Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 07, 2023

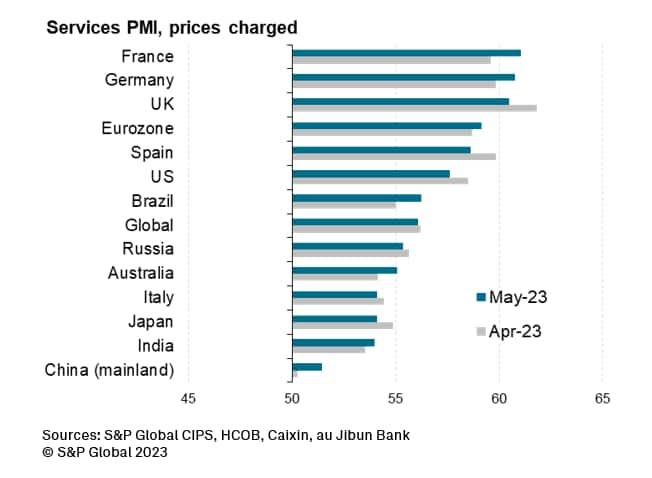

Inflationary pressures eased globally in May, according to the latest PMI survey data, though remained elevated thanks principally to wage pressures. Price rises were hence more widely seen in the labour-intensive services economy, but selling prices fell in manufacturing for the first time in three years. Especially stubborn selling price pressures were seen in the UK, while - at the other end of the scale -prices fell in mainland China.

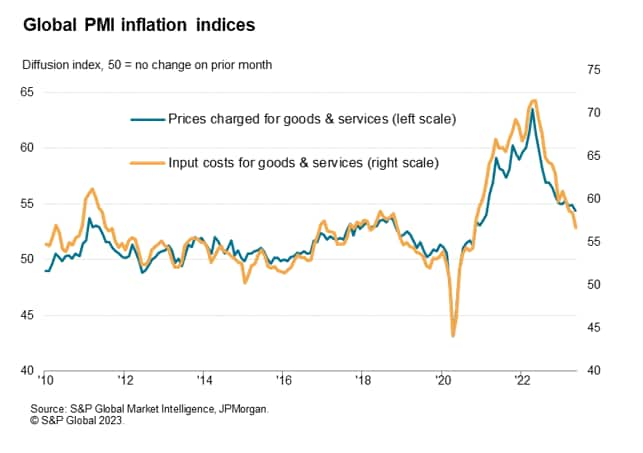

The Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - showed companies' costs continuing to rise sharply in May, though the rate of increase moderated further from the near-record highs seen this time last year. May's increase was the smallest recorded since October 2020.

