Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Aug, 2021

Asia-Pacific's private insurance technology landscape may be dotted with several unconventional startups seeking to unseat incumbents, but venture capitalists will gravitate toward less disruptive and more collaborative technology startups.

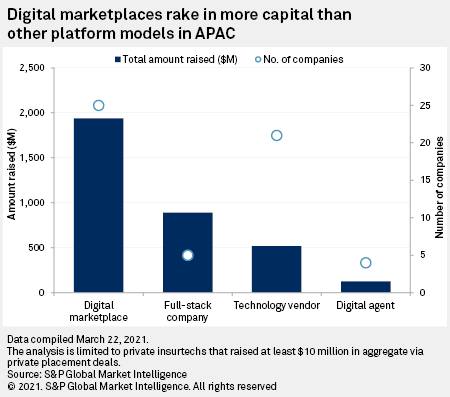

Investors are mostly backing digital marketplaces that drive business to existing carriers, according to S&P Global Market Intelligence's analysis of 56 APAC insurtechs that disclosed at least $10 million of capital raised via private placement deals. About 25 brokerages raked in nearly $2 billion in the region, accounting for more than half of the aggregate amount raised by the companies in our review.

Tech vendors streamlining existing carriers' back-office operations are the second-largest in number, at 21, although they accounted for only 15% of the total amount raised. Growing competition in the online intermediation space, especially in China, could prompt investors to focus on less crowded and more profitable niches. We believe the vendor model will gain more investor attention as a result.

The APAC region, with most of its insurtechs complementing existing carriers, presents a contrast to the U.S., where private capital is skewed toward full-stack companies looking to disrupt the incumbents. Among the 56 APAC insurtechs reviewed by us, there are only five full-stack companies, which collectively represented only 26% of the aggregate capital raised.

Regulatory restrictions on the issuance of carrier licenses in the APAC region will limit growth in the number of tech companies seeking to both underwrite and sell policies. But the small number of existing digital carriers will see a growing share of the aggregate amount raised by insurtechs, thanks to their high capital needs. We believe digital carriers that embrace both offline and online distribution channels will see faster growth.

On the lowest end of the spectrum is the digital agency category, which accounted for only 4% of the aggregate amount raised by insurtechs. Tech companies operating as agents typically offer policies with their branding and work with only a handful of carriers.

Big technology companies like Tencent Holdings Ltd., Ant Group Co. Ltd., Amazon.com Inc. and Grab Holdings Inc. will influence the insurtech ecosystem in the region, thanks to their role as investors, partners and competitors. For technology startups chasing consumers online, collaborations with popular lifestyle and e-commerce platforms could be important for scale.

China, India largest insurtech markets in the region

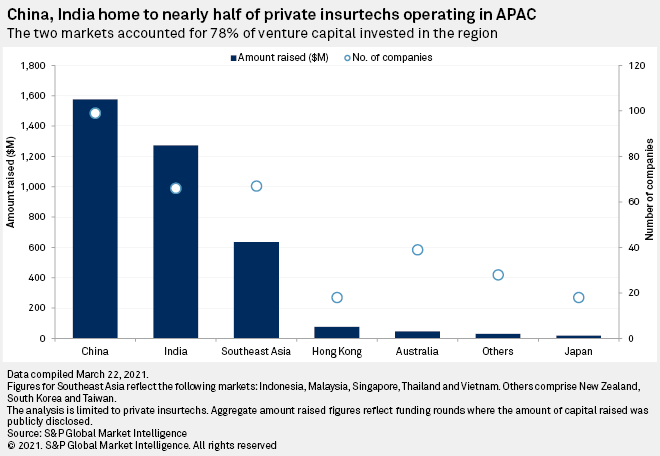

S&P Global Market Intelligence data shows at least 335 private insurtechs operating in Asia-Pacific, with about 122 of them disclosing $3.66 billion in aggregate capital raised via private placement deals.

