All major APAC and most European equity indices closed lower, while US indices were mixed. US government bonds were almost unchanged on the week, while most benchmark European bonds were lower on the week. European iTraxx and CDX-NA closed wider on the week across IG and high yield. The US dollar, oil, and natural gas closed higher, while gold, silver, and copper closed lower.

Americas

Major US equity markets closed mixed on the unusually volatile week; S&P 500 +0.8%, Nasdaq flat, DJIA -0.3%, and Russell 2000 -1.0% week-over-week.

10yr US govt bonds closed 1.77% yield and 30yr bonds 2.08% yield, which is +1bp and -1bp week-over-week, respectively

DXY US dollar index closed 97.27 (+1.7% WoW).

Gold closed $1,787 per troy oz (-2.5% WoW), silver closed $22.30 per troy oz (-8.3% WoW), and copper closed $4.31 per pound (-4.7% WoW).

Crude Oil closed $86.82 per barrel (+2.0% WoW) and natural gas closed $4.64 per mmbtu (+22.7% WoW).

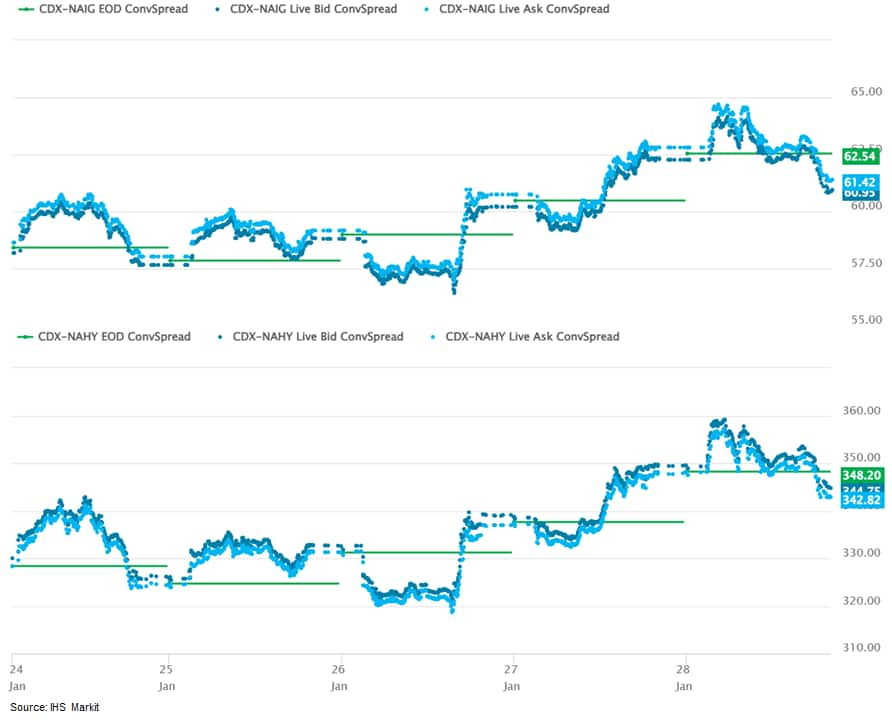

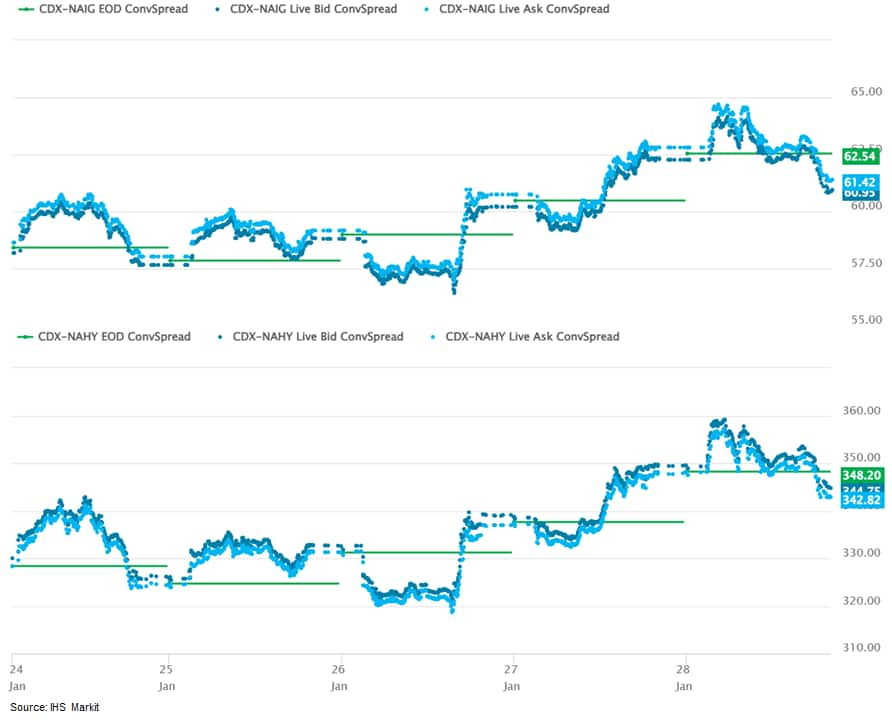

CDX-NAIG closed 61bps and CDX-NAHY 344bps, which is +3bps and +16bps week-over-week, respectively.

EMEA

Most major European equity indices closed lower on the week except for UK +0.8%; Spain -1.0%, France -1.5%, Germany -1.8%, and Italy -1.8% week-over-week.

Most major 10yr European government bonds closed lower on the week except for Italy -2bps; Germany +2bps, France +3bps, Spain +7bps, and UK +8bps week-over-week.

Brent Crude closed $88.52 per barrel (+0.7% WoW).

iTraxx-Europe closed 59bps and iTraxx-Xover 286bps, which is +4bps and +17bps week-over-week, respectively.

APAC

All major APAC equity indices closed lower on the week; Australia -2.6%, Japan -2.9%, India -3.1%, Mainland China -4.6%, Hong Kong -5.7%, and South Korea -6.0% week-over-week.

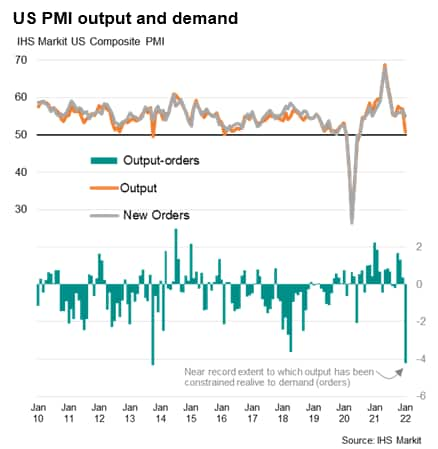

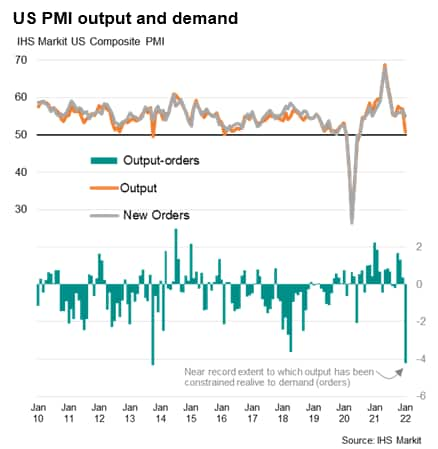

- Adjusted for seasonal factors, the IHS Markit Flash US Composite PMI Output Index - covering both manufacturing and service sectors - posted 50.8 in January, down sharply from 57.0 in December. The resulting increase in activity was only marginal, and the smallest since July 2020. (IHS Markit Economist Chris Williamson)

- The January flash PMI is therefore indicative of annualized GDP growth close to stalling at the start of 2022, representing a marked contract to the robust growth of 3.25-3.5% signaled for the fourth quarter of 2021.

- Both manufacturing and service sector firms reported near-stagnant output as the steep spike in virus cases associated with the Omicron wave dented demand and meant ongoing supply issues and labor shortages were exacerbated by renewed pandemic related containment measures.

- Although output was constricted by the Omicron wave, demand growth remained somewhat more resilient. New orders for goods and services continued to rise strongly, albeit registering the weakest rise since December 2020. The resulting gap between output and new orders was the second largest recorded by the survey to date, exceeded in the last 12 years only by the gap seen in October 2013, reflecting the near-unprecedented constraints on output recorded in January due to the flare up of COVID-19 cases and accompanying virus containment precautions.

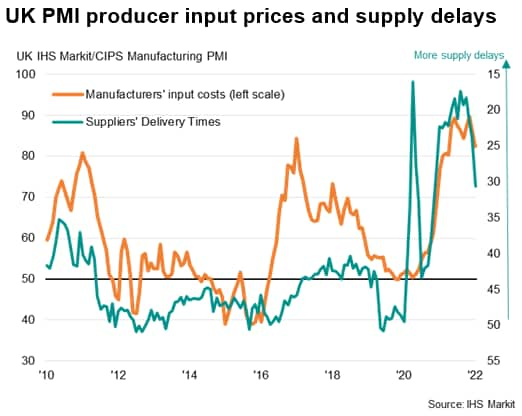

- Average supplier delivery times lengthened to a slightly greater degree than in December due to the Omicron impact, but the extent of delays remained far below that seen throughout much of the second half of 2021.

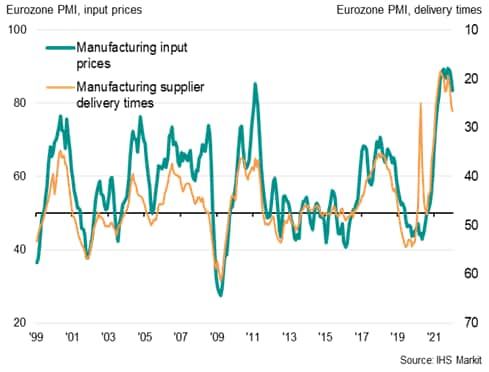

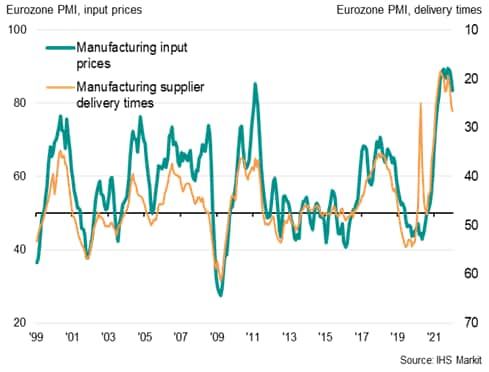

- The headline IHS Markit Eurozone Composite PMI® dropped two points from 55.4 in November to 53.4 in December, according to the 'flash' reading*, indicating an easing in the rate of output growth to the lowest since March. The decline takes the average reading for the fourth quarter to 54.3, substantially lower than the 58.4 average seen in the third quarter. As such the PMI data point to a marked weakening of economic growth in the closing quarter of 2021, albeit with the rate of growth remaining above the survey's pre-pandemic long-run average of 53.0. (IHS Markit Economist Chris Williamson)

- The slowdown masked wide variations in performance by sector. Service sector output growth slowed sharply for a second month running, dropping to its lowest since last April, amid soaring COVID-19 infection rates. The rapid spread of the Omicron variant led to the reimposition of many measures to contain the virus in recent weeks, notably in Germany, France, Italy and Spain, which adversely affected consumer- and hospitality-oriented businesses in particular.