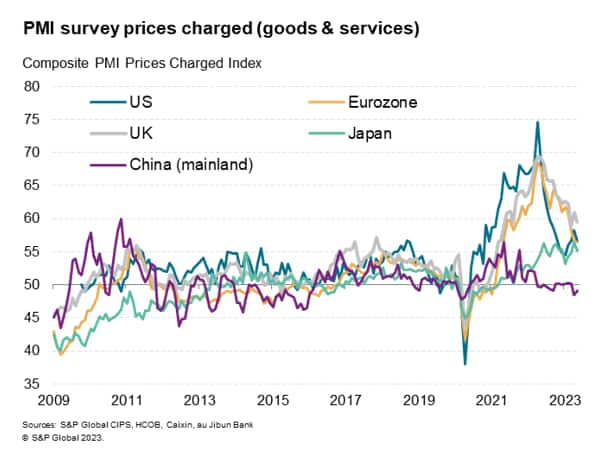

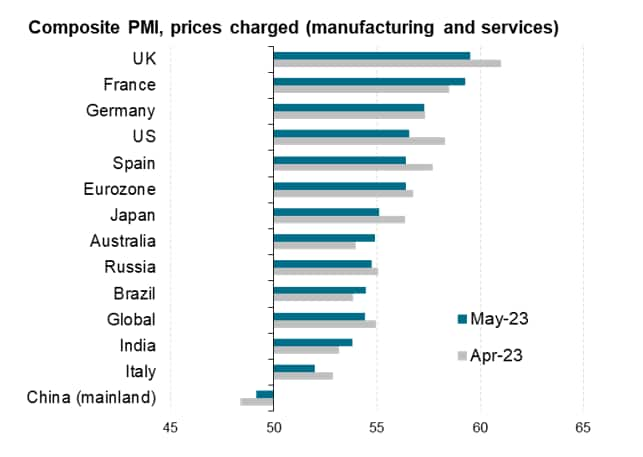

Average prices charged for goods and services also continued to rise at an elevated pace as companies passed higher costs on to customers. Although the rate of increase was likewise down sharply from the all-time highs seen this time last year, May's rise in selling prices exceeded all survey highs prior to the pandemic.

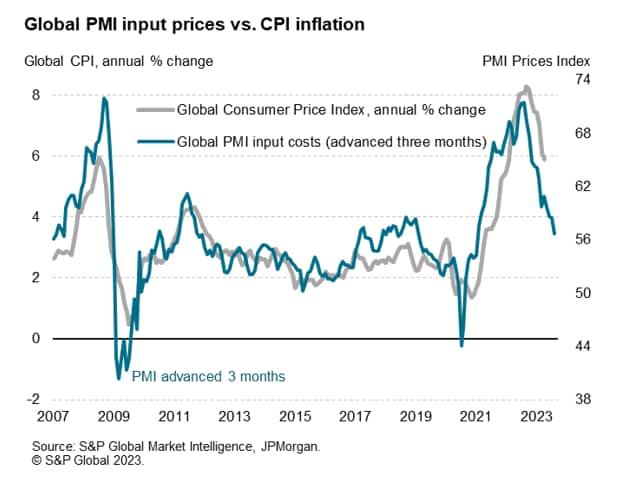

A comparison of the survey data against official consumer price inflation rates suggests that the slower growth of company costs should feed through to lower consumer inflation in the months ahead. The PMI data suggest that the overall annual rate of global inflation will have cooled to around 3.5% by the third quarter. That compares with an average of just over 2.5% in the decade preceding the pandemic.

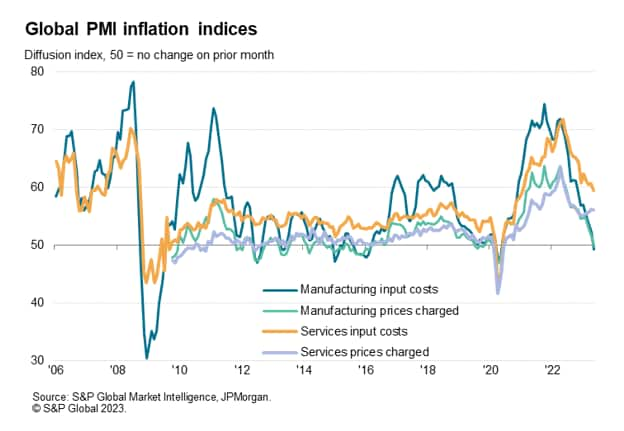

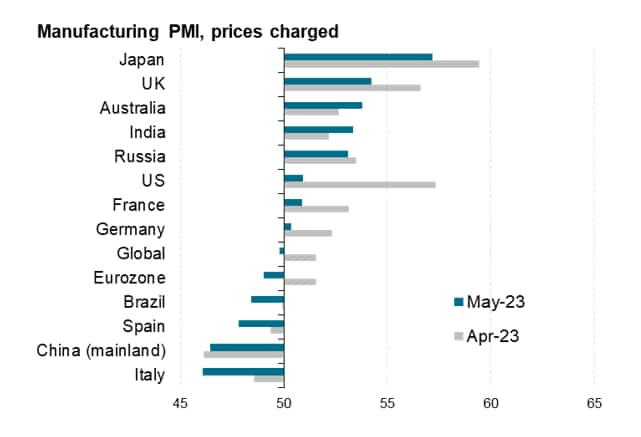

A breakdown of the data reveals a marked divergence in price and cost trends by broad sector. Most notably, input costs fell in manufacturing for the first time in three years but continued to rise at a steep - albeit moderating - rate in the service sector.

