Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 09, 2022

By Michael Dall

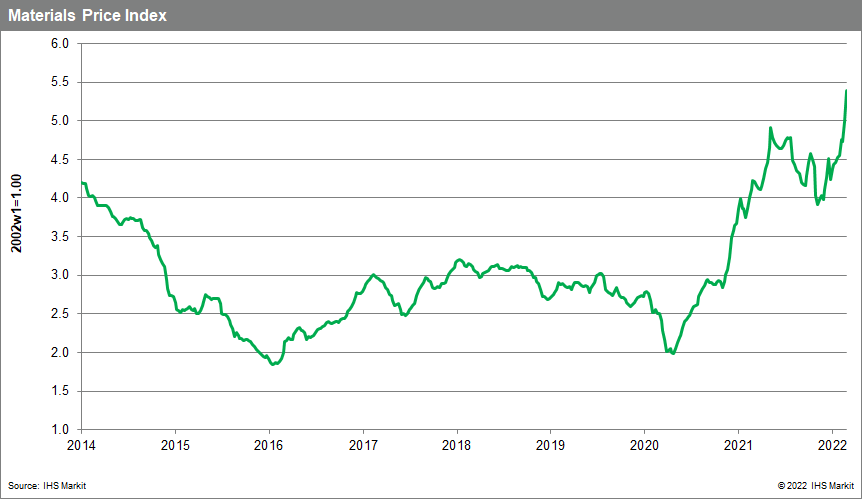

Our Materials Price Index (MPI) jumped 8% last week, the largest weekly increase on record. Price increases were uniform with all ten sub-components in the index rising. After last week's increase, commodity prices have now surpassed the all-time high set in April 2011.

Energy prices continue to soar and were the largest contributor to the MPI's increase last week. Our energy sub-index jumped 21.9%, the second largest weekly gain ever recorded only behind the previous week's increase. Natural gas, oil and coal prices all increased but it was the latter that recorded the most extreme price hikes. Australian thermal coal reached $353 per metric ton, its highest ever price, and a $91 per metric ton increase on the previous week. Overall, global coal prices climbed 35.9% last week. Oil prices also spiked with Brent crude reaching $118 per barrel for the first time since 2013. A geopolitical risk premium will continue to be attached to energy prices until additional supply arrives or fighting in Ukraine ends. Industrial metal prices also surged last week amid concerns over future supply. The LME contract for aluminum rose above $3,600 per metric ton, its highest price since 1988. Russia is the second largest exporter of the metal and, with the market already in deficit and inventory low, price risk is clearly to the upside. The LME's record price of $4,280 per metric ton is potentially in reach should Russian exports be reduced.

With inflation already high, the jump in energy prices last week only adds additional upward pressure on global prices while at the same time lowering projected economic growth - an unwelcome combination. Thus far there has been minimal actual supply disruption from the conflict. The risk remains elevated with further upside potential for prices. Supply chains are set to tighten with the disruptions and bottlenecks that have plagued markets for two years now likely to continue at least through the second half of the year. However, as prices soar the likelihood of demand destruction rises. Still, expect the MPI to continue to break records in the coming weeks.

Posted 09 March 2022 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.