- Manufacturing growth meanwhile accelerated to the fastest since last August. Although staffing issues curbed output in some factories, supply constraints eased, helping boost production in many firms. Average supplier delivery delays lengthened to the least extent since January of last year, with fewer items reported in short supply and shipping delays showing signs of easing. Growth was recorded in all major manufacturing sectors, including a second consecutive month of rising production in the auto sector.

- By country, business activity rebounded in Germany after a slide into mild contraction in December, registering the strongest expansion since September thanks to a surge in factory production and a return to growth for the service sector. In contrast, growth in France hit the lowest since April, reflecting a near-stalled factory sector and a sharply weaker service sector performance. Meanwhile, growth ground almost to a halt across the rest of the region as a whole amid a renewed contraction of services activity.

- Average selling prices measured across both manufacturing and services meanwhile picked up to grow at a rate matching the survey all-time high recorded in November. A new record was seen in the service sector as costs were driven higher by energy and wage costs. Prices charged for goods leaving the factory gate also rose at an increased rate, just shy of November's survey high, though an easing in manufacturers' input price inflation to the lowest since last April was also reported, linked in part to the alleviating supply crunch.

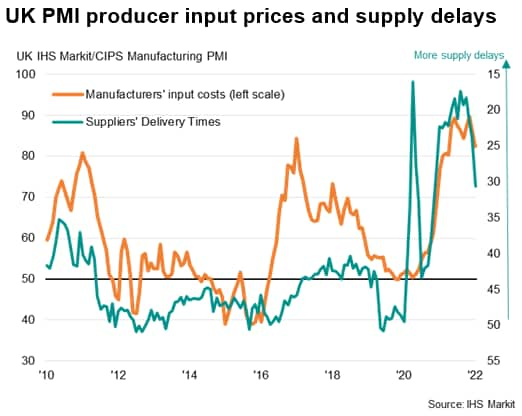

- The IHS Markit/CIPS composite UK PMI output index, covering both services and manufacturing, fell from 53.6 in December to 53.4 in January, according to the early 'flash' reading, indicating the slowest rate of expansion since the lockdowns in February of last year. (IHS Markit Economist Chris Williamson)

- Service sector growth slowed - albeit only slightly - in January, easing for a third month running to hit the weakest since last February. There were, however, wide divergences within this vast section of the UK economy.

- Rising COVID-19 cases and heightened restrictions imposed to contain the Omicron variant caused activity in the hotels & restaurant sector to fall sharply for a second month running, dropping at a rate not seen since last February, accompanied by a further sharp deterioration in transport and travel services activity. On the other hand, growth of business-to-business services accelerated to the fastest since last July, with financial services activity also picking up strongly during the month, helping to largely offset the weakness in hospitality-oriented sectors.

- Manufacturing output growth meanwhile ticked up to the fastest since August as alleviating supply constraints allowed factories to stem the recent rapid growth of backlogs of uncompleted orders. Suppliers' delivery times lengthened to the least extent since November 2020.

- Although manufacturing input cost inflation slowed, feeding through to a marked cooling of factory gate selling price inflation, service sector costs rose at an increased rate, fueled in particular by higher energy prices and wage growth. Charges levied for services consequently rose at the second-steepest rate on record as firms passed higher costs on to customers.

- Service sector prospects consequently improved in January, with new orders growth lifting from December's ten-month low and expectations for the year ahead perking up to the brightest since August

- The outlook is less bright in manufacturing, however. While output growth was boosted by fewer supply constraints, growth of new orders slowed sharply to the weakest since January of last year, registering the second-worst performance since June 2020. New export orders for goods barely rose after four months of continual decline, with around one-in-three firms linking lost export business at least in part to Brexit.

- General Motors (GM) is reported to be investing USD6.5 billion in Michigan for battery and vehicle assembly, said to be announced the week of 24 January. Separately, GM has confirmed USD154 million at a New York plant for electric motor components. The Detroit News reported on 21 January that GM plans to spend USD6.5 billion at two facilities in Michigan. Reportedly, USD4.0 billion will go to the Orion Assembly Plant and USD2.5 billion to a new battery plant in Lansing. The report says that the Lansing battery plant will bring about 1,700 jobs and the investment into Orion will make that the third US battery electric vehicle plant (BEV), after Factory Zero in Detroit and the addition of Ultium EV production at the company's Spring Hill (Tennessee) plant. These reports are similar to reports in December and January as well. The Lansing battery plant would reportedly be located on the same site as GM's Lansing Delta Township Assembly plant, which builds the Buick Enclave and Chevrolet Traverse. GM's Michigan investment has not been confirmed, but reportedly will be in the coming days. At that time, IHS Markit will report on the final details, and how we expect the investment to affect GM's US production. GM has committed to shifting its light-vehicle sales in the US to 100% zero emissions by 2035 and has committed USD35 billion in funding to get there. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Britishvolt has announced that it has secured funding from the UK government and other investors to support its new battery manufacturing facility. These announcements will help add flesh to the bones of what will be a significant project to further support the growth of local battery electric vehicle (BEV) production. IHS Markit currently forecasts that despite plans to end the sale of non-plug-in light vehicles in the UK from 2030, the total share of production of such vehicles will rise from 9.4% in 2022 to 51.2% in 2030, of which BEVs will make up 6.2% and 47.5%, respectively. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Renault-Nissan-Mitsubishi Alliance plans to triple its investment and spend EUR20 billion (USD22.65 billion) over the next five years for joint development of electric vehicles (EVs), reports Reuters. The alliance partners are expected to announce a formal plan this week. Under the plan, the alliance is expected to come up with more than 30 new EVs underpinned by five common platforms by 2030. The planned investment will be in addition to the EUR10 billion they have already spent on vehicle electrification. The report confirms the alliance's commitment to jointly develop electrified vehicles. The alliance aims to drive synergies in the development and manufacturing of electrified vehicles and gain a stronger foothold in the EV industry globally. Meanwhile, Renault, Mitsubishi and Nissan have already announced their individual targets for year 2030. In November 2020, Mitsubishi unveiled plans to raise the proportion of EVs, including plug-in hybrid EVs (PHEVs) and hybrid EVs, in its total sales to 50% by 2030 as part of its revised Environmental Plan. In November 2021, Nissan released its 'Ambition 2030' long-term plan focused on electrified vehicles and technological innovations. The plan supports Nissan's goal to be carbon-neutral across the life cycle of its products by fiscal year (FY) 2050. The automaker aims to invest JPY2 trillion (USD17.6 billion) over the next five years to accelerate the electrification of its model line-up. It will introduce 23 new electrified models, including 15 new EVs by FY 2030, aiming for an electrification mix of more than 50% globally across the Nissan and Infiniti brands. In June 2021, Renault announced its plans for accelerating its electrification strategy which is expected to lead to Renault's electric and electrified vehicle line-up making up around 65% of its sales mix in 2025, of which 30% are battery electric vehicles (BEVs). BEVs are expected to make up to 90% of the Renault brand mix by 2030. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The US federal government, states, and cities have launched a new program, the Building Performance Standards Coalition, to push forward Biden administration initiatives to reduce the GHG emissions from the energy use in buildings. Announced on 21 January to coincide with Biden's speech at the US Conference of Mayors meeting, the $1.8-billion program aims to retrofit buildings for energy efficiency and develop and implement new building codes. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- To date, 33 state and local governments have signed up to work with DOE and the Environmental Protection Agency (EPA) in the new coalition. The participants represent 22% of the US population and nearly 20% of the nation's building footprint (more than 15 billion square feet of floor space), the White House said.

- DOE says there are almost 129 million non-industrial buildings in the US that collectively use 75% of the nation's electricity and 40% of its energy. Energy use in buildings is responsible for 35% of US CO2 emissions, according to DOE. For those reasons, buildings were cited specifically on 22 April 2021 when Biden raised the US goal for carbon reduction by 2030 to 52-55% below a 2005 baseline. "The United States can create good-paying jobs and cut emissions and energy costs for families by supporting efficiency upgrades and electrification in buildings through support for job-creating retrofit programs and sustainable affordable housing, wider use of heat pumps and induction stoves, and adoption of modern energy codes for new buildings," the White House said at the time.

- On 8 December, he issued a directive for federal buildings and facilities to achieve net-zero emissions by 2045 through energy efficiency, electrification, and use of carbon-free electricity. In May 2021, Biden launched a program to train workers in retrofitting federal buildings to reduce energy use. January's announcement about the new coalition said that DOE already has granted over $25 million in funds under this project, working closely with labor unions to train a new generation of construction workers.

- At the core of the new program is a pledge by the states of Colorado and Washington, Washington, DC, and 30 local governments (include population centers such as New York City, Los Angeles, Chicago, and Seattle) to develop stricter building performance standards. Each government pledged to advance legislation or regulation by Earth Day 2024 (22 April).

- China's zero COVID policy and stringent testing and quarantine measures have contributed to logistics costs hikes, big price fluctuations in origin countries and uncertainty for importers. The Chilean cherry season is under way in China and stakeholders in the supply chain are facing huge logistics challenges. Wholesale prices are expected to go down after the Chinese New Year, which falls on 1 February. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Chinese New Year for this year is a bit earlier than usual years. Now is the peak period for imported fruit sales, especially those from the southern hemisphere. The delay in shipment arrivals has negatively affected the supply.

- China and Hong Kong SAR continue to adopt the zero Covid policy and enforce very stringent testing and disinfectant measures for customs clearance. The process is long and slow and the requirements are high and complex.

- Jack Liu, a local importer based in Shanghai told IHS Markit: "Over 10,000 containers carrying cherries are waiting for customs clearance at Hong Kong SAR. Every day only 180-500 containers can complete the process and be cleared. The delay to the end consumers is about 10 days.

- "This year air freight rates are rising to CNY7-8/kg ($1.11-1.26/kg) from CNY5-6/kg of last year. We have to multiply the costs to each 5kg box and pass the costs on." Additionally, logistics companies have to pay extra port charges when the goods are stuck at the port.

- The current reduced cherry supplies meant spot prices are firm, about CNY400 per box (5kg) for size J, JJ CNY480/box. After Chinese New Year, consumer demand will slow down. However, there will be more cherries arrived by then. The ample supplies and slower demand may push the prices down, meaning a huge margin shrinkage for importers. The prices are expected to drop to CNY100-150/box for J, JJ CNY200-250/box after the festive season.

