Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Generate and test ideas with ClariFI®

ClariFI, our alpha research and portfolio management platform, provides powerful analytics and global market data solutions that let investment managers and quantitative researchers easily access S&P Global Market Intelligence’s data libraries through a secure, hosted, or locally installed environment. Combining industry-leading analytics and content into a single platform reduces time-to-market without compromising the complexity and uniqueness of your investment strategies.

ClariFI’s Visual Query Language eliminates the need to learn a programming language without sacrificing model or strategy complexity.

Quickly test, build, and implement new models. Accelerate your time-to-market with our robust data and transformation and extraction tools.

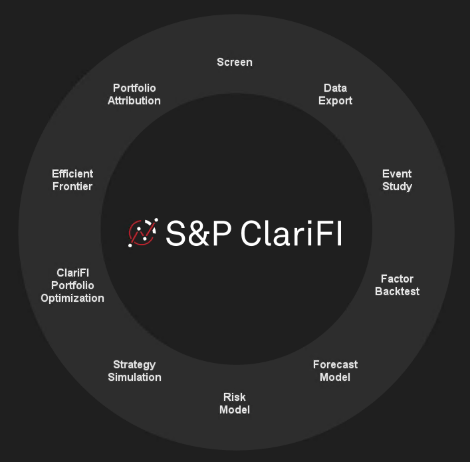

Our platform offers a comprehensive suite of functionalities — screening, back-testing, event studies, portfolio construction, optimization, and attribution — integrated for enhanced operational efficiency and faster idea generation. Each feature can be utilized interactively or scheduled for production, with all factors and models automatically cataloged for easy future access.

Launch new ideas swiftly and stay ahead of competitors. ClariFI also supports seamless integration of proprietary and third-party data, with options to enhance your formula library using R and MATLAB.

Our Data Management module facilitates the quick and accurate integration and organization of complex datasets visually, without programming.

Enhance productivity with our robust automation tools designed for streamlined operations.

Efficiently iterate across multiple scenarios by selecting different sets of universes, date ranges, and factors. Our intuitive drag-and-drop interface enables smarter iterations and quick visualizations of potential outcomes.

The ClariFI API facilitates programmatic extraction of both raw and analytical data in a RESTful JSON format. JSON output with HTTPS support ensures secure data transfer, while seamless integration with popular tools such as Python and R enhances usability. Additionally, Python can be leveraged to create custom interactive reports via Jupyter notebooks.

Streamline your research and customize the execution of production activities effortlessly. Drag-and-drop automation dependencies allow for optimal execution order, with workflows running sequentially or simultaneously depending on performance goals. The system also supports direct updates to screens and models, execution of back-tests, and automated emailing of reports.

Harness our integrated workflows to seamlessly filter data and validate investment signals.

Utilize the Screening module to discover new investment opportunities with advanced tools. Key features include:

The Factor Backtesting workflow evaluates factors based on their correlation to future returns across diverse investment universes. Features include:

Simulate complex strategies effortlessly while maintaining the uniqueness of your investment approach.

Simulate realistic portfolio performance over time with detailed trade-by-trade insights. Key features include:

The ClariFI portfolio optimizer efficiently solves complex mean-variance problems. Features include:

Optimize your portfolio with insights into risk-return dynamics

Evaluate dynamic stock selection scenarios leveraging ClariFI’s portfolio optimizer and explore various risk-return trade-offs.

Gain insights into the sources of portfolio risk and return with our flexible attribution tools. Key features include:

You're one step closer to unlocking our suite of financial information solutions and services.

Fill out the form to learn more about ClariFI solutions.