Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 06, 2021

By Michael Dall

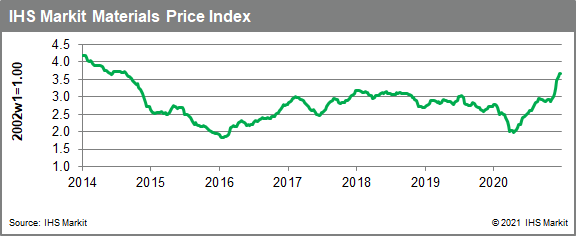

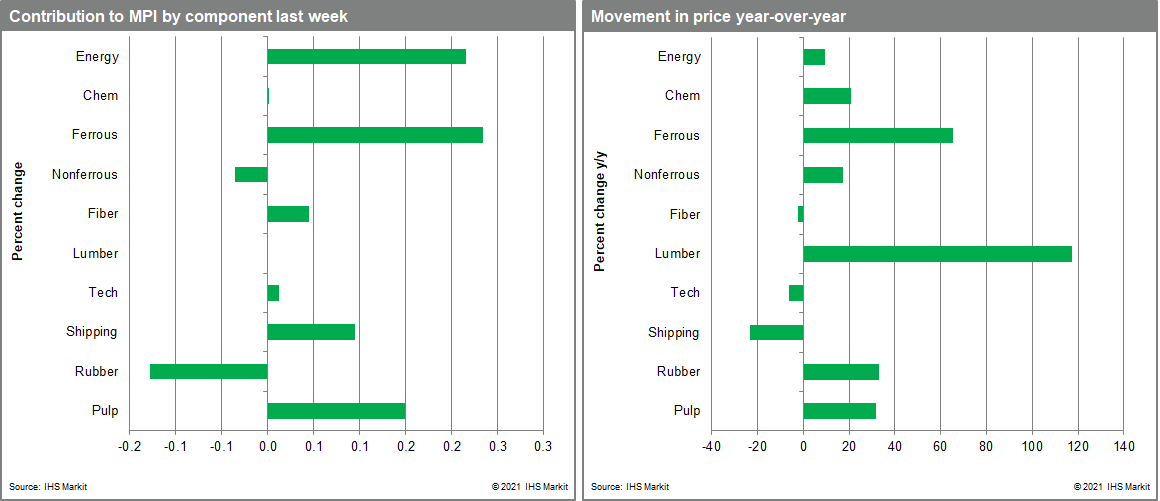

Our Materials Price Index (MPI) rose 0.6% last week, its eighth consecutive increase. While the pace of price increases has slowed from the historical highs in December, commodity markets started 2021 primed for growth -- the MPI climbed nearly 28% in the final quarter of 2020 and is now at its highest level since early September 2014. Year-over-year, the MPI climbed 35% an impressive feat in the face of unprecedented economic headwinds.

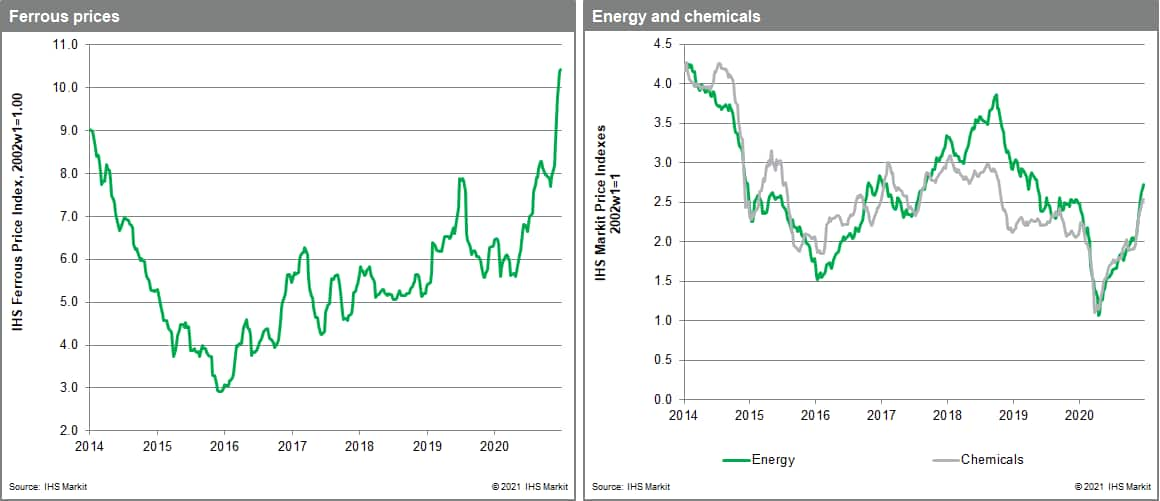

Energy contributed the most to this week's increase with the sub index increasing by 1.8% as global natural gas prices jumped. Colder than normal winter temperatures in China, Japan and South Korea as well as a constrained seaborne shipping market across the continent combined to push prices 5% higher. The oil markets also finished 2020 on a bright note with the price of Brent crude at around $51 a barrel, lifting prices 1.1% from the previous week. Metals markets remained quiet over the Christmas holiday with the nonferrous metal subcomponent declining by 0.43%, following a 1.5% drop last week. Nonferrous metals prices remain elevated, though, with industrial base metal prices collectively 17% higher than a year ago.

Commodity market sentiment remains positively influenced by the belief that a strong economic rebound will occur in 2021. As vaccines are successfully rolled out across the globe commodity traders have an optimistic near-term outlook. A pledge by the US Federal Reserve to keep interest rates low will weaken the value of the US Dollar lower and provide further impetus to global commodity prices. A new US administration, a Brexit trade deal and continuing goods news on mainland Chinese manufacturing activity add to the positive mood. The question for 2021 is how long supply-chain bottlenecks last and whether they last long enough to create elevated goods price inflation. An answer may be apparent immediately after the Lunar New Year holidays when Asian markets return from their normal seasonal lull.

Posted 06 January 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence