d of firm transportation capacity, according to Market Intelligence data.

Market Intelligence's analysis, which used an index of customers and tariff data, covered U.S. interstate gas pipeline contracts with maximum daily transportation of over 100,000 Dth/d and estimated reservation charges, if available.

Pipelines provide gas transportation service to shippers such as producers, utilities, industrial customers, power generators and energy marketers, often under firm contracts. Most of these agreements feature fixed reservation charges that are paid monthly regardless of the actual gas volumes moved or stored, plus a tariff component based on volume to compensate pipeline companies for their variable costs. Market Intelligence estimates of monthly reservation revenue use maximum revenue, because negotiated rates are often not disclosed.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.