Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 24, 2023

By Michael Dall

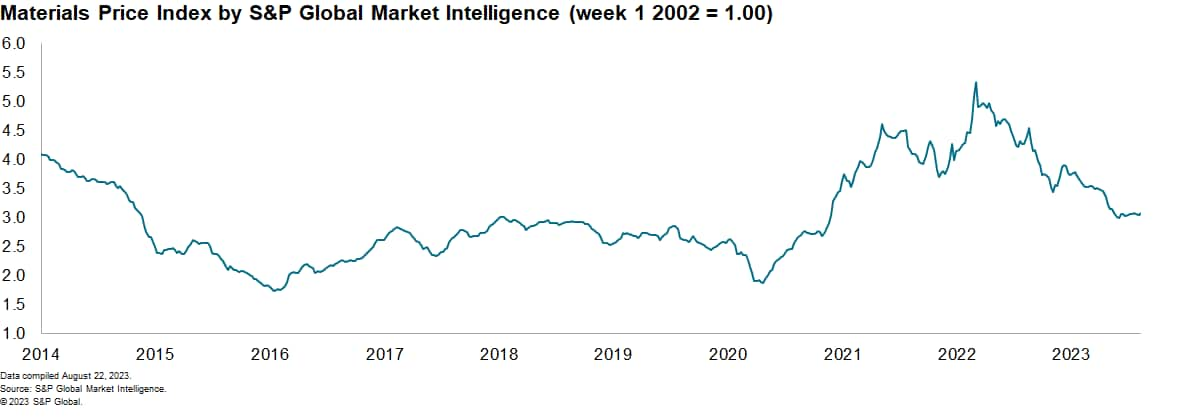

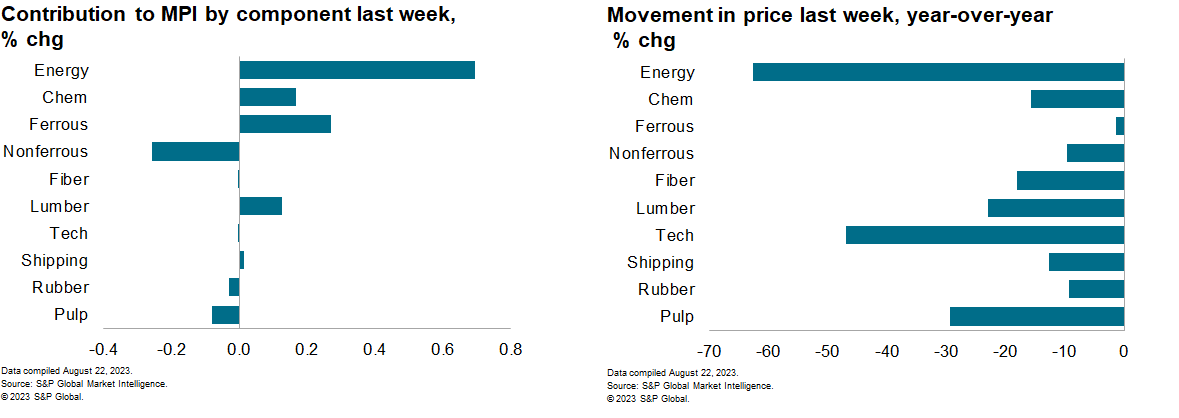

The Material Price Index (MPI) by S&P Global Market Intelligence increased 0.9% last week, returning to growth following two consecutive weekly declines at the start of August. Last week's increase was mixed with exactly half of the ten subcomponents rising. The trend so far in 2023 remains down with the index 30% lower than its year-ago level.

Higher energy and lumber prices were the main drivers of last week's rise in the MPI. The energy sub-index increased 3.5% — the biggest rise in two months. Natural gas prices surged as speculation that labor strikes would occur at multiple LNG plants in Australia prompted nerves among market traders. Australian LNG accounts for around 10% of global supply, so any disruption in that market has a significant knock-on impact on prices.

These factors sent European spot landed prices up to $11.97/MMBtu from $9.80/MMBtu the previous week. Asian prices also jumped by 26% for the week. Fundamentals in the European gas market remain sound with storage levels already higher than the November target set by the European Union. It does, however, show the volatility in global energy prices and the upside risk they pose to commodities overall. Elsewhere, lumber prices rose 4.5% after a significant acceleration in the number, size, and severity of fires in British Columbia (and other parts of western Canada), which is one of the most important regions for supply.

Market sentiment weakened last week as strong data in the US and fears over Chinese growth dominated trading. Global equity prices had the single worst week since March after strong July industrial production (IP) figures in the US. IP rose 1.0% in July, reflecting a large increase in manufacturing production (0.5%) and a jump in utilities output (5.4%).

It remains the S&P Global Market Intelligence view that further Federal Reserve action is needed in the short term to control inflation. Higher interest rates will ultimately slow demand and weak demand remains the significant downward pressure on global commodity prices. However, supply side tightening has been effective in supporting prices in oil markets. We expect this to be the case in other commodity markets over the next six months resulting in flat prices over the remainder of 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.