Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 01, 2021

By Michael Dall

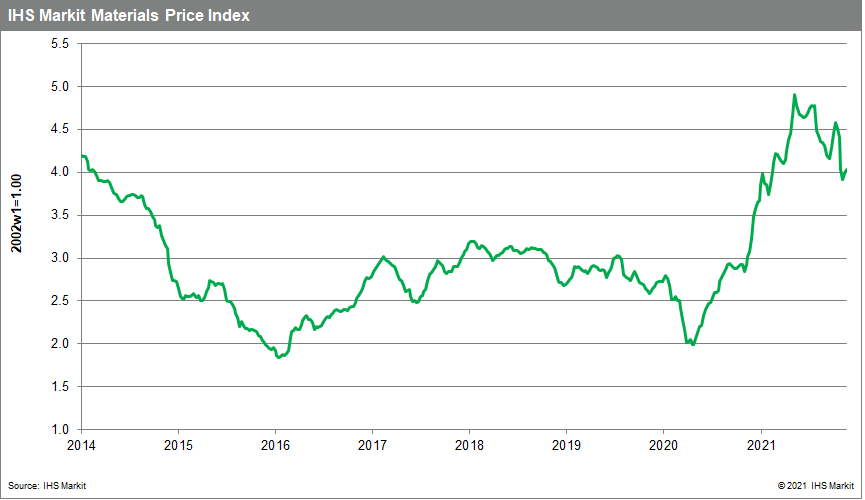

Our Materials Price Index (MPI) rose 1% last week, following a 1.7% increase the previous week. The increases were widespread with seven of the ten MPI sub-components up last week. Despite last week's rise, commodity prices have dropped over 12% since mid-October, a change that points to cost pressures in goods markets ebbing as early as the first half of 2022.

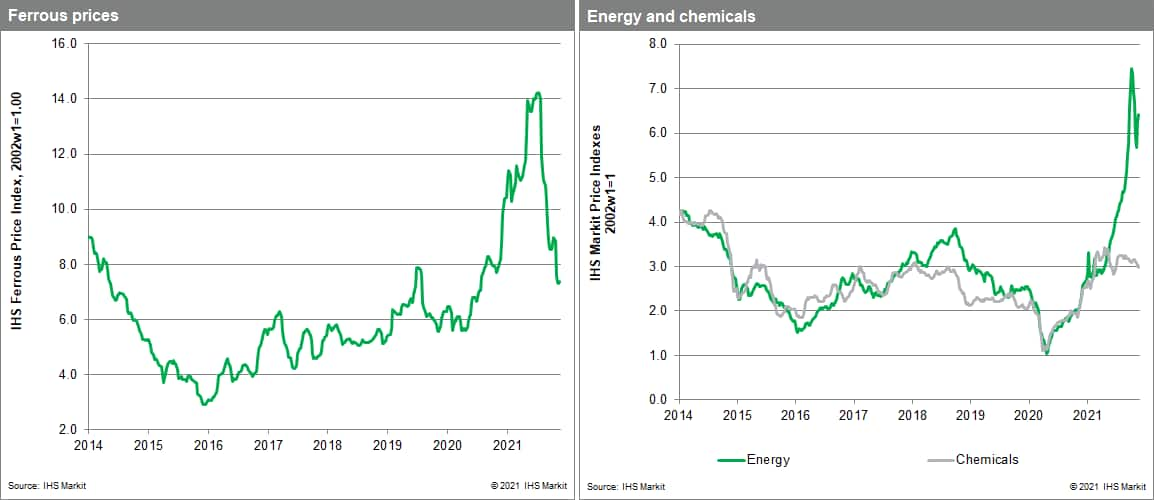

Metal prices were the main contributor to the MPI's climb last week. Our nonferrous metals sub-index was up 1.9% with five of the six big base metals pushing higher (lead proved the exception, with its price dropping fractionally). Tighter supply was the main reason for the price rises with visible nickel inventories standing at 85,000 tonnes last week, down from a high of 273,000 tonnes in the first quarter of 2021. This sent nickel prices up to $21,130 per tonne, a seven-year high. Lower inventories are also placing upward pressure on tin. Tin prices touched $40,950 per tonne, the highest on record, although they did pare back from those highs in late-week trading. Zinc prices climbed 4.6% after Glencore announced that it would halt production at its Italian smelter due to high energy prices in Europe. The company said that the smelter will undergo maintenance until at least December and would not restart until there was a "meaningful" change in power prices.

What started as a quiet week on markets due to the US Thanksgiving holiday was upset by the emergence of the Omicron variant of COVID-19 in southern Africa. This sparked a broad sell-off on global markets on Friday with equities suffering the largest daily drop in over a year. Until this latest development in the pandemic, markets were focused on rising price inflation. Notwithstanding real concerns about aggregate inflation, commodity prices look increasingly like they hit their high-water mark back in May. This good news must now be balanced against the likelihood of fresh restrictions to combat this new variant of COVID-19. Tightening US monetary policy and slower growth in China have been signaling a further modest correction in commodity prices through 2022. The question is now whether the Omicron variant will also impact the supply-side of markets and negate the downward pressure we see developing on prices.

![]()

Posted 01 December 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence