Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 19, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI for May will be released in the coming week for a first look at economic conditions midway into the second quarter. Additionally, Fed minutes from the FOMC's May meeting will be eagerly anticipated while, on the economic data front, GDP will be due from several economies including the US, Germany, Taiwan and Singapore. Inflation data are also expected from the US, UK, Singapore and Malaysia.

Risk sentiment has been frail at the start of the week, affected by concerns around the US debt-ceiling, though this was not unexpected with the S&P Global Investment Manager Index having preluded this likelihood across the month of May.

That said, the attention in the coming week may be split with economic fundamentals amid a flurry of economic releases and the US Fed minutes from their early May meeting due. Specifically, the May FOMC meeting re-emphasised the Fed's focus on the evolution of inflation, thereby shifting the attention to the Fed's favourite inflation gauge - the core PCE data - which is updated on Friday, in addition to scrutinising the minutes for further insights into the Fed's interest rates outlook.

The series of flash PMI data for May will also help to better inform the market of current economic conditions with sub-indices such as business activity and price indices to watch for growth and inflation developments. With a marked divergence between manufacturing and service performance persisting on a global scale in April, it will be of interest to assess whether current expansions across major developed economies will continue as this can affect the already delicate risk sentiment across markets.

As well as the UK flash PMI, inflation data will be keenly watched by the Bank of England after selling price inflation for goods and services reaccelerated in April according to PMI indications. This was primarily driven by service sector price increases amid higher demand for services.

Finally, in APAC, Bank of Korea and Bank Indonesia will convene to update monetary policy, though no changes are expected according to consensus.

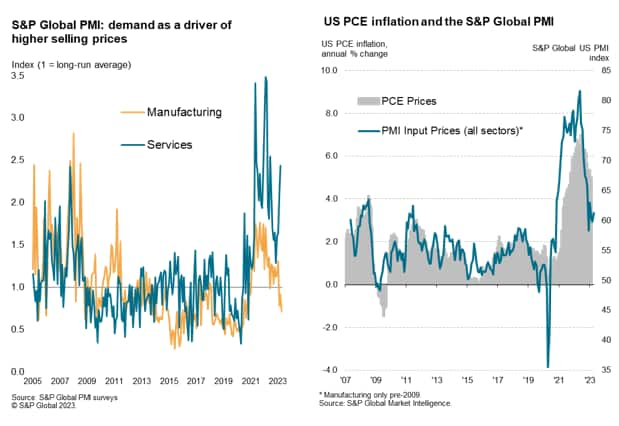

In addition to revealing a marked divergence between strong service sector expansions - led by post-pandemic spending by consumers - and subdued manufacturing growth, the various flash PMI surveys for the major developed economies - due to be updated for May in the coming week - have signalled a corresponding shift in inflationary pressures from goods to services.

Measured globally, the surveys have shown demand acting as a driver of higher prices in the service sector to an extent not exceeded since 2007 in recent months, barring some months seen during the reopening of economies after lockdowns in 2021 and early 2022.

In contrast, demand is now acting a driver of higher selling prices for goods to the lowest extent seen since September 2020, in fact acting as a disinflationary force compared to its long run average.

The PMI data have a good track record of accurately anticipating changes in official inflation data, with the input cost gauges in particular tending to act with a lead of several months on CPI and other inflation measures. Hence the stickiness of some of these PMI price indicators have been a cause for concern and need to be watched closely in the upcoming flash releases.

The S&P Global US PMI input cost index, covering both manufacturing and services, for example, showed a reacceleration of cost pressures in April to a four-month high. The US survey's index of selling price inflation for US goods and services gathered pace for a third straight month. All of which suggests the Fed's closely watched PCE inflation gauge, also updated this week, could likewise prove stubbornly elevated.

Monday 22 May

Canada Market Holiday

Japan Machinery Orders (Mar)

China (Mainland) 1Y and 5Y Loan Prime Rate (May)

Taiwan Export Orders (Apr)

Hong Kong Inflation (Apr)

Eurozone Consumer Confidence (May, flash)

Tuesday 23 May

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany HBOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea Consumer Confidence (May)

Singapore CPI (Apr)

Taiwan Industrial Production (Apr)

Eurozone Current Account (Mar)

United States New Home Sales (Apr)

United States Building Permits (Apr)

Wednesday 24 May

South Korea Business Confidence (May)

United Kingdom Inflation (Apr)

Germany Ifo Business Climate (May)

United States Fed FOMC Minutes (May)

Thursday 25 May

South Korea BOK Interest Rate Decision

South Korea PPI (Apr)

Germany GDP (Q1, final)

France Business Confidence (May)

Indonesia BI Interest Rate Decision

United States GDP (Q1, 2nd est.)

United States Initial Jobless Claims (May 20)

United States Pending Home Sales (Apr)

Friday 26 May

Japan Tokyo CPI (May)

Singapore GDP (Q1, final)

Australia Retail Sales (Apr, prelim)

Thailand Balance of Trade (Apr)

Malaysia CPI (Apr)

Singapore Industrial Production (Apr)

Taiwan GDP (Q1)

United Kingdom Retail Sales (Apr)

France Consumer Confidence (May)

United States Personal Income and Consumption (Apr)

United States Core PCE Price Index (Apr)

United States UoM Sentiment (May, final)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

May flash PMI releases

The first indications of May economic conditions come from the upcoming flash PMI releases for major developed economies including the US, UK, eurozone, Japan and Australia. All due Tuesday, May 23rd.

April's PMI surveys revealed better than anticipated performances, supported primarily by service sector growth across major developed economies. Whether the latest resurgent demand for services can continue to buoy growth, or if we will see a revival in manufacturing sector growth, will all be studied through the upcoming flash releases. Furthermore, supply chain, labour market and inflation updates will also be gleaned through the PMI sub-indices. Read more in our special report this week.

Americas: Fed FOMC minutes, Q1 GDP, core PCE, personal income and spending figures

Minutes from the latest May Federal Open Market Committee (FOMC) meeting will be published next week for insights into the Fed's thoughts.

Separately, a second estimate of the US Q1 GDP will be released while the Fed's preferred inflation gauge, the core PCE index, will be updated for April following weaker than expected headline CPI data. Amid the outperformance in consumer services, according to the S&P Global US Sector PMI, personal income and spending figures will also be of interest to assess the depth and continuity of the current growth spurt.

Europe: UK inflation, Germany GDP, Ifo data,

Besides the PMI figures, UK inflation data will be eagerly watched with the consensus pointing to higher year-on-year inflation, though falling on a monthly basis. A divergence in survey gauges of manufacturing and services selling price inflation was observed in April and the official data will be assessed for corresponding changes. UK retail sales are also updated.

Asia-Pacific: BOK, BI meetings, Taiwan GDP, Singapore CPI, GDP

In APAC, Bank of Korea (BOK) and Bank Indonesia (BI) will decide interest rates though no changes are expected according to consensus. Other tier-1 data releases include GDP from Taiwan and Singapore while April CPI will also be due from Singapore and Malaysia.

Previewing the May Flash PMI Surveys: Assessing Growth Resilience and Inflation Indicators - Chris Williamson

Malaysian Economy Shows Sustained Expansion in Early 2023 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.