Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 05, 2023

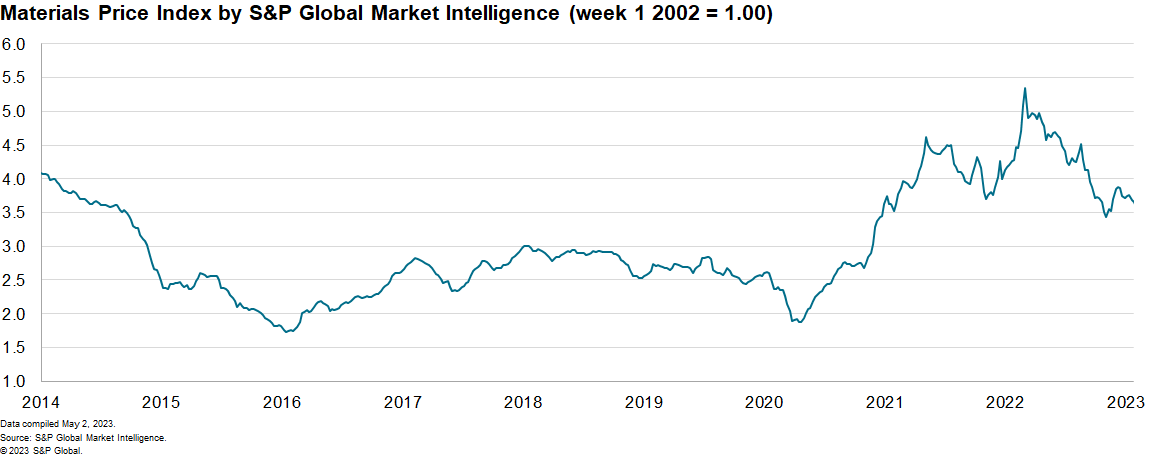

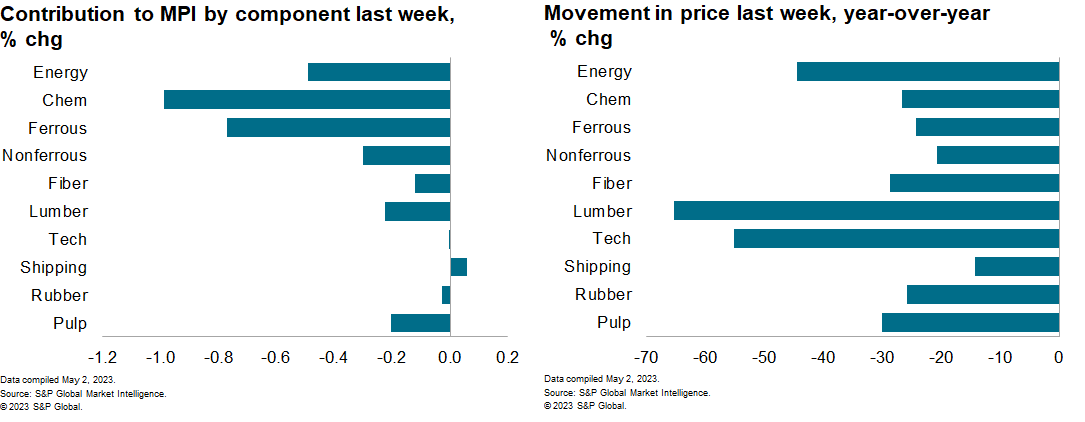

The Material Price Index (MPI) by S&P Global Market Intelligence decreased 3.1% last week, the fourth consecutive weekly decline. The decrease was widespread with nine of the ten subcomponents falling. The story of 2023 so far has been one of falling commodity prices with the MPI decreasing in 12 out of the last 16 weeks. The index also sits 32% below its year ago level which was near the all-time peak.

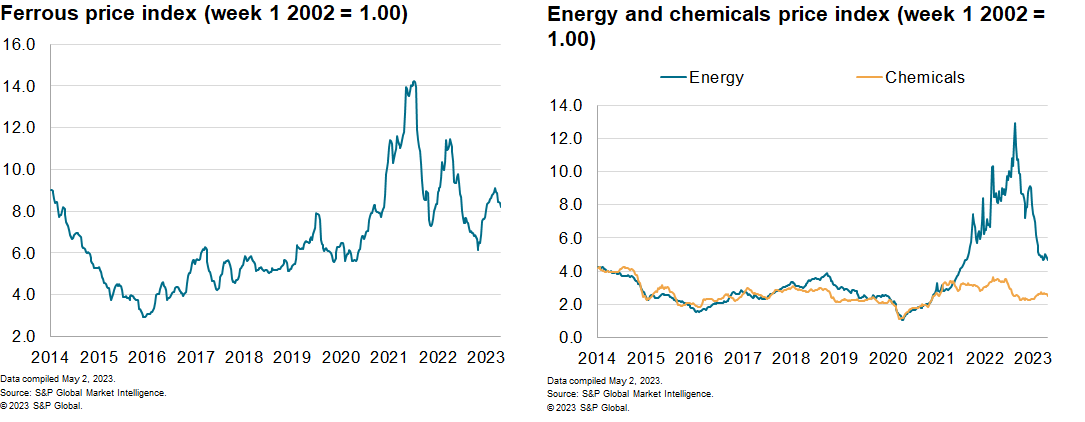

The declines were significant last week with three subcomponents falling more than 3% and nine falling more than 1%. Lumber paced the group with an 11.2% decline, offsetting the more than 6% climb over the previous two weeks. North American lumber prices remain low but have demonstrated robust weekly volatility. Pulp prices fell 5.8%, the fourth consecutive weekly decline. The pulp index is on a near continuous downward correction since the start of 2023. Chemicals was the third weakest category, posting a 5.1% decline. Ethylene, polyethylene, and benzene all declined 5% last week in a broad selloff symptomatic of strong capacity and lower input costs. Iron ore, ferrous scrap, and copper rose through March but are relapsing as an expected surge in demand does not live up to expectations.

The global economy remains resilient but most of the strength is from services not manufacturing or construction. On the whole, growth is showing signs of slowing in the first half of 2023. GDP came in sluggish in the US and the Eurozone for the first quarter. The latest economic data releases reaffirm the narrative that although consumer demand remains upbeat in many countries, the manufacturing sector is stagnating. Improving supply conditions-both from increasing output and better logistics-and the sluggish demand for industrial materials is creating room for the continued downward correction in materials pricing. However, headwinds remain, most obviously in the form of broad inflation measures. The year-over-year increases in the consumer price index in April remained very high in Spain, France, and Germany and the personal consumption expenditures price index in the US reaccelerated in Q1 2023. The stubborn inflation measures lend support for central banks to consider additional interest rate hikes. In the current week, we will get more PMI data and the April report on the US employment situation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.