- China's Yantai greenhouse grown cherries has started this year's campaign from 20 January, sold for CNY600/kg for wholesale. Local sources said that domestic production has limited varieties, small volume and the prices remain high compared with imports. For cherries, China's research and development and cultivation are still far lagging behind Chile's.

- Hess Midstream LP guided for 2022 saying it would spend $235 million this year, primarily on expanding gas compression capacity in the Bakken. The company said it was also expanding gathering system well connects there to meet its accelerated pace of development in the basin. More specifically, the company provided details on the capex program: "Approximately $135 million of the 2022 capital budget is allocated to gas compression, with activities focused on the completion of two new greenfield compressor stations and associated pipeline infrastructure, which are expected to provide, in aggregate, an additional 85 MMcf per day of gas compression capacity when brought online during the year. (IHS Markit PointLogic's Annalisa Kraft)

- "In addition, Hess Midstream expects to initiate construction on a third greenfield compressor station, which is expected to provide an additional 65 MMcf per day of gas compression capacity when brought online in 2023, further enhancing gas capture capability and supporting Hess' development in the basin. Reflecting increasing drilling activity by Hess, approximately $90 million is allocated to gathering system well connects to service Hess and third‑party customers," Hess Midstream continued.

- "We are poised for continued volume and Adjusted EBITDA growth after a strong finish to 2021. The tie-in of our newly expanded Tioga Gas Plant gives us the capacity to capture further volume growth and drive free cash flow, creating an opportunity to return additional capital to our shareholders," Hess Midstream COO John Gatling said. "We remain focused on operational and commercial execution to capture increasing gas volumes, which are expected to increase by more than 30% by 2024 relative to 2021 based on Hess' current nominations."

- The January 25 guidance also touched on volumes. "In 2022, full year gas gathering volumes are anticipated to average 350 to 365 million cubic feet (MMcf) of natural gas per day and gas processing volumes are expected to average 330 to 345 MMcf of natural gas per day, reflecting Hess' announced three-rig program in the Bakken."

- The company also guided longer term. "In 2023 and 2024, Hess Midstream expects continued growth in Adjusted EBITDA and Adjusted Free Cash Flow generation sufficient to fully fund growing distributions without incremental debt or equity while creating additional capital allocation flexibility, including potential return of capital to shareholders. Hess Midstream continues to expect gas gathering and processing to comprise approximately 75% of total affiliate revenues excluding passthrough revenues, with 2023 and 2024 gas gathering and gas processing MVCs providing visibility to expected future revenue growth."

- South Korea's LG Chem plans to build the nation's first supercritical pyrolysis recycling plant by 2024, the company announced last week. The company will begin constructing this year a 20,000 mt/year pyrolysis oil facility in Dangjin City, within South Korea's South Chungcheong Province, it said. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- This plant will use a supercritical pyrolysis-based process, developed by UK-based Mura Technology, to decompose plastic waste as raw material, LG Chem said.

- LG Chem expects this plant to have industry-leading productivity as more than 80% of the plastic waste feed can be converted into renewable oils, while the remaining 20% of by-product gases can serve as energy.

- Mura Technology said LG Chem can use its process in the upcoming plant to recycle 25,000 mt/year of plastics into raw materials, that can in turn produce new plastic.

- LG Chem has not decided what kind of plastic it intends to produce at this new facility - LG said it will further review expansions once the plant is fully operational by Q1 2024, and may consider construction of similar facilities at other sites.

- Mura Technology confirmed that LG Chem had also become a shareholder of its company, besides licensing its technology. Mura Technology added that it had also licenced its process to Mitsubishi Chemical Corporation in June 2021, and has strategic partnerships with Dow and Chevron Phillips Chemical Corporation.

- According to LG Chem, supercritical pyrolysis technology allows decomposition of used plastic with steam at high temperature and pressure, using supercritical water. Using supercritical water is unlike technologies that apply heat directly to a reactor as it suppresses the generation of chars during pyrolysis, hence there is no anticipated limit to continuous operation.

- The Volkswagen (VW) Group has met the latest European Union (EU) emissions targets in 2021 as a result of the growing percentage of electrified vehicles in its sales parc, according to a company statement. Based on the company's own preliminary figures, the VW Group's fleet average CO2 emissions of new passenger cars in the EU came in at 118.5g/km in 2021. This is around 2% less than the legal target, according to VW's own data, but the European Commission will report its own data at a later date. Christian Dahlheim, the VW Group's head of sales, said, "Our Group-wide electric offensive picked up significant speed last year with many attractive new models. Nearly one in five vehicles delivered in Europe was electrified, and more than half of these were all-electric. This helped us to further reduce CO2 fleet emissions and fulfil the EU target. We were also able to inspire many new customers for e-mobility." Emissions for Bentley and Lamborghini are measured in a separate category and therefore are not included in the above fleet average figure. VW stated that 472,300 electrified vehicles (battery electric and plug-in hybrids) were sold in the EU, Norway, and Iceland in 2021, which was a 64% year-on-year (y/y) increase. This raised the proportion of VW's electrified vehicle sales to an overall share of 17.2%, up from 10.1% in 2020. In 2020 the Group achieved average CO2 emissions of 99.9 g/km for its fleet in the EU, UK, Norway, and Iceland, although this figure was calculated based on the New European Driving Cycle (NEDC). (IHS Markit AutoIntelligence's Tim Urquhart)

- Bloomberg has reported that according to several of its sources, the People's Bank of China (PBoC) has given banks window guidance to boost lending to both households and companies. Although official data have not been released yet, Bloomberg's sources have noted that preliminary data from the first half of January 2022 show that credit disbursements has been slower than a year earlier. (IHS Markit Banking Risk's Angus Lam)

- The PBoC has slashed both the short-term and the medium-term loan prime rates (LPRs) in recent weeks and has also directed banks to ease lending to real estate companies in order to acquire projects from weaker counterparts as well as to boost consumer mortgage loans.

- There was some news on 24 January regarding project financing, with developer Agile Property selling its stake to China Overseas Land and Investment in a joint project with the latter to boost its liquidity as part of the aforementioned project acquisition policy.

- IHS Markit assesses that, considering that the reserve requirement ratio (RRR) is still at around 8.4% after it was reduced in December 2021 and after a succession of LPR cuts, it is likely that a further cut in the RRR will come in the first quarter. Overall, based on the current situation, we expect credit growth in China to be around 11.6% in 2022, around 0.3% points higher than the 2021 credit growth rate.

- The Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) on 20 January held its benchmark policy rates at 14%, following four consecutive rate cuts from September 2021, a decision indicated previously by President Recep Tayyip Erdoğan. (IHS Markit Country Risk's Jessica Leyland)

- This cycle of monetary easing at a time of widespread global tightening pushed the Turkish lira to record lows of over TRY18:USD1, although it now stands at around TRY13.5:USD1, and inflation to 36% year on year in December 2021, the highest in almost 20 years and well over the TCMB's 5% inflation target.

- The president's statement and the TCMB's subsequent implementation further indicates the executive's direct control of the TCMB and monetary policy. The TCMB cited wider geopolitical issues, such as high energy prices and Russia-Ukraine war risks, as drivers of the decision.

- IHS Markit assesses that, instead, the rate decision is a move seeking to quell growing domestic economic discontent and perceptions that President Erdoğan's unorthodox policies are responsible - sentiment held even among Erdoğan's traditional voter base. Unofficial but credible polls from the PolitPro political data and statistics platform show Erdoğan's ruling Justice and Development Party (Adalet ve Kalkınma Partisi: AKP) polling at its lowest level since 2015.

- Holding interest rates should reduce downside risks for the local currency and upward pressure on annual consumer price inflation. IHS Markit forecasts that high inflation will not retreat significantly until late- 2022. Although this would increase the risk of popular protests, the Turkish security forces have sufficient capacity to prevent these from escalating rapidly.

- Loss of government popularity also increases the risk that the AKP will target potential presidential opposition candidates and others with criminal investigations and allegations ahead of the 2023 general and presidential elections, to reduce the popularity and divide the opposition amid economic decline and diminishing support for the incumbent president.

- January's headline German Ifo index, which reflects business confidence in industry, services, trade, and construction combined, rebounded from 94.8 to 95.7, its first improvement since June 2021. This latest level is modestly below its pre-pandemic level of February 2020 (96.4) and the long-term average of 97.0. The Ifo institute interprets this cautiously, commenting that "the German economy is starting the new year with a glimmer of hope". (IHS Markit Economist Timo Klein)

- Business expectations alone drove January's improvement, increasing from an 11-month low of 92.7 to 95.2. This remains somewhat below their long-term average (97.5), although far above their all-time low of 71.9 in April 2020. Confidence about the next six months rose the most in the retail and service sectors, which had been hurt the most in the final quarter of 2021 by the level of administrative restrictions imposed to keep the pandemic situation under control. Manufacturing and construction expectations improved too, however, in this case linked to diminishing supply chain problems.

- In contrast, the assessment of current conditions worsened modestly once more, the sub-index slipping from 96.9 to an eight-month low of 96.1. This is slightly below its long-term average of 96.7 and moderately lower than its pre-pandemic level of 99.1 in February 2020. The sector breakdown shows that services and retail continued to suffer from broadly unchanged restriction levels that have greatly reduced access of unvaccinated persons to most shops and services. This contrasts with the current situation in manufacturing and construction, where survey participants see matters in a brighter light now.

- Pulling current conditions and expectations together, January's sectoral breakdown reveals that the retail sector, which had suffered the most in late 2021, also has improved the most at the start of 2022. This is followed by services and manufacturing, with construction sector confidence rising the least. In manufacturing, capacity utilization increased from 84.9% to 85.6%, a level close to its long-term average. This demonstrates that output is starting to catch up with the orders backlog. Only the wholesale sector declined slightly once more as current conditions deteriorated again, which could not be compensated fully by rising optimism about the future.

- The US Conference Board Consumer Confidence Index edged down 1.4 points to 113.8 (1985=100) in January after recording gains for three straight months. December's reading was revised down from 115.8 to 115.2. (IHS Markit Economists Akshat Goel and William Magee)

- The index of views on the present situation improved to 148.2 in January from 144.8 last month, despite headwinds from continued price increases and the rapid spread of the Omicron variant.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) edged lower to 43.8 but remains near historical highs.

- The expectations index fell 4.6 points to 90.8 even as a higher proportion of consumers planned to buy homes, automobiles, and major appliances over the next six months.

- The expectations index was driven lower by weakening optimism about business conditions and job prospects in the short term, with 23.8% of consumers expecting business conditions to improve, down from 25.4%. A greater percentage (19.0%) expects business conditions to worsen, up from 18.6%.

- Consumers are also less optimistic about their job prospects: 22.7% of consumers expect more jobs to be available in the coming months, down from 24.2%; 15.7% anticipate fewer jobs, up from 14.7%.