China and India are collectively home to nearly half of private insurtech companies in the APAC region and attracted about 78% of the investments. The two markets will continue to corner the lion's share of investor interest, thanks to their large and fast-growing insurance markets.

In China, insurance premiums grew at a compound annual growth rate of 13% from 2014 to 2019 to $617 billion, according to data released by the National Bureau of Statistics of China. Insurance premiums in India totaled $107 billion in India for 12 months ended March 31, 2020, after growing at a CAGR of 10% from fiscal 2015 to fiscal 2020, according to the Insurance Regulatory and Development Authority data. In the pandemic-affected 2020, China's insurance premium growth slowed to 6%.

The threat of wide-sweeping disruption in insurance has yet to manifest in the region. For instance, in China, which is the second-largest insurance market in the world, online sales represented only 6.43% of the overall insurance industry premiums in 2020, according to the data released by the Insurance Association of China. But the share of internet insurance premiums is rising in the market.

We counted 67 insurtechs in Southeast Asia, including 37 in Singapore, 11 in Indonesia, nine in Malaysia, eight in Thailand and two in Vietnam. Australia has 39 insurtechs, and Hong Kong and Japan each have 18 insurtechs.

Our detailed study focused on startups that raised at least $10 million, comprising 56 companies. We segmented these companies based on their sector focus, platform and distribution models.

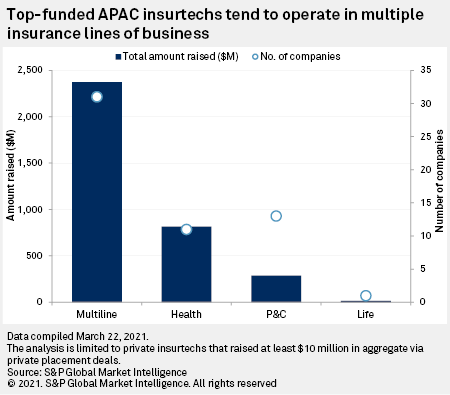

By insurance sector, 31 of the 56 companies we reviewed operate in all three verticals: Life, health and property and casualty. We counted about 13 insurtechs with a focus on property and casualty, with most of them operating in the auto insurance space. However, slowing auto insurance premiums in China could mean that insurtech investors could turn their gaze toward faster-growing segments like health.

Hong Kong and India home to digital carriers

Full-stack tech companies that originate and retain insurance risks are few and far between in the region, thanks to the limited supply of insurer licenses. In contrast, the U.S. insurtechs have greater flexibility to create a full-stack structure, subject to regulatory capital requirements, by establishing a carrier on a de novo basis or through the acquisition of entities that are already fully licensed.

Our review found at least five full-stack companies, which collectively raised nearly $890 million. Two of them are in India, two in Hong Kong and one in Singapore.

Full-stack companies controlling both manufacturing and distribution of insurance products pose the biggest risk to traditional players operating in the insurance value chain: carriers and human intermediaries. The use of technology to control risk selection and underwriting, sell policies, and provide claim services distinguishes digital insurers from incumbents.

China was perhaps among the first markets to award an online-only insurer license. ZhongAn Online P & C Insurance Co. Ltd., which now trades on the Hong Kong Stock Exchange, was approved in 2013 to become a carrier that accepts business through digital-only channels.

Hong Kong followed suit in 2017, creating a differentiated framework for virtual insurers. Online insurers in Hong Kong cannot use agents, banks or brokers to acquire customers and must use proprietary digital distribution channels. Sun Life Financial Inc.-backed Bowtie Life Insurance Co. Ltd. and Cathay Ventures-backed OneDegree each raised $30 million. The other virtual insurers in the city — namely Blue Insurance Ltd., Avo Insurance Company Limited and ZA Life Ltd. — did not disclose how much capital they raised. Blue and Avo are backed by Hillhouse Capital Management Ltd. and ZA Life is backed by ZhongAn Online.

