All major US and European, and most APAC equity indices closed higher on the week. US and benchmark European government bonds closed higher on the week. CDX-NA and European iTraxx closed tighter across IG and high yield. Gold, oil, copper, and silver closed higher on the week, while the US dollar and natural gas were lower.

Americas

All major US equity markets closed higher on the week; Nasdaq +2.2%, S&P 500 +1.8%, DJIA +1.6%, and Russell 2000 +1.5% week-over-week.

10yr US govt bonds closed at a 1.58% yield and 30yr bonds 2.04% yield, which is -3bps and -12bps week-over-week, respectively.

DXY US dollar index closed 93.94 (-0.1% WoW).

Gold closed $1,768 per troy oz (+0.6% WoW), silver closed $23.35 per troy oz (+2.8% WoW), and copper closed $4.73 per pound (+10.6% WoW).

Crude Oil closed $82.28 per barrel (+3.7% WoW) and natural gas closed $5.41 per mmbtu (-2.8% WoW).

CDX-NAIG closed 52bps and CDX-NAHY 300bps, which is -2bps and -8bps week-over-week, respectively.

EMEA

All major European equity indices closed higher on the week; France +2.6%, Germany +2.5%, UK +2.0%, Italy +1.7%, and Spain +0.5% week-over-week.

All major 10yr European government bonds closed higher on the week; UK closed -6bps, Spain-3bps, France-3bps, Germany-2bps, and Italy-1bps week-over-week.

Brent Crude closed $84.86 per barrel (+3.0% WoW).

iTraxx-Europe closed 50bps and iTraxx-Xover 256bps, which is -2bps and -8bps week-over-week, respectively.

APAC

Most major APAC equity markets closed higher on the week except for Mainland China -0.6%; Japan +3.6%, India +2.1%, South Korea +2.0%, Hong Kong +2.0%, and Australia +0.6% week over week.

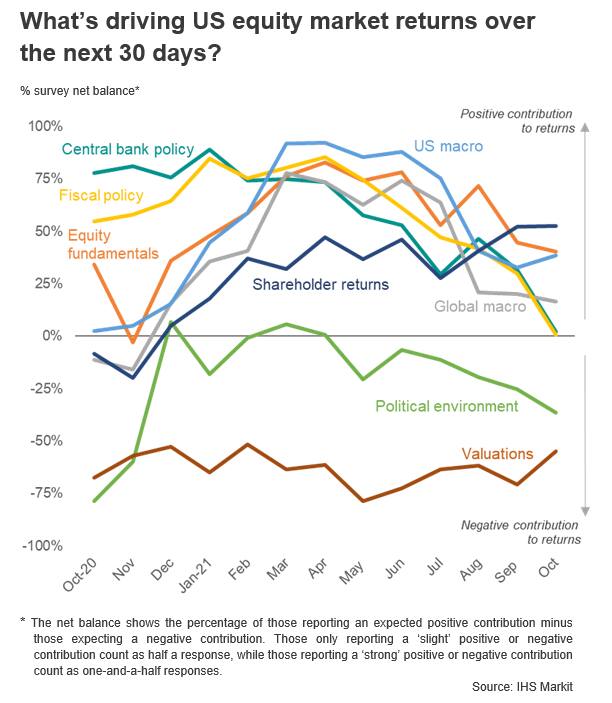

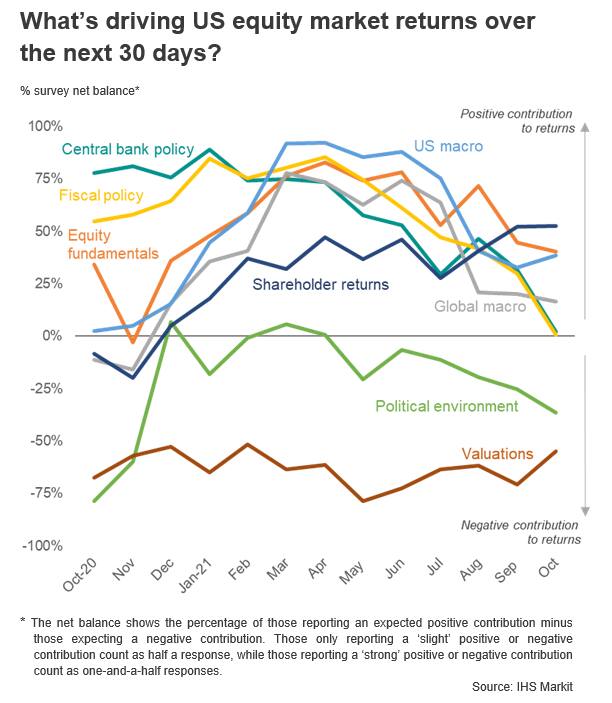

- US equity investors' risk appetite has picked up in October from the one-year survey low seen in September, but remains subdued compared to earlier in the year as investors cite concerns over the political environment and perceive waning equity market support from monetary and fiscal policy. (IHS Markit Economist Chris Williamson)

- The positive views on shareholder returns, which hit a survey high in October, have played a role in driving financial stocks to the top of the sector preferences for the next 30 days, followed closely by energy names. The outlook for the latter has also been buoyed by recent surging spot prices for energy.

- This subdued level of risk appetite evident in October compared to earlier in the year corresponds with a marked pull-back in investors' expectations of year-end equity market performance over the past six months. While the US is seen to be the best performing equity market in 2021, followed by Japan and the EU, sentiment towards all three has fallen compared to April. The UK market's expected performance has meanwhile slipped behind the other developed markets, while investment managers have now taken a bearish view towards China and, to lesser extents, Latin America and the rest of Asia.

- When comparing how the perceived drivers have changed over the past year, it is central bank policy that has seen the largest pull-back in sentiment, falling even further in October to hit a new survey low. Similarly, investor perceptions of how government fiscal policy can help drive the market have also fallen to a new survey low and - like monetary policy - is seen as providing only marginally positive support to US equities over the coming month.

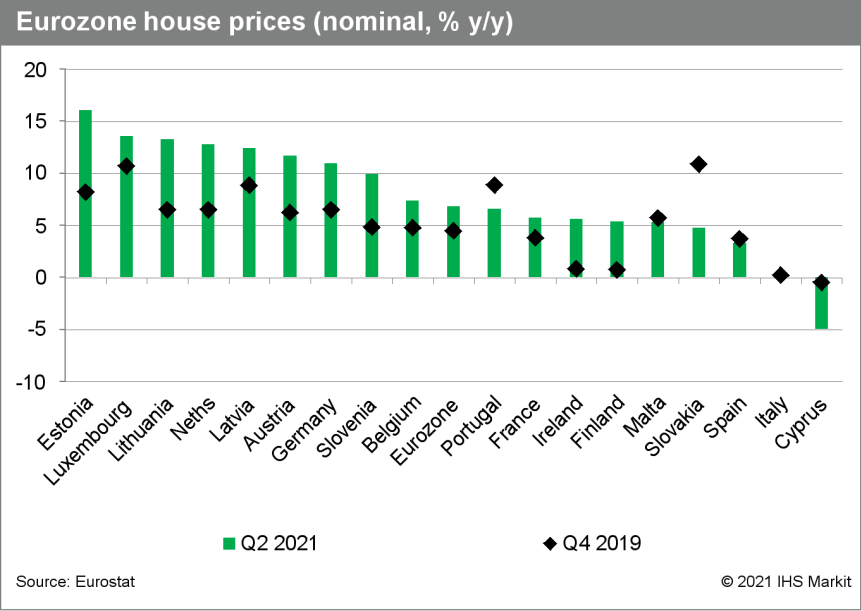

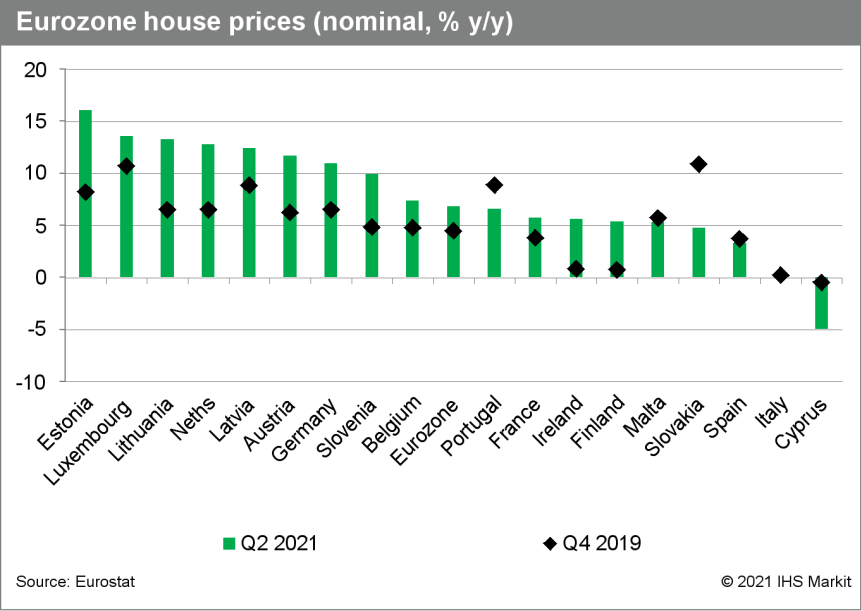

- House prices in the eurozone increased by 6.8% y/y in the second quarter of this year, the fastest rate of increase since the second quarter of 2006. The y/y rate of increase has increased in six of the past seven quarters and the cumulative rise in eurozone house prices compared with pre-pandemic levels is now approaching 10%. (IHS Markit Economist Ken Wattret)