- In the statement issued at the conclusion of its two-day policy meeting that ended this afternoon (26 January), the Federal Open Market Committee (FOMC) all but guaranteed that it would begin to raise interest rates at the next meeting, on 16 March. The Committee asserted that "[w]ith inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate." This is about as clear as FOMC signaling gets when it comes to an imminent adjustment in the stance of monetary policy. Also at this meeting, the FOMC affirmed its existing Statement on Longer-Run Goals and Monetary Policy Strategy. It also set forth broad principles for normalizing its balance sheet that are consistent with IHS Markit analysts' expectations. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

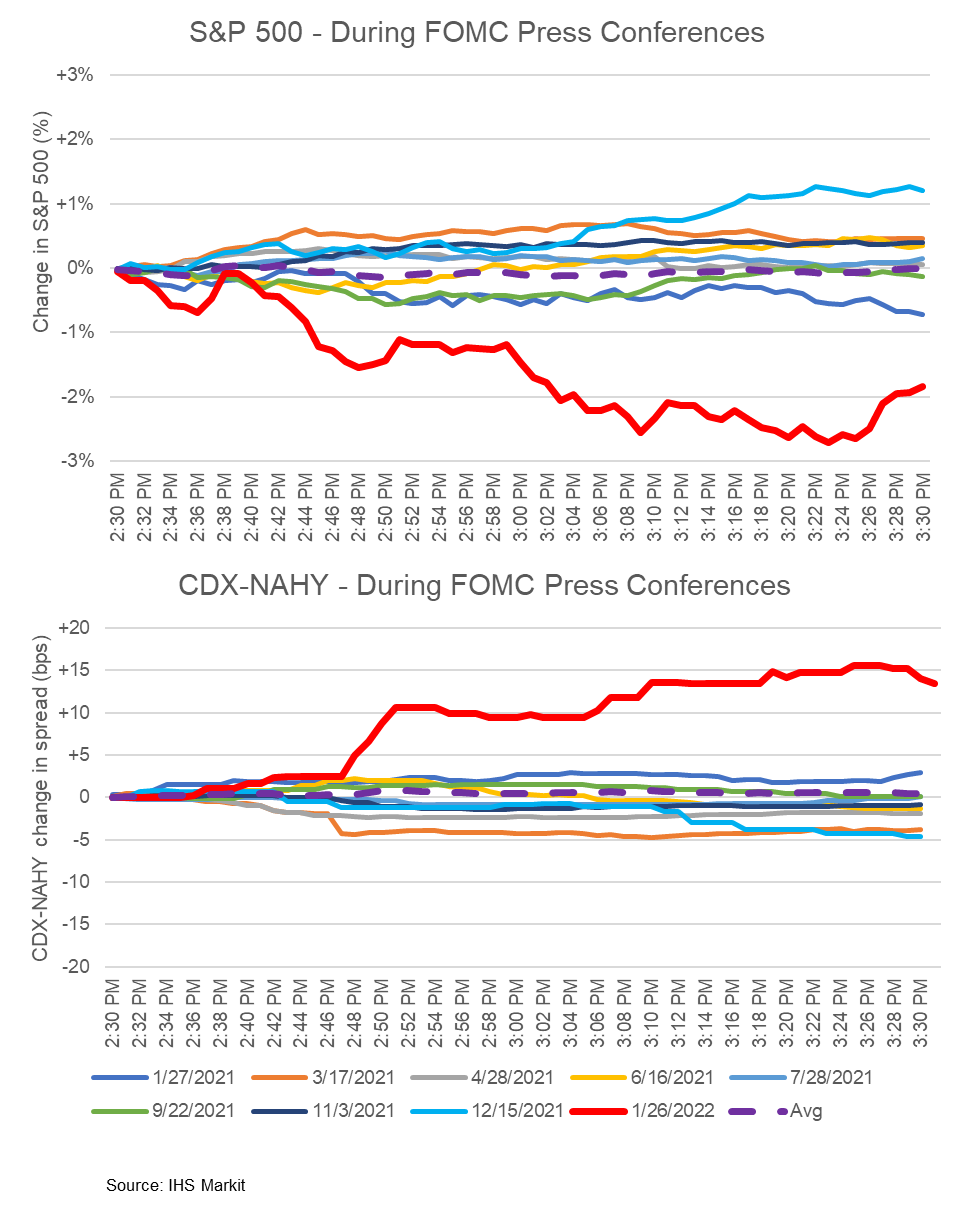

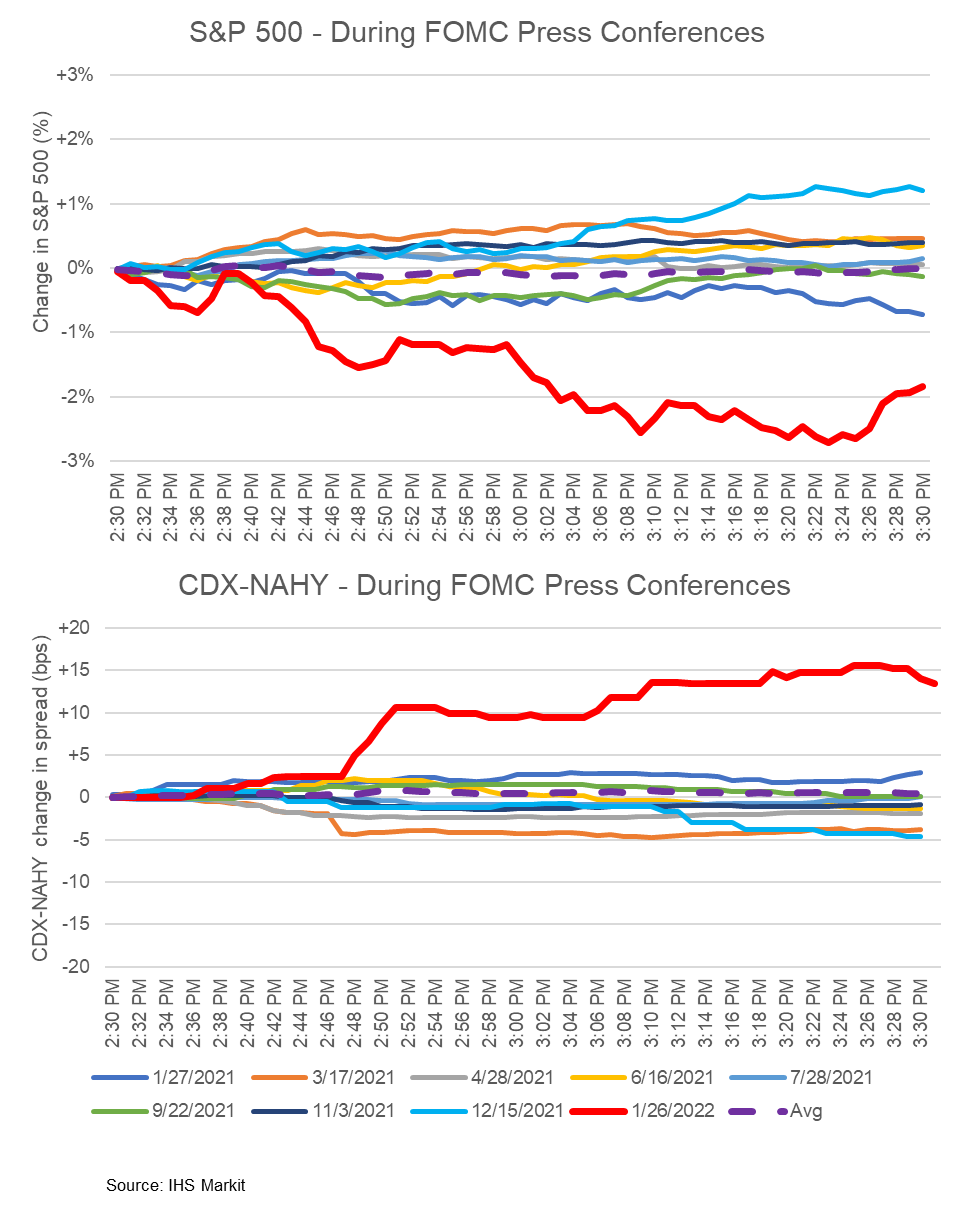

- The graphs below show the S&P 500 and CDX-NAHY intraday reaction to every 2021-present Fed Chairman Powell FOMC press conference, with performance indexed to the start of the session. The S&P 500 declined as much as 2.7% and CDX-NAHY widened out as much as 15bps during the day's press conference, which is by far the worst reaction to any FOMC press conference over the past year.

- US new home sales increased 4.2% in the fourth quarter, the first increase since the third quarter of 2020. Builders sold 762,000 new homes in 2021, down from 822,000 in 2020. Annual sales fell in all four regions. This release gives a complete first full picture of the fourth quarter and of 2021. (IHS Markit Economist Patrick Newport)

- The annual drops are mainly payback for strong sales in 2020.

- The median and average new home prices soared 14.3% and 19.4%, respectively, from a year earlier in the fourth quarter. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs have also soared. The Census's construction cost index for homes under construction (the three-month average), which came out today (26 January), was up 16.8% in December—which means that builders' margins have narrowed to almost nothing.

- Inventory—the number of homes for sale at the end of the month—increased by 10,000 in December to a 13-year-high 403,000. Only 39,000 homes classified as inventory were completed; inventory units still in the planning stage were 101,000.

- New home sales shot up 11.9% in December to an 811,000-unit seasonally adjusted annual rate. A double-digit sales increase sounds impressive. This one is not because it was not statistically significant.

- Australia's headline consumer price inflation rose 1.3% quarter on quarter (q/q) in non-seasonally adjusted terms - the fastest quarterly increase in inflation since the September quarter of 2012 - representing 3.5% year-on-year (y/y) growth. The country's measures of core inflation (trimmed mean and weighted median) also reached seven-year highs due to the broad-based nature of price increases. In fact, the only major sub-component of the consumer price index (CPI) to record a decline in the December quarter was the health component, which fell by 0.3% q/q. (IHS Markit Economist Bree Neff)

- According to the Australian Bureau of Statistics (ABS), the key driver of the upside surprise in inflation was "non-discretionary" inflation - the price increases on goods and services for which households have relatively inelastic demand, such as food, automotive fuel, housing, and healthcare. Non-discretionary inflation was up 4.5% y/y in the December quarter, whereas discretionary inflation was up only 1.9% y/y, according to the ABS.

- Contributing heavily to non-discretionary inflation - and the transportation component of the CPI - automotive fuel prices alone rose 6.6% q/q during the December quarter, and were up by 32.3% y/y. This was the highest annual increase in fuel prices since 1990. Furthermore, the housing component of the CPI was boosted by a second consecutive quarter of rapid price growth for new dwelling purchases, up 4.2% q/q and 7.5% y/y, marking the largest annual increase since Australia introduced its Goods and Services Tax (GST) in 2000. According to the ABS, the increase was driven by continued shortages of materials and workers, as well as the end of the government's HomeBuilder subsidy, making home buyers ineligible for the reductions in home prices that the subsidy offered.

