Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 30, 2021

By Michael Dall

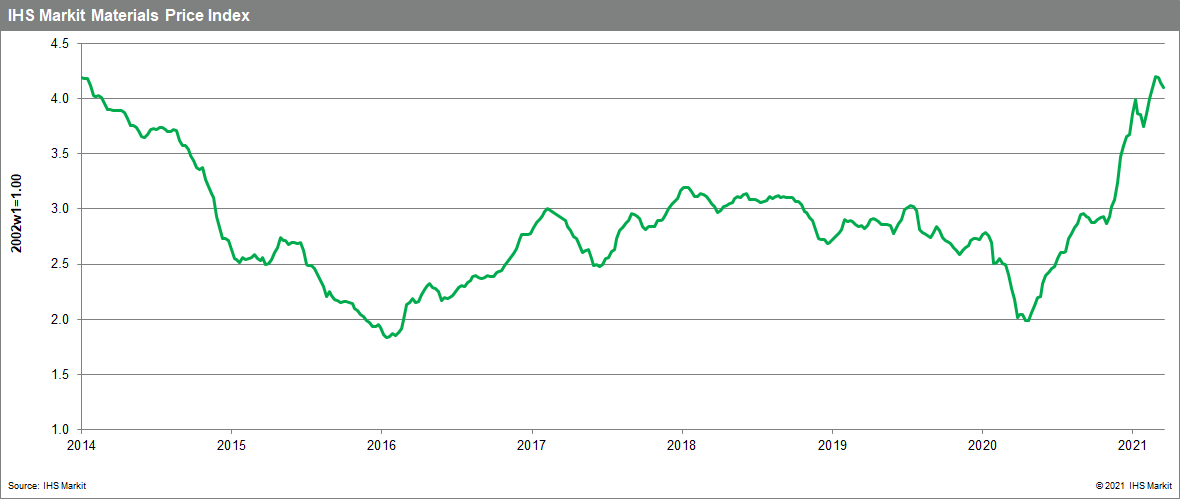

Our Materials Price Index (MPI) fell 1% last week, its third consecutive weekly decrease. Notwithstanding last week's retreat, the MPI is still at its highest point since January 2014. Commodity markets are markedly different from this time last year, with prices as measured by the MPI 87% higher than late March 2020.