- The quarterly time series for the eurozone goes back to the first quarter of 2005 and the cumulative increase in prices since then is just shy of 50%. This is despite two crises during that period, in 2008-09 and 2011-12, which saw house prices decline markedly in some member states.

- The strength in the second quarter's data was broad-based across most of the eurozone, with seven member states showing y/y increases in double digits.

- Of the larger member states, the highest y/y increases in the second quarter were in the Netherlands (12.8%) and Germany (10.9%). The lowest were in Spain (3.3%) and Italy (0.4%). Cyprus was the only member state to show a y/y contraction (-4.9%).

- In response to increasing downward pressure on the Mainland China economy, more regions are expected to take measures to stabilize their property markets. However, the general policy stance will remain measured. (IHS Markit Economist Yating Xu)

- Harbin, the capital city of northeastern province Heilongjiang, issued a slew of measures to ease developers' liquidity difficulties and shore up demand, according to the local government website. The measures came into effect on 1 October and will last until the end of 2021.

- The measures include easing restrictions on developer's presales funds and providing support for property firms' sales promotion campaigns. Authorities have also decided to offer subsidies to certain first-time home buyers and lower the land value-added tax rate for all types of housing. Additionally, the government eased the requirements for provident fund applications for second-hand.

- Supernus Pharmaceuticals and Adamas Pharmaceuticals (both US) have announced that they have reached a deal whereby Supernus will acquire Adamas for approximately USD400 million, rising to approximately USD450 million, depending on the sales achieved by Adamas's Parkinson's disease (PD) drug Gocovri (amantadine). The proposed acquisition corresponds to a tender offer of USD8.10 per share, with this price rising by USD0.50 per share if Gocovri's net sales reach USD150 million in any four consecutive quarters between closing and the end of 2024, and by a further USD0.50 per share if Gocovri's net sales reach USD225 million in any four consecutive quarters within this time period. The transaction is expected to close towards the end of the current year, or in early 2022. (IHS Markit Life Sciences' Milena Izmirlieva)

- ExxonMobil has announced plans to build its first large-scale advanced recycling facility in Baytown, Texas, with start-up slated for late 2022. The facility, which will employ a process developed in-house, will initially have capacity to convert 30,000 metric tons/year of waste plastics to chemical feedstock. ExxonMobil says an initial trial of its process has recycled more than 1,000 metric tons of plastic waste and demonstrated the capability of processing 50 metric tons per day. The company intends to build about 500,000 metric tons of advanced recycling capacity globally through 2026. In Europe, the company is collaborating with Plastic Energy on a plant in Notre Dame de Gravenchon, France, that is expected to process 25,000 metric tons/year of plastic waste when it starts up in 2023, with the potential for further expansion to 33,000 metric tons/year. (IHS Markit Chemical Advisory)

- Covestro is coordinating an EU innovation project, called Circular Foam, to develop waste-management systems and chemical-recycling processes for rigid polyurethane (PU) foams. The company says it is working with 21 partners from across nine countries to "close the material cycle" for rigid PU foams, used as insulation material in refrigerators and buildings. (IHS Markit Chemical Advisory)

- Through the project, experts from science, business, and society will develop "a comprehensive solution model" over the next four years, Covestro says. The goal is to close the material cycle for PU rigid foams and prepare the Europe-wide implementation of this blueprint. The project could save 1 million metric tons (MMt) of waste, 2.9 MMt of carbon dioxide (CO2) emissions, and €150 million ($174 million) in incineration costs every year in Europe from 2040, Covestro says.

- PU rigid foams from refrigerators and buildings are today incinerated for energy recovery rather than recycled. "In this process, the raw materials used are lost and high CO2 emissions are produced," Covestro says.

- Under the leadership of Covestro, the Circular Foam project is investigating and developing two possible recycling paths for PU rigid foams: chemolysis and smart pyrolysis. The aim in developing the two processes is to obtain polyols and amines as raw materials for the production of PU rigid foams in as high a quality as possible and so enable their reuse.

- Toyota announced 12 October in a company statement that it will aim to equip its vehicles with highly efficient solar power generation systems as it ramps up its efforts to achieve carbon neutrality. Toyota has started discussions on joint research with the National Institute of Advanced Industrial Science and Technology (AIST) and Toyota Central R&D Labs Inc. (Toyota CRDL). AIST is one of the largest national research institutions in Japan and carries out advanced research into solar power and other forms of renewable energy, and into the production and use of hydrogen; and Toyota CRDL is focused on achieving technological advances. Using the joint research, Toyota will seek to improve the conversion efficiency of solar power generation systems and batteries and bring down costs to allow for wider adoption by using data collected by AIST. (IHS Markit AutoIntelligence's Isha Sharma)

