Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 17, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy and important week ahead is packed with central bank policy decisions from the US, UK and Taiwan, while inflation data updates will be due from several economies including the UK, Canada and Japan. The most recent indications of economic conditions in March will also be gleaned from the flash PMI data from major developed economies, due next Friday.

The recent risk-off mood that captured markets had been well reflected in the latest March S&P Global Investment Manager Index (IMI) with risk appetite having fallen sharply, especially amongst North America investors. Furthermore, sector preferences revealed that the biggest month-on-month change was for financials as investors turned sharply bearish in March from a previously bullish stance in February towards the sector. While the latest Silicon Valley Bank (SVB) collapse dealt a significant blow to market sentiment, chief on the minds of the near 300 money managers in the IMI survey was instead the central bank policy outlook. This suggested to us that the macro picture remains a key factor in guiding the policy outlook and prices, which we will further track next week with the flash PMI data due for March (see box and special report).

Meanwhile, we will also seek confirmation on central banks' positioning, especially for the US Fed, widely viewed to be caught between their inflation fight and further financial stability restoration duties. Besides the degree to which the FOMC might hike rates in the upcoming March 21-22 meeting, with views ranging from no hike to the pre-SVB fallout consensus of 50 basis points, the rhetoric and projections will also be assessed for their near- to longer-term stance.

As far as recent official CPI figures and early survey price indicators have shown, the Fed's inflation fight is far from over. That said, recent market gyrations - one just has to take a look at the CBOE Volatility Index (VIX) - even after the authorities stepped in decisively with emergency measures to allay fears, underscores the nervousness in the markets regarding hidden sources of financial stress in the new higher interest rate environment.

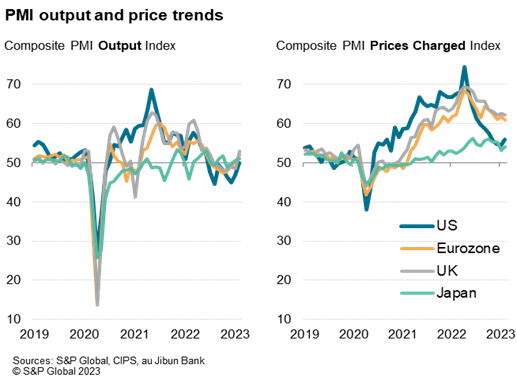

Last month's flash PMI surveys saw a strong market reaction as the better-than-anticipated data led to markets pricing in more aggressive rate trajectories for the FOMC and ECB in particular. While this more hawkish outlook is now being challenged by banking sector concerns, the macroeconomic data will still play a key steer on policy, hence the surveys will be back in focus.

Things to watch out for include hints about the sustainability of the revival of growth seen in February, which globally struck an eight-month high to allay recession fears (see special report). However, we note that this recent strength likely reflects some factors which may prove short lived. In particular, warmer than usual weather appears to have buoyed consumer spending in the US and Europe, notably on services The re-opening of the Chinese economy will also likely have provided a near-term fillip to growth which - based on prior re-openings - will quickly lose some of its impetus. Similarly, a recent improvement to supply chains have buoyed industrial production, but new order inflows need to rise to ensure this new level of production is viable.

We will also be eager to see how the price gauges have fared in March. Prior data saw some stubbornly elevated readings and, in some cases, increased rates of inflation during February. Watch out in particular for service sector input cost gauges, the lion's share of which is often accounted for by wages. Finally, but not least, we will need to keep an eye on the business expectations indices in the light of recent banking sector worries.

Monday 20 March

Japan BOJ Summary of Opinions (Mar)

China (Mainland) Loan Prime Rate (Mar)

Germany Producer Prices (Feb)

Taiwan Export Orders (Feb)

Eurozone Total Trade Balance (Jan)

United Kingdom House Price Rightmove (Mar)

Thailand Customs-Based Trade (Feb)

Tuesday 21 March

Japan Market Holiday

Australia RBA Meeting Minutes (Mar)

New Zealand Trade (Feb)

Hong Kong Overall Balance (Q4)

Germany ZEW Economic Sentiment (Mar)

Canada CPI (Feb)

Canada Retail Sales (Jan)

United States Existing Home Sales (Feb)

Wednesday 22 March

Indonesia Market Holiday

United Kingdom Inflation (Feb)

Norway Labour Force Survey (Feb)

United States Fed Funds Target Rate (22 Mar)

Thursday 23 March

Singapore CPI (Feb)

Philippines Policy Interest Rate (Mar)

Taiwan Discount Rate (Q1)

Taiwan Industrial Output (Feb)

Switzerland SNB Policy Rate (Q1)

Norway Key Policy Rate (Mar)

United Kingdom BOE Bank Rate (Mar)

United States Current Account (Q4)

United States Initial Jobless Claims

United States New Home Sales (Feb)

Eurozone Consumer Confidence (Mar, flash)

Singapore Manufacturing Output (Feb)

Canada BOC Meeting Minutes (Mar)

Friday 24 March

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany S&P Global Flash PMI, Manufacturing & Services*

France S&P Global Flash PMI, Manufacturing & Services*

Eurozone S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan CPI (Feb)

United Kingdom GfK Consumer Confidence (Mar)

United Kingdom Retail Sales (Feb)

Taiwan Jobless Rate (Feb)

United States Durable Goods (Feb)

Thailand Manufacturing Production (Feb)

United Kingdom CBI Trends (Mar)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

March flash Purchasing Managers' Index (PMI) data

The earliest economic indicators for March, in the form of the flash PMI data for the US, UK, eurozone, Japan and Australia, will be released on Friday for a first look into economic conditions. Flash PMI data for February surprised on the upside for several economies including the US, UK, and eurozone, which led to shifting expectations with regards to central bank policies and corresponding market reactions. Meanwhile uncertainties persist with regards to growth, the inflation trajectory and wider business outlook. As such, the upcoming PMI data, especially the details from PMI sub-indices on new orders, suppliers' delivery times and prices, will be keenly watched to help shape market expectations.

Americas: US Fed FOMC meeting, Canada CPI

Next week's US Federal Open Market Committee (FOMC) meeting will be the highlight after recent financial stability concerns invited the market to pare back their rate hike expectations. The consensus has shifted from 50 basis points (bps) to 25bps. In addition to the rate decision, the meeting statement, projections and press conference will all be scrutinised for the Fed's position, especially as they balance the ongoing task in taming inflation with supporting financial stability. Als watch out for homes sales and durable goods orders data from the US, the former in particular being eyed for clues as to the resilience of the US housing market amid rising borrowing costs.

Europe: BoE meeting, UK inflation and retail sales, Eurozone consumer confidence and ZEW survey

With the Bank of England widely seen to be approaching the end of their tightening cycle, and amid ongoing financial market volatility, there exists uncertainty as to whether the BoE will implement another 25bps hike at its next MPC meeting. Absent the latest banking sector concerns, recent economic data, including the S&P Global / CIPS PMI, make for a compelling case to see the BoE move again, but some policymakers are of the view that inflation has peaked and hence policy tightening can be paused.

Asia-Pacific: Taiwan CBC meeting, China loan prime rate, Japan, Singapore CPI

In APAC, another central bank meeting unfolds in Taiwan while the loan prime rate will be due from mainland China. Besides flash PMI data, the focus will be with economic data including Japan and Singapore's CPI prints.

Global Recession Risks Ease as Business Growth Picks Up in February - Chris Williamson

APAC Region Expected to be Resilient to Global Headwinds in 2023 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.