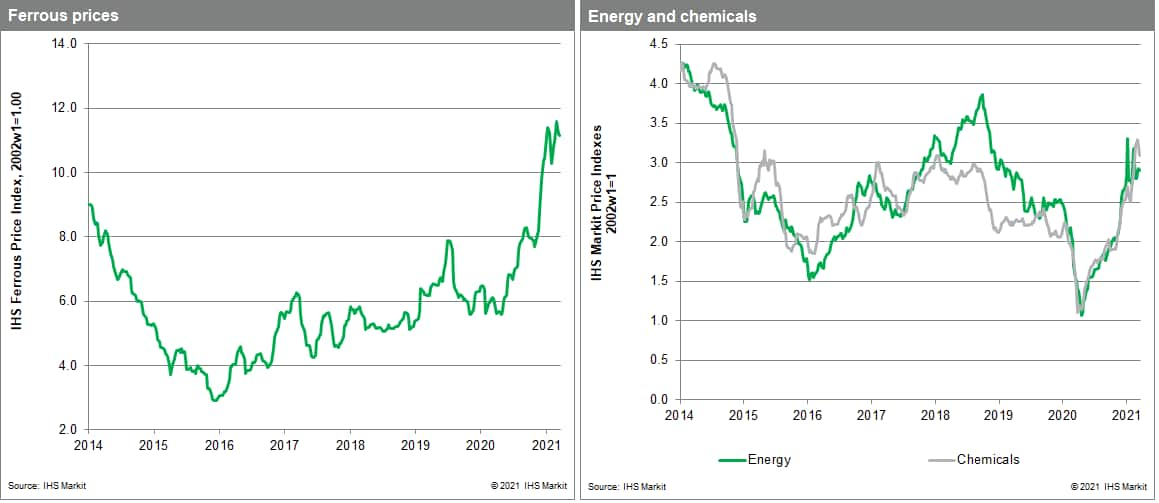

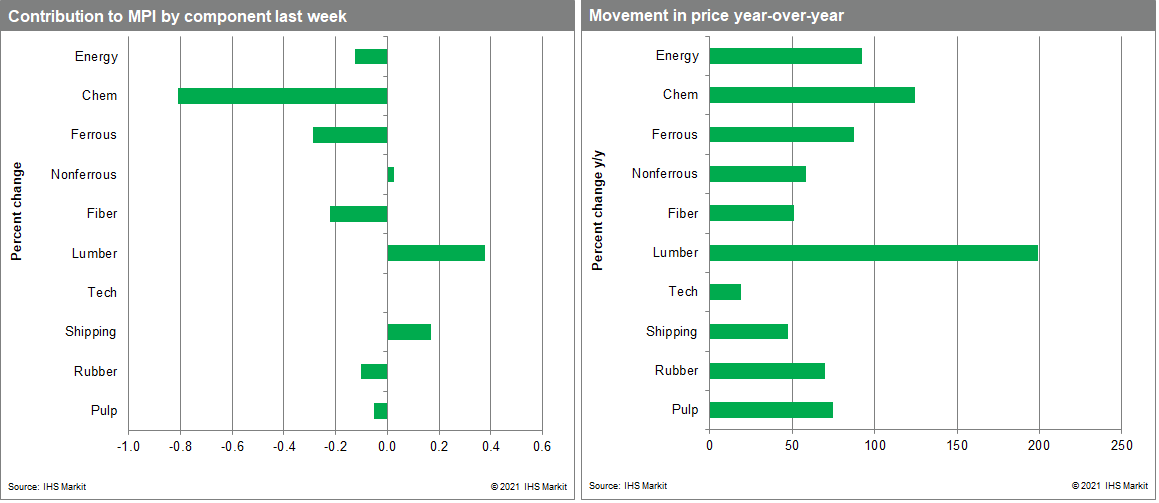

Six of the MPI's ten sub-components posted decreases last week with chemicals seeing the biggest downward move. The index dipped 4.2% with lower crude oil prices and improving supply driving prices lower. Brent crude dropped to a low of $60.50 having broken $70 at the start of March and this decline fed through to lower feedstock costs for chemicals. In addition, Asian supply levels have improved with several plants restarting production, which resolved existing shortages. North American production continues to make good progress after last month's cold snap in Texas creating further downward pricing pressure. There is also less pricing pressure in base metals with our steelmaking raw materials index decreasing 0.7% last week. The index has now declined for three weeks in a row although prices are retreating from historic highs. One of the reasons for the drop is an expectation that the Chinese government will soon impose new policy measures to crackdown on pollution. This will likely include measures to restrict blast furnace operations in mainland China, which has reduced buyer interest in iron ore. Lumber markets are still experiencing price inflation however with our sub-index increasing 10% last week. Low interest rates and a desire for single family homes, because of the pandemic, have boosted homebuilding rates and lumber demand is vastly outstripping supply.

The US treasuries sell-off continued last week as investors continue to focus on strong future growth prospects and the associated inflation risks. The past year of rising commodity prices already ensures higher goods price inflation this summer. Whether this burst of inflation is prolonged or only temporary will depend on how quickly problems in production and logistics services are resolved. Commodity prices were generally unaffected by the container ship blockage in the Suez Canal last week, but they are likely to be impacted in the coming weeks. Shipping costs were already soaring before the Ever Given ran aground (our shipping sub-index increased 21.6% in the last four week). This latest incident only highlights the fragility of supply chains in early 2021 and increases the upside price risk. The hope is that disruptions and bottlenecks fade as the pandemic recedes in the second half of the year. If they do, markets look to be in a better balance with cost pressures becoming manageable even as a broader recovery gains traction. Delivery times, currently extended, will be a clear sign that conditions in supply chains are returning to normal. If they do not begin retreating by late summer or decline only slowly in the third and fourth quarter, the rise in goods price inflation may become uncomfortably long.

Posted 30 March 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence