Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

By Sean Sullivan and Susan Dlin

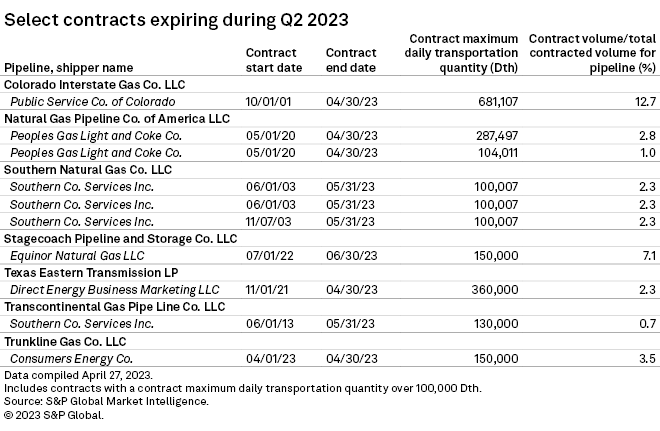

Big US interstate natural gas pipeline companies will have contracts representing a total of about 2.2

This projected volume of pipeline contract expirations was less than the volume in the first quarter, which was almost 3.9 million Dth/d, according to an analysis of S&P Global Market Intelligence data. The analysis covered contracts with a maximum transportation quantity of 100,000 Dth/d or more.

Contracts end

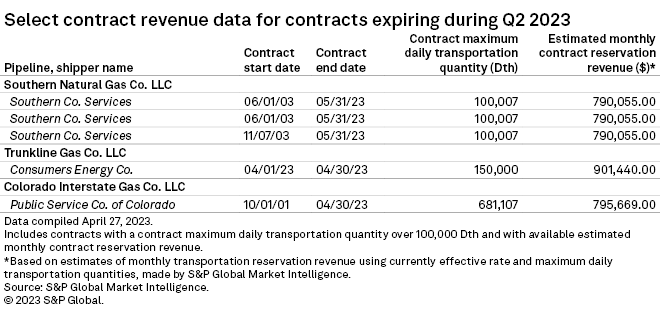

Among second-quarter contract expirations, Kinder Morgan Inc.'s Colorado Interstate Gas Co. LLC was projected to see the largest potential impact on its contracted maximum daily transportation volumes at 681,107 Dth/d, which was also the largest fraction of total contracted volume at 12.7%. The contract, with electric and gas utility Public Service Co. of Colorado, expired April 30.

Kinder Morgan declined to comment on the numbers but directed interested parties to its online electronic bulletin boards. Spokespeople for other pipelines whose expiring contracts are referenced in this article either declined to comment on commercial contracts or did not respond immediately to requests for comment.

The expiration and renewal of contracts between pipeline companies and shipper customers are part of the normal business cycle in the sector. The number of contracts that reach the end of their primary term in a quarter relates to how many projects were completed 15 or 20 years ago, the typical primary terms for transportation contracts.

Other companies in the Kinder Morgan family were due to have contracts expire. Natural Gas Pipeline Co. of America LLC was expected to drop almost 400,000 Dth/d of contract maximum daily transportation quantity in two contracts that expired April 30. The contracts represented about 3.8% of the company's total contracted transportation volume. The expiration of three contracts with Southern Co. Services Inc. on May 31 could mean a reduction of over 300,000 Dth/d, or about 6.9%, on the Southern Natural Gas Co. LLC system. Stagecoach Pipeline & Storage Co. LLC was due to have a contract with Equinor Natural Gas LLC covering 150,000 Dth/d, or 7.1%, expire June 30.

Other companies with expiring agreements include Enbridge Inc.'s Texas Eastern Transmission LP, whose contract with Direct Energy Business Marketing LLC worth 360,000 Dth/d, or 2.3% of maximum contracted volumes, expired April 30.

Trunkline Gas Co. LLC's contract with Consumers Energy Co., which represented 150,000 Dth/d, or 3.5% of maximum contracted volumes, rolled off on April 30. Trunkline Gas is a subsidiary of Energy Transfer LP. Williams Cos. Inc.'s Transcontinental Gas Pipe Line Co. LLC stood to drop 130,000 Dth/d, or 0.7%, when a contract with Southern Co. Services expires May 31.

|

– Access – Get more details on natural gas transportation projects – Follow the latest news |

Midstream builds

At a May 22-24 oil and gas industry conference by Hart Energy, upstream experts said US production will be hampered by a lack of infrastructure such as LNG export terminals and pipelines to move gas to the terminals and other markets.

Kinder Morgan, in its first-quarter earnings call in April, said the Permian Basin region in West Texas and New Mexico will need another major gas pipeline within four years.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.