- The ABS reported the previous week that the unemployment rate plunged to a seasonally adjusted 4.2% in December 2021, as the economy added further jobs and the labor force participation rate remained steady at an elevated 66.1% for a second consecutive month. This puts the unemployment rate at a level not seen since 2008, and is approximately at the rate that the RBA considers to be full employment.

- Avocadoes, seedless grapes Red Globe, mangoes and blueberries are among those fresh fruit with steep increases in retail price compared to the same week last year during the week beginning from 15 January, according to the USDA's report: Specialty Crops at Major Retail Supermarket Outlets (21 January 2022). (IHS Markit Food and Agricultural Commodities' Hope Lee)

- On national weighted average in supermarkets, Hass avocado prices rose 11% w/w to $1.5 each, a 52% y/y increase from the same week last year. Various Greenskin varieties showed no price change from last week at $2.0 each, but 160% y/y increase; it was $0.77 each at the same week last year. Most produce are Mexico origins; some are from the Dominican Republic.

- Mangos weakened 1% w/w to $1.2 each, but, 50% up y/y. Main origins are Mexico, Ecuador, Brazil, Peru. Other suppliers include Puerto Rico, Guatemala and Vietnam. Both India and Colombia have obtained market access to the US mango market recently.

- For w/w comparison, blueberries packaged in various sizes showed different price fluctuations. Blueberries in 6 oz package rose 4% w/w to $2.98, 20% up y/y; fruits in 18 oz package were flat w/w, but, 31% up y/y. Fruit packaged in 1 pint went down 6% w/w to $2.91, 21% up y/y. Main origins are Mexico, Chile, Peru, Florida and California.

- Selected grape prices rose w/w and y/y significantly for this week. Red Globe rose 105% w/w to $2.99 per pound, 39% up y/y. Black Seedless grew 8% w/w to $2.94 lb, 32% up y/y. Red Seedless rose 23% w/w to $2.87 lb, 25% y/y. Peru and Chile are the main origins.

- Red raspberries in 6 oz package decreased 14% w/w to $2.39 lb, 21% down y/y. Mexico is the key origin.

- Strawberries in 1 lb package increased 8% w/w to $3.07 lb, 3% up y/y. Fruit in 2 lb package weakened by 21% w/w to $5.27 lb, 12% up y/y. Strawberries are mainly from California, Florida and Mexico.

- In an unusual strategy, Stellantis is planning to begin exporting production of light commercial vehicles (LCVs) from its plant in Kaluga (Russia) to the European market, according to a Reuters report. Exports will begin with the company's three sibling mid-sized vans that are built at the plant; the Peugeot Expert, the Opel Vivaro and the Citroën Jumpy, with shipping expected to begin in February. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Russian output of these models would combine with output from European production sites in Valenciennes (France) and Luton (UK), to help meet growing demand to Western Europe for medium and light delivery vans, mainly as a result of the boom in online shopping since the onset of the COVID-19 virus pandemic in March 2020.

- Output of LCVs at the Kaluga plant has doubled in 2021, according to Stellantis, and the spare capacity will now be used to serve the European market as well as the domestic Russian market. Production of vans began at Kaluga in 2017, which was originally established as the PSMA joint venture (JV)) between PSA and Mitsubishi to build passenger cars for the Russian market.

- There are also plans to add other programs at the plant for export, including plans to build the new Fiat Scudo (a version of the aforementioned mid-sized Peugeot, Citroën and Opel vans) for export at the end of 2022. There is also a plan to start production of diesel engines and manual transmissions for export, as well as to add the production of compact vans for a number of Stellantis brands.

- This is an unusual step as the majority of Russian production by foreign OEMs is generally targeted at the domestic Russian market. Over the last two decades, a large number of major global non-Russian OEMs have established their own production presence in Russia, with hopes that it would eventually overtake Germany to become the biggest in the wider European region, with volumes of over 3 million units in the latter part of the last decade forecast at the time.

- The Russian light-vehicle market closed the gap significantly to the German market on a number of occasions, most notably in 2008 just prior to the financial crisis, when the Russian LV market hit 2.96 million units and the German market was at 3.34 million units, and then following the recovery in 2012 when Russia returned to 2.94 million units, which would turn out to be its historical peak so far. However, it suffered a gradual decline in 2013 and 2014 before lower oil and gas prices hit the valuation of the ruble in the second half of 2014.

- Jidu Automotive, an electric vehicle (EV) startup backed by Chinese search engine giant Baidu and Chinese carmaker Geely Auto, has said that it raised nearly USD400 million in its A round of financing from Baidu and Geely. Jidu says that it will begin deliveries of its mass-produced "robot" cars in 2023, reports Reuters, citing a company statement. Reuters reported in April 2021 that Jidu expected to raise a total of CNY50 billion (USD7.9 billion) to develop its intelligent EVs, which the company is calling "robot" cars. The USD400 million the startup has just raised will mainly go towards the research and development of its first model, which will be unveiled in April at the Auto China 2022. Expectations for Jidu's first model are quite high as its parent company Baidu is a leading player in the development of Level 4 autonomous technology and artificial intelligence (AI) solutions. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chair Jerome Powell's press briefing yesterday at the conclusion of the Fed's policy meeting leaned decidedly hawkish. Following a statement from the Federal Open Market Committee (FOMC) all but guaranteeing that the Fed would begin to raise interest rates at the next scheduled meeting, on 16 March, the Chair repeatedly stressed developments that are likely to lead the Fed to take multiple steps in coming months to reduce the extraordinary amount of monetary stimulus implemented during the pandemic. The Fed will stop bond purchases in March, as planned. It will begin to raise interest rates in March and expects it will be appropriate to raise interest rates several more times over the coming year to bring inflation back down toward target. It is likely to begin shrinking its balance sheet, which surged some $4.7 trillion since the pandemic began, around the middle of this year. Shrinkage will start earlier and be decidedly faster and larger than during the last episode of balance sheet normalization, from October 2017 to July 2019. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

