Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Dec, 2017 | 13:00

With peak gift giving time approaching, we decided to analyze the trendy market for subscription boxes to find out which ones are most likely to be gifted this year – and in the years to come.

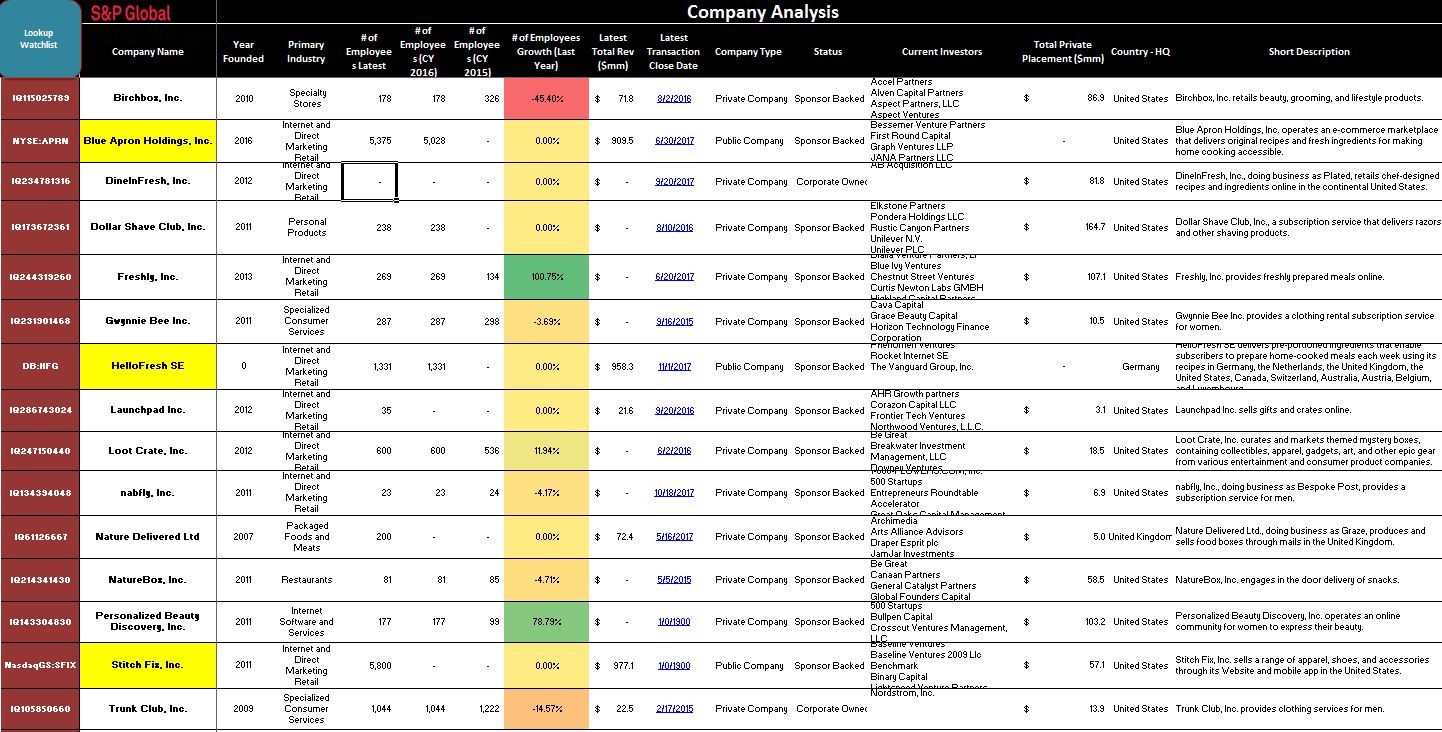

We used the S&P Capital IQ platform to analyze private, corporate-owned, and public subscription box companies, including a few that recently went public (most notably Blue Apron). We pulled company financials, layered in basic details like founding year, location, and product offering, and added in our employee headcount data sourced from Department of Labor 5500 forms to help assess growth rates, as shown in the chart below.

Click on the image below to enlarge.

To give additional context, we also looked at qualitative data from the Key Developments section of the S&P Capital IQ platform on recent corporate announcements, M&A transactions, and M&A discussions.

Based on our analysis, the top performing private company in 2017 is Loot Crate, which provides monthly subscription boxes that feature gaming, sports, and pop culture-themed collectibles. With YoY U.S. employee growth at 11.9% and $18.5M Series A funding in 2016, it appears Loot Crate is putting its capital to work with the 2017 launch of two new boxes: a limited edition video game box in conjunction with video game company Bungie and a more traditional sports loot box.

