Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 06, 2023

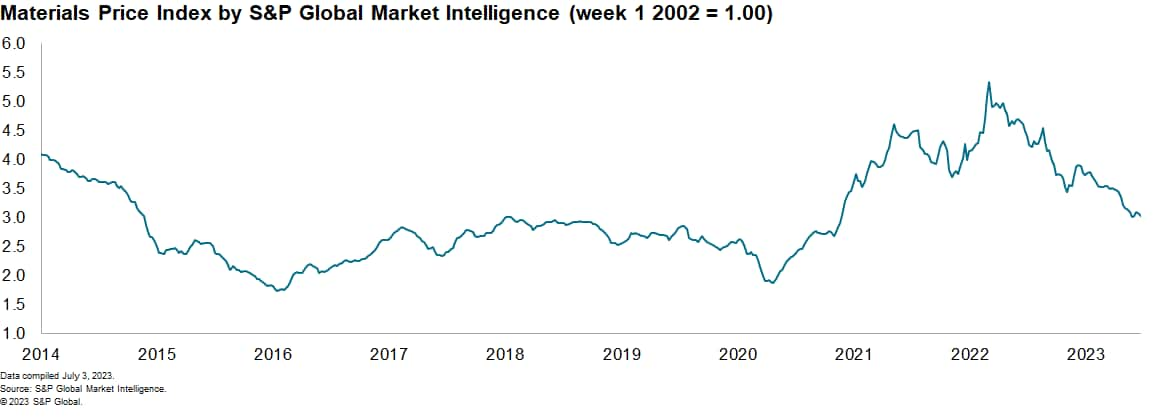

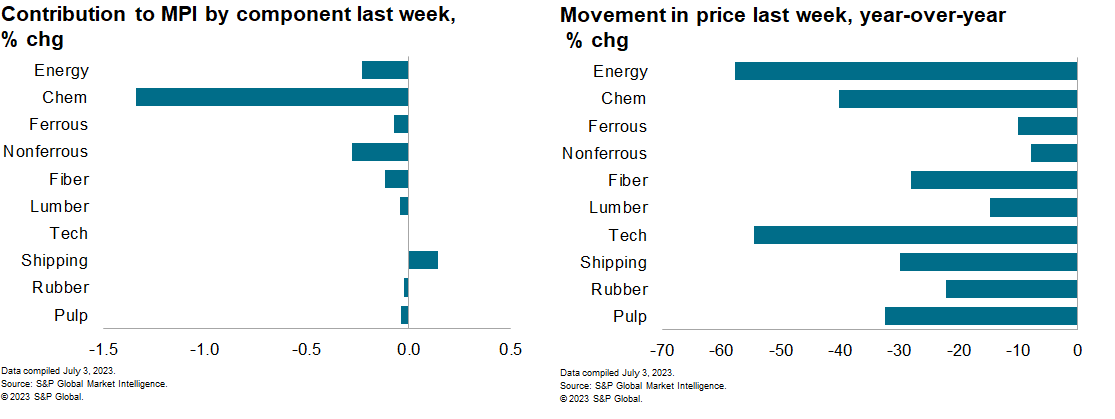

The Materials Price Index (MPI) by S&P Global Market Intelligence resumed its decline last week, falling 2% after the previous week's pause. The decline was broad with nine of the ten subcomponents falling. Rounding out this half of the year, the MPI declined 19 of the past 26 weeks and now sits 20% lower than it was at the end of 2022.

By far the most impactful decline in the past week is the 7.9% fall in chemical prices. Ethylene prices fell 11% globally, mostly due to a 36% decline in European ethylene prices. Propylene had a similar fate with a 7% global and 34% European decline. Benzene fell 5% globally with little regional variation. This speaks to weak downstream demand for petrochemicals, rising inventories, and falling costs — notably natural gas.

Nonferrous metals fell 3% following 4 weeks of increases. Nickel and tin fell the most, with 6% and 4.5% declines, respectively. A case regarding the London Metal Exchange's decision to cancel nickel trades in March began on June 20 and resultant speculation may have hurt nonferrous prices.

Bulk freight rates increased 4% last week as carriers attempted another round of general rate increases. Whether this holds in the weak demand environment is yet to be seen.

Lumber saw its only decline in June, falling 1.5%. This is an indication that the Canadian wildfires are unlikely to significantly impact lumber supply long term.

The US economy continues to post stronger growth numbers than previously expected. First quarter real GDP growth was revised up from 1.3% to 2% (annualized) and S&P Global Market Intelligence has increased its second-quarter GDP real growth estimate to 1.8%. Manufacturers' orders for durable goods rose 1.7% month-on-month in May and the Conference Board Consumer Confidence Index increased 7.2 points to 109.7 in June, with other indicators exhibiting surprising resilience.

Mainland China's yuan fell to a seven-month low after the reopening following the Dragon Boat Festival holiday on June 26, owing both to the US's monetary tightening and economic performance.

Europe continues to struggle after the energy crisis of 2022. While natural gas prices have eased, the economic response has been slow, with persistent inflation and weak growth. The second half of 2023 will see industrial materials prices continue to be under downward pressure from a struggling global economy and high interest rates.

—Written by Gregory Muller

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.