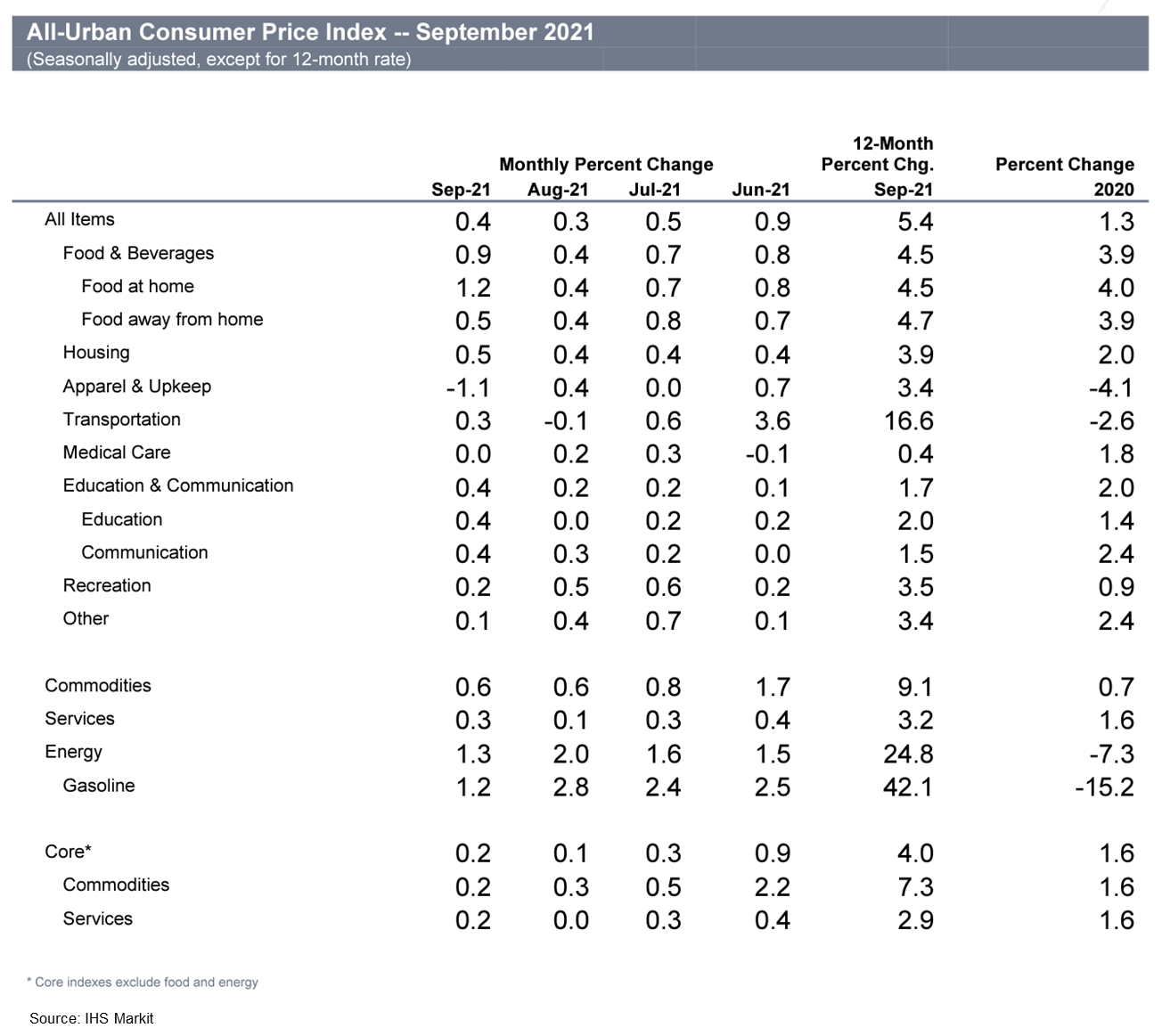

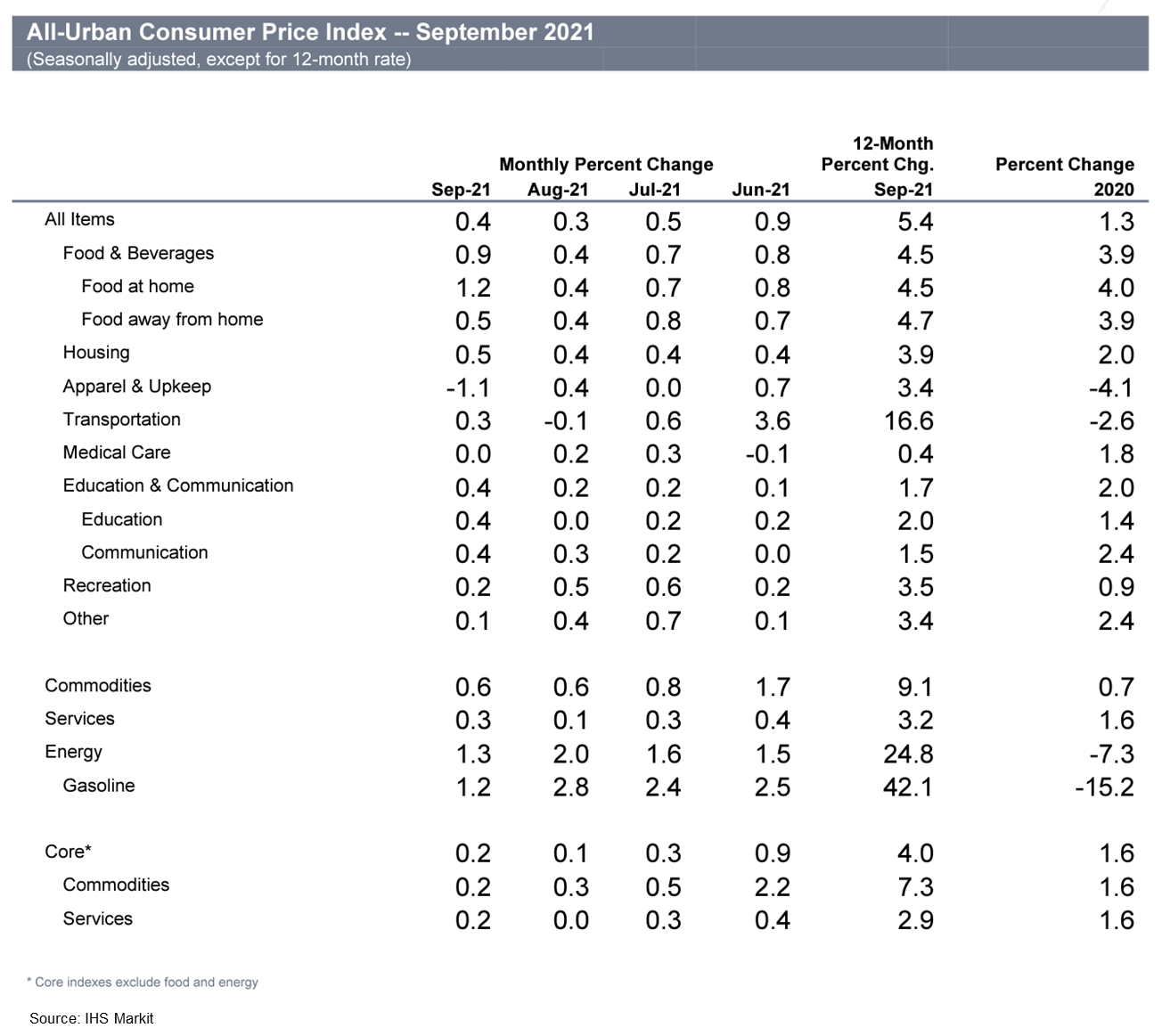

- The US Consumer Price Index (CPI) rose 0.4% in September following a 0.3% increase in August. The core CPI, which excludes the direct effects of moves in food and energy prices, rose 0.2% in September after a 0.1% increase in August. The headline CPI was boosted by price increases for food (0.9%) and energy (1.3%). (IHS Markit Economists Ken Matheny and Juan Turcios)

- During September, large price swings occurred in several components, both negative and positive. Notable declines occurred for used vehicles (0.7%), apparel (1.1%), and several travel-related components including airline fares (6.4%), lodging away from home (0.6%), and car and truck rental (2.9%). The price of used vehicles declined for the second consecutive month but was 42.3% above June 2020.

- The price of new vehicles rose 1.3% in September and is up 8.6% over the six months, as severe supply-chain bottlenecks have resulted in extraordinarily lean inventories and have encouraged dealers to raise prices.

- Rent inflation rose sharply in September, a potential harbinger of large increases in coming months as the surge in house prices translates into higher rents. Owners' equivalent rent (OER) rose 0.4% on the month, the largest increase in five years. Rent of primary residence (RPR) rose 0.5%, the largest increase in two decades. Annual (12-month) rent inflation readings were low in historical context in September, at 2.9% for OER and 2.4% for RPR, but are likely to rise notably in coming months.

- The 12-month change in the overall CPI edged up to 5.4% while the 12-month change in the core CPI remained at 4.0%. IHS Markit experts anticipate that 12-month inflation readings will moderate over the course of 2022 as base effects recede and supply-chain issues are addressed.

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 21 and 22 September, were released today. Policymakers discussed upcoming changes to the Fed's program of securities purchases, progress toward its maximum employment and price stability goals, and risks to the outlook. The pace of recovery in labor markets had slowed at the time of the FOMC meeting, while, for some participants, concerns had intensified that inflation could remain elevated for an extended period and cause longer-run inflation expectations to rise above the Fed's inflation target. Policymakers made no formal decision about when to begin reducing the pace of the Fed's securities purchases, but they did signal that a change was likely soon. The discussion revealed in the minutes was consistent with our expectation that the Fed will begin tapering asset purchases soon according to a plan to end such purchases around the middle of next year. Policymakers' concern about upside risks to inflation and inflation expectations reinforced our expectation that the first increase in the target for the federal funds rate could occur in early 2023. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Eurozone industrial production fell by 1.6% month on month (m/m) in August, the biggest fall since April 2020. The decline matched the market consensus expectation (according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- However, July's initially reported rise of 1.5% m/m has been revised down marginally to 1.4%, while manufacturing production in August contracted by an even larger 2.0% m/m. The first increase in energy production for four months (+0.5% m/m) accounted for the difference.

- As the eurozone industrial production data can be very volatile from month to month, IHS Markit also tracks the three-month-on-three-month rate of change. This has flatlined since April and was barely positive (just 0.1%) in August.

- Net of the various updates and revisions, as of August eurozone industrial production was 1.3% below February 2020's pre-pandemic level.

- Eurozone retail sales volumes, meanwhile, rose by a negligible 0.3% m/m in August, well below the initial market consensus expectation (of +0.8% m/m, according to Reuters' survey). July's already large 2.3% m/m decline in sales has also been revised down to a 2.6% m/m drop.