Digital carriers embracing tradition will see rapid growth

Two of the fastest-growing full-stack companies are only partly digital. Go Digit General Insurance Ltd. in India and Singapore Life Pte. Ltd. in Southeast Asia have adopted omnichannel strategies, allowing consumers to sign up for policies through their websites and offline networks such as agents.

The multi-channel strategy has allowed the two companies to achieve rapid scale. Insurance carriers cannot disregard offline channels, especially for selling complex products such as universal life insurance in the region. Life insurance is generally considered a push product as consumers do not proactively seek life policies. Further, consumers typically lean on advisers to take them through the fine print of high-premium policies.

Launched in 2017, SingLife grew its annual gross written premium at a compound annual growth rate of nearly 200% to S$142 million in 2019 from S$16 million in 2017. The company is set to grow much bigger thanks to its acquisition of Aviva's Singapore operations in late 2020. The merger of the legal entities awaits court approvals.

A comparison in the scale of the operations of Go Digit and Acko General Insurance Ltd. in India illustrates the superiority of the hybrid strategy compared to the digital-only channel.

Both Acko and Go Digit received insurer licenses in 2017 and have so far raised more than $200 million. Acko does not accept business from offline channels and recorded gross written premium of only 3.58 billion rupees for 11 months ending February 2021, whereas Go Digit with its omnichannel strategy saw gross written premium of 20.89 billion rupees for the same period.

While SingLife and Go Digit may not be the archetypal examples of digital insurers, their digital tools enhance the offline sales process and speed up the claim settlement.

Digital marketplaces attracting bulk of investor capital

Among insurtechs that raised at least $10 million, about 45% operate as digital marketplaces offering a transparent way to compare coverage and price options among different providers.

Most digital marketplaces directly serve individual consumers through their websites and apps, providing a full suite of life, health, auto and travel policies. India's PolicyBazaar and China's Waterdrop are among the large digital marketplaces that market products underwritten by insurance carriers directly to consumers.

Digital brokers building a two-sided marketplace seek to create "network effects." They typically position themselves as portals where consumers can gain education about insurance protection and seamlessly buy policies. More people flocking to their comparison sites could lead to more insurance carriers employing the aggregator as a sales channel. Greater coverage options and better pricing terms will attract more user traffic.

The digital marketplace model, however, is quickly evolving, especially in China, where digital brokers like Xiaobang Guihua are adding advisory features. Xiaobang Guihua recommends insurance products via its WeChat public account as well as through a stand-alone app.

While customer acquisition efforts typically entail marketing spend to build a brand, some Chinese marketplaces have developed innovative use cases to generate traffic. Waterdrop and Qingsongchou allow people to initiate crowdfunding campaigns seeking support for medical expenses. Other innovations such as mutual aid plans help participants share the medical cost burden of critical illness. The crowdfunding and mutual aid platforms often serve as lead generators for their insurance marketplaces. Waterdrop shut down its mutual aid platform earlier this year.

Agency model has limited appeal among upstarts

A small number of insurtechs have chosen the digital agency model. Digital agents act on behalf of just one or two insurers per vertical and may often serve as the digital touchpoint for the customer. Traditional carriers might favor digital agency relationships if the technology partner's data predictions and risk profiling of customers help lower loss ratios.

Sunday Insurance distributes health, auto and travel products underwritten by KSK Insurance (Thailand) Public Co. Ltd. in Thailand; Huddle Insurance in Australia works with The Hollard Insurance Company Ltd. to offer home and auto policies; China's CreditEase Insurance Agency's carriers include The People's Insurance Company (Group) of China Ltd., Taikang Insurance Group Inc. and Ping An Insurance (Group) Co. of China Ltd.

Chinese insurtechs providing hardware and software to incumbents

A growing number of technology startups do not chase insurance consumers online and instead provide hardware, software and analytics to carriers, brokers and agents. They provide solutions that assist incumbents in customer onboarding, claims processing and other internal functions.

