Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 26, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing and services PMIs will be released next week for a detailed look into November economic conditions. The turn of the month also brings the US jobs report for November and eurozone inflation data, all of which will be watched intently for central bank policy guidance.

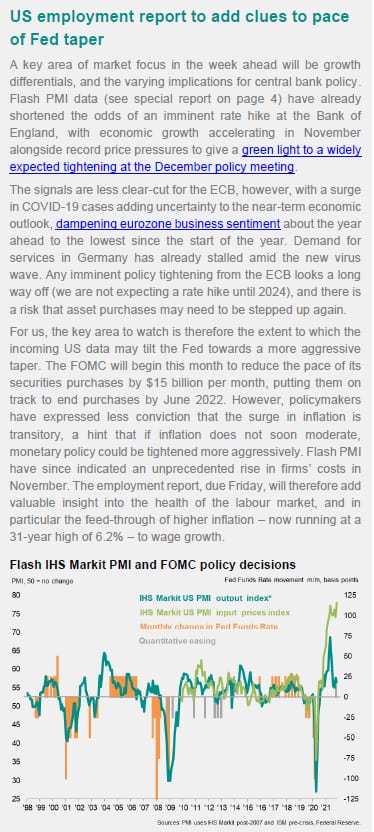

The past week has been one of see-sawing sentiment towards inflation and central bank outlooks, particularly the Fed. The renomination of Fed chair Jerome Powell - a relatively less dovish choice compared to Lael Brainard (now also the vice-chair pick) - saw equities trading lower at the start of week. That changed ahead of the Thanksgiving holidays, whereby data, including the IHS Markit Flash US Composite PMI revealed a steady recovery of the US economy. Details from the November Fed FOMC minutes meanwhile pointed to mixed views on inflation, but hinted at a preparedness to raise rates "sooner than participants currently anticipated" if warranted by the data, therefore placing additional focus on the week's upcoming employment report, another of the Fed's highly watched gauges.

The inflation situation meanwhile also runs hot in the eurozone, as indicated by the flash PMI data. The key focus for the region will therefore be on the flash HICP inflation reading.

APAC economies will get a fresh set of PMI updates for November, one keenly watched for sustained growth amid the recovery from the latest Delta wave and for any signs of supply constraints abating.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.