- The pandemic has reduced the availability of some sub-categories in the retail sales data. Still, in brief, there was a strong divergence of sales of food, beverages, and tobacco (-1.7% m/m) and other sales (+1.8% m/m) in August.

- There was a strong rebound in mail-order and internet sales (9.0% m/m) following successive sharp declines in June and July. Relative to their pre-pandemic level, mail-order and internet sales were up by 33% in August.

- Mainland China's merchandise export growth accelerated from 25.6% year on year (y/y) in August to 28.1% y/y in September in terms of US dollar, according to the General Administration of Customs (GAC). However, merchandise imports rose 17.6% y/y, dropping from a 33.1% y/y expansion the previous month. In terms of 2020-21 average, September exports growth rose by 1.4 percentage points from the previous month and was the fastest since the beginning of the year. (IHS Markit Economist Yating Xu)

- By trade partners, the headline export growth was largely driven by strong demand from the United States with its purchase improving from an expansion of 17.8% y/y in August to 25.5% y/y in September. However, exports to the European Union and Japan moderated, and ASEAN's purchase accelerated only marginally. By export commodities, mechanical and electronic products, especially cellphone that rose 70% y/y, led the headline export growth. Meanwhile, exports of pandemic-control products improved from contraction to expansion, and consumer goods such as toys and bags continued to accelerate, reflecting the sustained global supply-chain disruption caused by the Delta variant spread and the inventory replenishment in Western countries.

- The decline in import growth was partially due to the declining commodity imports under the decarbonization policy as well as the high baseline in the same period last year. The import volumes of steel, copper, and crude oil registered a double-digit contraction in September, driving a significant slowdown in value growth despite the sustained high prices. However, the volume of coal imports in September rose to their highest this year as power plants scrambled for fuel to boost electricity generation to ease the power crunch. Meanwhile, imports of electronic and agricultural products expanded at slower paces compared with August.

- Trade surplus continued to increase from USD58.3 billion in August to USD66.8 billion in September as export growth accelerated while import growth slowed. The cumulative surplus growth rate picked up to 35% y/y from 28.8% y/y a month earlier. Trade surplus with the United States rose further from USD37.7 billion in August to USD42 billion in September.

- According to the 2019 Health Care Cost and Utilization Report published by the non-profit Health Care Cost Institute (HCCI), healthcare spending for individuals under the age of 65 who receive employer-based health insurance coverage increased by 2.9% in 2019 to reach USD6,001. This contributed to a cumulative increase in healthcare spending of 21.8% between 2015 and 2019, which corresponds to USD1,074 per person. The increase was driven partly by greater utilisation and partly by increased prices, with the latter having risen every year since 2015. In 2019, average prices grew by 3.6%, which meant that average prices in 2019 were 18.3% higher than in 2015. The figures include the amount paid for medical and pharmacy claims, but do not include manufacturer rebates for prescription drugs. The HCCI report, which is available here, examined trends within four categories of service: inpatient admissions, outpatient visits and procedures, professional services, and prescription drugs. Of the total USD6,001 spend in 2019, 31.4% was accounted for by professional services, 27.8% by outpatient visits and procedures, 21.6% by prescription drugs, and 19.3% by inpatient admissions. (IHS Markit Life Sciences' Milena Izmirlieva)

- French President Emmanuel Macron has unveiled an EUR30-billion (USD35 billion) plan to "reindustrialize", reduce "overdependence" on certain raw material imports, support decarbonization and environmentally sustainable manufacturing, and generally boost the country's high-technology sectors, including pharmaceuticals. The proposed France 2030 strategy arrives six months ahead of a French presidential election campaign in which Macron is seeking a second term. However, the concept of France strengthening its manufacturing autonomy long predates the upcoming election. While the strategy clearly has political drivers, it should not be construed as merely a last-minute pitch to voters. The financial package proposed by Macron would result in EUR4 billion in capital investment and about EUR30 billion in budget spending over around five years. The first tranche of between EUR3 billion and EUR4 billion is envisaged to be allocated from January 2022. The details of the plan relating to the pharmaceutical and healthcare sectors remain vague, except for a headline commitment to develop and produce "at least 20 biomedicines [or biopharmaceuticals] against cancer, emerging diseases and chronic illnesses", as well as rare diseases, by 2030. The industrial impact of this plan on the pharmaceutical sector is potentially significant, particularly in terms of financing start-up biotechs, supporting the growth of domestic French manufacturers, and investing in research and development (R&D) centers. (IHS Markit Life Sciences' Eóin Ryan)

- Global solar module prices will take another two years before they stabilize following the current supply chain tightness, which in the near term will delay construction and installations, analysts told the recent Solar and Storage Finance Summit. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- "We expect to see [solar] module prices return to the normal price decline in the next year or so," Ravi Manghani, managing director of Denver, Colorado-based Clean Energy Associates, said during a 6 October presentation at the summit, which UK-based Solar Media Tech hosted. But, Manghani said, it will take until the end of 2024 for solar module prices to reach 23-24.5 cents/watt prices, "which is where we effectively would have been prior to the upswing in commodity and logistics prices."

- The global weighted-average levelized cost of electricity (LCOE) of utility-scale, solar photovoltaic (PV) plants declined by 85% between 2010 and 2020, from $0.381/kWh to $0.057/kWh in 2020, owing to "improving technologies, economies of scale, competitive supply chains, and improving developer experience," the International Energy Agency said in a June 2021 report.

- At the start of 2020, solar module prices were in the mid-to-low 30 cents/watt and currently they are in the mid-to-high 30 cents/watt, Manghani said.

- Tata Motors has entered into a binding agreement with TPG Rise Climate whereby the latter, along with its co-investor ADQ, will invest in Tata subsidiary TML EVCo, reports Autocar India. According to the source, TPG Rise Climate will invest INR75 billion (USD1 billion) for an 11-15% stake in TML EVCo (translating to an equity valuation of up to INR673 billon), while Tata Motors intends to expand its electric vehicle (EV) portfolio to 10 models by 2026 with a INR150-billion investment in the EV business. TML EVCo will help Tata Motors channel future investments into EVs, dedicated battery electric vehicle (BEV) platforms, advanced automotive technologies, charging infrastructure, as well as battery technologies. The first round of investment is due to be completed by March 2022, while the remainder will be invested by the end of 2022. Tata Motors chairman Natarajan Chandrasekaran said, "I am delighted to have TPG Rise Climate join us in our journey to create a market-shaping electric passenger mobility business in India. We will continue to proactively invest in exciting products that delights customers while meticulously creating a synergistic ecosystem. We are excited and committed to play a leading role in the Government's vision to have 30% electric vehicles penetration rate by 2030." Tata Motors is also implementing Project Helios, under which it has confirmed plans to expand its portfolio to 10 India-specific EVs by 2026, as well as a transition to a modular multi-energy platform. (IHS Markit AutoIntelligence's Tarun Thakur)