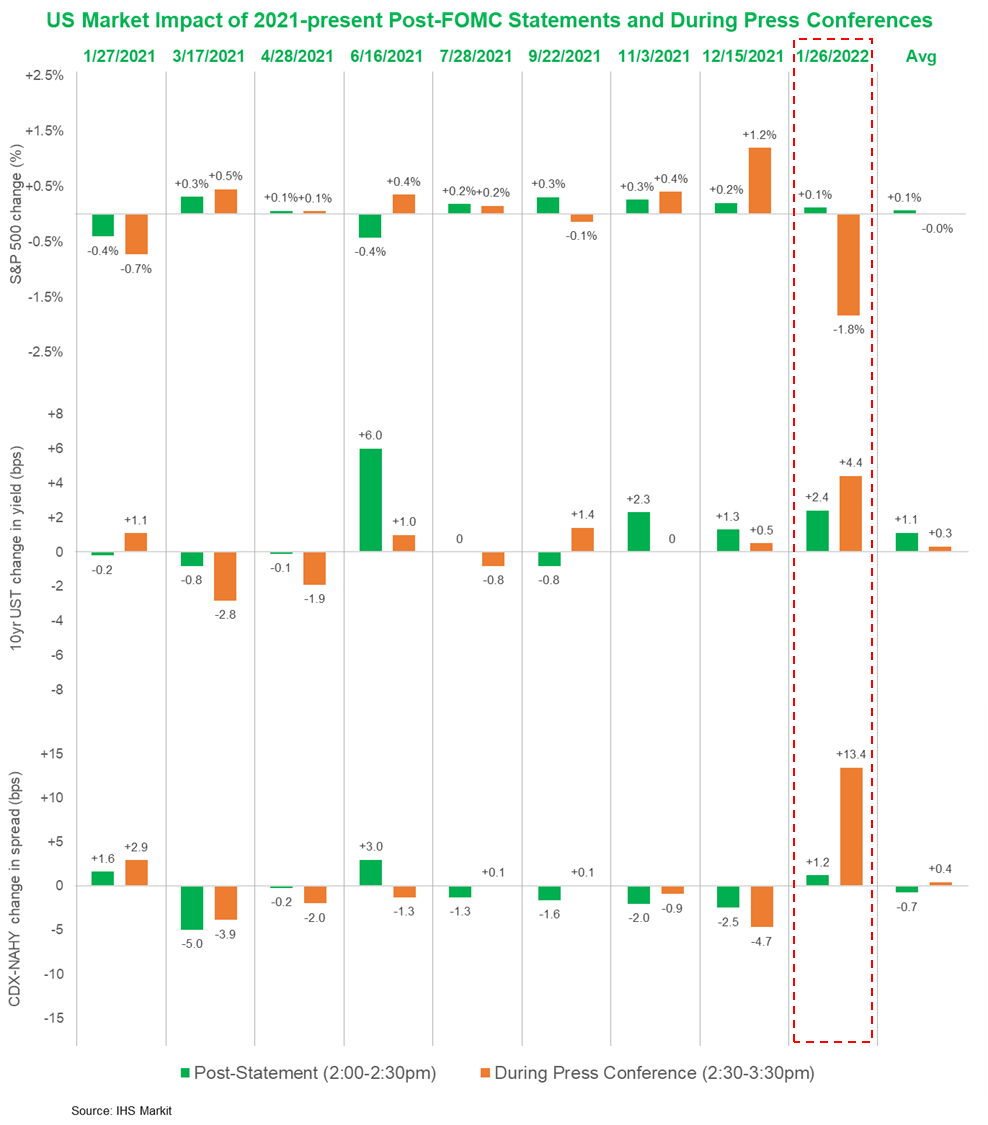

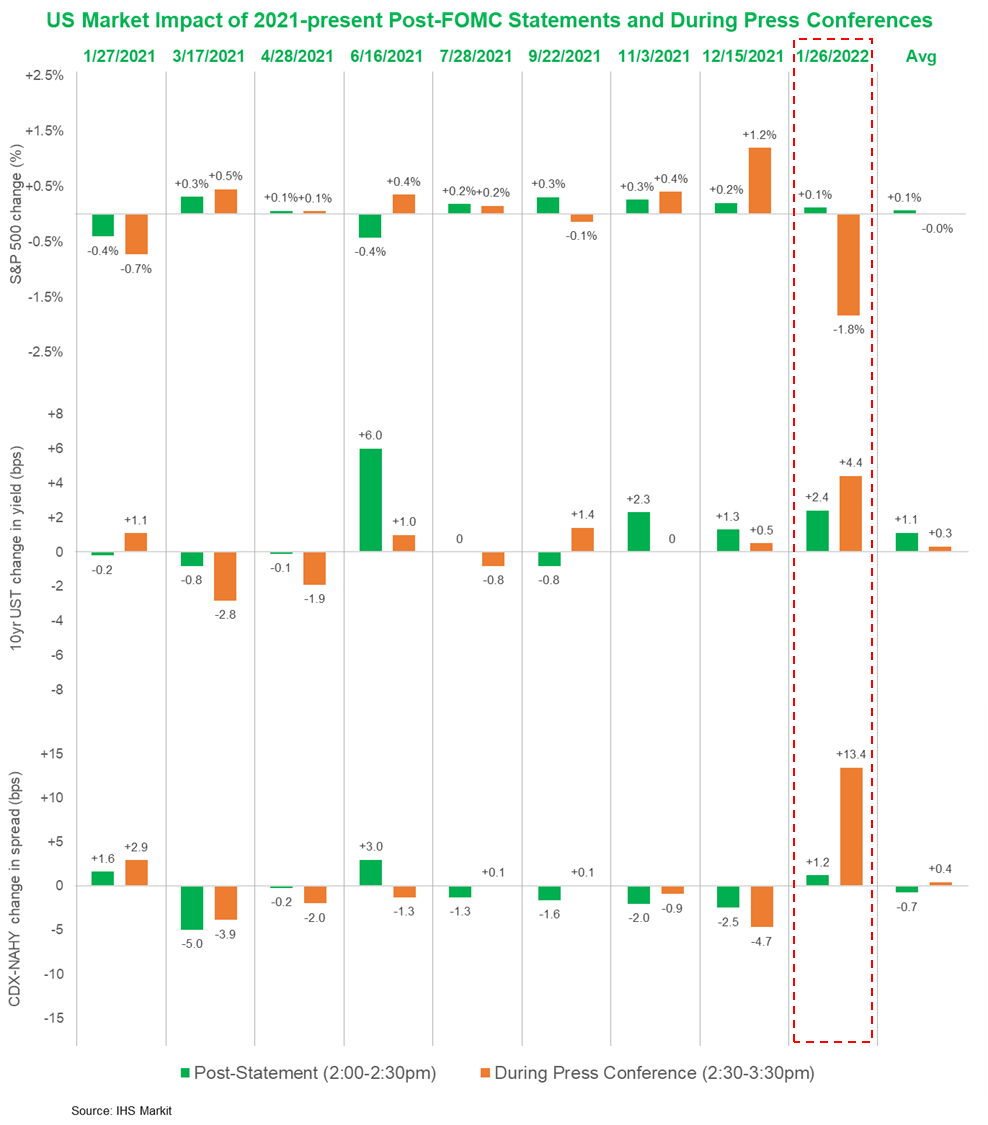

- The below chart separates the market reaction to every 2021-present FOMC meeting 30 minutes after the release of the statement and upon the conclusion of the press conference across the S&P 500, 10yr UST, and IHS Markit's CDX-NAHY (performance measurement only during the periods of 2:00-2:30pm ET for the statement release and between 2:30-3:30pm ET for the press conference). Yesterday's sell off (highlighted in red) during the press conference was the worst over the past year of meetings across all three of those major US benchmarks.

- US GDP rose at a 6.9% annual rate in the fourth quarter according to the Bureau of Economic Analysis (BEA)'s "advance" estimate, 0.5 percentage point lower than our latest tracking estimate. GDP growth increased sharply from 2.3% in the third quarter but continues to reflect the resurgence of COVID-19 cases and the ongoing supply chain problems. Federal government assistance to households, businesses, and state and local governments declined materially. (IHS Markit Economists Ken Matheny, Michael Konidaris, and Lawrence Nelson)

- Relative to our tracking estimates, personal consumption expenditures (PCE) were higher than expected but inventory investment was lower. The former reinforced our expectation for robust growth of PCE in the first quarter, while the latter suggested less of a decline in the pace of inventory building in the first quarter. The combination implied an upward revision to our forecast of fourth-quarter GDP growth to 1.9%.

- The upturn in GDP growth in the fourth quarter was led by PCE, which grew at a 3.3% annual rate, up from 2.0% in the third quarter, and by inventory investment, which increased by $240 billion, contributing 4.9 percentage points to GDP growth. Also contributing to the faster GDP growth were business fixed investment (up 2.0%) and net exports (up $51 billion). These were partially offset by declines in both federal (down 4.0%) and state and local (down 2.2%) government consumption and gross investment.

- Prices accelerated further in the fourth quarter, roughly in line with our expectations. The GDP price index rose at a 6.9% rate, up from a 6.0% increase in the third quarter. The core PCE index rose at a 4.9% rate, up from a 4.6% increase in the third quarter.

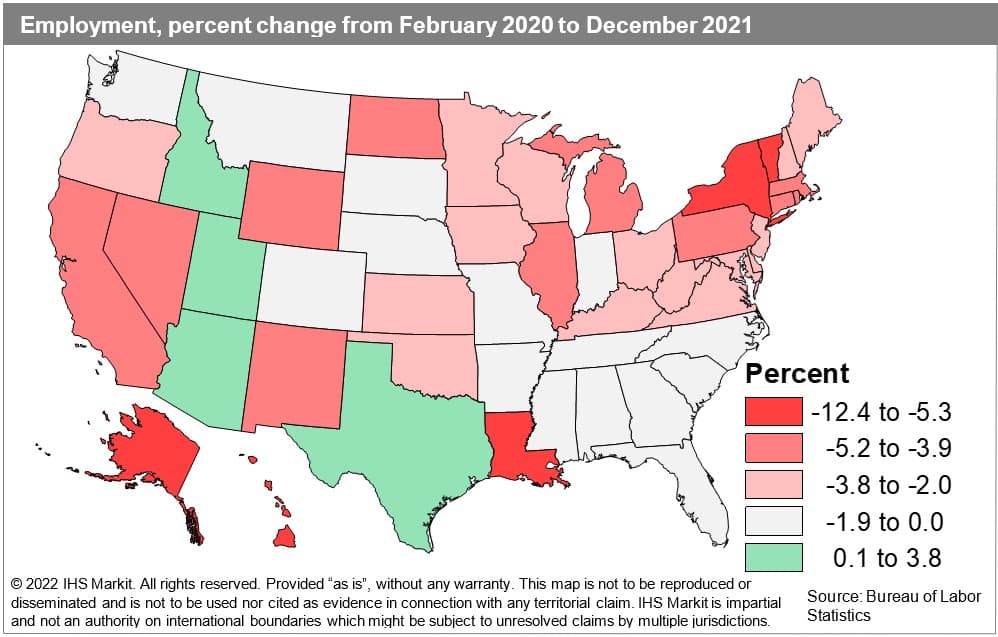

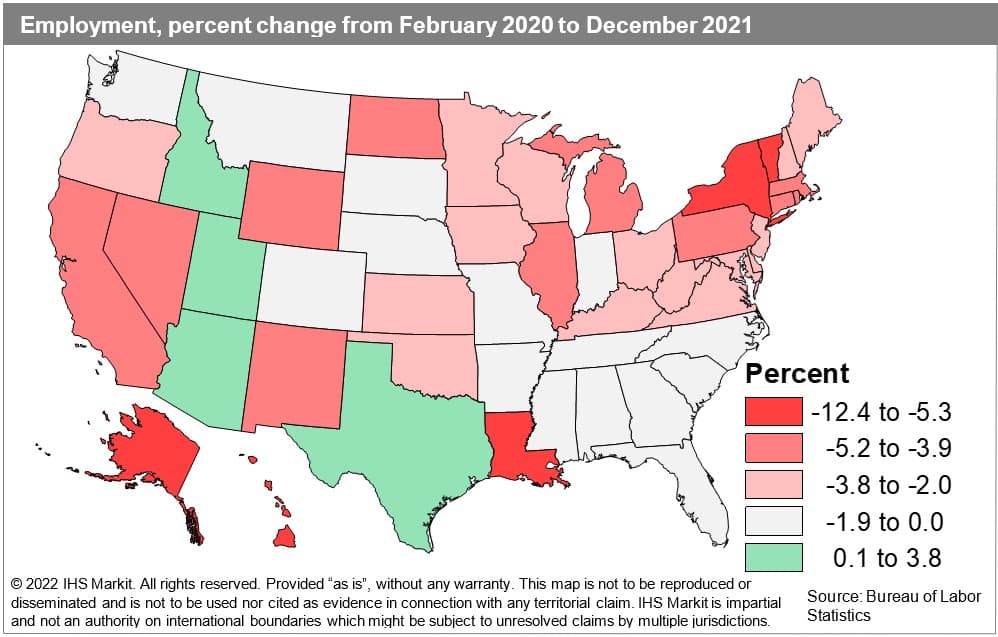

- US state labor markets continued to recover and posted rising employment levels in December, firmly leaving behind the disruption of the Delta variant surge. This most recent data was collected prior to the arrival of the current Omicron variant wave. While gains in total private nonfarm employment were solid nationwide, the Northeast far outpaced the rest of the country. Leisure and hospitality hiring in New York and Massachusetts made great strides as the industry moves out of a deep job deficit. While the Midwest expanded further, lackluster manufacturing hiring and declines in business services and financial activities in Nebraska, the Dakotas, and Minnesota restrained the region from seeing stronger job growth. Healthy gains in trade, transportation, and utilities and in hospitality services propelled the South and West. Over the year, the hardest-hit states of the Northeast and West bounced back the most in 2021 compared with states in the South and Midwest. (IHS Markit Economist James Kelly)

- The Texas Alliance of Energy Producers' Texas Petro Index showed a 28.8% year over year improvement in December capping a year of recovery from contractions in 2019 and 2020. Creator of the Texas Petro Index (TPI) and Alliance Petroleum Economist Karr Ingham stated: ""The Texas upstream oil and gas industry endured a punishing two-year contraction, the second year of which was at the hands of COVID, which finally came to an end with the January 2021 trough in the Texas Petro Index. The index has been steadily on the rise since then with higher prices, a growing rig count, and a return to at least modest growth in industry employment." The monthly TPI released on January 26 showed a December 2021 improvement at 172.6, up from December 2020's 134.0. According to the alliance release: "The TPI reached its cyclical low point of 131.2 in January 2021, and has increased by 31.6% since then, marking an 11-month and counting expansion thus far. The Texas Petro Index remains well below its pre-contraction level, however; the December 2021 TPI is about 19% below the most recent cyclical peak of 213.6 established in February 2019." Ingham is bullish the TPI can continue to rise this year, "…assuming continued steady growth in upstream activity levels in Texas." However, the TPI is unlikely to match a 314.0 peak reached in November 2014 due to increases in efficiency. As Ingham explained, "Simply put, fewer rigs, employees, and other resources are required to produce record and growing volumes of crude oil and natural gas. Even as production continues to grow, other upstream indicators remain well below prior levels, keeping the index in check." Highlights of the TPI included (IHS Markit PointLogic's Annalisa Kraft):

- Natural gas prices paid to producers averaged $5.79/mmbtu for the year, the highest annual average since 2008. While natural gas prices were trending higher in 2021 anyway, the upward price spike in February 2021 in response to Winter Storm Uri clearly pushed the average significantly higher…natural gas prices were moving upward to the highest levels since 2014 in the second half of the year.