Some companies like eBaoTech Corp. offer various cloud-based computing models, allowing insurers to migrate data, applications and infrastructure to the cloud and access modernized core systems. Applications built on cloud systems make it easier for creating new policy types and help better integrate with sales channels. China-based eBaoTech operates in more than 30 markets around the world, including Japan, India and Southeast Asian markets.

Data Enlighten's auto loss assessment platforms are integrated with PICC, China Pacific Insurance (Group) Co. Ltd. and Ping An, among others, allowing carriers to handle auto insurance claims. Sequoia Capital-backed Nuanwa Technology offers artificial intelligence-based platforms, assisting health insurers with product design, sales and risk control.

We tracked about 21 technology vendors in the region, 17 of which are based in China. Among notable companies outside of China, Singapore-based CXA Group Pte. Ltd. provides white label solutions for corporates, small and medium businesses to help employees pick health coverage and manage claims. The company, which operates in China and Southeast Asia, is selling its brokerage business to focus on its software-as-a-service business.

Several insurtechs that started as simple lead-generation websites in China are now adding technology vendor models by providing risk assessment, underwriting and claims assistance to carriers. Publicly listed digital broker Huize Holding Ltd. illustrates this trend among digital brokers in China, which leverage their vast troves of data to work with insurers to customize policies for their users.

Insurtechs, big techs frenemies

For several digital underwriters and intermediaries operating in the region, China-based Zhong An appears to be a source of inspiration. The publicly traded digital insurer pioneered the concept of embedded insurance in the region by partnering with popular consumer technology platforms. Bundling short-term, inexpensive policies with digital transactions made on e-commerce and ride-hailing platforms allowed ZhongAn to achieve rapid scale in a short time.

Acko, for instance, sells intra-city travel policies to ride-hailing company Ola users for premiums as low as 1 Indian rupee per ride. Indonesia-based PT. PasarPolis Indonesia sells vehicle, health, accident, life, property, and travel insurance policies through Go-Jek, Tokopedia, and Traveloka. Another Indonesian insurtech, Qoala, provides insurance products covering flight and train delays, phone display damages and e-commerce logistics for Traveloka, Ovo, Dana, and Momo users in Southeast Asia. Australia-based Cover Genius distributes insurance products for global e-commerce companies, including Booking, eBay, Shopee, Tile and Wayfair.

In this model, large digital conglomerates with loyal userbases become the distribution channels. Insurtechs can sell policies directly to millions of their users. Dependency on big techs, however, brings its own risks. While consumers may recognize the insurtechs as providers of the coverage, big tech partners will continue to wield influence over the larger customer relationship. Commissions charged by big techs could weigh heavily on the profitability of insurtechs.

Further big techs' insurance aspirations put them in direct competition with insurtechs. Ant Group and Tencent in China; Grab in Southeast Asia; Amazon and Paytm in India already operate as internet insurance distributors.

Tencent's online distribution platform, known as WeSure, allows users to make insurance inquiries, purchases and claims directly on its instant messaging and lifestyle platforms, WeChat and QQ. WeSure works as an agent for MetLife, Inc., AXA and Ping An, among others. The digital conglomerate is also a significant partner for insurtechs in China. We counted at least three insurtechs in which Tencent holds a stake: Waterdrop, Qingsongchou and Xiaobang Guihua. Besides, several Chinese insurtechs primarily depend on Tencent's WeChat to conduct their business.

Amazon, which holds a stake in digital insurer Acko, holds an agency license to distribute products underwritten by the Indian digital insurer. But Acko's exclusive relationship with Amazon may not last long as the e-commerce company plans to seek a brokerage license to work with multiple insurers.

While big techs are vying to become digital intermediaries in the insurance space, established carriers are building proprietary digital channels. Startups that assist both incumbents and big techs in making this transition will likely emerge as winners.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Products & Offerings

Segment