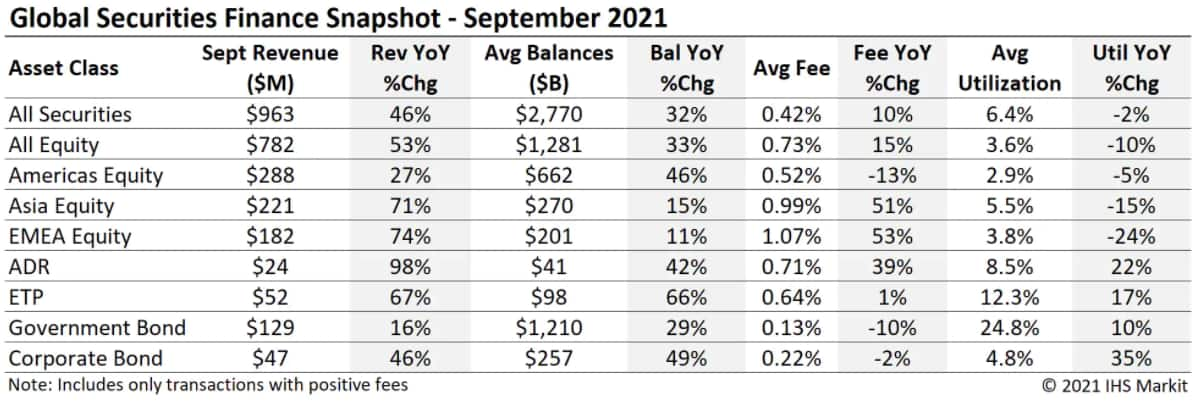

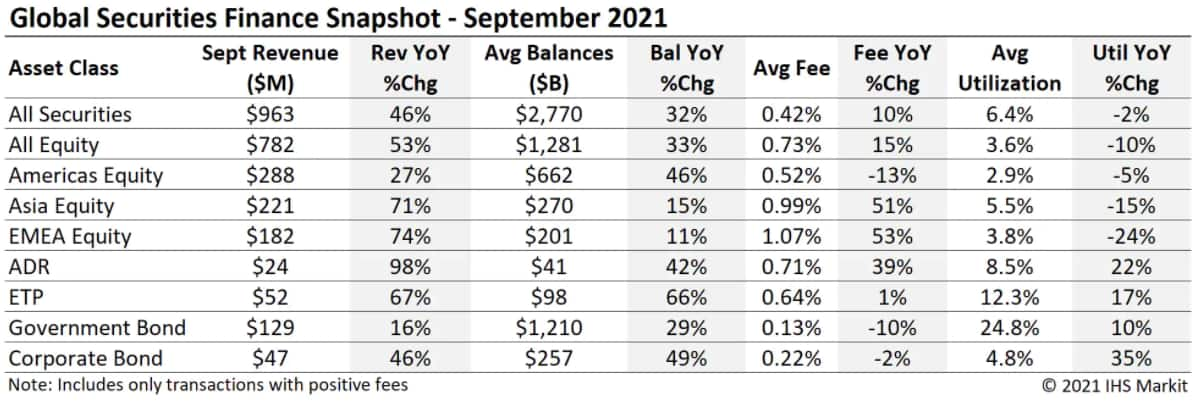

- Global securities finance revenues totaled just over $963 million in September, a 46% YoY increase. The comparison with 2020 remained favorable in September, partly owing to a particularly remunerative arbitrage related trade in EMEA. In general, return drivers which were in place for the first two months of Q3 continued to play out in September, including lockup expiries for recent IPOs; some other drivers include increased borrow demand for corporate bonds and related exchange traded products, the uptrend in APAC equity special balances and corporate action event related trades. In this note we'll discuss the drivers of September revenue, which pushed total Q3 revenues to $2.75 billion, a 23% YoY increase. (IHS Markit Securities Finance's Sam Pierson)

- US producer prices for final demand increased 0.5% in September and 8.6% from a year earlier. Food prices, up 2.0% for the month, were only bested by energy prices, which climbed 2.8%. All other producer prices rose a comparatively modest 0.2%. (IHS Markit Economist Michael Montgomery)

- Final demand prices for services grew 0.2%. Retail and wholesale trade margins climbed thanks to large margins at gas stations and "other" services, which edged 0.2% higher, but transportation and warehousing prices plunged 4.0% because of a 16.9% drop in airline passenger fares; airfares surged a total of 18.0% in July and August.

- The rise in energy prices was across the board, with natural gas, electricity, and oil-based products all rising between 2% and 12% over the month. Disruptions to supplies of petroleum and natural gas caused by Hurricane Ida played a role in the September increases, but it was far from the sole cause of the spike. Oil prices have continued to rise in October, suggesting no reversal soon.

- Bottom line: Inflationary pressures persisted in September because of bottlenecks, supply shortages, and strong demand in addition to the usual number of special forces. Alas, the massive drop in airline fares is not likely to repeated soon to bail out the aggregates.

