Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 07, 2022

By Chris Williamson and Shreeya Patel

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

This week, a number of key economic releases will add insights to macroeconomic conditions in the US, UK and Eurozone after PMI survey data hinted at further global recession risks and persistent inflation, albeit with some encouraging rays of light.

US retail sales and inflation data will be high on the agenda for many this week. Retail sales figures in the US have been hard hit by the growing cost of living, though inflation data should indicate a further moderation in inflationary pressures, notably after easing cost pressures were indicated by PMI surveys. Consumer sentiment data will meanwhile provide a timely gauge into how households are coping with rising mortgage costs and the ongoing cost of living squeeze. Recent data have shown some signs of sentiment reviving, but the impact of rising interest rates may not yet be fully reflected. In that respect, the FOMC meeting minutes will also be eagerly assessed for guidance on the Fed's appetite for further rate hikes.

With the UK driving much of the market turmoil in recent weeks, the FX and gilt markets will be watching political developments as PM Truss seeks to restore some authority, and will be eager for more clues as to growing recession risks. UK unemployment, industrial production and GDP data will be released, with the latter in particular likely to add to signs that the economy contracted again in the third quarter. Eurozone watchers will keep a close eye on industrial production and German inflation data where in the latter the 70-year high is expected to be confirmed, presenting a picture of rising stagflation risks.

Key releases for mainland China will also be keenly awaited by markets this week amid signs that ongoing COVID-19 containment measures likely continued to restrain economic activity, though also suppressed price pressures. Data updates include inflation and balance of trade. Watch out also for Q3 GDP figures for Singapore, where forecasters expect a relatively solid expansion. The Bank of Korea will also convene to make another key policy decision, with rate hikes on the table.

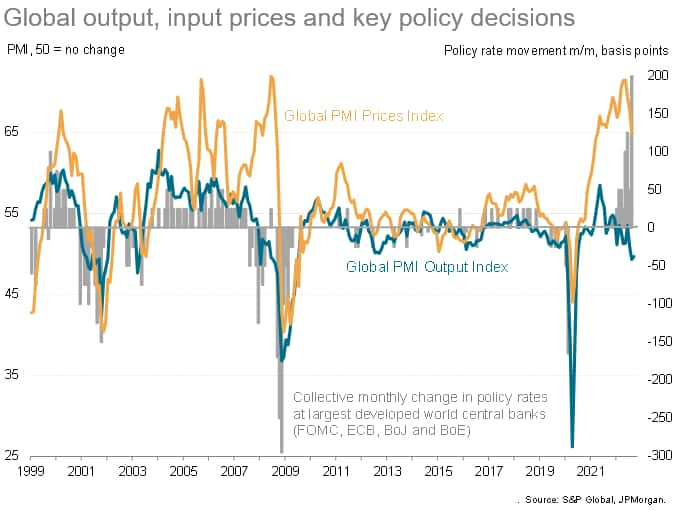

The September PMI surveys indicated a second month of falling global economic activity, rounding off the worst calendar quarter since 2009 if pandemic lockdown months are excluded. Inflationary pressures, as measured by the PMI input cost index (which covers average prices paid for a variety of inputs including raw materials, energy, rents, bought-in services and wages) remained elevated, but encouragingly fell to their lowest for one-and-a-half years.

The situation of course varies geographically, with the drop in inflationary pressures most evident in the US. Easing supply constraints, inventory drawdowns, lower oil prices and cooling demand took pressure off firms' costs, as did the stronger dollar. However, the energy crisis linked to the Ukraine war meanwhile meant cost pressures re-accelerated in Europe, exacerbated by weakened sterling and euro currencies. A similar currency effect was evident in Japan, where price pressures also rose.

The data will nonetheless fuel debate as to whether policymakers, notably in the US, will start to see their aggressive policy tightening as helping cool inflationary pressures. The concomitant increased risk of a global recession could potentially also further encourage a change in tone as to the required degree of further tightening. The upcoming FOMC minutes, as well as US consumer confidence and retail sales data, will provide further guidance in this respect.