Traditional retailers are finding the subscription model attractive, which has resulted in M&A activity within this niche industry. DineInFresh, which operates under the name Plated.com, was acquired for $300MM in September by AB Acquisitions, a holding company of food retailers such as Albertsons and Safeway. Dollar Shave Club, a popular razor and shaving products subscription service, was purchased for $1B by Unilever in 2016. Furthermore, our Key Developments show that Wal-Mart was rumored to be interested in acquiring beauty box provider BirchBox in August of this year, but this transaction has not materialized.

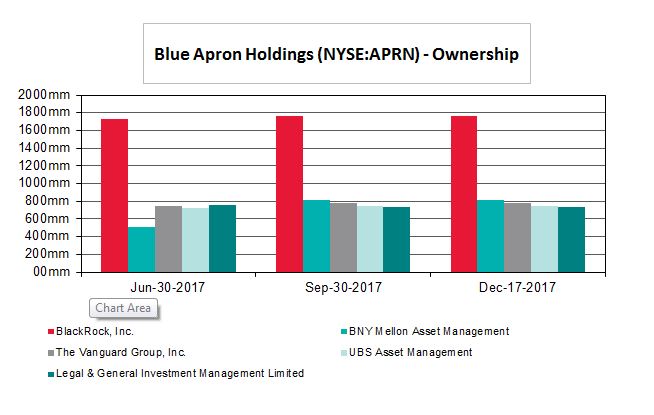

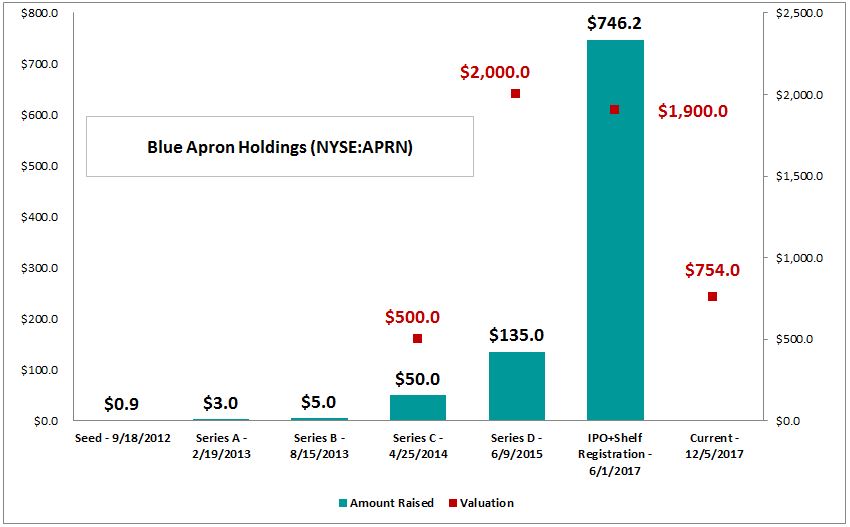

Next, we looked at public company comparables, including two recent subscription box companies that went public in 2017. Blue Apron Holdings Inc. (NYSE:APRN), which provides subscribers with cooking ingredients and recipes, debuted in late June at $10 a share and a $1.9B market capitalization. Public markets have not been kind to this stock, and prices have faltered. As of early December, it was trading below $4 a share with a market capitalization of less than $750MM. Bessemer Venture Partners currently owns slightly over 19% of total shares outstanding, which is valued around $135MM. In aggregate, private equity firms own 33.3% of total shares outstanding.

Click on the images below to enlarge.

Stitch Fix, Inc. (NasdaqGS:SFIX), which sends its customers a box of clothing chosen by a personal stylist, went public in late November, debuting at $15 a share with a market capitalization of $1.45B. The company’s shares have steadily appreciated since, trading above $24 a share as of early December with a market capitalization of more than $2.3B. Stitch Fix is heavily backed by private equity and venture capital; three separate firms hold an aggregate of 43% of total shares outstanding. Benchmark is the largest holder, owning 23.5% of the company which is valued around $545M.

So, which subscription boxes do you think will be around for gifting next holiday season?

This is a quick case study showing how you can you can find interesting opportunities using the S&P Capital IQ platform, and in particular, our private company data.

From all of us at S&P Global Market Intelligence, we wish you a productive and happy 2018!