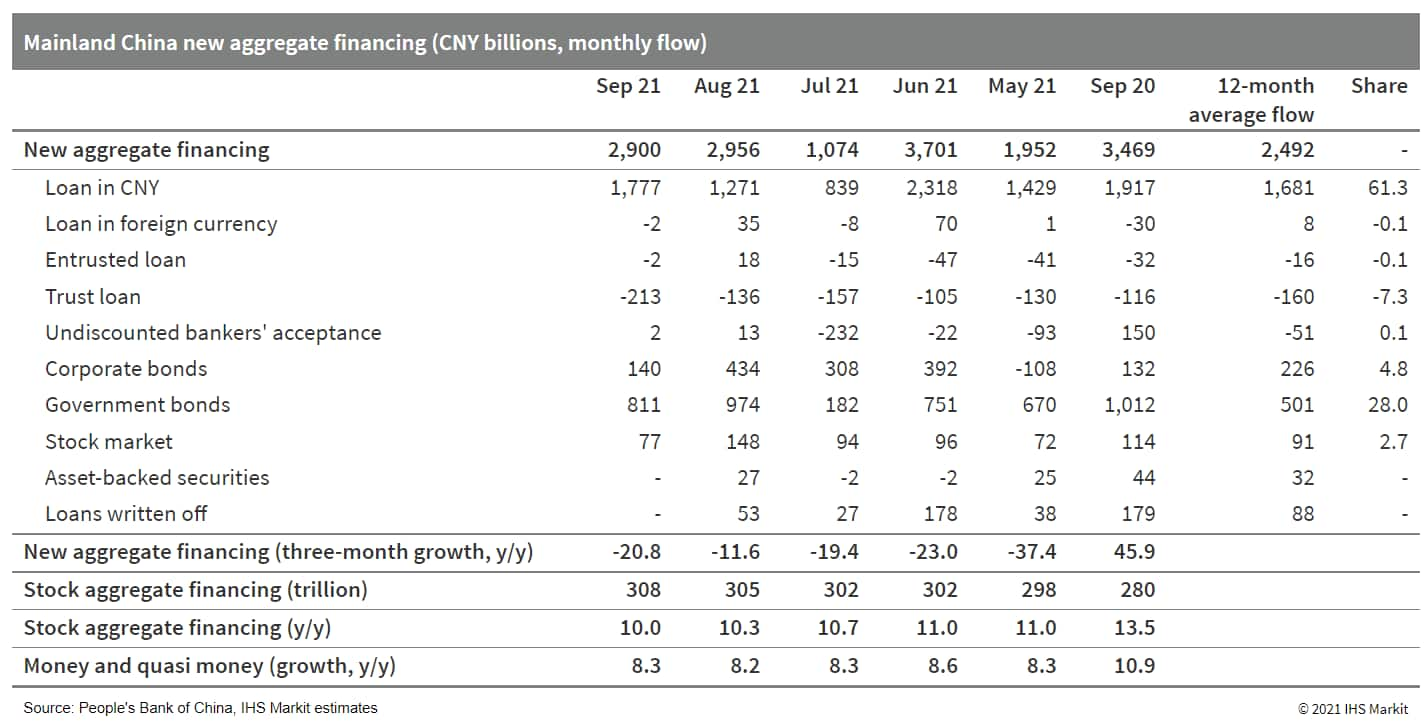

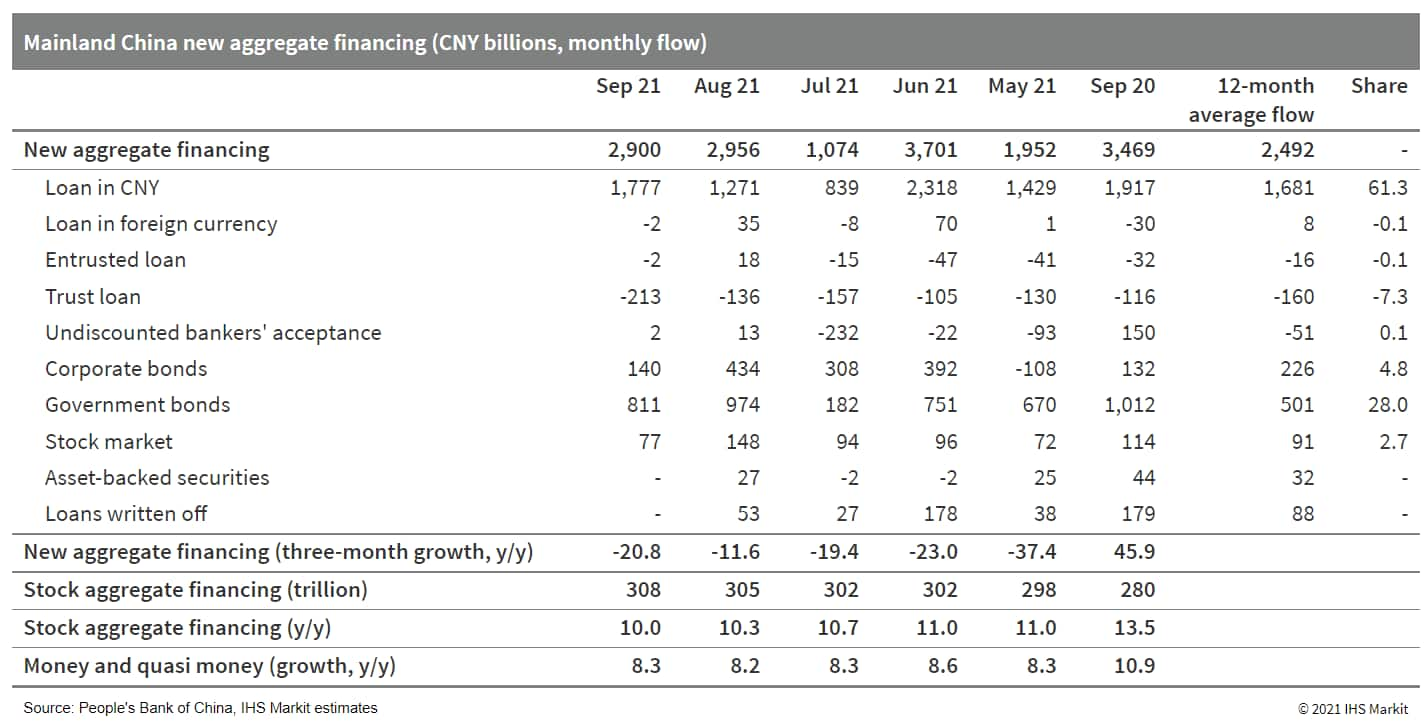

- Mainland China's new total social financing (TSF), the broadest measures of net new financing to the real economy, reached CNY2.9 trillion (USD449.13 billion) in September, down by CNY567.5 billion year on year (y/y) yet up by CNY387.6 billion from the comparable 2019 level, according to the People's Bank of China (PBoC). Stock TSF has expanded by 10.0% y/y through the end of third quarter, further slowed from 10.3% y/y in August and marked the seventh consecutive month of decline or no change in year-on-year growth rate. (IHS Markit Economist Lei Yi)

- Government bond issuance remained the major contributor to the year-on-year decline in new TSF, which registered a contraction of CNY200.7 billion y/y. This should partially be attributed to the relatively high base of over CNY1 trillion in September 2020, as this year's September reading was still higher than the 2019 level by CNY433.2 billion. On a month-on-month (m/m) basis, government bond issuance edged down by 17% from August, yet the September reading of CNY811 billion was still the second highest so far this year.

- Dissipated pandemic impact in September supported the mild month-on-month improvement in financing demand of the real economy. Renminbi-denominated loans rose by CNY506.1 billion from August, or a 40% m/m increase. Both household and corporate bank borrowing registered a month-on-month increase in September; yet year-on-year contraction persisted for medium-to-long-term borrowing, owing to the production curbs and power shortage disruptions, as well as continued financial de-risking and the Evergrande event weighing on home buying demand.

- India's economic activity accelerated sharply after the easing of lockdown restrictions in July, led by a rebound in industrial growth. A sharp rise in electricity demand, coupled with domestic supply constraints and soaring international energy prices, led to fuel shortages at power plants that are projected to last until at least mid-November, and potentially up to six months. With the effects of rising demand set to be dampened by emerging supply constraints, the real GDP growth forecast for fiscal year (FY) 2021 remains at 7.7%, with supply disruptions posing a significant downside risk to the recovery's momentum. (IHS Markit Economists Rashika Gupta, Deepa Kumar, and Hanna Luchnikava-Schorsch)

- India's industrial sector has undergone a solid recovery in recent months, after state-level restrictions to contain the second wave of the coronavirus disease 2019 (COVID-19) virus pandemic were progressively eased. The weak base of the previous year's national lockdown has kept the index of industrial production in double-digit expansion in annual terms since March, but it has also shown a sequential improvement in growth since June, with output now exceeding pre-pandemic levels.

- Post-lockdown pent-up demand drove the expansion of capital, infrastructure, and intermediate goods, as well as consumer durables in June and July, while non-durable goods production finally returned to growth in August.

- The Reserve Bank of India (RBI)'s consumer survey showed a sharp rebound in sentiment in September, with the current situation and future expectation indices now either above or nearing the level seen before the start of the second pandemic wave in April. This improvement is largely due to subsiding pandemic concerns and improved vaccination progress since August, with approximately 20% of the population now being fully vaccinated and nearly 52% having received at least one dose of vaccine. Although the risk of a possible third pandemic wave has not fully subsided, it has now diminished greatly, with new daily infections remaining in decline.

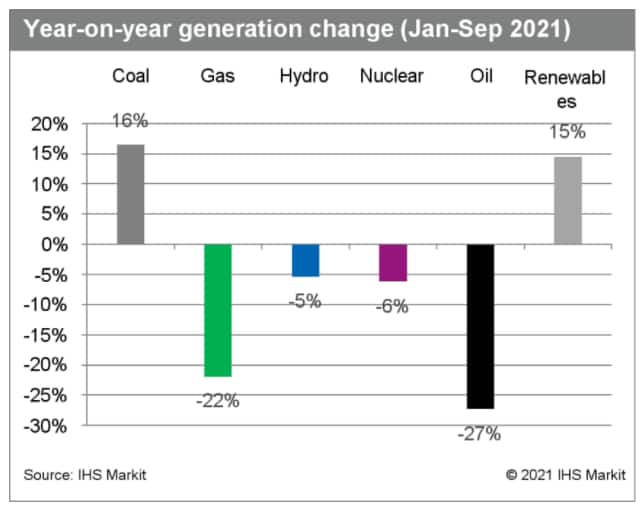

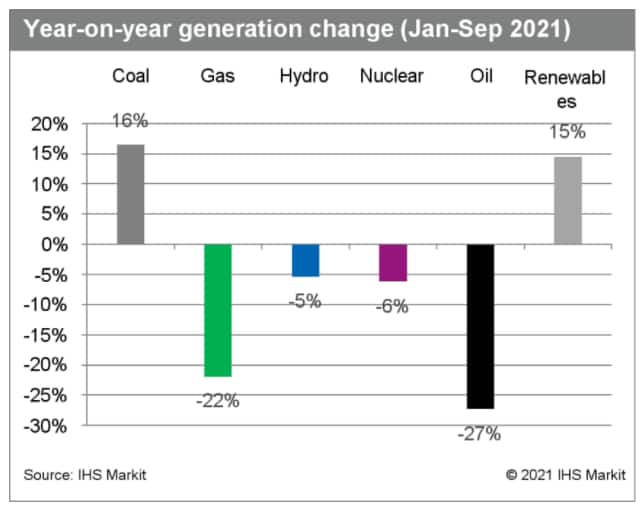

- Electricity demand has remained strong throughout the year, registering robust growth of 11% year on year (y/y) in January-September 2021, despite localized lockdown measures in April-May 2021 and normal-to-good monsoon rainfall during June-September 2021. After two consecutive years of poor growth, the rebound in power demand in 2021 was expected. However, it has exceeded all records, registering average growth of 5% on pre-pandemic levels (January-September 2019).

- India's power output has also remained strong since the start of 2021 and was up by 13.7% in the first half of the year, as indicated by the index of industrial production. However, the surge in demand and disproportionate pressure on coal as a source of power generation have led to supply constraints, leaving power plants with critically low stocks. India's power generation capacity (388 GW) is dominated by coal, which accounts for about 54% of the total capacity mix and approximately 72% of the generation mix. The availability of coal resources is therefore critical for the smooth operation of the Indian power system.

