Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 27, 2023

After the Fed meeting and March flash PMI releases, a series of economic data takes over as the highlights to watch amid increasing financial market stress. This includes the US core PCE data, eurozone inflation and early PMI figures out of some APAC economies. A number of central bankers will also be making appearances across the week, including Fed members, and their comments are expected to be closely watched for further insights into how financial stability could detract from the inflation focus.

The Fed FOMC meeting concluded largely in line with expectations this week, whereby the Fed struck a balanced tone between their banking sector concerns and its price stability restoration mission, much like the 25 basis points (bps) hike that was implemented. Furthermore, the Fed also carved out room for manoeuvring in upcoming meeting by loosely committing to further hikes.

That said, the summary of economic projections continued to reflect a median forecast for the target range to reach 5%-5.25% by the end of 2023, suggesting that the Fed's inflation focus remains little changed and therefore continue to be data-dependent. As far as the latest S&P Global Flash US Composite PMI is concerned, input cost pressures for firms have eased, but output price inflation rose, outlining the arduous journey in the inflation fight for the Fed. Next week's core PCE data for February will therefore be keenly assessed alongside indicators such as consumer confidence, personal income and consumption for a health check of the US economy.

Meanwhile March flash HICP figures for the eurozone will be due after S&P Global Flash Eurozone Composite PMI revealed that prices continued to rise sharply, albeit at a slower rate in March. In light of the European Central Bank's determination to bring inflation down from current elevated levels, the latest readings may continue to back the hawks.

Finally, in APAC, we will watch the Bank of Thailand for any further hikes in March. More importantly, NBS PMIs from mainland China and S&P Global's Taiwan Manufacturing PMI will be released at the end of week, providing insights after Australia and Japan flash PMI revealed mixed signals for March.

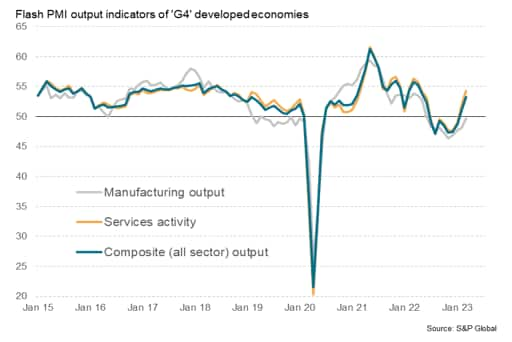

Financial market impact of the flash PMIs was blurred by ongoing concerns over banking sector stress, but where a message was taken it was generally that the surveys continued to point to reduced near terms recession risks, with output growth accelerating across the world major developed economies on average.

However, drill down deeper and the cracks appear. In particular, developed world growth is being driven almost entirely by the services economy, which is surprising given the sector's exposure to higher interest rates and the impact of the cost-of-living squeeze on households. We therefore remain sceptical of the resilience of this upturn, especially as at least some of the recent impetus appears to be derived from short-term factors such as a warmer than usual start to the year and a post-pandemic tailwind for travel.

Meanwhile in manufacturing there were signs of the sector stabilizing after the slump of late last year, but this flat picture is being driven by improving supply rather than any fundamental upturn in demand,. In fact, new orders for goods continued to fall across the four largest developed economies on average, down for a tenth straight month. In short, manufacturers are maintaining production merely by eating into backlogs of work. In the absence of new demand, production growth will inevitably slow. The risk is that, with interest rates being hiked again in March in Europe and the US, such demand improvement looks unlikely. This would leave economic growth dependent on what looks like an unsustainable burst of life in the service sector.

Monday 27 March

Japan Service PPI (Feb)

Japan Leading Indicator Revised (Jan)

Eurozone M3 (Feb)

Germany Ifo Business Climate (Mar)

United Kingdom Nationwide House Price (Mar)

Tuesday 28 March

Australia Retail Sales (Feb)

United States CaseShiller Home Price Index (Jan)

United States Consumer Confidence (Mar)

Wednesday 29 March

Germany GfK Consumer Sentiment (Apr)

Norway Retail Sales (Feb)

Thailand 1-Day Repo Rate

United States Pending Sales Change (Feb)

Thailand Manufacturing Production (Feb)

Thursday 30 March

India Market Holiday

Switzerland KOF Indicator (Mar)

Eurozone Business Climate (Mar)

Eurozone Consumer Confidence (Mar)

Germany CPI (Mar, prelim)

United States GDP (Q4, final)

United States Initial Jobless Claims

Friday 31 March

South Korea Industrial Output (Feb)

South Korea Retail Sales (Feb)

Japan CPI, Tokyo (Mar)

Japan Unemployment Rate (Feb)

Japan Industrial Output (Feb, prelim)

Japan Retail Sales (Feb)

Taiwan S&P Global Manufacturing PMI* (Mar)

China (Mainland) NBS Manufacturing PMI (Mar)

Japan Housing Starts (Feb)

Germany Import Prices (Feb)

Germany Retail Sales (Feb)

United Kingdom Current Account (Q4)

Switzerland Retail Sales (Feb)

Thailand Trade (Feb)

Thailand Current Account (Feb)

Hong Kong Retail Sale (Feb)

United Kingdom GDP (Q4)

United Kingdom Business Investment (Q4)

Eurozone HICP (Mar, flash)

Eurozone Unemployment Rate (Feb)

Norway Unemployment (Mar)

United States Personal Income and Consumption (Feb)

United States Core PCE Price Index (Feb)

Canada GDP (Jan)

United States UoM Sentiment (Mar, final)

* Press releases of indices produced by S&P Global and relevant sponsorscan be found here.

Americas: US Q4 GDP final estimate, core PCE, consumer confidence, personal income and consumption figures, Canada GDP

Following the FOMC meeting, a series of economic data releases will be eagerly anticipated including the final estimate for US Q4 GDP and February's core PCE reading. While the Q4 GDP may be relatively backward-looking data, attention will be with the core PCE, consumer confidence and personal and incoming figures. A stronger than expected US CPI reading previously added pressure to the Fed prior to the eruption of the slew of banking sector issues. Developments on the Fed's favourite inflation gauge, the core PCE index, will likewise be key. Meanwhile personal incoming and consumption growth is expected to slow in February according to consensus expectations.

Canada GDP reading for January will also be due.

Europe: UK Q4 GDP, eurozone inflation, consumer confidence

Across the Atlantic, the UK updates Q4 GDP which saw a preliminary print of 0.4% year-on-year (y/y). More recent PMI figures offer some support, however, including the latest March S&P Global / CIPS Flash UK Composite PMI reading which indicated the UK may have returned to growth in Q1.

In the eurozone, post the flash PMI releases, we will get the flash HICP data and consumer confidence figures for March. Flash PMI data suggested that price pressures eased, though remained elevated by historical standards.

Asia-Pacific: Mainland China NBS PMI, Taiwan S&P Global Manufacturing PMI, Bank of Thailand meeting, Japan unemployment rate, Tokyo CPI

In APAC, mainland China's National Bureau of Statistics releases their PMIs while the S&P Global's Taiwan Manufacturing PMI will also be due ahead of the market holidays at the start of the new week. The PMI figures offer a first look into March economic conditions while S&P Global PMI figures for the wider APAC region will be updated over the course of the following week.

Meanwhile, the Bank of Thailand convenes in the final week of March and will be watched for any further action after four consecutive hikes.

Finally in Japan, Tokyo area CPI and nationwide unemployment figures are expected in the week.

Flash PMI Data Signal Accelerating Developed WorldEconomic Growth in March - Chris Williamson

Thailand's Tourism Sector Drives Economic Recovery - Rajiv Biswas

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.