Monday 10 October

Canada & Japan Market holiday

Indonesia Consumer Confidence (Sep)

Netherlands Manufacturing Production (Aug)

Finland Industrial Production (Aug)

Austria Industrial Production (Aug)

Greece Inflation Rate (Sep), Industrial Production (Aug)

United States Fed Evans Speech

New Zealand Electronic Retail Card Spending (Sep)

Tuesday 11 October

United Kingdom BRC Retail Sales Monitor (Sep), Unemployment Change (Aug)

Australia Building Permits (Aug)

Philippines Balance of Trade (Aug)

Indonesia Retail Sales (Aug)

Czech Republic Inflation Rate (Sep)

Hungary Core Inflation (Sep)

Italy Industrial Production (Aug)

Brazil Inflation Rate (Sep)

Wednesday 12 October

Australia Westpac Consumer Confidence Index (Oct)

Japan Machinery Orders (Aug)

South Korea Interest Rate Decision

United Kingdom GDP (Aug), Balance of Trade (Aug), Industrial Production (Aug), Construction Output (Aug),

Eurozone Industrial Production (Aug)

Mexico Industrial Production (Aug)

United States MBA Mortgage applications (Oct), PPI (Sep), FOMC minutes

India Industrial Production (Aug), Inflation (Sep)

Thursday 13 October

Japan Bank Lending (Sep), PPI (Sep)

Australia Consumer Inflation Expectations (Oct)

Germany Inflation (Sep), Current Account (Aug)

China New Yuan Loans (Sep)

United States Inflation (Sep), Jobless claims (Oct)

Brazil Business Confidence (Oct)

Friday 14 October

South Korea Unemployment Rate (Sep)

Japan Foreign Bond Investment (Oct)

Singapore GDP Growth (Q3)

China Inflation (Sep), Balance of Trade (Sep)

France Inflation (Sep)

Spain Inflation (Sep)

Eurozone Balance of Trade (Aug)

India Monetary Policy Meeting Minutes, Balance of Trade (Sep)

United States Retail Sales (Sep),

US University of Michigan Consumer Sentiment (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Americas: US Inflation, retail sales, consumer sentiment and FOMC meeting minutes

Another busy week for the US sees key economic data come to light with attention on inflation figures. Markets are forecasting inflation at 8.1% in September, easing from 8.3% in August. The energy crisis is still having profound implications on prices, but latest PMI releases suggest inflation pressures are starting to moderate. Meanwhile, retail sales and consumer sentiment data will shed light on household trends amid rising interest rates and the ongoing cost of living squeeze. Forecasts point a modest 0.2% increase in sales, but it will be especially interesting to see if the pessimism continues to ease. How the FOMC assessed the economic situation when hiking interest rates by another 75 basis points in September will meanwhile be revealed in the meeting minutes.

Europe: UK unemployment, GDP, industrial production, EZ industrial production and Germany inflation

The UK dominated headlines last week following market turmoil on the back of new tax decisions. This week, UK economic releases will be high on the agenda with GDP and labour market data providing an update on the country's performance. Unemployment data - out Tuesday - is expected to remain low despite growing price pressures on firms and businesses. GDP and industrial production data, meanwhile, will likely point to slowdowns in growth and will likely add to growing signs of recession.

Elsewhere in Europe, industrial production and trade data for the eurozone will likely remain weak, while a 10% inflation rate for September is expected to be confirmed in Germany.

Asia-Pacific: India industrial production, inflation, Singapore Q3 GDP, China inflation and balance of trade

APAC watchers are treated to a number of releases including Singapore's Q3 GDP estimate. Latest PMI data for Singapore have remained strong, with the country topping the ASEAN rankings in recent months. China inflation and balance of trade data will also be watched with the latter expected to take a hit from a combination of virus-containment measures and weak global demand.

In India a strong industrial production performance is expected while inflation figures will loiter around the 7% mark. The Bank of Korea will meet to set interest rates, where they will likely not shy away from another hike despite a slowdown in September's inflation rate.

Global manufacturing - Chris Williamson

APAC - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.