Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jun 03, 2021

Research Signals - May 2021

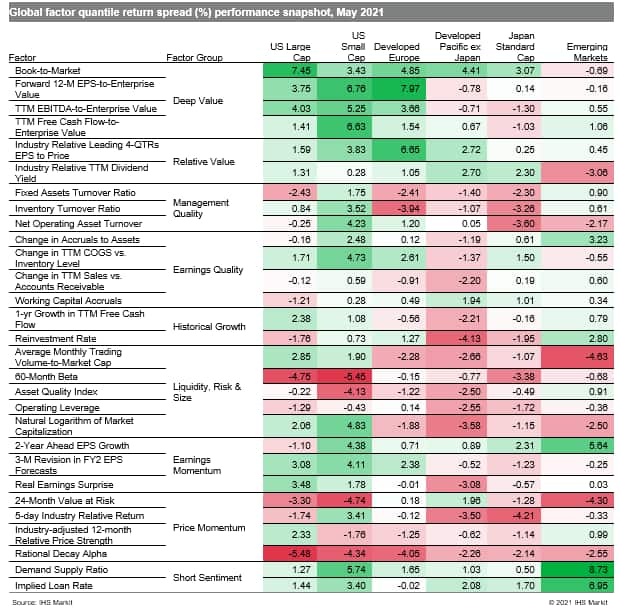

Inflation fears remain the main theme in global markets, though major equity markets have extended their gains for the year. Investors are increasingly optimistic on an improving economic outlook, including that captured by a strong upswing in the J.P.Morgan Global Manufacturing PMI, led by solid expansions in the eurozone, UK and US. However, the survey continues to point towards increased inflationary pressures, as confirmed by the steepest rise in input costs for over a decade and record inflation of selling prices. While Fed officials maintain the view that inflation is largely driven by transitory factors, similar questions remain on the transitory nature of another key theme to markets surrounding the staying power of the current value cycle (Table 1).

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.