- Bruce Power, which for 20 years has leased a massive nuclear plant on Lake Huron from Ontario Power Generation, on October 14 announced a series of changes, including increased power output and supply of medical isotopes. The new site generation peak is 6,550 MW, an increase from 6,300 MW in 2016, which has been achieved through investments and innovations in the facility. Bruce Power also announced a Cobalt-60 isotope harvest later this year. The medical isotopes will be sent to Ottawa-based Nordion for processing and distribution, and will provide enough isotopes to sterilize 10 billion pairs of surgical gloves and COVID swabs. Isotopes from the harvest will also be used in the treatment of breast cancer and brain tumors. The company also launched 'Project 2030' with the goal of achieving a site peak of 7,000 MW by 2030 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovations, and leveraging new technology, which could include integration with storage and other forms of energy to increase the site peak at Bruce Power. (IHS Markit PointLogic's Barry Cassell)

- Volkswagen (VW) Group CEO Herbert Diess has reportedly warned the automaker's supervisory board that delaying its battery electric vehicle (BEV) program could lead to up to 30,000 job losses. Two sources told Reuters that Diess added that competition from new entrants in the German market had led to the company accelerating this shift to BEVs. VW spokesperson Michael Manske confirmed Diess's position, stating, "There is no question that we have to address the competitiveness of our plant in Wolfsburg [Germany] in view of new market entrants." Referring to Tesla preparing to start production in the country, he added, "Tesla is setting new standards for productivity and scale in Grunheide [Germany]." Manske went on to say, "A debate is now underway and there are already many good ideas. There are no concrete scenarios." Following the report, which first appeared in Handelsblatt, a spokesperson for VW's workers' council said that although it would not comment on the remarks, "a reduction of 30,000 jobs is absurd and baseless". It is unclear why the comments were made in this situation. However, the threat of a 30,000-employee headcount reduction under any circumstances would create huge ripples within the organization, and especially among its highly unionized workforce in Germany. The report indicates that the comments were made in relation to Tesla's upcoming site in the country, which is expected to have a capacity of around 500,000 units per annum (upa) yet will employ just 12,000 staff. In comparison, VW's main Wolfsburg facility is said to be capable of building 700,000 upa with 25,000 staff. (IHS Markit AutoIntelligence's Ian Fletcher)

- Hyundai plans to develop its own semiconductors to reduce reliance on chipmakers, reports Reuters, citing Hyundai's global chief operating officer José Muñoz. It is working on developing its own chips, an effort which he said "takes a lot of investment and time". The automaker's parts affiliate Hyundai Mobis would play a key role in the in-house development plan. Muñoz noted the worst has passed for the industry chip shortage, adding Hyundai had the "toughest months" in August and September. "The [chip] industry is reacting very, very fast," he said, adding that Intel is investing a lot of money to expand capacity. "But also in our case, we want to be able to develop our own chips within the group, so we are a little bit less dependent in a potential situation like this". He also said that Hyundai aims to deliver vehicles at the level of its original business plan in the fourth quarter, and offset some of its production losses next year. It is also on track to produce electric vehicles (EVs) in the US in 2022, and is looking into both enhancing its existing factory in Alabama and increasing its production capacity. (IHS Markit AutoIntelligence's Jamal Amir)

- Total US retail trade and food services sales increased 0.7% in September. Core retail sales were stronger than expected, implying more personal consumption expenditures (PCE) in the third and fourth quarters. (IHS Markit Economists James Bohnaker and William Magee)

- Gasoline station sales rose 1.8% and were up 38% over 12 months. Gasoline consumption in the US has made a full recovery to pre-COVID-19 levels, and elevated pump prices are also supporting nominal gasoline sales. Regular gas prices averaged $3.18/gallon in September, the highest monthly level since 2014.

- Sales at motor vehicle and parts dealers increased 0.5% in September to end a four-month slide, leaving the level of sales still 13% lower than its April peak. Auto sales will not soon approach early 2021 levels as semiconductor chip shortages and high retail prices are expected to persist well into next year.

- Sales at food services and drinking places increased 0.3%, suggesting that the restaurant industry continued to recover modestly in September despite the spread of the Delta variant.

- Retail sales increased strongly and broadly in September as consumers likely funneled more of their spending toward goods and away from services. Ongoing virus concerns could mean a more gradual return to pre-pandemic spending patterns.

- This report may also reflect earlier-than-usual holiday shopping as it has been widely publicized that supply-chain disruptions will result in product shortages and longer delivery times over the next several months.

- The US University of Michigan Consumer Sentiment Index decreased 1.4 points from its September level to 71.4 in the preliminary October reading—still slightly below its nadir in April 2020 and nearly the lowest in a decade. (IHS Markit Economists James Bohnaker and William Magee)

- The decline was driven by worsening views on both the present situation and the future. The present situation index fell 2.2 points to 77.9, and the expectations index declined 0.9 point to 67.2.

- Elevated consumer prices are weighing on sentiment. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.2 point to 4.8% to reach its highest level since 2008. This is likely a reaction to higher gasoline prices, which averaged $3.27/gallon during the week ended 11 October. Pump prices are at a seven-year high.

- However, consumers expect price pressures to ease over the longer term; the expected 5-to-10-year inflation rate declined 0.2 point to 2.8%, which is well within the historical range over the past several decades.

- Views on buying conditions for big-ticket items remained poor. The index of buying conditions for large household durable goods and automobiles slumped further as high prices and limited inventories continue to be challenges. The index for homebuying conditions improved off cycle lows but is severely depressed in a historical context.

- The recent trend in consumer sentiment is somewhat at odds with other measures of consumer activity. Retail sales and data on credit- and debit-card spending suggest that consumers are spending confidently heading into the fourth quarter. The weakness in sentiment is likely a reflection of ongoing anxieties about the Delta variant, even though the number of COVID-19 cases in the US has declined in recent weeks. Higher prices for gasoline and other consumer products are also factors weighing on sentiment. We expect that sentiment will track spending more closely as these factors improve.