- The Texas statewide rig count has increased each month since the record low 105 rigs at work on average in August 2020. The December 2021 monthly average rig count of 275 reflects the addition of 170 rigs since then, and the count continues to climb. The Texas rig count remains well below the 533 rigs at work on average in October and November 2018, and the 904 rigs at work on average in November 2014.

- Over 8,700 original drilling permits were issued in 2021, an increase of nearly 40% compared to the 2021 annual total, which was the lowest in the entire history of the TPI analysis dating back to 1995.

- Nearly 18,600 direct upstream oil and gas jobs have been added thus far in the current expansion, including nearly 16,500 over the last 12 months. However, that follows the loss of over 83,000 jobs over the course of the entire contraction, 63,000 of which were shed during 2020 alone. As of December, estimated upstream industry employment in Texas was 175,925, compared to the low point of 157,330 in September 2020, and the most recent cyclical employment peak of over 240,000 jobs in December 2018. Direct upstream oil and gas employment in Texas achieved its all-time high of over 307,000 jobs in December 2014.

- China's auto market will continue to play a central role in accelerating the global auto industry's transition to electrification over the next few years, IHS Markit's latest forecasts show. Data from the China Passenger Car Association (CPCA) indicate that retail sales of passenger new energy vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), reached 475,000 units in China in December 2021, taking the country's full-year passenger NEV sales to a record of 2.99 million units, surging 170% year on year (y/y). The strong momentum will be carried into 2022 and propel the country's NEV production to reach new heights through 2025. According to IHS Markit's latest forecasts, China's NEV production volume is expected to approach 9.5 million units in 2025, accounting for 30% of the country's total light-vehicle production. The projections take into account factors such as an increase in NEV models, preferential policies for NEVs, the wider availability of public EV charging stations and automakers' continual efforts to speed up new car deliveries. The penetration rate of NEVs reached 22.6% in December 2021 in the Chinese passenger vehicle market, according to CPCA data. Chinese OEMs have outperformed their JV counterparts to lead sales growth in the NEV segment. This is in part thanks to Chinese OEMs' early involvement in the NEV sector and their ability to respond quickly to consumer demand changes. The success of the Wuling Hongguang Mini EV has encouraged a number of local OEMs to launch budget models. However, we do not expect the segment to become a key one for EV manufacturers from a longer-term point of view. Consumers buying such vehicles tend to be highly price-sensitive, and the size of the A segment should also constrain the sales growth potential of such vehicles. Through 2025 IHS Markit still expects the C and D segments to be the two largest segments by production volume in the Chinese BEV market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Volkswagen (VW) Group's software unit Cariad has entered into a partnership with Bosch to develop advanced driver-assistance systems for consumer vehicles, according to a company statement. The partnership aims to develop automated functions that will allow drivers to temporarily take their hands off the steering wheel. The companies will jointly build a standardized software platform to offer Level 2 and 3 automated capabilities for vehicles sold under the VW brands suitable for volume production. The first of these functions are to be installed in 2023. Cariad CEO Dirk Hilgenberg said, "Automated driving is key to the future of our industry. With our cooperation, we'll strengthen Germany's reputation for innovativeness. Bosch and Cariad will further enhance their expertise in the development of pioneering technologies. This underscores our ambition to deliver the best possible solutions to our customers as soon as possible." To create new revenue streams in the future, carmakers are increasingly focusing on software-related services for vehicles. VW has bundled all its software efforts into one unit, Cariad, which will power passenger vehicles that will be "Level 4 ready" by 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nestlé has announced a new plan to tackle child labor risks in cocoa production, which involves an income accelerator program, aiming to improve the livelihoods of cocoa-farming families, while also advancing regenerative agriculture practices and gender equality. (IHS Markit Food and Agricultural Policy's Sandra Boga)

- A cash incentive will be paid directly to cocoa-farming households for certain activities such as, enrollment of children in school and pruning among several others. Nestlé's new plan also supports the company's work to transform its global sourcing of cocoa to achieve full traceability and segregation for its cocoa products. As Nestlé continues to expand its cocoa sustainability efforts, the company plans to invest a total of CHF1.3 billion by 2030, more than tripling its current annual investment.

- The income accelerator program will offer a new approach to help support farmers and their families in their transition to more sustainable cocoa farming, it added. The incentives will encourage behaviors and agricultural practices that are designed to steadily build social and economic resilience over time. With Nestlé's new approach, cocoa-farming families will now be rewarded not only for the quantity and quality of cocoa beans they produce, but also for the benefits they provide to the environment and local communities.

- These incentives are on top of the premium introduced by the governments of Ivory Coast Ghana that Nestlé pays (LID) and the premiums Nestlé offers for certified cocoa. This cocoa is independently audited against the Rainforest Alliance Sustainable Agriculture Standard, promoting the social, economic and environmental well-being of farmers and local communities.

- Cocoa-farming communities currently face immense challenges, including widespread rural poverty, increasing climate risks and a lack of access to financial services and basic infrastructure like water, health care and education. These complex factors contribute to the risk of child labor on family farms, it explained.

- The program rewards practices that increase crop productivity and help secure additional sources of income, which aim to close the gap to living income and help protect children. By engaging in these practices, families can additionally earn up to CHF500 annually for the first two years of the program. The higher incentive at the start will help accelerate the implementation of good agricultural practices to build future impact.

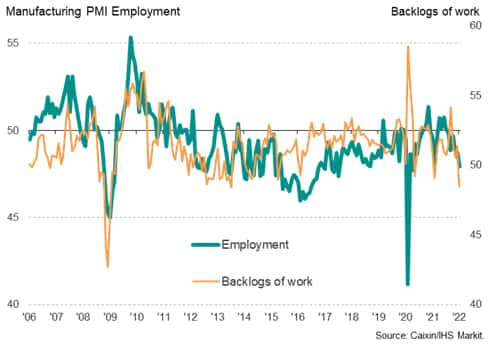

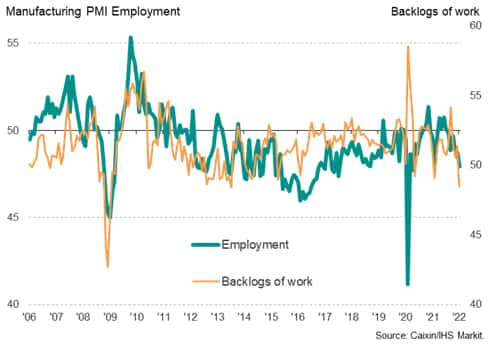

- Tightened restrictions to fight the Omicron wave has led to a renewed decline in manufacturing production in mainland China, with demand also weakening - notably from export markets. With producers' order books becoming increasingly depleted, firms cut staffing levels to an extent not seen since April 2020. The scope for Chinese authorities to combat the slowdown were enhanced by price pressures remaining very subdued, certainly by international standards. However, perhaps of greater concern is the impact on global supply chains - and inflation - from this additional disruption to the Chinese manufacturing economy. (IHS Markit Economist Chris Williamson)

- Manufacturing production in mainland China fell in January, according to PMI survey data produced for Caixin by IHS Markit, as the Omicron wave disrupted business activity. The survey data had shown output growth accelerating in December ahead of the Omicron outbreak, rising at the fastest rate for two years, as business revived from the Delta wave, which had been linked to output falling between August and October. However, the re-imposition of restrictions to safeguard against the spread of COVID-19 in several regions during January were reported to have again curbed factory production and stymied demand.

- New orders likewise fell back into decline amid the January Omicron restrictions, fueled by the largest drop in export orders recorded by the survey for 20 months.

- Ominously, the January survey also showed that the drop in new orders caused backlogs of uncompleted work to fall at a rate not exceeded since the height of the global financial crisis in 2008-9. This depletion of manufacturing order books hints at the build-up of excess capacity relative to demand, and in turn caused increasing numbers of firms to scale back workforce headcounts. The resulting decline in factory employment was the largest recorded since the early stages of the pandemic in April 2020.

- An additional impact of the Omicron wave was a further lengthening of supply chains, with average supplier delivery times lengthening to the greatest extent since October. This constriction of supply in turn drove up prices for purchased inputs at manufacturers, though importantly the rate of inflation remained far below the surging rates of increase seen in the months prior to last November. Average prices for goods leaving the factory gate also rose at a sharply reduced rate compared to that seen throughout much of last year, albeit picking up slightly in January.

- US real personal consumption expenditures (PCE) declined 1.0% in December as real PCE for goods declined 3.1% and real PCE for services rose 0.1%. The decline in goods PCE reflects a pullback in spending following early holiday shopping as well as an ongoing adjustment of spending patterns back toward pre-pandemic norms. The small increase in real PCE for services, meanwhile, leaves it still below its pre-pandemic trend. (IHS Markit Economists Kathleen Navin and Gordon Greer III)

- The weakness in real PCE for goods was broad based, with notable declines in furnishings and durable household equipment (-6.2%), recreational goods and vehicles (-4.9%), and clothing and footwear (-6.2%).

- Although overall spending on services edged higher in December, virus-sensitive categories such as food services declined, suggesting growing concerns related to the spread of the Omicron variant began to play a role in the December data.

- Personal income increased 0.3% in December, and the personal saving rate rose 0.7 percentage point to 7.9%. Real disposable personal income decreased 0.2% amid higher consumer prices. Wage and salary income increased 0.7% in December and has essentially recovered to its pre-pandemic trend, up 13.4% over the last two years.

- The PCE price index increased 0.4% in December and its 12-month change was 5.8%. Excluding food and energy, the core PCE price index rose 0.5% in December and 4.9% over 12 months.

- The pandemic and elevated inflation remain headwinds for household spending, but personal income growth rooted in strongly rising wages is expected to support faster expansion in PCE in coming months.

