Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 12, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The coming week will bring important insights into economic trends in the US and China at the start of the fourth quarter, most notably via industrial production and retail sales updates for October. Concerns are centred on the extent to which supply chain issues are limiting US output and whether ongoing COVID-19 related disruptions are again affecting China's factories. Similarly, while some alleviation of Delta wave infections will have likely helped support US consumer spending, tightened restrictions due to its "zero Covid" policy may have hurt China's high streets. However, while factory PMI data deteriorated for both the US and China in October, the more consumer-focused service sector PMIs rose.

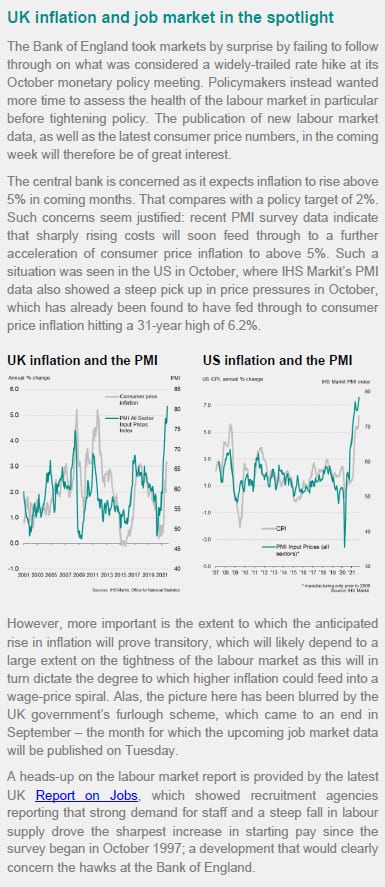

The focus in Europe will be on the UK as the Bank of England ponders whether to start hiking interest rates. Inflation data look set to show the further acceleration of price pressures, but more uncertain will be the impact of these higher prices on consumer spending, via updated retail sales numbers, and whether wage pressures are rising. Some insight into the latter will be provided by the official labour market report, which will have a particular importance given the Bank of England's stated focus on how the job market is holding up as the country's furlough scheme unwinds.

Also watch out for updated third quarter eurozone GDP numbers, the flash release for which showed a surprisingly strong 2.2% gain, as well as a first release of Japan's GDP, which looks to have fallen in the three months to September, albeit with recent survey data hinting at renewed strength in October.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location