Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 26, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

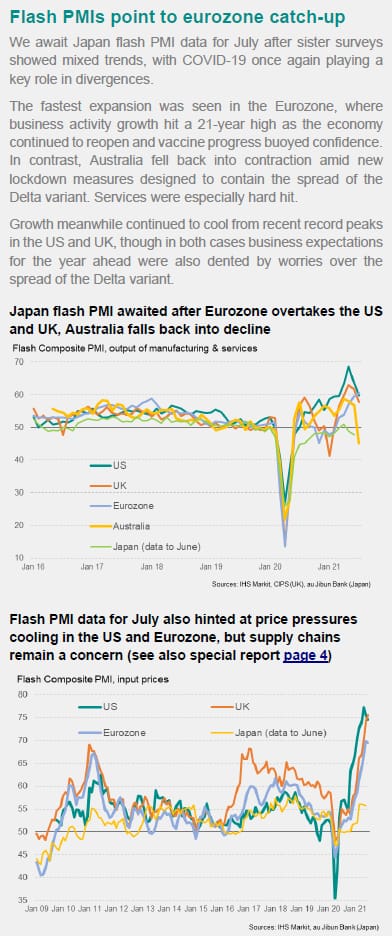

The Fed convenes its Federal Open Market Committee (FOMC) with markets looking for confirmation that the Fed still sees the spike in inflation as transitory after CPI jumped to 5.4% in June. Friday's flash PMI data brought some relief on this front, with the US survey price gauges down for a second straight month to hint that the inflation surge may have already peaked.

However, even with recent falls, the survey price indicators remain elevated globally, and supply chain delays remain widespread. The latter have been further exacerbated by the Delta variant leading to more production and shipping problems in Asia Pacific in particular. If further COVID-19 waves mean supply problems persist for longer than previously thought, raw material prices could stay higher for longer. And the longer these goods prices remain stubbornly high, the greater the chance of wage pressures growing.

On the other side of the inflation equation, demand growth is showing some signs of peaking as the initial boost from the reopening of economies fades. The flash PMI surveys also saw a sharp pull-back in business expectations about the year ahead, as more uncertainty crept in, due mainly to the Delta variant.

Thus, while second quarter GDP readings also released during the week will inevitably show impressively strong growth in economies including the US and Eurozone, more uncertain will be the strength of Japan's flash PMI as a fourth COVID wave hits the economy, and July's broader global PMIs due at the start of August.

Contact us

PMI commentary: Chris Williamson, Jingyi Pan

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location