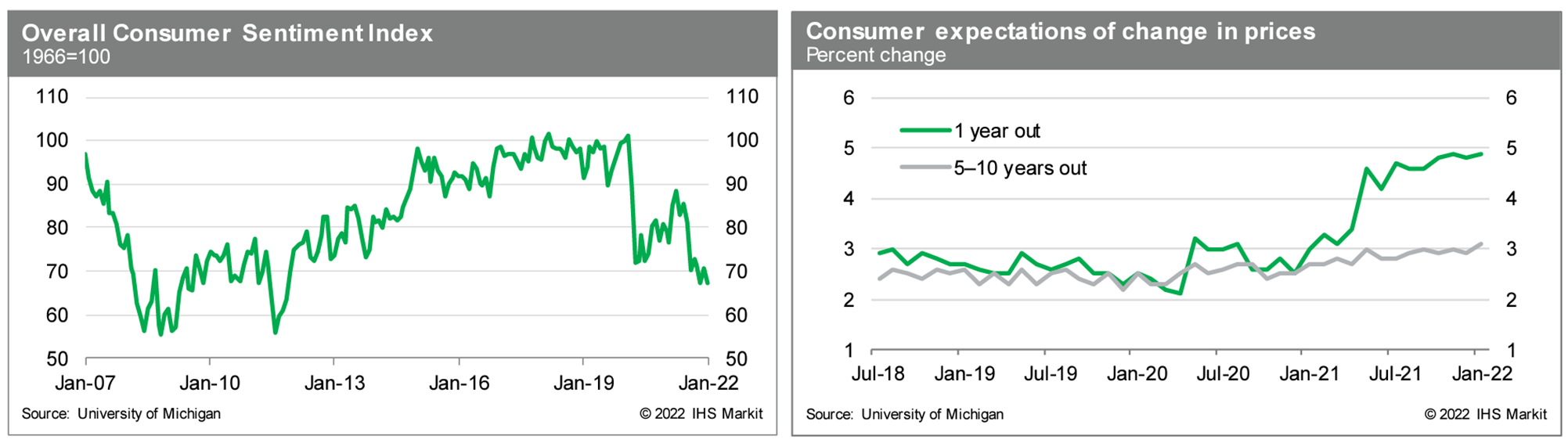

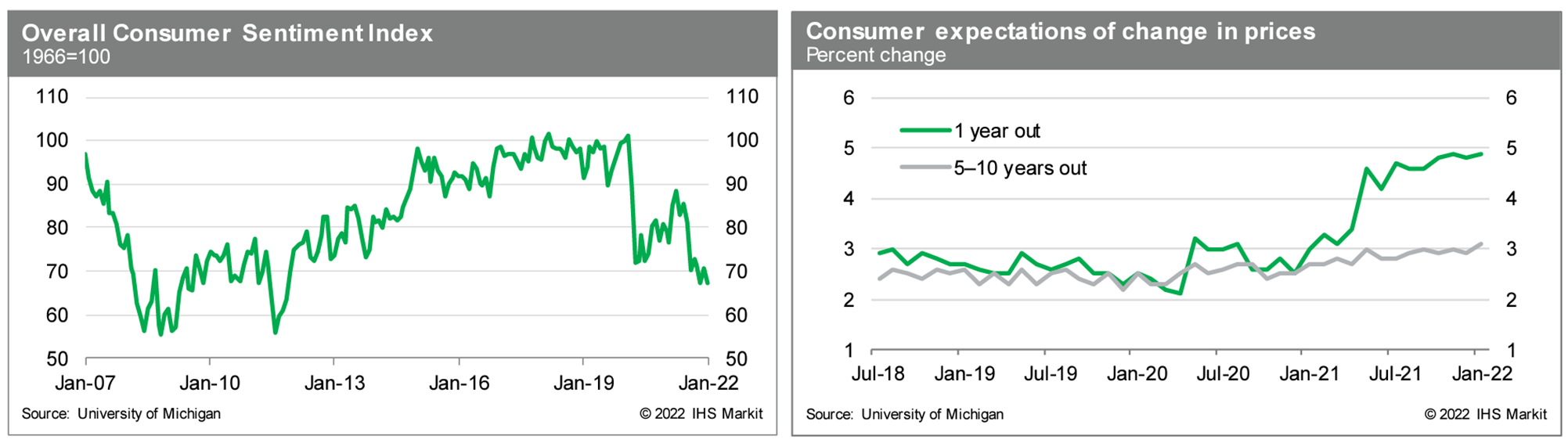

- The US University of Michigan Consumer Sentiment Index fell 3.4 points to 67.2 in the final January reading—slumping to its lowest level since November 2011. (IHS Markit Economists Akshat Goel and William Magee)

- A combination of falling stock prices, low confidence in government economic policies, and heightened geopolitical risks in addition to the existing themes of the Omicron variant and rising prices has created the perfect storm for consumer sentiment—sentiment is down 23.9% since April 2021.

- While there are myriad factors pulling down sentiment, escalating inflation appears to be the foremost source of drag. At 7.0%, the 12-month increase in the consumer price index (CPI) in December was the highest in nearly four decades. The median expected one-year inflation rate in the University of Michigan survey edged up 0.1 percentage point to 4.9%, its highest level since 2008.

- Households earning below $100,000 per year were most affected by higher consumer prices—the index of sentiment for these households declined 7.7 points, while that for households earning over $100,000 per year rose 1.3 points.

- The index of buying conditions for automobiles fell by 12.0 points in January as high prices and limited inventories continue to be a drag on buying sentiment. The price of new vehicles is up 12.3% since March while used car prices are up 39.0% since March.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the IHS Markit expectation for solid job and wage growth in the coming months, which should continue to support ongoing growth of consumer spending. Sentiment will track spending more closely as inflation subsides, although these may not align until next year.

- The eurozone economic sentiment indicator (ESI) has declined for the third successive month in January, by just over one point to 112.7. Given revisions to prior months' data, January's outcome significantly undershoots the market consensus expectation (of 114.5). Key points from the activity side of January's survey include the following (IHS Markit Economist Ken Wattret):

- Sentiment has declined in four of the five key sectors in January, with retail (just 5% of the ESI) the exception. Although relatively elevated still, sentiment indices across all key sectors are down from their recent peaks.

- Services sentiment (20% of the ESI) has fallen by almost two points, after tumbling by more than seven points in December 2021, one of the biggest declines in the series' history. Echoing the recent weakness of IHS Markit's PMIs, services activity has been hit hard by the latest wave of the COVID-19 pandemic.

- Although industrial sentiment (the highest weighted sector, at 40% of the ESI) has edged down, most of the sub-surveys, including order books and production expectations, are robust. Demand remains solid despite ongoing supply chain disruption to production.

- Consumer sentiment (20% of the ESI) has also edged down, as already indicated by the prior 'flash' data. Consumer expectations of the economic outlook have fallen sharply, however.

- Overall employment expectations have softened in each of the last two months but the index remains well above its long-run average, indicating that businesses remain confident about economic prospects despite the various growth headwinds at present.

- Chinese automaker Great Wall Motors has announced plans to invest BRL10 billion (USD1.8 billion) in its Iracemapolis manufacturing facility in Brazil, reports Automotive Business Brazil. The plans include an investment of BRL4 billion from 2023 to 2025 and the remainder over an indefinite period, according to the report. By 2025, Great Wall aims to achieve a 60% localization rate of its vehicles produced in Brazil, and an annual production capacity of 100,000 vehicles per year. However, company executives say that is the optimistic scenario, which suggests actual output could be more modest in the first years of the plan, the report states. Great Wall reportedly confirmed that, of the vehicles produced under the plan, some would be sold in Brazil and some exported to other Latin American countries. In addition, Great Wall plans to build electric and hybrid vehicles, as well as ICE vehicles, in Brazil. Great Wall purchased the Brazilian facility from Daimler, with this latest report providing further details of the company's plans, but largely confirming elements of the investment plan already reported. Although the facility could have a production capacity of 100,000 units per year, IHS Markit forecasts output to be more modest through 2030, at less than 20,000 units in most years. The facility was a Mercedes-Benz plant, building the GLA and C-Class from 2016 to 2020, with output peaking in 2017 at 8,432 units. IHS Markit forecasts that Great Wall will offer its Haval H2, Ora Haomao, and Poer Pao II in Brazil in 2023, adding the Tank300 in 2024, including some imported units. IHS Markit forecasts Great Wall's Brazilian sales to reach 14,300 units in 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

- As the world's first seaborne shipment of liquefied hydrogen gets underway, optimists see the dawn of a hydrogen economy that could help avert climate disasters in the coming decades. Having arrived at Hastings, Victoria, Australia on 20 January, the world's first purpose-built liquefied hydrogen carrier-the Suiso Frontier-is preparing to transport the fuel back to the Japanese port of Kobe by the end of February. (IHS Markit Net-Zero Business Daily's Max Lin)

- Some observers have compared the vessel to the Elizabeth Watts, which carried the world's first ocean-going oil cargo in 1861, and the Methane Pioneer, responsible for moving the first LNG shipment in 1959. Suiso means hydrogen in Japanese.

- "This is kind of like a history-making event, with the first international shipment of liquid hydrogen … for the purpose of trade between two countries," Daryl Wilson, executive director of industry body the Hydrogen Council, told Net-Zero Business Daily.

- Experts believe hydrogen must have a greater share in the future energy mix for the world to counter climate change. According to the International Energy Agency, global demand for low-carbon hydrogen needs to amount to 520 million metric tons (mt)/year by 2050 to help achieve net-zero emissions at the midcentury point.

- The vision can be only realized if hydrogen can be shipped by sea. European and Northeast Asian countries will seek large quantities of hydrogen from overseas suppliers as they cannot produce sufficient volumes to meet domestic demand, the International Renewable Energy Agency (IRENA) has predicted.

- But there remain stiff technical and commercial challenges in seaborne hydrogen transportation. In liquid form, hydrogen needs to be stored in tanks at minus 253 degrees Celsius-just 20 degrees above absolute zero-to avoid evaporation.

- The temperature is much lower than the boiling points of common seaborne commodities. LNG, often described as a super-chilled fuel, only needs to be cooled to minus 162 degrees Celsius for shipping and storage.

- When constructing the Suiso Frontier, the pilot vessel for the Hydrogen Energy Supply Chain (HESC) project, Kawasaki Heavy Industries (KHI) had to install a double-walled, vacuum-insulated tank with a capacity of 1,250 cubic meters (cu m) for this purpose.

- In the HESC's pilot phase, Japan and Australia together committed A$500 million ($351 million) to creating a hydrogen supply chain between the two countries. The Australian federal and Victorian state governments each contributed A$50 million, while Tokyo footed the rest of the bill.

- Aside from the vessel, the supply chain includes a demonstration plant that produces hydrogen gas from biomass and brown coal in Victoria's Latrobe Valley via gasification, a 0.25-mt/day liquefaction plant in Hastings, and land-based transportation and storage facilities in Japan and Australia.

- Paraxylene (PX) Asia Contract Price (ACP) negotiators failed to settle the February contract amid wide bid-offer expectations, two sources told OPIS on Friday. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Negotiations were stymied by a $900/mt CFR Asia versus $1,080/mt CFR buy-sell gap, said one source in China.

- PX users bid $850-900/mt CFR on Thursday, the source said.

- Buyers participating in the PX ACP process include U.K.-headquartered INEOS, Japan's Mitsui, Japan's Mitsubishi, Taiwan's China American Petrochemical (CAPCO), China's Yisheng Petrochemical, China's Shenghong Petrochemical, and Taiwan's Oriental Petrochemical (OPTC).

- OPIS previously reported that the February contract was offered at $1,080-1,100/mt CFR.

- The lowest February ACP nominations came at $1,080/mt CFR from four producers -- Japan's ENEOS, South Korea's SK Global Chemical (SKGC), U.S.-headquartered ExxonMobil and India's Reliance. A $1,090/mt CFR offer was made by Japan's Idemitsu Kosan, while South Korea's S-Oil nominated the highest ACP at $1,100/mt CFR.

- The PX ACP also failed to settle in January, with buyers squaring off at $810/mt CFR against sellers at $940/mt CFR.

Posted 31 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.