Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 02, 2022

The global manufacturing PMI survey revealed a further easing of inflationary pressures in November, with firms' costs rising at the slowest rate for two years. Weakening demand and inventory reduction policies are taking the strain out of supply chains and even leading to increased reports of price discounting.

The combination of falling demand and fewer supply issues is helping bring factory price inflation down sharply in the US, Europe and Japan, though COVID-19 restrictions in mainland China are causing some new problems in terms of global supply chains. The outlook for prices also remains highly contingent on energy market developments.

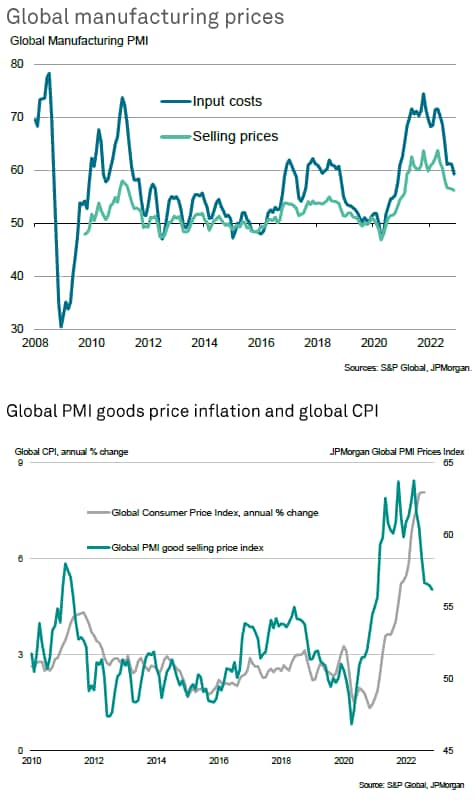

The input cost index from the JPMorgan Global Manufacturing PMI survey, compiled by S&P Global, fell to a two-year low in November, signalling a further cooling of raw material price pressures from the 13-year peak seen in October of last year.

The reduced growth of input costs in turn fed through to lower selling prices inflation for goods leaving the factory gate, the rate of increase of which moderated in November for a seventh successive month. The lower factory gate price inflation bodes well for consumer goods prices inflation to likewise ease further in the coming months.

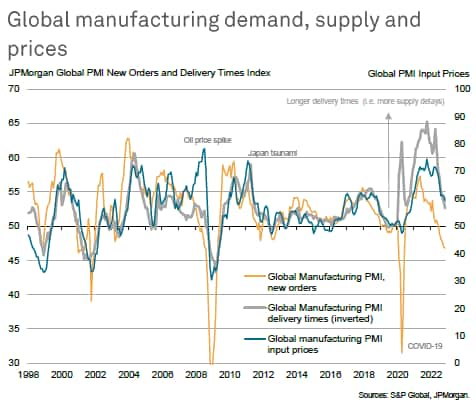

The easing in price pressures can be traced first and foremost to a drop in demand for manufactured goods, which has led to one of the sharpest downturns in input buying by manufacturers recorded by the PMI survey since the global financial crisis. Measured overall, new orders placed for manufactured goods fell in November at a rate which has not been exceeded since 2009, excluding initial pandemic lockdown months. Manufacturers are also starting to deliberately run down warehouse inventories on inputs, reflecting an increasingly gloomy demand outlook.

This reduction in demand for goods and their associated inputs has removed some pricing power from the suppliers of these goods and inputs.

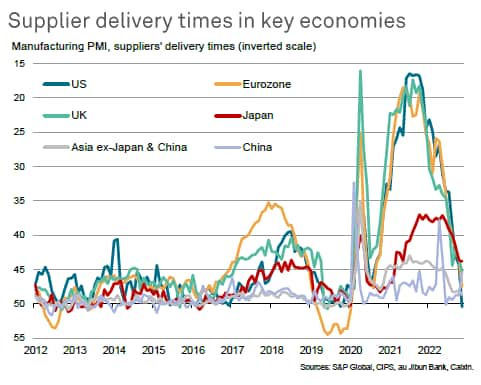

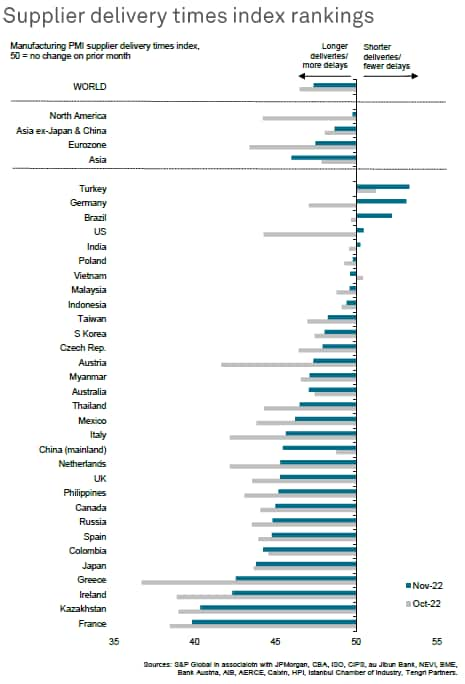

A commensurate consequence from the downturn in demand for goods and inputs has been a further marked reduction in the number of supplier delivery delays globally. The global PMI suppliers' delivery times index, a key gauge of supply chain health and price developments, signalled the fewest delays since January 2020 - prior to the pandemic - in November. Delivery times even improved in some important manufacturing economies, including the US and Germany.