Similarly, average prices charged for goods globally fell for the first time in nearly three years in May but prices charged for services rose at a rate just shy of April's six-month high, thus remaining far higher than any rates of inflation recorded by the survey in the decade prior to the pandemic.

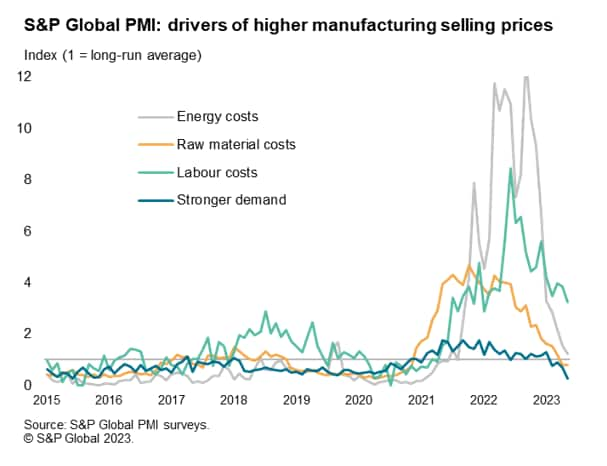

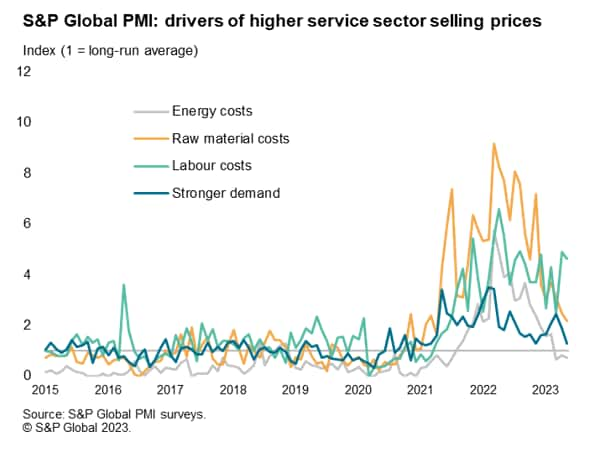

Analysis of the responses provided by PMI survey respondents can be used to estimate the degree to which different factors are driving inflation in different sectors. This information is gleaned from anecdotal evidence provided by companies to accompany the direction of change signaled for each survey variable. These data are presented as time series for which a value of 1.0 represents the long-run average.

In manufacturing, the only major factor exerting any significant upward pressure on selling prices in May was labour costs, though even here the upward pressure is now the weakest since November 2021 - though is notably still well above anything seen prior to the pandemic since data were first available in 2005.

Raw material costs and demand are both now exerting negative pressure on manufacturing prices, with demand for goods notably exerting the strongest disinflationary pressures in the history of the survey. Energy costs - which had been the biggest driver of higher prices throughout much of the pandemic - are now exerting pressure close to the long-run average.

Labour costs are also the principal driver of higher inflation in the service sector, though unlike manufacturing the degree of recent upward pressure remained especially elevated in May rather than cooling to any significant extent. Raw materials meanwhile exerted the lowest upward pressure on services prices since April 2021 and the upward influence from demand was the weakest since November 2020. Energy costs had a lower than long-term impact for a third successive month in May.

Looking at the world's major economies, inflationary pressures were most stubborn in the UK during May, where the rate of selling price inflation for goods and services is now running substantially above that of the US, Japan and the eurozone average. Output prices are meanwhile falling in mainland China.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location