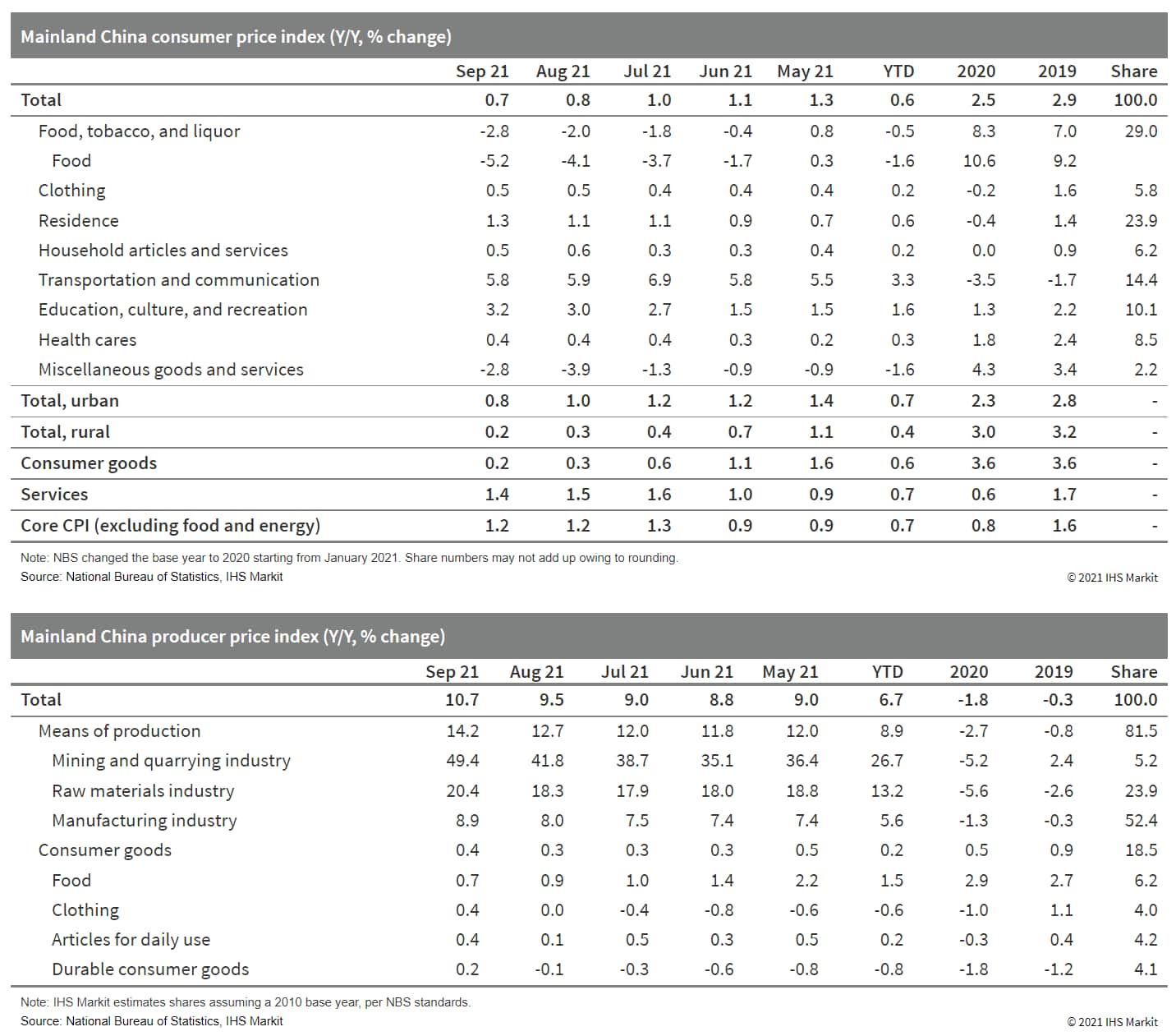

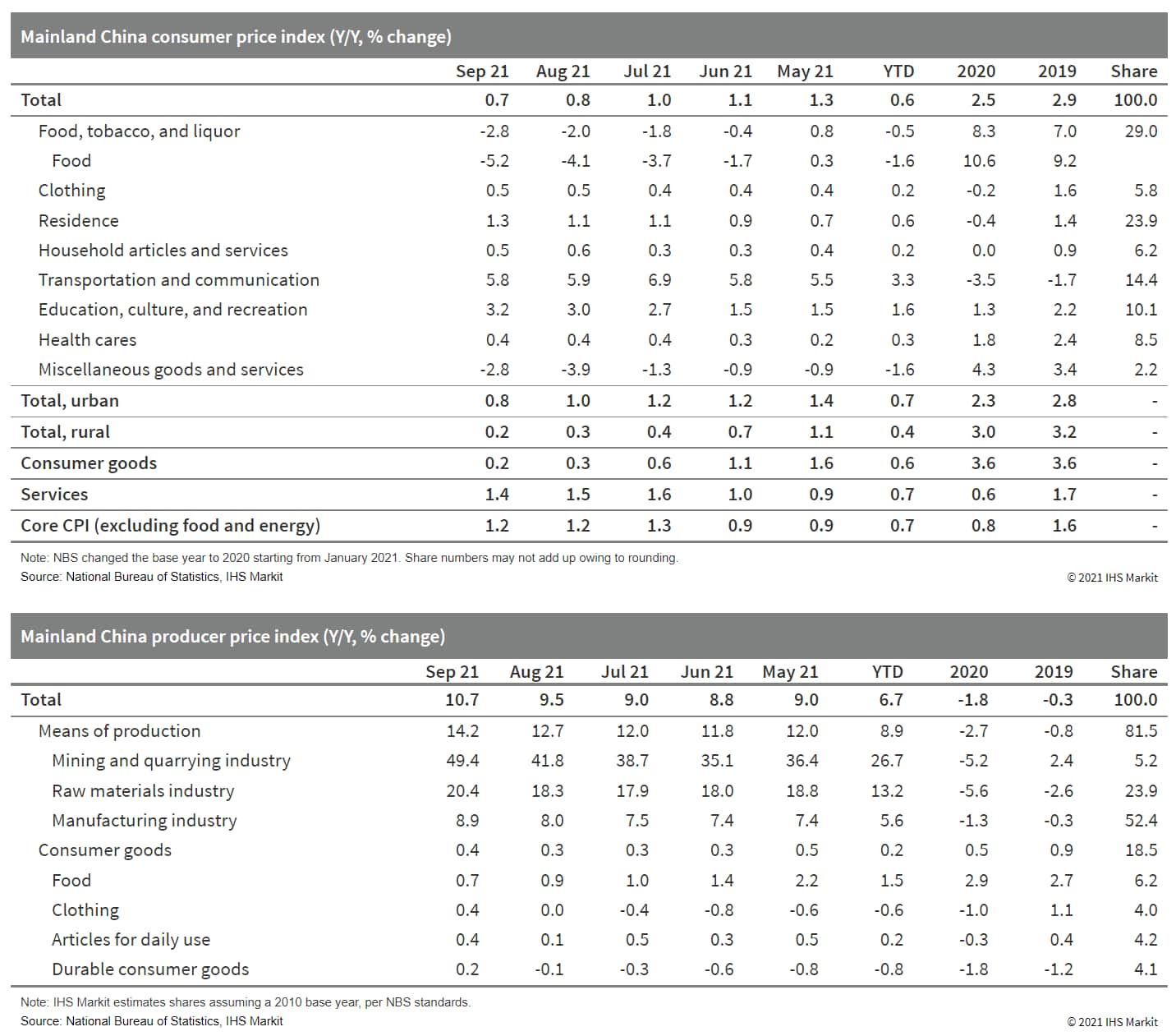

- Mainland China's Consumer Price Index (CPI) increased by 0.7% year on year (y/y) in September, down by 0.1 percentage point from the August reading, according to the National Bureau of Statistics (NBS). Month-on-month (m/m) CPI inflation came in at 0.0%, down by 0.1 percentage point from the prior month. (IHS Markit Economist Lei Yi)

- The disinflation in headline CPI inflation largely came from the widened deflation in food prices, which fell by 5.2% y/y in September. Pork prices deflation, in particular, registered 46.9% y/y in September, up by 2 percentage points from August. Non-food prices, on the other hand, increased by 2.0% y/y in September compared with 1.9% in August, led by rising vehicle fuel prices. Sporadic COVID-19 outbreaks moderated service price inflation, which fell by 0.1 percentage point to 1.4% y/y in September, with air tickets, tourism agency, and hotel accommodation services all reporting weaker inflation than the month before. Excluding the volatile food and energy components, core CPI inflation stayed unchanged from the prior month at 1.2% y/y.

- The Producer Price Index (PPI) inflation hit a record high, ticking up by 1.2 percentage points to reach 10.7% y/y in September. Month-on-month PPI inflation registered 1.2%, up by 0.5 percentage point from August.

- The Colombian energy regulator published on 26 September the list of the companies that qualified for the third auction of renewable energy projects, to be held on 26 October. The energy ministry also published on 30 September 2021 Colombia's hydrogen roadmap, targeting 1GW of electrolysis capacity by 2030 and escalated usage of fuel-cell vehicles. Both developments point to a rapid expansion in renewables in the country, which would attract large-scale foreign investment and generate thousands of jobs, according to the energy ministry. (IHS Markit Country Risk's Carlos Caicedo)

- Colombia largely relies on hydropower, but has considerable potential to develop renewable sources. The energy matrix in Colombia is currently dominated by hydropower, accounting for 69.6% of power generation, followed by natural gas with 12.3% and coal with 9.3%. Gasoline and diesel account for 7.8%, while non-conventional renewable resources contribute just 1% to energy generation.

- The upcoming October auction is the result of recent landmark regulatory implementation. Several milestones have been accomplished in 2021 to date, such as the approval by Congress of the Energy Transition Bill in June, the award of the first auction of storage in lithium batteries (to be used as backup) in July, and the publication of terms for the third auction of renewable energy slated for 26 October.

- The publication of the hydrogen roadmap adds to Colombia's ambitious plan for renewables. On 30 September 2021, the energy ministry published the country's hydrogen roadmap that "establishes the path for the development, generation and use of this cleaner energy, promoting the consolidation of Colombia's energy transition for the next 30 years", according to the government.

- Colombia appears certain to boost electricity generation coming from renewables, but poor infrastructure and lengthy environmental licensing procedures pose hurdles. Colombia's infrastructure is deficient, and this is likely to slow development of projects. The obsolete power distribution network will require both an overhaul and the construction of additional lines. Poor road and port infrastructure, particularly in the Guajira department, where the largest projects will be located, will slow the delivery of equipment and machinery to production sites.

- Taiwan Semiconductor Manufacturing Co. (TSMC) has announced plans to build a new chip manufacturing plant in Japan in 2022, reports Kyodo News, citing the company's CEO C. C. Wei. TSMC will invest around JPY1 trillion (USD8.8 billion) in the new plant, which will produce 22-nanometer and 28-nanometer chips, and will also receive financial aid from the Japanese government. "Facilitating the domestic production of semiconductors is extremely important," said Japanese industry minister Koichi Hagiuda. The plant is expected to begin operations from the end of 2024 and will be jointly run with Sony Group Corporation. According to sources familiar with the matter, Denso Corporation is also considering joining the project. The latest plan by TSMC is pending approval from its board. The company has not yet disclosed the location of the plant and other details such as capacity. The new plant will focus on the production of chips that are currently having the biggest supply issues because of high demand from automakers and technology companies. (IHS Markit AutoIntelligence's Isha Sharma)

Note: US fixed income markets were closed in observance of the Columbus Day and Indigenous Peoples' Day market holidays on Monday, October 11, 2021

Posted 18 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.