Hence, both demand- and supply-side factors are serving to act as downward pressures on input cost inflation in the manufacturing sector, which should help to further alleviate global inflationary pressures in the coming months.

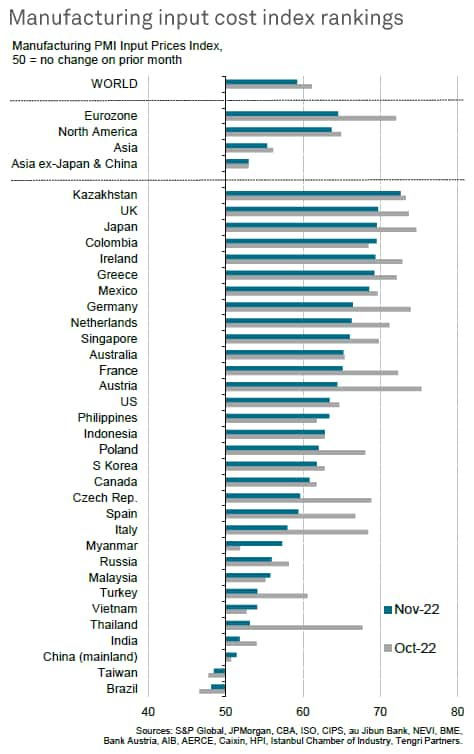

Looking across the 31 economies for which S&P Global PMI data are available, the UK saw the second-steepest increase in manufacturing input costs in November behind only Kazakhstan, followed by Japan. At the other end of the scale, prices fell in Brazil and Taiwan, and rose especially modestly in mainland China and India.

Across the 29 economies in which prices rose, only six reported higher rates of inflation (Colombia, the Philippines, Myanmar, Malaysia, mainland China and Vietnam).

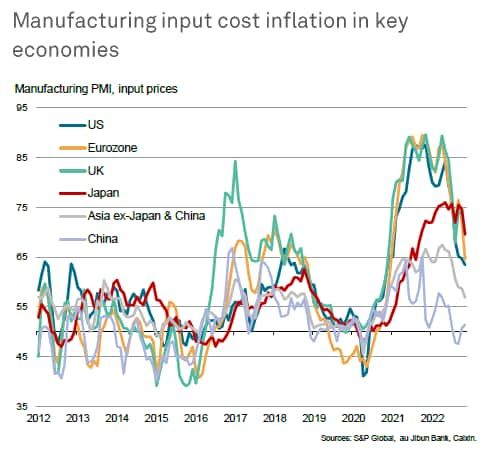

Input cost inflation has consequently slowed substantially since earlier in the year across most major economies, notably sliding to the lowest since late-2020 in both the US and eurozone, and hitting the second-lowest since late-2020 in the UK. In Japan, the rate of increase waned to the lowest since September 2021.

The steepest easing in the rate of input cost inflation compared to October was registered in Thailand, but particularly sharp coolings in the rate of inflation were seen in many eurozone economies, notably Germany, Austria, Italy, Spain and France.

While measured globally suppliers' delivery times lengthened to the smallest extent since January 2020, there were marked variations in supplier performance around the world. Delivery times even improved in five economies compared with October - namely Turkey, Germany, Brazil, the US and India. Of the other 26 economies, only mainland China, Vietnam, Australia and Colombia reported a worsening supply chain situation in terms of lead times lengthening at an increased rate.

Broadly speaking, of the major regions of the world, supply chain constraints have eased to the greatest extent in North America in recent months, but are showing signs of worsening again in parts of Asia, notably reflecting heightened COVID-19 restrictions in China.

Industrial prices are coming under downward pressure from a combination of falling demand and improving supply, the November PMI surveys depicting a global manufacturing sector which is seeing a shift from a sellers-market to one in which buyers are starting to regain some power in price negotiations.

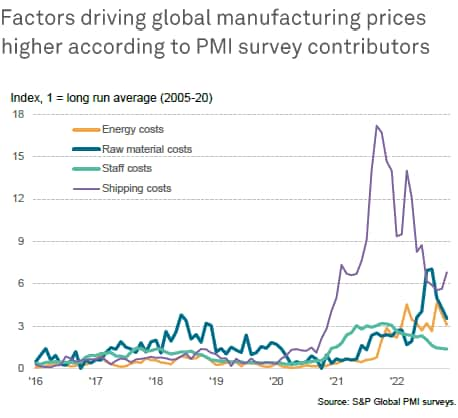

The surveys are also registering a marked cooling of upward price pressures form shipping rates in recent months, albeit with a small uplift evident in November, as well as reduced upward price growth momentum from wages and salaries.

However, while these weakening fundamentals point to the risk of further price softness to come in the months ahead, there remain many uncertainties. In particular, energy prices remain volatile and look likely to continue to present both upside and downside risks to manufacturing costs and prices depending on Ukraine war developments, winter weather and China's COVID response.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location